- All Articles Personal Income Tax

How Have Past Stock Market Downturns Affected Income Tax Revenue? March 9, 2026

Major Stock Market Downturns of the Past Have Set Off Multi-Year 30 Percent Drops in Income Tax Revenue. Stock market downturns pose significant but uneven risks to California's income tax revenues. Smaller, short-lived downturns typically cause little lasting damage, but major downturns have led to 30 percent revenue drops that lasted three years. The state faces heightened risks today given the concentration of California-based tech companies whose stock prices have been driving the market to all-time highs.

Income Tax Withholding Tracker February 27, 2026

Income tax withholding in February came in $179 million (2 percent) above budget projections and 4 percent higher than last year. The past few months have seen more modest withholding growth compared to last fall. Zooming out to cover December, January, and February, the 3-month withholding total was just 3 percent higher than during the same period one year ago.

2025 Update: Tech Company Stock Pay Accounts for One-Quarter of Withholding Growth So Far in 2025-26 December 3, 2025

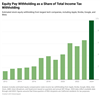

California's technology companies, including Apple, Google, Nvidia, Meta, and Broadcom are the most valuable companies in the world and employ thousands of highly-paid workers in the state. Many employees at these companies receive equity pay, such as stock options and restricted stock units, in addition to their base salary. As we first pointed out two years ago, state income tax withholding on stock pay has grown to more than $10 billion annually due to the AI boom in asset prices for these companies. With updated data through 2025Q3, we now believe growing withholding from these sources accounted for a quarter of the strong income tax withholding growth seen in the first three months of 2025-26.

The 2025-26 Budget: Partial Income Tax Exclusion for Military Retirement Income February 13, 2025

The Governor proposes to exclude from state income taxation up to $20,000 in annual military retirement benefits. The exclusion would be available to individuals with income below $125,000 ($250,000 for joint taxpayers.) Our assessment is that the economic and fiscal rationale for this proposal is weak. Nonetheless, we recognize that other factors often are relevant to the Legislature’s decisions. In assessing the administration’s proposal, the Legislature will need to decide if these other factors are enough to support this tax change. If the Legislature simply wants to provide limited tax relief to veterans, that might also improve veterans’ perceptions of the state, it could adopt the administration’s proposal. If the Legislature instead prefers that this tax expenditure have a clear economic or fiscal rationale, it could reject the administration’s proposal.

Update: Tech Company Equity Pay Driving Withholding in 2024 November 20, 2024

California's technology companies, including giants like Apple, Google, Nvidia, and Meta, are some of the most valuable companies in the world and support thousands of high-paying jobs in the state. Many employees at these companies receive equity pay, such as stock options and restricted stock units, in addition to their base salary. As we first pointed out a year ago, state income tax withholding on equity pay has grown notably in recent years due to the AI boom in asset prices for these companies. With updated data from early 2024, we now believe withholding from these sources reached about 10 percent of all income tax withholding during the first half of 2024.

IRS Data Show Pandemic Uptick in Outmigration Continues July 31, 2024

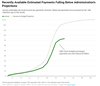

Recently released figures from the Internal Revenue Service (IRS) show that California continues to lose taxpayers to other states. The state has long had annual net outmigration (more people moving out of California to other states than moving in) but the trend has increased since 2020. Looking ahead, should the heightened trend of net outmigration continue, it could drag down annual income tax revenue growth below its long-term average.

Recent Revenues Coming in Below Governor's Budget Projections January 22, 2024

In the first few weeks of January, real-time personal income tax (PIT) revenue collections are running $3 billion to $4 billion short of the January target for current year revenue projections included in the 2024-25 Governor's Budget.

How Does Tech Company Equity Pay Affect Income Tax Withholding? November 16, 2023

California's technology companies, including giants like Apple, Google, Nvidia, and Meta, are some of the most valuable companies in the world and support thousands of high-paying jobs in the state. Many employees at these companies receive equity pay, such as stock options, as part of their compensation. State income tax withholding on this equity pay has grown notably, reaching 6 percent in the last few years. The recent jump in these companies' stock prices, which affects withholding on equity pay, has bolstered otherwise weak income tax withholding during 2023.

October Tax Collections November 17, 2022

Although October colletions from the state's “big three” tax revenues—personal income, corporation, and sales taxes—came in far ahead of Budget Act assumptions, this is not indicative of better than expected revenue performance for 2022-23 overall. Instead, a closer look at the data shows that the recent trend of revenue weakness continued in October.

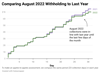

Income Tax Witholding Tracker: August 2022 September 1, 2022

August state income tax withholding was down $450 million (6.1 percent) compared to last year.

IRS Migration Data Shows Increased Movement in 2020 August 16, 2022

New IRS data on taxpayer migration during the first year of the pandemic shows an uptick of movement between California and other states, as well as within California.

Income Tax Witholding Tracker: July 2022 August 5, 2022

California income tax withholding collections were $90 million (1 percent) lower in July compared to last year.

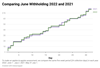

Income Tax Withholding Tracker: June 2022 July 11, 2022

California income tax collections were down 2 percent in June relative to last year.

Income Tax Withholding Tracker: November 1 - November 30 November 30, 2021

California income tax withholding collections in November were up nearly a third over last November.

Income Tax Withholding Tracker: October 1 - October 31 November 3, 2021

California income tax withholding in October was up 8.2 percent over October 2020, a slower growth rate than in the three previous months.