Income Tax Withholding Tracker: November 1 - November 30

November 30, 2021

Bottom Line: California income tax withholding collections in November were 32.9 percent above November 2020, and collections to date in fiscal year 2021-22 are 22.7 percent above 2020-21.

California employers are required to make regular income tax withholding payments for their employees, which can provide a real-time indication of the direction and magnitude of the aggregate change in the employers’ payrolls. Most withholding payments are for employees’ wages and salaries, but withholding is also due on bonuses and stock options received by employees. We caution against giving too much weight to withholding numbers in any given month, as they often include one-time payments (say, for taxes on stock options associated with large initial public offerings) that are unlikely to recur. Nonetheless, monthly withholding payments provide a useful near-real-time indicator of the state’s evolving economic situation.

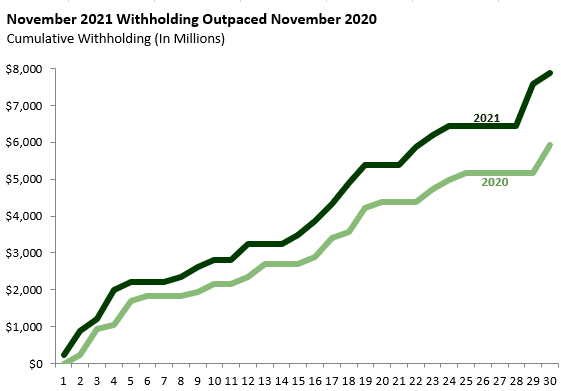

The first graph shows that withholding payments in November were up $1.9 billion (32.9 percent) over November 2020. This month had 19 collection days compared to 18 in November 2020, but this is still an extraordinary growth rate. Recent initial public offerings may have contributed to this increase. Fourteen California companies with an aggregate confirmed market value of $36.7 billion went public in November, led by Aurora at $14.0 billion. Other firms going public with a value of $1 billion or more were Embark Trucks, Nextdoor, Bird, Expensify, Allbirds, UserTesting, MDxHealth, and NerdWallet. In contrast, just five firms with a confirmed aggregate value of $11.2 billion went public in November 2020, led by Maravai Life Sciences at $7.0 billion. We note that IPO-related withholding on employees’ ‘restricted stock units’ is due on the date that the stock units vest, which may be later than the company’s IPO date.

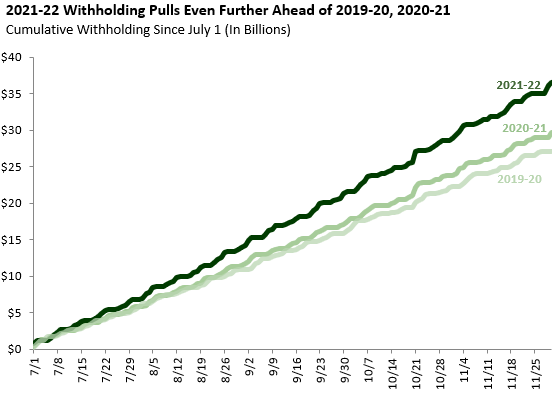

The next graph shows cumulative withholding since the start of the fiscal year compared to the same dates in 2020-21 and 2019-20. Collections through November 30 were up $6.7 billion (22.7 percent) over 2020-21 and $9.4 billion (34.5 percent) over 2019-20.

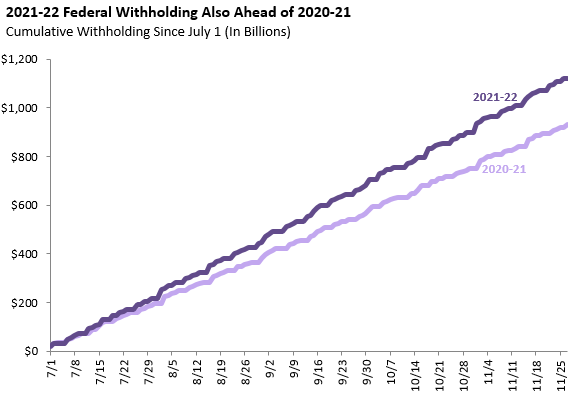

The next graph shows federal income tax withholding since July 1 in 2020-21 and 2021-22. Through November 27, federal withholding was up 20.2 percent from last year, somewhat below the state’s pace.