- All Articles Personal Income Tax

Revenue Tracking: July 2015 General Fund Collections August 18, 2015

Updated information about July 2015 major tax collections in California's General Fund has been released.

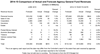

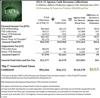

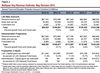

2014-15 Agency Cash: Revenue Collections $732 Million Above Projection July 14, 2015

In total, 2014-15 General Fund agency cash revenue collections exceeded the Governor's estimate, as incorporated in the 2015-16 budget plan he signed into law last month, by $732 million.

2014-15 Agency Cash: Big Three Taxes $655 Million Above Projection July 14, 2015

Collections of the state's three major General Fund taxes combined for 2014-15 were over $650 million above the Governor's projections as incorporated into the budget act signed on June 24.

May Revision: 2014 Personal Income Tax Numbers May 26, 2015

We discuss 2014 personal income tax data from both our May Revision revenue estimates and those of the administration.

May Revision: Proposition 30 Estimates, Accrual Uncertainties May 18, 2015

We discuss the May Revision estimates for Proposition 30 revenues.

May Revision: LAO Revenue Outlook May 16, 2015

Our office's May Revision revenue outlook anticipates billions of dollars of additional revenues in 2015-16, compared to the administration's updated projections.

FTB Spring 2015 Revenue Exhibit Data Posted May 14, 2015

The Franchise Tax Board has posted its spring "exhibit" data, which contains information used by our office and the administration to understand state income tax collections.

4/2015: Personal Income Tax Far Above Projections May 8, 2015

This post provides updated data from the tax agencies on monthly agency cash collections of California's key state taxes.

April 2015 Daily Personal Income Tax Tracker May 1, 2015

We tracked April 2015 personal income tax (PIT) collections on a daily basis. April is a key month for collections of the PIT, the state government's largest revenue source.

2013 FTB Data: Personal Income Tax Base Varies Regionally April 30, 2015

The Franchise Tax Board has released data on taxes paid and income reported on 2013 California personal income tax returns by county.

3/2015: Revenues $1.3 Billion Above Fiscal Year Projection April 15, 2015

This note provides information on March 2015 state tax collections.

April 15 and Accruals: Complexity April 15, 2015

This note discusses the state's complex revenue accrual rules, which affect Proposition 98 school funding and various aspects of state budgeting, in the context of the April 15 personal income tax deadline.

February 2015 Income Taxes Far Above Forecast March 17, 2015

This post discusses February 2015 personal income, sales, and corporate income tax collections (the General Fund's "Big Three" tax sources).

New College Access Tax Credit Affects Budget Revenue Projections February 27, 2015

This note discusses the complex effects on state budget revenue projections related to the new College Access Tax Credit.

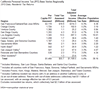

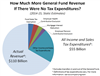

California State Tax Expenditures Total Around $55 Billion February 19, 2015

In response to questions received during a January Senate budget hearing, we examine California's General Fund tax expenditures: tax deductions, credits, exclusions, and the like that reduce revenues below what they would be otherwise.