Summary. The 2023-24 budget package anticipated a funding shortfall for programs supported by cannabis tax revenues. Our new revenue estimates are higher, yielding a smaller funding shortfall.

Background. In November 2016, California voters approved Proposition 64, which legalized the nonmedical use of cannabis. Proposition 64 created two excise taxes on cannabis: a retail excise tax and a cultivation tax. Chapter 56, Statutes of 2022 (AB 195, Committee on Budget) eliminated the cultivation tax on July 1, 2022.

Preliminary Total for Second Quarter of 2023: $157 Million. The administration currently estimates that retail excise tax revenue was $157 million in the second quarter of calendar year 2023 (April through June). The revised estimate for the first quarter of 2023 (January through March) is now $129 million, substantially higher than the $104 million preliminary estimate announced in May.

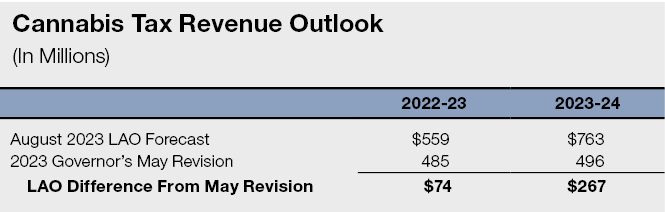

Current LAO Estimate for 2022-23: $559 Million. We currently project cannabis tax revenues of $559 million in 2022-23 and $763 million in 2023-24. As shown in the figure below, our current projection for 2022-23 is $74 million above the budget package assumption for 2022-23. Our 2023-24 revenue forecast, while encouraging, is extremely uncertain given the ups and downs of California’s licensed cannabis market.

2023-24 Budget Package Anticipated Funding Shortfall for Programs Supported By Cannabis Tax Revenues. Cannabis tax revenues support subsidized child care and various other programs. AB 195 established a “baseline” level of annual funding for these programs and included some mechanisms intended to maintain funding at the baseline. Most notably, AB 195 appropriated $150 million General Fund to backfill funding shortfalls if cannabis revenues came in lower than expected in 2022-23 or 2023-24. The budget package assumed that the administration would use the entire $150 million to backfill funding shortfalls resulting from low 2022-23 revenues. Even with this backfill, the budget package assumed that funding would fall $102 million short of the baseline.

Smaller Funding Shortfall Under LAO Estimates. As noted above, our 2022-23 revenue estimate is $74 million higher than the budget package assumptions. Under our estimates, funding would fall just $28 million short of the baseline.