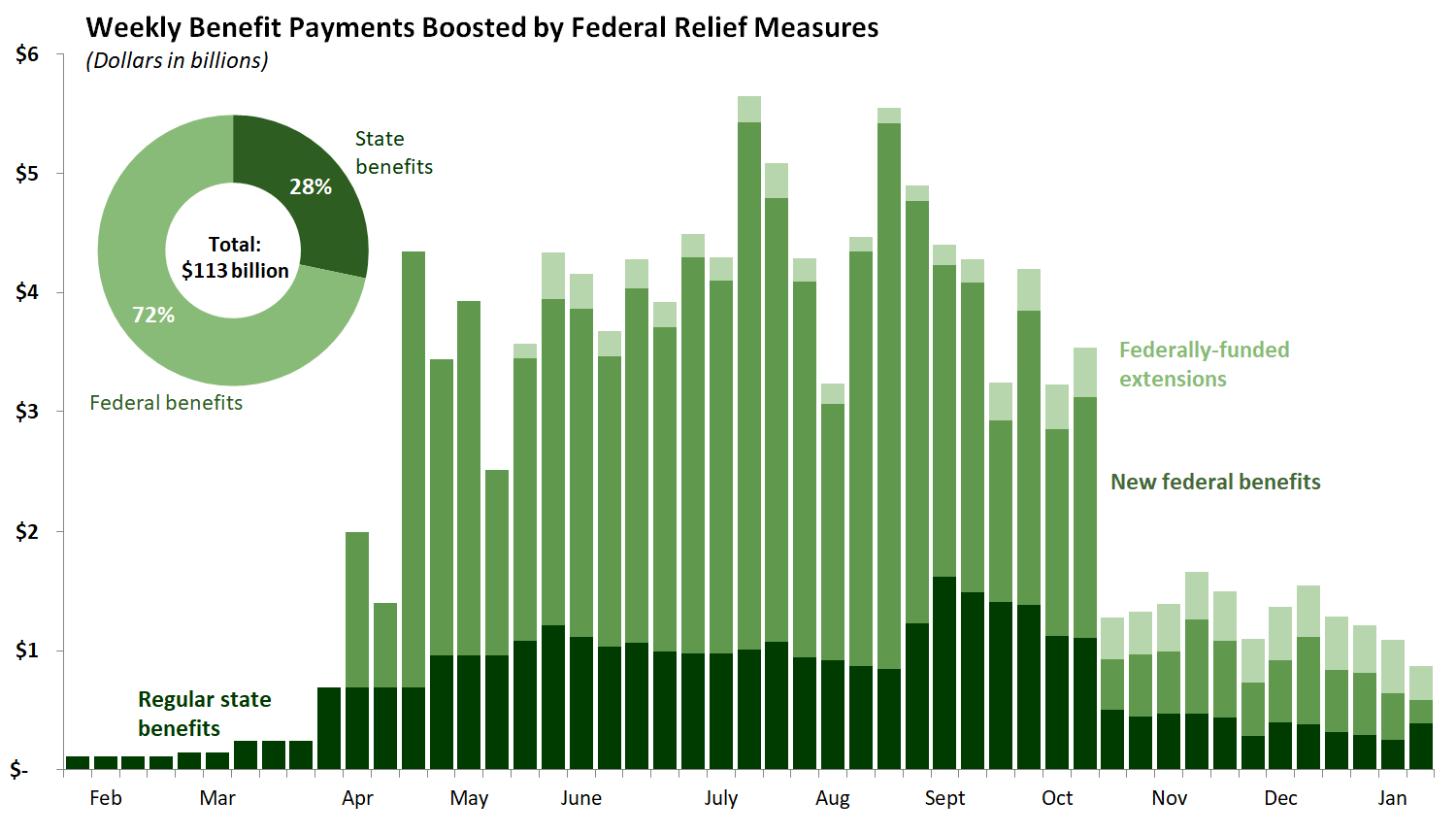

As a result of the COVID-19 pandemic, California has experienced an unprecedented rise in unemployment. Early in the economic downturn, the key measure that captured the impact of the virus on the state’s workers was the number of new unemployment claims being filed each week. At this stage, however, the level of continued claims—the total number of people receiving unemployment benefits each week—is equally important. It is now clear that the unprecedented amount of state and federal dollars flowing to California workers in the form of weekly UI benefits has stabilized household budgets throughout the pandemic. Under normal economic conditions, the state distributes about $100 million in UI benefits per week. During the COVID-19 pandemic, the state has regularly distributed several billion dollars per week in UI benefits. In total, the state has distributed more than $115 billion in UI benefits to California workers during the pandemic.

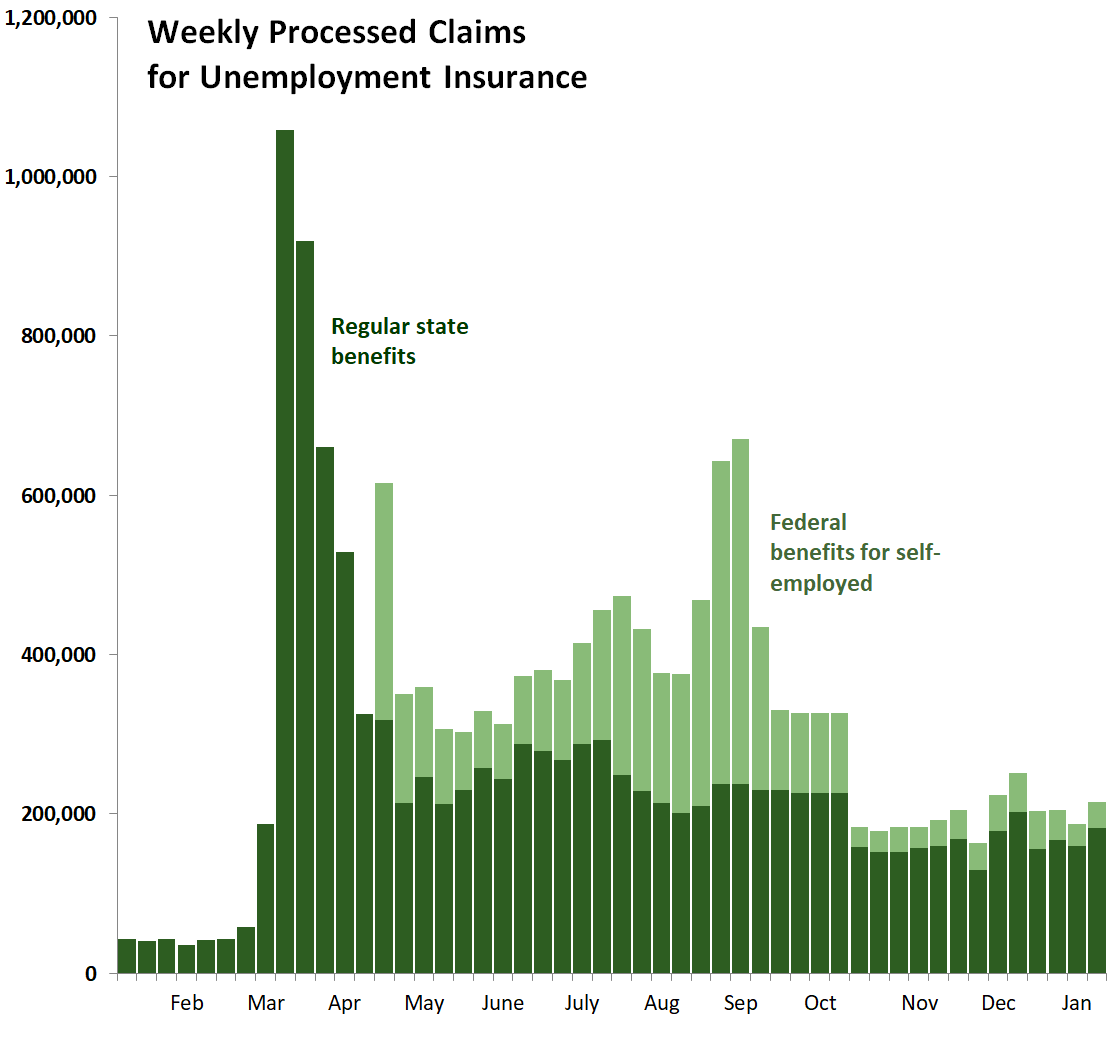

Initial Claims for Regular UI Benefits Remain Elevated, But Steady, in November, December, and Early January As shown in the figure below, processed claims for regular UI benefits held steady about 160,000 claims per week during November, December, and early January.

Initial Claims for Federal Self-Employment Benefits Falls Sharply at End of Year. During August and early September, new claims for the federal Pandemic Unemployment Assistance (PUA) program for self-employed workers spiked unexpectedly, as shown in the figure above. To limit potentially fraudulent claims, the administration stopped automatically approving backdated PUA claims. Processed claims for this program have fallen sharply since the administration’s action to limit fraudulent claims. Since that time processed claims have remained at this new lower level, between 20,000 and 50,000 claims per week.

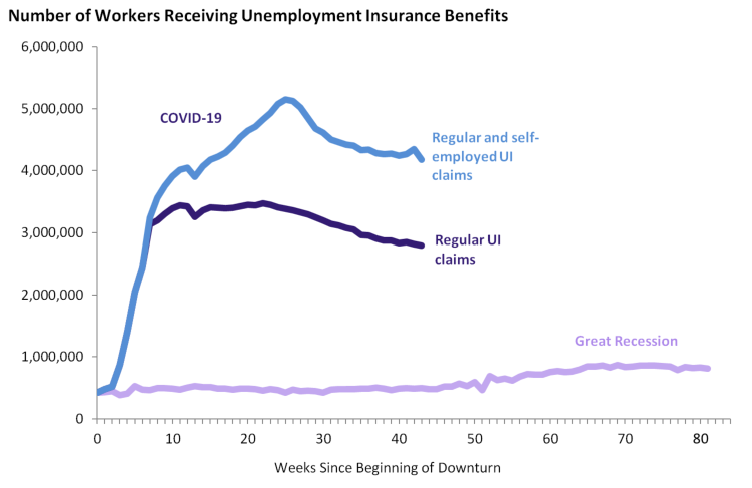

Regular Continued Claims Continue Slow Decline, Falling to 2.8 Million. As of January 9, California had 2.8 million workers receiving regular unemployment benefits. As shown in the figure below, this represents a continuation of the slow decline seen in recent months. Since the regular claims caseload peaked in mid-August, the number of workers receiving normal UI benefits has fallen by about 20 percent.

After Some Decline, Continued Claims for Self-Employed Workers Inches Upward. After declining by about 250,000 workers since its peak in early September, the number of self-employed workers receiving federal PUA benefits increased somewhat in recent weeks before declining significantly during early January. Our office is still investigating the underlying reasons for this trend change.

Weekly UI Benefits Significanly Boosted by Federal Stimulus, Which Recently Was Extended. As shown in the figure below, the federal expanded UI benefits enacted in the spring significantly boosted weekly UI distributions in the state throughout the spring and summer. A smaller federal benefit expansion continued through most of the fall. Looking ahead, the first rounds of additional federal UI benefits will be distributed to California workers in the next few weeks, most notably a $300 weekly add-on for all UI recipients through mid-March.

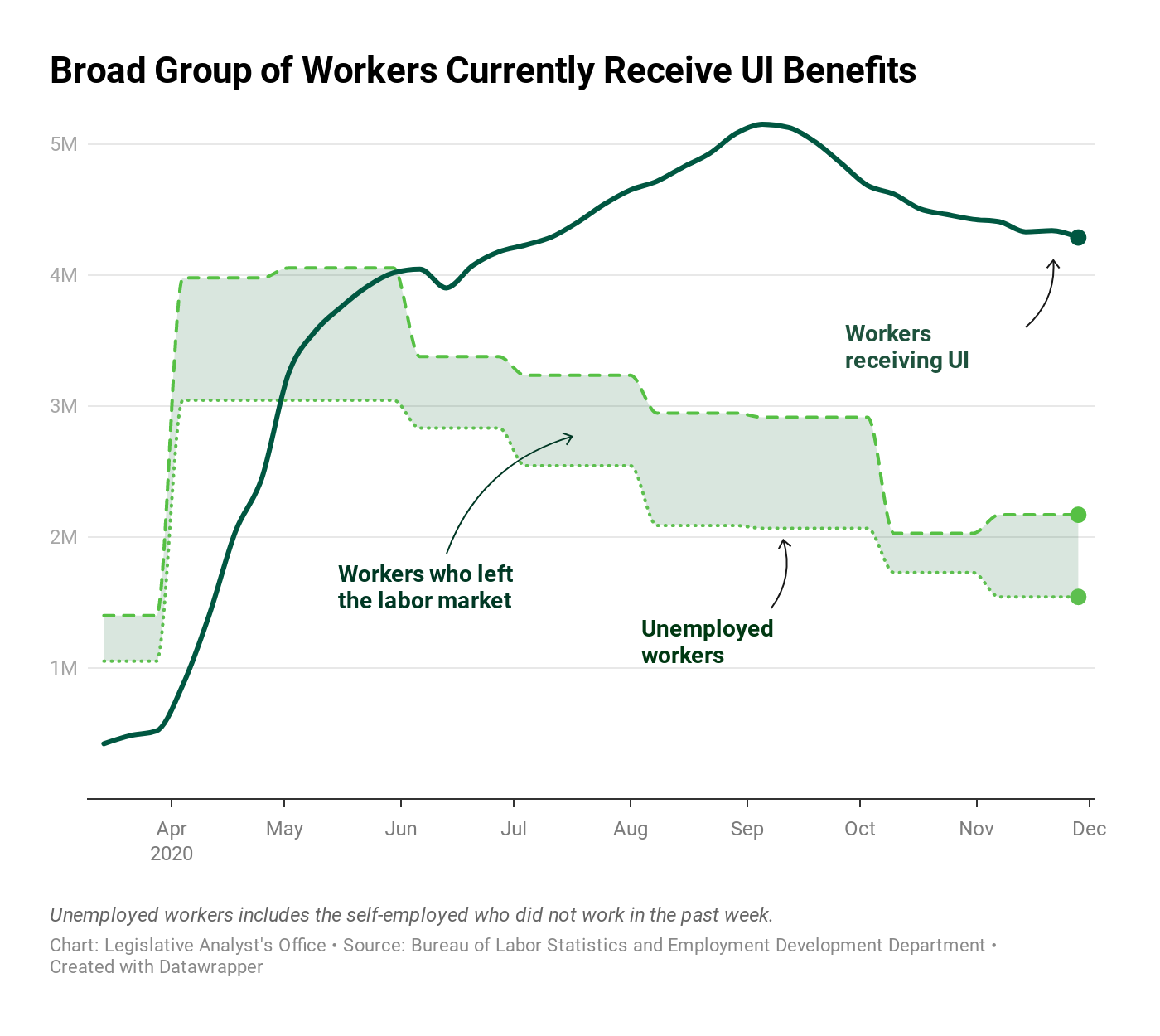

In Total, 7.8 Million California Workers Received UI Benefits at Some Point During Pandemic. According to data made available recently by EDD, roughly 7.8 million California workers received UI benefits at some point during the pandemic. This represents roughly 4 in 10 California workers.

Broad Group of Workers Receive UI Benefits, Not Just Those Identified as Unemployed in Federal Surveys. The figure below compares the number of workers who received UI benefits each week with the number of workers who report on federal surveys as being unemployed each month. As shown in the figure, the number of workers receiving benefits has consistently exceeded the number of unemployed workers, by a factor of two in recent months. The number of workers receiving UI benefits also exceeds the combined number of unemployed workers and those who have left the labor market since the pandemic began. Although we are continuing to looking into this dynamic more closely, the vast majority of this discrepancy appears due to a difference between how unemployment is calculated in federal surveys and how UI eligibility is determined by the state. One example of workers who would be eligible for UI but not unemployed for purposes of the federal survey include: workers who have had their hours reduced but continue working.