LAO Contact

February 22, 2023

The 2023-24 Budget

CalWORKs

Summary. In this post, we provide some basic background on the California Work Opportunity and Responsibility to Kids (CalWORKs) program followed by an overview and assessment of the Governor’s CalWORKs budget proposals.

Background

The CalWORKs program was created in 1997 in response to the 1996 federal welfare reform legislation that created the federal Temporary Assistance for Needy Families (TANF) program. CalWORKs provides cash grants and job services to low-income families. The program is administered locally by counties and overseen by the state Department of Social Services.

CalWORKS Provides Cash Assistance to Low-Income Families. Grant amounts generally are adjusted for family size, income level, and region. Recipients in high-cost counties receive grants that are 4.9 percent higher than recipients in lower-cost counties. As an example, a family of three in a high-cost county that has no other earned income currently receives $925 per month, whereas a similar family in a lower-cost county receives $878 per month. In 2022-23, the administration estimates the average CalWORKs grant amount to be $960 per month across all family sizes and income levels. These grants are funded through a combination of federal TANF block grant funding, state General Fund, and county dollars. Families enrolled in CalWORKs typically are also eligible for CalFresh food assistance and Medi-Cal health coverage. CalWORKs benefits are deposited into Electronic Benefit Transfer (EBT) cards, which operate similar to debit cards and also handle benefits for CalFresh and some other, smaller programs. Unless otherwise exempt, parents who receive CalWORKs benefits are generally required to work or participate in qualified training or job-search activities.

Family Size Differs From CalWORKs Assistance Unit (AU) Size. Monthly CalWORKs grant amounts are set according to the size of the AU. The size of the AU is the number of CalWORKs-eligible people in the household. Grant amounts are adjusted based on AU size—larger AUs are eligible to receive a larger grant amount—to account for the increased financial needs of larger families. As of October 2021 (when the most recent analysis was conducted), about 40 percent of CalWORKs cases included everyone in the family (and thus the AU size and the family size were the same). In the remaining 60 percent of cases, though, one or more people in the family were not eligible for CalWORKs and therefore the AU size was smaller than the family size. We expect the share of families containing at least one ineligible member will decrease when updated data are made available due to recent policy changes which have extended lifetime assistance limits for adults and reduced the likelihood that adults will be sanctioned for failing to meet work requirements.

Family Members May Be Ineligible for CalWORKs for Several Reasons. Most commonly, people are ineligible for CalWORKs because they (1) exceeded the lifetime limit on aid for adults, (2) currently are sanctioned for not meeting some program requirements, or (3) receive Supplemental Security Income/State Supplementary Payment (SSI/SSP) benefits (state law prohibits individuals from receiving both SSI/SSP and CalWORKs). Additionally, many individuals are ineligible due to their immigration status. Undocumented immigrants, as well as most immigrants with legal status who have lived in the United States for fewer than five years, are ineligible for CalWORKs.

Federal, State, and County Governments Share CalWORKs Costs. Federal law allows for a degree of state flexibility in the use of federal TANF funds. The state receives $3.7 billion annually for its TANF block grant, about $2 billion of which goes to CalWORKs (an additional $1 billion helps fund aid for some low-income college students and the remainder helps fund a variety of smaller human services programs). To receive its annual TANF block grant, the state must spend a maintenance-of-effort (MOE) amount from state and local funds to provide services for families eligible for CalWORKs. This MOE amount is $2.9 billion. State and federal CalWORKs funding generally is allocated to the counties, all of whom directly serve eligible families. In addition to funding for cash grants, counties receive several other funding allocations to administer and operate CalWORKs. The main funding allocation—known as the “single allocation”—currently funds employment services, eligibility determination, and administrative costs. Funds within the single allocation are fungible, meaning counties are not required to spend, for example, the employment services portion of the single allocation exclusively on employment services but can instead use some of those funds on administrative costs at their discretion.

Under State Law, Local Revenue Growth Automatically Triggers CalWORKs Grant Increases. Following a major realignment of state and local responsibilities in 1991, some funds generated by the state sales tax and vehicle license fee accrue to a special fund with a series of subaccounts which pay for a variety of health and human services programs. Under state law, sufficient revenue growth in the Child Poverty and Family Supplemental Support Subaccount triggers an increase in CalWORKs cash grant amounts. In the past, this account funded grant increases of 5 percent in 2013-14 and 2014-15, of 1.43 percent in 2016-17, 5.3 percent in 2021-22, and 11 percent in 2022-23. In addition, this account has funded the repeal of the maximum family grant policy starting in 2016-17.

State Has Recently Made Major Augmentations to CalWORKs. Among the most notable changes made to CalWORKs in the past three budgets were:

Providing a temporary 10 percent grant increase funded by General Fund and extending from October 1, 2022 to September 30, 2024.

Increasing the lifetime limit for adults receiving aid from 48 months to 60 months beginning May 1, 2022. (The lifetime limit had previously been reduced from 60 months to 48 months in 2011.)

Increasing the earned income disregard for applicants (or the amount CalWORKs applicants can earn before further income effects their eligibility for the program) from $90 to $450 per month. (The 2022-23 budget includes $79.5 million General Fund to implement this change starting in March 2023.)

Effective January 1, 2022, increasing the amount of child support that could be “passed through” to CalWORKs families from $50 to $100 a month for one child families, and from $50 to $200 for larger families (those with two or more children). (Under state and federal law, additional child support payments made beyond this pass-through level are retained by the state as reimbursement for the state and federal costs of CalWORKs.)

Increasing the additional monthly stipend provided to pregnant women on CalWORKs from $47 to $100, and allowing women to become immediately eligible upon verification of their pregnancies (as opposed to waiting until the second trimester). The eligibility change occurred on July 1, 2021, and the enhanced stiped began May 1, 2022.

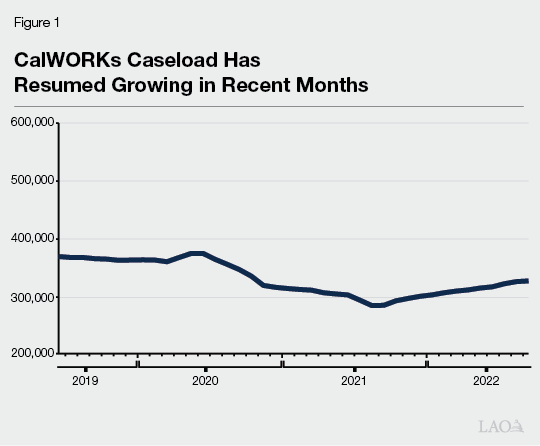

Caseload Has Resumed Growing After Extended Period of Decline. Figure 1 shows how CalWORKs caseload has changed since 2019-20. Following the onset of the COVID-19 pandemic in spring 2020, CalWORKs caseload began what was a historically anomalous decrease given high unemployment. (We discuss this phenomenon in previous posts, in which we conclude the decrease likely was related to extraordinary federal and state aid offered to low-income individuals in response to the pandemic and related state at home orders.) This decline continued until September 2021, the month during which a federal bonus for Unemployment Insurance benefits expired. Caseload has increased each month since September 2021, although it still remains about 40,000 families below pre-pandemic levels in the most recent data.

Budget Overview and Assessment

Total CalWORKs Spending Projected to Increase Alongside Growing Caseload. As shown in Figure 2, the Governor’s budget proposes $7.3 billion in total funding for the CalWORKs program in 2022-23, a net increase of $108 million (1 percent) relative to the most recent estimate of current-year spending. This increase is the net effect of higher underlying costs due to growing caseload partially offset by the expiration of a one-time augmentation to the Housing Support Program and a proposed decrease in county administrative funding.

Figure 2

CalWORKs Budget Summary

All Funds (Dollars in Millions)

|

2022‑23 Revised |

2023‑24 Proposed |

Change From 2022‑23 |

||

|

Amount |

Percent |

|||

|

Number of CalWORKs cases |

347,868 |

360,307 |

12,439 |

4% |

|

Cash grantsa |

$4,050 |

$4,358 |

$308 |

8% |

|

Single Allocation |

||||

|

Employment services |

$1,268 |

$1,301 |

$34 |

3% |

|

Cal‑Learn case management |

12 |

12 |

— |

3 |

|

Eligibility determination and administration |

626 |

578 |

‑47 |

‑8 |

|

Subtotals |

($1,905) |

($1,892) |

(‑$13) |

(‑1%) |

|

Stage 1 child care |

$518 |

$524 |

$6 |

1% |

|

Other allocations |

||||

|

Home Visiting Program |

$103 |

$100 |

‑$3 |

‑3% |

|

Housing Support Program |

285 |

95 |

‑190 |

‑67 |

|

Other |

316 |

320 |

4 |

1 |

|

Subtotals |

($704) |

($515) |

(‑$190) |

(‑27%) |

|

Otherb |

$28 |

$24 |

‑$4 |

‑13% |

|

Totals |

$7,206 |

$7,314 |

$108 |

1% |

|

aDoes not include the cost of an estimated 2.9 percent grant increase funded by certain realignment revenues, which the Governor’s budget projects beginning in October 2023. We roughly estimate this would increase cash grants by about $95 million in 2023‑24. bPrimarily includes various state‑level contracts. |

||||

General Fund Costs Projected to Grow Notably in 2023-24. Figure 3 shows how CalWORKs costs are shared between federal, state, and local revenue sources. The budget proposes an almost $1.2 billion increase in the amount of General Fund going towards CalWORKs (213 percent, discussed below), although the state still accounts for a relatively small share of overall program costs (23 percent).

Figure 3

CalWORKs Funding Sources

(Dollars in Millions)

|

2022‑23 |

2023‑24 |

Change From 2022‑23 |

||

|

Amount |

Percent |

|||

|

Federal Temporary Assistance for Needy Families block grant funds |

$3,621 |

$2,610 |

‑$1,011 |

‑28% |

|

General Fund |

546 |

1,712 |

1,166 |

213 |

|

Realignment funds from local indigent health savings |

909 |

738 |

‑171 |

‑19 |

|

Realignment funds dedicated to grant increases |

924 |

1,045 |

121 |

13 |

|

Other county/realignment funds |

1,205 |

1,208 |

3 |

— |

|

Totals |

$7,206 |

$7,314 |

$108 |

1% |

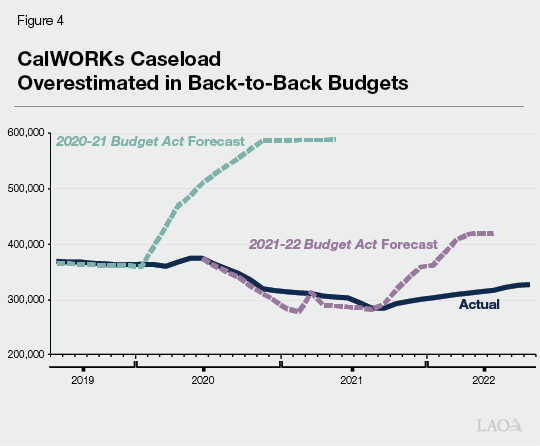

During Pandemic, Caseload Declines Reduced General Fund Costs. Figure 4 shows how the 2020-21 and 2021-22 spending plans both notably overestimated CalWORKs caseload. (As discussed above, these projections were based on historical experience in which caseload has grown during times of high unemployment. Contrary to this established pattern, caseload during the pandemic decreased.) Consequently, in both years, the state appropriated hundreds of millions of dollars for CalWORKs which could not be immediately spent. Because federal law requires a minimum amount of General Fund spending on CalWORKs and related programs, much of these unexpected savings materialized as unspent federal funds, or “TANF carryforward” (because not enough General Fund was spent to use those funds). The Governor’s budget proposes applying nearly $1 billion in TANF carryforward to CalWORKs in 2022-23. However, the combination of resumed caseload growth and recent programmatic expansions has exhausted this temporary supply of TANF carryforward. Consequently, General Fund must be used to cover the costs of the program that were more recently covered with federal TANF carryforward funds. The net cost of this change is nearly $1 billion in the budget year.

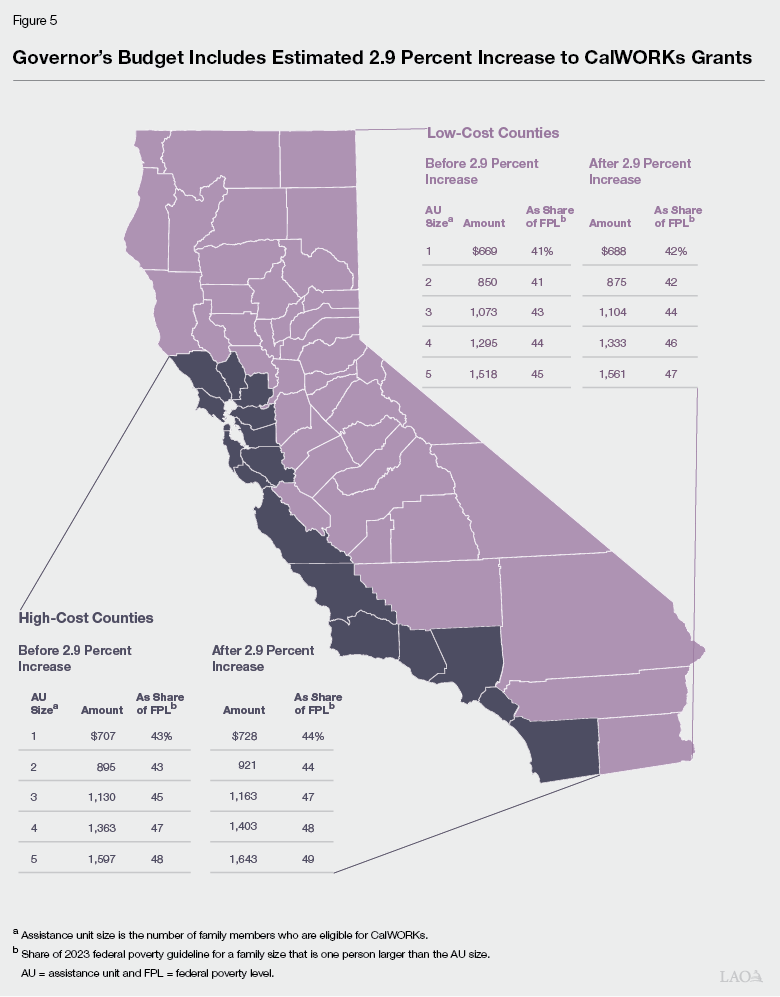

Budget Estimates 2.9 Percent Grant Increase Triggered by Local Revenue Growth. We estimate the Governor’s budget includes a budget-year cost of $95 million (annual cost of $125 million) to fund a 2.9 percent increase to cash grants starting in October 2023. This increase was triggered and will be funded by revenue growth in the Child Poverty and Family Supplemental Subaccount. As part of the 2018-19 Budget Act, the Legislature set a goal to increase CalWORKs grants to 50 percent of the federal poverty level (FPL) for a family that is one person larger than the AU size. Figure 5 shows the 2.9 percent increase would raise grants for all AU sizes in high-cost counties to between 44 percent and 49 percent of the FPL for a family one person larger than the AU size, and to slightly lower levels for families in lower-cost counties. The administration has emphasized that this is their current estimate of the size of the grant increase that could be afforded by the subaccount, but that they will be updating the estimated size of the grant increase at the May Revision.

Administration’s Caseload, Grant Increase Estimates Appear Reasonable. Our office independently forecasts CalWORKs caseload as well as grant increases triggered by growth in realignment revenue. Though our estimates for both figures have often diverged widely from the administration’s in the past, at this time our two offices’ estimates are similar for both forecasts. We will revisit both these estimates in the spring when additional data are made available.

Administration’s Proposed Reduction to County Administrative Funding Poses Trade-Offs. Starting in 2018-19, the state (in conjunction with counties) developed a new funding formula which increases (or decreases) administrative funding in increments of $28 million based on caseload changes. This formula recognizes that most administrative services are provided by full-time county employees, and counties cannot rapidly change their staffing levels in response to changing caseload. Administrative funding changes occur when there is a caseload change of about 20,000 families.

During the pandemic, caseload decreased by about 60,000 families, which normally would trigger three consecutive years of funding decreases. However, in recognition of the high level of uncertainty surrounding caseload projections at the time, these decreases were suspended the last three years, and the state in fact provided both ongoing ($40.8 million starting in 2021-22) and temporary ($55 million for both 2022-23 and 2023-24) augmentations to the base level of administrative funding.

Under the Governor’s budget, the administration proposes to reduce county administrative funding by one increment ($28 million) to align funding with recent caseload declines (the budget also assumes an additional decrease in administrative funding related to cost-sharing agreements with other county-administered programs). Although the proposal is consistent with the design of the funding formula, projected caseload increases create some complications. Both our and the administration’s caseload forecasts anticipate rising caseload next year. Under our projections of out-year caseload, if funding is reduced in the 2023-24, counties would be eligible for an increase in administrative funding next year (in 2024-25). Consequently, decreasing county administrative funding this year could introduce unnecessary disruption to county services. Additionally, the 2022-23 budget include budget-related legislation that recognized the need to reevaluate the current funding methodology in light of increasing inflation and service costs. However, we recognize that, in the context of a budget problem, the Legislature may wish to consider the trade-offs of this proposal given counties have flexibility over the single allocation to cover additional administrative costs by shifting funds from other components of administration—such as employment services. We suggest asking the administration and counties to report on potential trade-offs of the proposed reduction on the overall services provided at the county level.

Budget Includes Major Proposal to Enhance EBT Card Security. In recent years, CalWORKs and other benefits loaded onto EBT cards have been subject to increasing levels of theft. The administration indicates this theft—once relatively rare—is now projected to cost the state $121 million for reimbursements in 2023-24. Most of this theft is believed to be accomplished through creating “clones” of EBT cards, a process made relatively easy due to the absence of some security features now common to debit and credit cards, such as security chips. The budget proposes $50 million one time ($17.1 million General Fund) to provide some of these improvements. We are still working with the administration to better understand this proposal. Some key questions we have are: (1) how this change will affect existing cardholders, and whether there will be a “grace period” as cards are being replaced (to prevent loss of benefits); (2) the total cost of the improvements, both to complete the transition and to maintain the improvements going forward; and (3) how these improvements affect the time line for expanding the California Food Assistance Program to some previously ineligible immigrants.