LAO Contact

February 7, 2023

The 2023-24 Budget

California State University

Summary

Brief Covers Governor’s Budget Proposals for the California State University (CSU). This brief analyzes the Governor’s budget proposals relating to CSU’s core operations, enrollment, and certain capital outlay projects.

Recommend Legislature Link CSU’s Funding Increase to Spending Priorities. The Governor’s main proposal for CSU is a $227 million (5 percent) ongoing General Fund base increase—the second of five annual base increases included in his multiyear compact. The Governor does not designate the base increase for any particular purposes, and the amount is not connected to CSU’s identified operating cost increases. We recommend the Legislature take a more transparent budget approach by determining which of CSU’s operating cost increases it wishes to support in 2023‑24 and providing funding designated for those particular purposes. In addition, given that the proposed General Fund base increases fall short of covering CSU’s projected operating cost increases in every year of the compact, the Legislature could consider supporting tuition increases to expand CSU’s budget capacity.

Legislature Could Revisit CSU’s Enrollment Growth Funding and Targets. The 2022‑23 Budget Act provided CSU with $81 million ongoing General Fund to grow resident undergraduate enrollment by 9,434 students. It also directed the administration to reduce these funds should CSU fall short of the target. Although CSU enrollment is declining in 2022‑23, the Governor’s budget does not remove the $81 million. The Legislature could consider removing these funds as a potential budget solution. Several factors are contributing to CSU’s recent enrollment declines, including fewer community college transfer students, smaller cohorts of continuing students, lower retention rates, and reduced average unit load. We recommend the Legislature consider these factors when setting an enrollment target for CSU in 2023‑24. We also recommend the Legislature send an early signal about its enrollment expectations for 2024‑25, given the timing of CSU’s admissions cycle.

Recommend Legislature Revisit Certain CSU Capital Projects. The 2022‑23 Budget Act provided CSU with $405 million one‑time General Fund for six specific capital outlay projects. As a budget solution, the Governor proposes to rescind these funds and instead provide $27 million ongoing General Fund beginning in 2023‑24 to debt finance the projects using university bonds. Although debt financing can be a reasonable way to fund capital projects, it would significantly increase total project costs. We recommend the Legislature revisit whether each of these projects is justified under the new circumstances. Currently, these projects remain in early planning and design phases. If a given project does not meet certain criteria, the Legislature could consider withdrawing state support for it at this time. Any affected projects could be reconsidered for funding in a future budget.

Introduction

Brief Focuses on the California State University (CSU). CSU is one of California’s three public higher education segments. Its 23 campuses provide undergraduate, teacher preparation, and graduate education. CSU generally offers degrees through the master’s level, while also providing doctorates primarily in a few applied fields. This brief is organized around the Governor’s 2023‑24 budget proposals for CSU. The first section provides an overview of the Governor’s CSU budget package. The remaining sections focus on core operations, enrollment, and capital outlay budget solutions, respectively. This brief is the second in our series of higher education budget analyses. The 2023‑24 Budget: Higher Education Overview was our first brief in this series, with subsequent briefs delving more deeply into each of the higher education segments’ budgets.

Overview

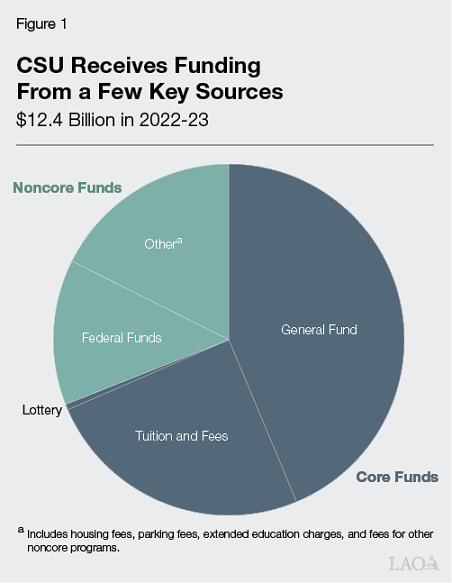

CSU Budget Is $12.4 Billion in 2022‑23. As Figure 1 shows, about 70 percent ($8.5 billion) of CSU’s budget comes from “core funds.” Core funds primarily consist of state General Fund and student tuition revenue, with a small portion coming from lottery funds. CSU uses its core funds to support its academic mission. Between 2021‑22 and 2022‑23, ongoing core funds per student increased 7.9 percent at CSU. The remainder of CSU’s revenue comes from federal funds and other nonstate sources. Federal funds are primarily for student financial aid. The other nonstate sources include revenue from noncore programs, such as student housing, parking, and extended education.

Ongoing Core Funding Increases by $310 Million (3.8 Percent) Under Governor’s Budget. As Figure 2 shows, nearly all of the increase comes from the General Fund. Ongoing General Fund would increase by $294 million (5.8 percent) in 2023‑24. In addition, CSU estimates its tuition revenue would increase by $16 million (0.5 percent) due to planned enrollment growth, with no increase due to changes in tuition charges. (At this time, the CSU Board of Trustees has not adopted any plans to increase tuition charges in 2023‑24.) Under the Governor’s budget, we estimate ongoing core funding per student would increase by 2.9 percent.

Figure 2

Nearly All of CSU’s Core Fund Increase Comes From General Fund

Ongoing Core Funds (Dollars in Millions)

|

2021‑22 |

2022‑23 |

2023‑24 |

Change From 2022‑23 |

||

|

Amount |

Percent |

||||

|

Ongoing Core Funds |

|||||

|

General Funda |

$4,606 |

$5,050 |

$5,344 |

$294 |

5.8% |

|

Tuition and feesb |

3,240 |

3,061 |

3,077c |

16 |

0.5 |

|

Lottery |

74 |

65 |

65 |

—d |

‑0.1 |

|

Totals |

$7,920 |

$8,176 |

$8,485 |

$310 |

3.8% |

|

FTE studentse |

394,930 |

377,757 |

381,191 |

3,434 |

0.9% |

|

Funding per student |

$20,055 |

$21,643 |

$22,260 |

$618 |

2.9 |

|

aIncludes funding for pensions and retiree health benefits. bIncludes funds used for student financial aid. cReflects Governor’s budget level adjusted to reflect CSU’s estimate of additional revenue from proposed enrollment growth. dLess than $500,000. eReflects total resident and nonresident enrollment in undergraduate, postbaccalaureate, and graduate programs. |

|||||

|

FTE = full‑time equivalent. |

|||||

Governor’s Main Proposal Is an Unrestricted Base Increase. Last year, the Governor established a multiyear compact with CSU extending through 2026‑27. Consistent with the compact, the Governor’s largest CSU proposal in 2023‑24 is a 5 percent unrestricted base increase. As Figure 3 shows, the Governor’s budget also provides ongoing augmentations to cover retiree health benefit and pension cost increases, as well as debt service associated with a proposed cost shift for certain capital outlay projects. The Governor does not propose any new one‑time funding for CSU in 2023‑24, beyond funding one initiative consistent with last year’s budget agreement.

Figure 3

Governor’s Budget Plan for CSU Has a Few Components

General Fund Changes, 2023‑24 (In Millions)

|

Ongoing Spending |

|

|

Base augmentation (5 percent) |

$227 |

|

Retiree health benefit cost increase |

37 |

|

Debt service for capital outlay projectsa |

27 |

|

Pension cost increase |

3 |

|

CENIC cost increaseb |

—c |

|

Subtotal |

($294) |

|

One‑Time Initiatives |

|

|

Science and Technology Policy Fellows programd |

$10 |

|

Subtotal |

($10) |

|

Total |

$304 |

|

aThe Governor proposes to rescind $405 million in one‑time General Fund provided for six capital outlay projects in 2022‑23 and instead provide ongoing funding for CSU to debt finance these projects using university bonds. bThe 2021‑22 budget agreement included intent to provide these funds. cLess than $500,000. dThe 2022‑23 budget agreement included intent to provide these funds. CENIC = Corporation for Education Network Initiatives in California. |

|

Core Operations

In this section, we first provide background on CSU’s core operations. Next, we describe the Governor’s proposed base increase for CSU, followed by CSU’s plan for spending the funds. Then, we assess the Governor’s proposal and make associated recommendations.

Background

Below, we highlight CSU’s main operating cost pressures and the fund sources available to cover cost increases.

Cost Pressures

CSU’s Largest Operating Cost Is Employee Compensation. Like other state agencies, CSU spends the majority of its core funds (about 70 percent in 2021‑22) on employee compensation, including salaries and benefits. Accordingly, compensation almost always represents CSU’s largest cost pressure each year.

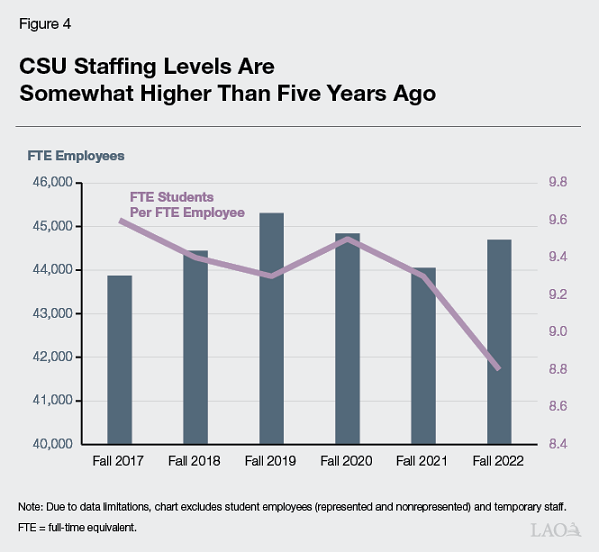

CSU Has About 45,000 Full‑Time Equivalent (FTE) Employees. Of these employees, about 45 percent are faculty, about 45 percent are staff, and the remaining 10 percent are managers and executives. (These data do not include student employees and other temporary staff.) As Figure 4 shows, staffing levels are 1.9 percent higher now than five years ago. Staffing levels increased from 2017 through 2019, dropped in each of the next two years, then rebounded somewhat in 2022. Because student enrollment decreased over the same period, the number of FTE students per FTE employee decreased—falling from 9.6 in fall 2017 to 8.8 in fall 2021. (We discuss the enrollment decrease in the “Enrollment” section of this brief.)

Most Employee Salary Levels Are Determined Through Collective Bargaining. About 90 percent of CSU’s employees are represented by a union. The largest unions are the California Faculty Association, which comprises about half of CSU’s salary pool, and the California State University Employees Union, which represents support staff and comprises about one‑quarter of CSU’s salary pool. Whereas the Legislature ratifies collective bargaining agreements for most represented state employees, state law authorizes the CSU Board of Trustees to ratify collective bargaining agreements for CSU’s employees. These collective bargaining agreements determine salary increases for represented employees. The agreements also often indirectly drive salary increases for the remaining 10 percent of CSU employees (primarily consisting of managers and executives) who are not represented by a union.

CSU Often Provides Salary Increases. As Figure 5 shows, CSU’s employees have received general salary increases in most of the past several years. However, no employee groups received general salary increases in 2020‑21 when the state reduced General Fund support for CSU to address a projected shortfall in revenues due to the COVID‑19 pandemic. Some groups also received no increases in 2021‑22, followed by larger‑than‑average increases in 2022‑23. At this time, general salary increases have not yet been determined for 2023‑24. While most of CSU’s represented employees have agreements in place for 2023‑24, those agreements do not specify salary increases for that year, instead allowing the union to reopen salary negotiations after the Governor’s May Revision is released. Two of CSU’s smaller bargaining units have collective bargaining agreements that expire before or during 2023‑24, meaning salary increases for these bargaining units also likely will be negotiated in the coming months.

Figure 5

CSU Employees Have Had Salary Increases in Most Years

General Salary Increases by Employee Groupa

|

2017‑18 |

2018‑19 |

2019‑20 |

2020‑21 |

2021‑22 |

2022‑23 |

|

|

California Faculty Association |

3.5% |

3.5% |

2.5% |

— |

4.0% |

3.0% |

|

California State University Employees Union |

3.0 |

3.0 |

3.0 |

— |

— |

7.0 |

|

Other represented employees |

2.0‑3.1 |

3.0 |

3.0‑3.8 |

— |

0‑4.0 |

0‑7.0b |

|

Nonrepresented employeesc |

2.5 |

3.0 |

3.0 |

— |

— |

7.0 |

|

aUnless otherwise noted, chart does not reflect other salary provisions, such as equity increases, service salary increases, and post‑promotion increases. bEmployee groups received 3 percent to 7 percent general salary increases, with the exception of represented student employees. Represented student employees received 1.3 percent increases in salary range minimums and maximums, but no general salary increase. cChart reflects merit salary increases for executives, managers, and confidential employees. Chart does not include “excluded employees,” who are primarily temporary staff (such as student assistants and consultants). |

||||||

CSU Is Directly Responsible for Certain Pension Costs. The California Public Employees’ Retirement System (CalPERS) administers pension benefits for CSU and most other state employees. The CalPERS Board sets employer contribution rates for pensions. When employer contribution rates increase, the state covers the cost associated with CSU’s payroll up to the 2013‑14 level. However, CSU is directly responsible for any pension costs associated with payroll beyond the 2013‑14 level. (The state adopted this arrangement in 2013‑14 to provide CSU with a stronger fiscal incentive to contain staffing costs.)

Pension Contribution Rates Are Scheduled to Increase. The Governor’s budget assumes employer rate increases consistent with CalPERS’ most recent projections. These projections show 2023‑24 rates increasing 1.3 percentage points (reaching 32.1 percent) for the largest tier of CSU’s workforce and increasing 2.2 percentage points (reaching 51.1 percent) for CSU’s peace officers and firefighters. We estimate these rate increases will generate roughly $15 million in additional costs to CSU associated with payroll beyond the 2013‑14 level. (CSU’s 2023‑24 operating budget request does not include these costs, as it is based on an earlier set of CalPERS projections showing lower rates in the budget year.) As noted earlier, the state also plans to provide CSU with additional funding to cover the cost of rate increases associated with payroll up to the 2013‑14 level.

CSU Is Also Responsible for Certain Health Benefit Costs. CalPERS also administers CSU’s health benefits, and it negotiates with health plan providers to establish premiums for the plans offered to CSU’s employees. CSU’s contribution to employee health benefits is based on the average premium of the most popular health plans. When premiums increase, the state covers the cost associated with CSU’s retirees. However, CSU is directly responsible for the cost associated with its active employees. Due to rising premiums, CSU’s contribution to employee health benefits increased at an average annual rate of about 3 percent from 2017 to 2022. In 2023‑24, CSU has identified $51 million in costs associated with an 8 percent increase in its contribution rate.

CSU Has Various Other Operating Costs. Beyond employee compensation, CSU has other ongoing costs, such as paying debt service on its systemwide bonds and covering other operating expenses and equipment (OE&E). Some of these other costs are also increasing. For example, high inflation over the past year has led to increased prices for equipment and supplies, while various factors, such as the increased incidence of liability claims and wildfires, are contributing to higher insurance premiums. As campuses open new facilities, they also incur additional costs, including for utilities, routine maintenance, and custodial services. In 2023‑24, CSU has identified the following cost increases:

- $23 million to cover inflation on OE&E.

- $14 million to cover increased liability and property insurance premiums.

- $6 million to cover operations and routine maintenance of new facilities.

Fund Sources

State Commonly Provides General Fund Augmentations to Cover Operating Costs. Over the past decade, CSU primarily has relied on state General Fund augmentations to cover increases in its operating costs. Since 2013‑14, the state has provided CSU with General Fund base increases in all years but one. (In 2020‑21, the state reduced General Fund base support for CSU to address a projected shortfall in revenues due to the pandemic. The funds were restored the following year.)

CSU Also Uses Tuition Revenue to Cover Operating Costs. Over the past decade, CSU has increased tuition only once, raising systemwide charges by 4.9 percent for undergraduate and teacher credential students and 6.5 percent for graduate students in 2017‑18. Currently, the systemwide tuition charge for full‑time resident undergraduate students is $5,742 per year. About 60 percent of resident undergraduate students receive financial aid awards that fully cover this charge. Students with financial need typically receive tuition coverage through either the state’s Cal Grant program or CSU’s institutional financial aid program.

Share of Costs Covered by General Fund Has Been Increasing. As the state has provided CSU with regular General Fund base increases and tuition charges have remained flat most years, the General Fund has been comprising a growing share of CSU’s core funds. Whereas we estimate the General Fund comprised 50 percent of CSU’s ongoing core funds ten years ago, it comprises 62 percent today. Ongoing General Fund support per student has also been growing. In 2022‑23, ongoing General Fund support per student was 48 percent higher than in 2017‑18 (rising from $9,055 to $13,368) in unadjusted terms, and 17 percent higher adjusted for inflation.

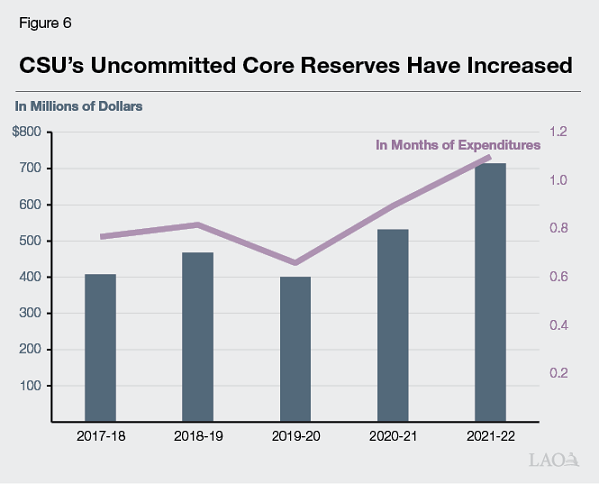

CSU Maintains Reserves for Planned Expenses and Economic Uncertainties. Like many other universities, CSU maintains reserves. CSU commits part of its reserves for planned one‑time activities, such as renovating a building or launching a new academic program. It also leaves some of its reserves purposefully uncommitted to prepare for economic uncertainties, including recessions. CSU’s systemwide reserves policy sets a target to maintain uncommitted reserves worth between three and six months of expenditures. At the end of 2021‑22 (the most recent data available), CSU had $2.5 billion in total core reserves, of which $714 million was uncommitted. As Figure 6 shows, CSU’s uncommitted core reserves have generally increased over the past five years, reaching 1.1 months of expenditures in 2021‑22. Nonetheless, the reserve level remains below the system’s target.

Campuses Have Largely Spent Recent Federal Relief Funds. Between March 2020 and March 2021, the federal government enacted three pieces of legislation providing COVID‑19 relief funds to higher education institutions. These three rounds of funds are collectively called the Higher Education Emergency Relief Fund (HEERF). CSU campuses received a combined $3.1 billion in HEERF funds. Of this amount, campuses were required to spend at least $1.3 billion on student financial aid. Any remaining funds were available for a broad range of institutional expenses associated with COVID‑19. As of January 2023, CSU campuses had spent $2.9 billion (96 percent) of the total relief funds they received. Aside from student financial aid, the largest categories of expenses were replacement of lost revenue, salaries and benefits, and information technology. Under current federal guidance, campuses have until June 30, 2023 to spend the remaining $134 million in relief funds.

Governor’s Proposal

Governor Proposes Base Increase. The Governor proposes a $227 million (5 percent) unrestricted base increase for CSU in 2023‑24. This is the second of five annual base increases included in the multiyear compact the Governor established with CSU last year. In addition to the base increase, the Governor’s budget would provide a combined $39 million for CSU pension and retiree health care cost increases.

CSU’s Plan

CSU Has Spending Plan for Proposed Base Increase. Though the Governor does not require CSU to use the proposed $227 million base increase for any particular purposes (other than “to support operational costs”), CSU’s operating budget request contains an associated spending plan. As Figure 7 shows, the largest amounts would go toward employee compensation. Specifically, the plan includes $92 million to increase employee compensation (which CSU estimates could support a 1.8 percent increase in the compensation pool), as well as $51 million to cover increases in certain health care premiums. The next largest amounts would go toward enrollment growth and the Graduation Initiative 2025 (CSU’s initiative to increase graduation rates and reduce equity gaps).

Figure 7

CSU Intends to Spend Base Increase on Various Cost Increases

General Fund (in Millions)

|

Amount |

|

|

Compensation pool increases |

$92 |

|

Health care premium increasesa |

51 |

|

Enrollment growth |

35 |

|

Graduation Initiative 2025 |

30 |

|

Liability and property insurance premium increases |

14 |

|

Operations and maintenance of new facilities |

6 |

|

Total |

$227 |

|

aReflects CSU’s employer contributions on behalf of active employees. |

|

Assessment

Unrestricted Base Increase Lacks Transparency and Accountability. The Governor’s proposed unrestricted base increase for CSU lacks transparency, as the funds are not designated for particular purposes. CSU has added some transparency to the Governor’s proposal by providing a spending plan, thereby allowing the Legislature to consider whether the funds would likely be used in ways that align with its priorities. Unlike with other types of augmentations, however, no statutory language requires CSU to spend the base increase consistent with its initial plan. As a result, the Legislature does not have assurance that the funds will be spent in ways that advance the outcomes it desires. While some amount of spending discretion can be appropriate when the state has put in place accountability systems with clear fiscal incentives for performance (such as the Student Centered Funding Formula for community colleges), the state has not put these conditions in place for CSU. Despite the performance expectations included in the Governor’s compact, no clear mechanism exists to increase or decrease CSU’s funding in response to its outcomes.

Amount of Governor’s Proposed Base Increase Is Arbitrary. The amount of the proposed 2023‑24 base increase was determined in an agreement made between the Governor and CSU, without being codified by the Legislature. At the time of the initial agreement, the Governor did not provide clear justification for the proposed amount based on CSU’s identified operating costs. Moreover, since the initial agreement was made last year, new information has become available on CSU’s cost increases as well as the state budget condition. We believe these factors warrant revisiting the amount of General Fund augmentation proposed for CSU in 2023‑24.

Proposed General Fund Augmentation Does Not Fully Cover CSU’s Projected Cost Increases. Under the Governor’s proposed General Fund augmentation of $227 million, some of CSU’s projected operating cost increases would not be covered in 2023‑24. For example, CSU’s associated spending plan for the proposed base increase does not include funding for projected cost increases due to inflation on OE&E. CSU’s spending plan also does not provide any funding for projects to address the system’s large and growing capital renewal needs. Under the multiyear compact, CSU would likely continue to have unaddressed costs in the out‑years. As we discuss in The 2023‑24 Budget: Higher Education Overview, we estimate that the Governor’s proposed General Fund increases would fall short of covering CSU’s projected operating cost increases every year through 2026‑27.

CSU Is Likely to Face Heightened Salary Cost Pressures. Notably, CSU’s spending plan for the proposed $227 million base increase in 2023‑24 accommodates a less than 2 percent increase to its compensation pool. CSU, however, faces significant upward pressure on employee compensation. Over the past year, both inflation and wage growth (across the nation and in California) were at their highest levels in several decades. Furthermore, inflation and broad‑based wage growth are expected to exceed 2 percent in 2023. Two employee compensation studies are also likely to contribute to salary cost pressures at CSU. The 2021‑22 Budget Act provided funding for a staff salary structure study, which was submitted to the Legislature in spring 2022. The study found wage stagnation at CSU relative to other higher education and general industry employers, with CSU salaries falling 12 percent below the market median on average. (The study did not examine differences in employee benefits.) In addition to the staff salary study, CSU has initiated a study focused on faculty salaries. It expects the findings of the faculty salary study to be available in spring 2023, in time to inform the Legislature’s final budget deliberations.

Recommendation

Link CSU’s General Fund Augmentation to Spending Priorities. Rather than give CSU an unrestricted base increase, we recommend the Legislature determine which of CSU’s potential operating cost increases it wishes to support in 2023‑24 and then provide associated funding designated for those particular purposes. For example, with the same total ongoing funding increase that the Governor proposes for CSU ($227 million), the Legislature could fund a 3 percent increase in CSU’s employee compensation pool ($157 million), projected employee health benefit increases ($51 million), and some capital renewal projects ($20 million). (We cover funding for enrollment growth in the next section of this brief.) The Legislature also could provide more or less than the Governor’s proposed amount, depending on its priorities and the state’s budget capacity. For example, if the Legislature wishes to support additional employee compensation increases, CSU estimates every 1 percent increase in the compensation pool would cost $52 million.

Consider Expanding Budget Capacity at CSU Through Tuition Increases. Given that the Governor’s proposed General Fund increases fall short of covering CSU’s projected operating cost increases every year of the compact period, the Legislature could consider supporting tuition increases at CSU. Pursuing tuition increases in 2023‑24 would require CSU to take quick action over the next few months, including calling a special meeting of the Board of Trustees in the first half of May. Pursuing tuition increases in 2024‑25 would allow greater time for student consultation and public notification. CSU recently indicated that it does not intend to pursue a tuition increase in 2023‑24 and has not yet made a determination for 2024‑25. CSU estimates that a 5 percent increase in systemwide tuition charges for all students would generate $83 million in net tuition revenue, as well as $42 million in additional funding for institutional financial aid. If the tuition increase were applied to the incoming student cohort only (similar to the model recently adopted by UC), additional revenue would be significantly lower in the first year but increase over the next several years. Under both models, students who receive tuition coverage through either the state’s Cal Grant program or CSU’s institutional financial aid program would not face higher costs. The state, however, would see higher Cal Grant costs. We estimate Cal Grant costs would increase by approximately $30 million ongoing if a 5 percent tuition increase were applied to all students, or by a smaller but growing amount if the tuition increase were applied to the incoming cohort only.

Enrollment

In this section, we first provide background on the state’s approach to funding CSU enrollment. Next, we cover recent trends in CSU enrollment. Then, we describe the Governor’s enrollment proposals as well as CSU’s enrollment plans. Finally, we assess those proposals and plans and make associated recommendations.

Background

Most CSU Students Are Resident Undergraduates. About 85 percent of CSU’s students are resident undergraduates. Undergraduates may enter CSU either as freshmen or as transfer students. Historically, roughly half of CSU’s incoming class each year has consisted of freshmen, and the other half has consisted of transfer students. In addition to resident undergraduates, CSU also enrolls resident postbaccalaureate and graduate students (comprising about 10 percent of its students) as well as nonresident students (comprising about 5 percent of its students).

State Budget Typically Sets Enrollment Growth Expectations for CSU. In most years, the state sets enrollment growth expectations for CSU in the annual budget act. These growth expectations historically applied to all resident students, but in recent years the state has applied them to resident undergraduates only. In addition, whereas the state historically set growth expectations for the budget year, some recent budgets have set an expectation for the following year. This approach of setting expectations one year in advance gives campuses more time to plan for growth, particularly since campuses make most of their admissions decisions for any given year before the budget is enacted in June.

State Typically Funds Enrollment Growth According to Per‑Student Formula. Typically, the state supports enrollment growth at CSU by providing a General Fund augmentation based on the number of additional students CSU is to enroll. The per‑student funding rate is derived using a “marginal cost” formula. This formula estimates the cost of the additional faculty, support services, and other resources required to serve each additional student. It then shares those costs between state General Fund and anticipated tuition revenue.

Last Year’s Budget Provided Enrollment Growth Funding for 2022‑23. The 2022‑23 Budget Act provided $81 million ongoing General Fund for CSU to grow resident undergraduate enrollment by 9,434 FTE students. The funding level was calculated at the 2021‑22 marginal cost per student of $13,087, with a state share of $8,586. (The state used the 2021‑22 rate because it had originally signaled its enrollment growth expectation that year, providing CSU more time to plan for growth.) Should CSU not meet the enrollment target, provisional language in the 2022‑23 Budget Act directed the administration to reduce the enrollment growth funding in proportion to the shortfall.

Recent Trends

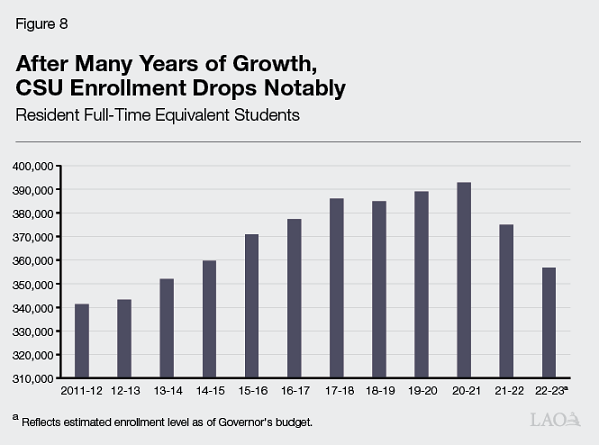

CSU Enrollment Continues to Decline in 2022‑23. As Figure 8 shows, CSU enrollment increased over much of the past decade, growing at an average annual rate of 1.6 percent from 2011‑12 through 2020‑21. CSU enrollment peaked in 2020‑21 at 392,793 resident FTE students. In the past two years, enrollment has decreased notably. In 2021‑22, enrollment decreased by 17,820 resident FTE students (4.5 percent) from the previous year. Though 2022‑23 enrollment data are not yet finalized, preliminary estimates show enrollment decreasing by an additional 18,125 resident FTE students (4.8 percent)—bringing enrollment down to 356,848 resident FTE students.

Increase in New Freshmen Is Offset by Larger Drop in New Transfer Students. In fall 2022, the number of new resident freshmen enrolling at CSU increased 8.6 percent over the previous year, as Figure 9 shows. This rebound brings the number of new freshmen closer to pre‑pandemic levels. However, the increase in new freshmen was more than offset by a 12 percent decrease in incoming transfer students. The steep decrease in transfer students is linked to community college enrollment declines, which accelerated at the start of the pandemic.

Figure 9

Enrollment Declined Among Many Student Groups in Fall 2022

Resident Fall Headcount

|

2019 |

2020 |

2021 |

2022 |

Change From 2021 |

||

|

Amount |

Percent |

|||||

|

Undergraduate |

||||||

|

New |

||||||

|

First‑time freshmen |

62,633 |

58,774 |

56,444 |

61,272 |

4,828 |

8.6% |

|

Incoming transfers |

56,385 |

60,420 |

54,649 |

48,006 |

‑6,643 |

‑12.2 |

|

Subtotals |

(119,018) |

(119,194) |

(111,093) |

(109,278) |

(‑1,815) |

(‑1.6%) |

|

Continuing |

290,939 |

294,616 |

293,020 |

277,959 |

‑15,061 |

‑5.1% |

|

Totals |

409,957 |

413,810 |

404,113 |

387,237 |

‑16,876 |

‑4.2% |

|

Postbaccalaureate/Graduate |

||||||

|

New |

17,494 |

20,360 |

19,007 |

16,797 |

‑2,210 |

‑11.6% |

|

Continuing |

28,886 |

28,646 |

31,152 |

29,623 |

‑1,529 |

‑4.9 |

|

Totals |

46,380 |

49,006 |

50,159 |

46,420 |

‑3,739 |

‑7.5% |

Continuing Student Enrollment Is Also Down. As Figure 9 also shows, continuing resident undergraduates declined by 5.1 percent from fall 2021 to fall 2022. Several factors are contributing to the enrollment decline among continuing students. First, CSU enrolled a smaller‑than‑usual incoming cohort in fall 2021, translating to fewer continuing students in fall 2022. Second, retention rates have generally decreased over the past couple of years. The percent of freshmen who return in their second year, for example, decreased from 85 percent for the fall 2019 incoming cohort to 82 percent for the fall 2021 incoming cohort. Third, average unit load among continuing undergraduates has also decreased over the past couple of years, from 13.3 units in fall 2020 to 12.9 units in fall 2022. The reduction in unit load is leading FTE students to decrease even faster than the headcounts shown in the figure.

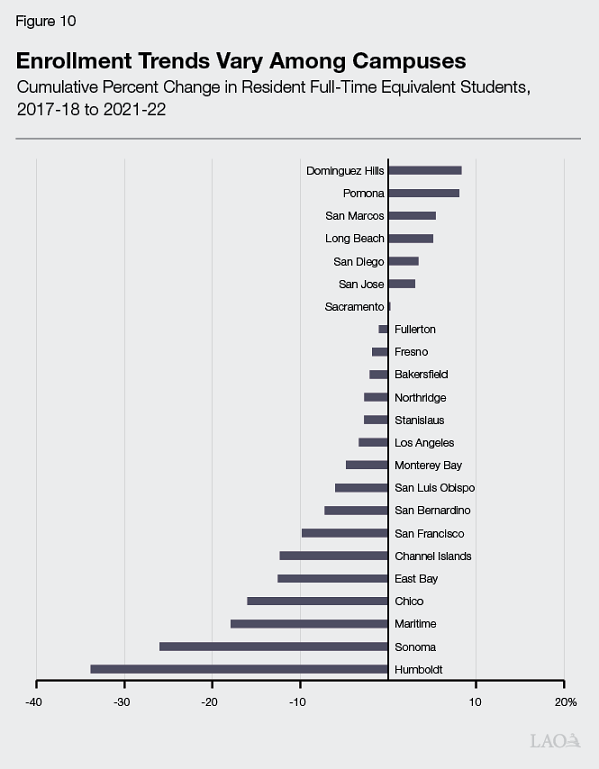

Recent Enrollment Trends Have Varied Among Campuses. As Figure 10 shows, enrollment trends varied widely among campuses over the past five years. From 2017‑18 through 2021‑22, the cumulative change in resident FTE students ranged from an 8.3 percent increase (at Dominguez Hills) to a 34 percent decrease (at Humboldt). In general, the campuses experiencing the most growth were concentrated in Southern California and the campuses experiencing the steepest declines were concentrated in Northern California. While campus‑level data are not yet available for 2022‑23, nearly all campuses (except San Diego, Humboldt, and San Bernardino) saw a decline in resident student headcount in the fall 2022 term.

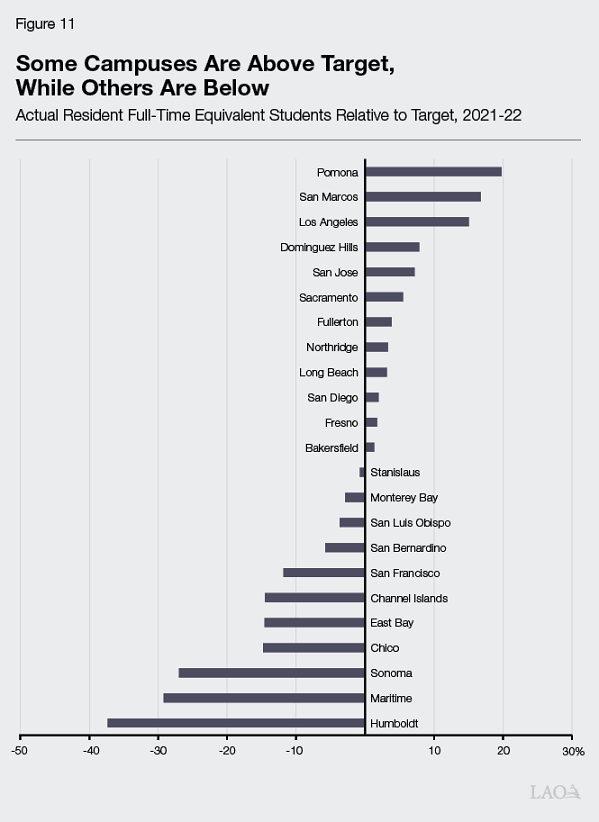

Some Campuses Are Below Their Enrollment Target. Over the years, CSU has tracked a running total of systemwide enrollment growth expectations, which it refers to as its enrollment target. It also tracks enrollment targets for each campus, reflecting that campus’s share of the system’s enrollment target and associated funding. In any given year, there is some variation between a campus’s actual enrollment level and its enrollment target. This is because campuses cannot perfectly predict yield rates, retention rates, and other aspects of student behavior. In 2021‑22, as Figure 11 shows, about half of campuses were above their target, while the other half were below. Seven campuses were more than 10 percent below their enrollment target.

Some Campuses Have Recently Discontinued “Impaction.” Over the years, many CSU campuses and programs have been designated as “impacted,” meaning they have more student demand than enrollment slots. In managing their enrollment, impacted campuses and programs adopt stricter admissions criteria than the minimum systemwide eligibility requirements. Amid recent enrollment declines, Chapter 465 of 2022 (AB 2973, Committee on Higher Education) simplified the process for campuses to remove these stricter admissions criteria. CSU reports that five campuses (Fresno, Maritime, Northridge, San Bernardino, and San Marcos) have made changes to impaction under the new process. Some of these campuses have discontinued the use of stricter admissions criteria for nonlocal applicants, while others have discontinued the use of stricter admissions criteria for all applicants within specific programs. Many other campuses and programs remain impacted for 2023‑24.

Some Eligible Applicants Continue to Be Redirected to Other Campuses. Due to impaction, some applicants meeting CSU’s minimum systemwide eligibility requirements are not accepted at any campus to which they apply. Since fall 2019, CSU has been redirecting these applicants to nonimpacted campuses. Yield rates among redirected applicants have tended to be low. In fall 2021 (the most recent data available), CSU redirected 11,143 eligible applicants, of whom 356 (3.2 percent) went on to enroll at a CSU campus.

Governor’s Proposals

Governor Does Not Reduce 2022‑23 Enrollment Growth Funding. Although CSU enrollment is declining, the Governor’s budget does not implement the 2022‑23 Budget Act provisional language directing the administration to reduce enrollment growth funding correspondingly.

Governor Has Enrollment Growth Expectation for 2023‑24 and Out‑Years. As part of the multiyear compact established between the Governor and CSU, the Governor expects CSU to increase resident undergraduate enrollment by 1 percent (3,434 FTE students) in 2023‑24. The Governor also expects CSU to continue increasing resident undergraduate enrollment by 1 percent annually through 2026‑27 (the last year of the compact). The compact does not specify the number of students CSU is to enroll each year, but it sets forth that CSU is to add approximately 14,000 FTE students in total over the next four years. Rather than provide designated funding for this enrollment growth, the Governor expects CSU to cover the associated cost from within its base increase each year.

CSU’s Plans

CSU Intends to Recover Enrollment Over Multiyear Period. In its fall 2022 compact progress report, CSU calculated its baseline 2022‑23 enrollment target by adding the 2022‑23 Budget Act expectation (an additional 9,434 resident undergraduate FTE students) to the previous systemwide enrollment target it had been tracking over time. To set the enrollment target for 2023‑24, it further added 3,434 resident undergraduate FTE students to this level. (Consistent with the compact, CSU assumes no growth in resident postbaccalaureate or graduate students.) As Figure 12 shows, this approach leads to an enrollment target of 387,114 resident FTE students in 2023‑24, growing to 397,623 resident FTE students by 2026‑27. Because of CSU’s current‑year enrollment declines, it would need to grow faster than 1 percent annually (as originally proposed in the compact) to reach these targets. CSU is planning to grow enrollment by 2 percent in 2023‑24, followed by an additional 3 percent annually in the out‑years. Under this plan, CSU effectively would catch up to its enrollment target by the last year of the compact.

Figure 12

Under CSU’s Plan, Enrollment Would Recover Over Multiyear Period

Resident Full‑Time Equivalent Students

|

2022‑23 |

2023‑24 |

2024‑25 |

2025‑26 |

2026‑27 |

|

|

Enrollment target under compact |

383,680 |

387,114 |

390,582 |

394,085 |

397,623 |

|

Annual percentage growth |

1% |

1% |

1% |

1% |

|

|

CSU’s planned enrollment level |

356,848a |

364,140 |

375,064 |

386,316 |

397,906 |

|

Annual percentage growth |

2% |

3% |

3% |

3% |

|

|

CSU's planned enrollment relative to compact target |

‑7% |

‑6% |

‑4% |

‑2% |

—b |

|

aReflects CSU’s estimated enrollment level as of Governor’s budget. bIn 2026‑27, CSU plans to slightly exceed the enrollment target under the compact (0.1 percent higher). |

|||||

CSU Would Set Aside Funds From Its 2023‑24 Base Increase for Enrollment Growth. Under CSU’s spending plan for the Governor’s proposed $227 million General Fund base increase (discussed in the “Core Operations” section of this brief), $35 million would be used for enrollment growth. CSU indicates it would allocate these funds to campuses that are at or above their target in 2022‑23, with the specific allocations to be determined after 2022‑23 enrollment data are finalized. (CSU also anticipates generating $16 million in tuition revenue from enrollment growth and allocating these funds in the same way.)

In 2024‑25, CSU Plans to Begin Reallocating Enrollment Funding Among Campuses. For many years, CSU has allowed campuses that miss their enrollment target to keep the associated funding. As part of its efforts to attain systemwide enrollment growth, CSU recently developed a plan to begin reallocating enrollment funding from campuses below their target. In 2024‑25, if a campus is 10 percent or more below its enrollment target in the previous year, CSU will reallocate 5 percent of the campus’s target and the associated funding to campuses at or above their target. CSU will reallocate another 5 percent in 2025‑26 for campuses 7 percent or more below their target in the previous year, as well as another 5 percent in 2026‑27 for campuses 5 percent or more below their target in the previous year. This plan is intended to incentivize all campuses to grow, while potentially also adding capacity at the highest‑demand campuses.

Assessment

2022‑23 Enrollment Growth Funds Are Not Serving Intended Purpose. The $81 million ongoing General Fund provided in 2022‑23 was intended to support costs associated with adding students, such as hiring more faculty and staff. Based on fall term data, most CSU campuses are likely to experience enrollment declines in 2022‑23, such that they are not expected to incur these additional costs. By allowing CSU to retain the enrollment growth funding, the Governor is effectively allowing it to use the funding for purposes other than the original intent.

Some Early Signs Suggest Enrollment Challenges Are Likely to Persist Into 2023‑24. While the 2023‑24 admissions cycle remains in its early stages, several early indicators suggest that growth could be challenging.

- High School Graduates. The number of high school graduates in California is projected to be roughly flat in 2022‑23 compared to the previous year. As a result, we do not expect to see demographically driven growth in the incoming freshmen class for fall 2023.

- New Applicants. As of January 2023, CSU reports a modest (3.1 percent) increase in freshmen applicants for fall 2023 compared to the previous year. However, this is offset by a larger (11 percent) decrease in transfer applicants, reflecting the continued impact of community enrollment declines on CSU’s transfer pipeline.

- Continuing Cohorts. In the past couple of years, CSU has enrolled smaller cohorts of new students. New resident student headcount decreased by 6.8 percent compared to the previous year in fall 2021, and then decreased an additional 1.6 percent in fall 2022. These smaller cohorts will remain at CSU in 2023‑24, leading to smaller cohorts of continuing students.

Legislature Has More Time to Influence 2024‑25 Enrollment. As CSU is already in the midst of making 2023‑24 enrollment decisions, the Legislature has less ability to influence its enrollment level in the budget year. The Legislature could, however, send an early signal to campuses about its enrollment expectations for 2024‑25. In setting an enrollment target for 2024‑25, it would likely want to consider the trends described above. The number of high school graduates next year is projected to increase by 0.6 percent, allowing for some demographically driven growth among new students in 2024‑25. However, the smaller incoming cohorts from the past couple of years will still be enrolled, potentially leading continuing student enrollment to remain low. At this time, other factors such as application volume, retention rates, and average unit load are uncertain for 2024‑25.

CSU Is Taking Certain Actions to Increase Enrollment. While various factors are likely to create enrollment challenges in the coming years, CSU is also taking certain actions that could offset those effects. For example, if CSU continues to remove stricter admissions criteria from previously impacted campuses or programs, yield rates might increase as more students get into their campus of choice. In addition, given the incentives created under CSU’s new enrollment reallocation plan, campuses might pursue additional recruitment and retention strategies. The potential reallocation of unused enrollment slots to higher‑demand campuses might also expand the number of students served systemwide in the out‑years.

Under CSU’s Plan, Enrollment Would Remain Below Previously Funded Levels in 2023‑24 and 2024‑25. The rates of enrollment growth under CSU’s plan (2 percent to 3 percent annually) are relatively high compared to historical averages. For comparison, CSU grew at an average annual rate of 1.6 percent during the decade of growth preceding the pandemic. Nonetheless, even if CSU were to achieve the planned growth, its enrollment level would remain below the previously funded level (that is, the 2022‑23 enrollment target of 383,680 resident FTE students) in both 2023‑24 and 2024‑25. This suggests CSU could support its planned enrollment levels in these years within existing resources.

Recommendations

Consider Reducing 2022‑23 Enrollment Growth Funds as Budget Solution. As we discuss in The 2023‑24 Budget: Overview of the Governor’s Budget, we recommend the Legislature plan for the risk of a larger budget problem by developing a larger set of potential budget solutions than the Governor has proposed. Given the 2022‑23 enrollment growth funds provided to CSU are not serving their intended purpose, the Legislature could consider adding these funds ($81 million) to the set of potential budget solutions. Removing these funds also would align with the provisional language enacted in the 2022‑23 Budget Act.

Recommend Setting 2023‑24 Enrollment Target in Budget Act. We recommend the Legislature specify the total number of students it expects CSU to enroll in 2023‑24 in the 2023‑24 Budget Act. This would enhance accountability by providing a clear goal against which CSU’s actual enrollment level can be measured. In deciding upon a target, the Legislature could use CSU’s planned enrollment level of 364,140 resident FTE students as a starting point. It could choose to increase or decrease this target based on the factors described above. As long as the target remains below the previously funded level (383,680 resident FTE students), we do not recommend providing any new enrollment growth funding.

Recommend Also Signaling Enrollment Growth Intentions for 2024‑25. Given the timing of the admissions cycle, we recommend the Legislature also signal any intent for additional enrollment growth in 2024‑25 in the 2023‑24 Budget Act. As with the budget‑year target, we recommend providing an augmentation for this enrollment growth only if the new target exceeds previously funded levels. The augmentation, if warranted, could be provided in the 2024‑25 budget to align the timing of the funding with the arrival of the students.

Capital Outlay Budget Solutions

In this section, we first provide background on capital outlay at CSU. Next, we describe the Governor’s proposed budget solutions relating to six CSU capital projects. Then, we assess that package of proposed budget solutions and make an associated recommendation. (The Governor also proposes budget solutions related to student housing projects across the higher education segments. We plan to review those proposals in the coming weeks.)

Background

State Funds Academic Facilities and Infrastructure at CSU. Traditionally, the state has funded CSU’s academic facilities, including classrooms, laboratories, and faculty offices. It has also funded certain campus infrastructure, such as central plants, utility distribution systems, and pedestrian pathways. In addition to these state‑supported assets, CSU has self‑supporting facilities, including student housing, parking structures, certain athletic facilities, and student unions. These types of facilities typically generate their own fee revenue, which covers associated capital and operating costs.

CSU Has Identified Many Capital Outlay Priorities. Under state law, CSU is to submit a capital outlay plan to the Legislature annually by November 30, identifying the projects proposed for each campus over the next five years. CSU’s most recent five‑year plan identifies $29.6 billion in projects proposed for 2023‑24 through 2027‑28, subject to available funding. The total amount consists of $22.7 billion in academic facilities and infrastructure projects as well as $6.9 billion in self‑supporting projects. Of the total amount, more than 70 percent is for improvements to existing facilities. This includes projects to address fire and life safety concerns, seismic risks, capital renewal (including the deferred maintenance backlog), and other programmatic issues. Less than 30 percent is for projects to add new space to support campus growth.

Two Main Ways to Fund CSU Capital Projects Are Cash and Debt Financing. One way the state may fund capital projects is by providing one‑time General Fund to CSU to pay for the project upfront in cash. The state commonly uses this approach to fund deferred maintenance projects, for example. A second way is by supporting the debt financing of capital projects. Under this approach, CSU borrows money for the projects by issuing university bonds, then repays the associated debt using its core funds. (State law authorizes CSU to use its main General Fund appropriation for this purpose.) CSU commonly uses this approach for larger projects, such as projects to renovate, replace, or construct an entire facility. Debt financing decreases the up‑front cost of these projects by spreading the cost out over many years. However, it increases the total project cost because CSU must pay interest on the borrowed amount.

In 2022‑23, State Funded Many CSU Capital Projects in Cash. At the 2022‑23 Budget Act, the state had a significant General Fund surplus. In addition, the state appropriations limit (SAL) constrained how the state could use revenues above a certain limit. One way the state addressed its SAL requirements was by spending on purposes excluded from the limit, including capital outlay. The 2022‑23 Budget Act provided over $400 million in one‑time General Fund to CSU for specific capital projects, in addition to $125 million for deferred maintenance, seismic mitigation, and energy efficiency projects across the system.

Governor’s Proposals

Governor Proposes to Shift Six Projects From Cash to Debt Financing. Since the enactment of the 2022‑23 Budget Act, the state budget condition has deteriorated, and the state now faces a budget problem. To reduce near‑term spending, the Governor proposes to rescind $405 million one‑time General Fund provided for six CSU capital projects in 2022‑23 and instead provide $27 million ongoing General Fund beginning in 2023‑24 to debt finance these projects using university bonds. Figure 13 lists the six projects, along with the associated one‑time funds that would be rescinded and the associated debt service augmentation that would be provided under the Governor’s proposal.

Figure 13

Governor Proposes Changing How Six CSU Capital Projects Are Funded

(In Millions)

|

Campus |

Project |

2022‑23 |

New Estimated |

|

Bakersfield |

New Energy Innovation Center |

$83.0 |

$5.5 |

|

San Diego (Brawley center) |

New STEM building |

80.0 |

5.3 |

|

San Bernardino (Palm Desert center) |

New student services building |

79.0 |

5.3 |

|

Chico, Fresno, Pomona, San Luis Obispo |

University farms facilities and equipment |

75.0 |

5.0 |

|

Fullerton |

New Engineering and Computer Science Innovation Hub |

67.5 |

4.5 |

|

San Luis Obispo |

Swanton Pacific Ranch rebuilding |

20.3 |

1.4 |

|

Totals |

$404.8 |

$27.0 |

|

|

STEM = science, technology, engineering, and math. |

|||

Assessment

Shifting Projects to Debt Financing Can Be a Reasonable Budget Solution. Changes in the state’s budget condition have made it more difficult to pay for large capital projects up front in cash. Given that facilities are typically used over many years, debt financing can be a reasonable alternative that spreads a facility’s costs across its useful life. In converting projects from cash to debt financing, the state can achieve near‑term savings. The state also maintains the flexibility to accelerate debt payments in the future, if it has a large surplus in any given year.

Debt Financing Would Increase Overall Project Costs. Although the Governor proposes to use a reasonable alternative financing option for these six CSU capital projects, his proposal also contributes to the state’s out‑year operating deficits. Moreover, it results in higher total project costs due to the associated interest payments. Under the Governor’s proposal, we estimate the state would spend roughly $810 million on the six projects—twice as much as originally budgeted—assuming the debt is repaid over 30 years at the proposed funding level of $27 million annually. (Depending on interest rates, actual debt service might be higher or lower than the proposed level.) Given the significantly higher cost, we think it would be reasonable to hold these projects to a more stringent standard before approving them for debt financing.

Projects Likely Do Not Address Highest Capital Outlay Priorities at CSU. Some of the capital projects identified in CSU’s five‑year plan are critical and urgent. Those projects often address deficiencies with existing facilities and infrastructure that could otherwise present life safety concerns or disrupt campus operations. In contrast, most of the projects that would be debt financed under the Governor’s proposal do not address these types of deficiencies with existing space. Moreover, four of the six projects primarily would add new space. Adding new space increases ongoing operations and maintenance costs, and it creates future capital renewal costs as building components eventually age.

Projects Affected by Proposal Are in Early Stages. Based on information provided by CSU, the six projects to be converted to debt financing are in planning and design stages. One project at the San Bernardino campus began preliminary plans in July 2022 and has spent $3.3 million to date. The remaining five projects are scheduled to begin preliminary plans in the coming months, with small amounts (less than $36,000 total) spent on these projects to date. To minimize project delays and the associated construction cost escalation, CSU is exploring options for these projects to move forward as budget deliberations over their funding continue. For example, campuses might use reserves to fund these projects over the next few months, or CSU might issue short‑term debt if authorized by the Board of Trustees. (Under the latter approach, CSU would be responsible for the debt service if the state were to withdraw its support for the projects.)

Recommendation

Revisit Whether to Move Forward With Each Project. Given that the Governor’s proposal to debt finance the six projects significantly increases their total costs, we recommend the Legislature revisit whether each project is justified under the new circumstances. In making this determination, it could consider the following criteria:

- Whether the project is among the most pressing of CSU’s capital needs, including projects that address critical life safety issues and minimize the risk of disruptions to existing campus operations.

- Whether justification for any new facilities has been provided based on factors such as unmet enrollment demand and overutilization of existing facilities.

- Whether the campuses constructing new facilities have a plan for covering any associated operating cost increases, as well as a plan to keep the facility in good condition across its life.

If the Legislature finds that a given project meets these criteria, it could approve the Governor’s proposal to debt finance that project. On the other hand, if the Legislature finds that a given project does not meet these criteria, it could consider withdrawing state support for that project at this time. CSU could consider including any affected projects in one of its future five‑year capital plans, with the Legislature reconsidering funding those projects at that time.