LAO Contacts

- Ann Hollingshead

- Targeted Legislative Augmentations

- Brian Metzker

- Broadband Infrastructure

- California Department of Technology

- FI$Cal

- Office of Data and Innovation

- Proposed California State Payroll System IT Project

- Brian Uhler

- Labor and Employment

- Tax Changes

- Brian Weatherford

- Governor's Office of Business and Economic Development

- Office of Planning and Research

- Eunice Roh

- Statewide Infrastructure

- Frank Jimenez

- Department of Food and Agriculture

- Jackie Barocio

- California Department of Veteran Affairs

- Jared Sippel

- California Arts Council

- Cannabis Regulation

- Department of Consumer Affairs

- Department of General Services

- Governor's Office of Emergency Services

- Nick Schroeder

- CalHR

September 27, 2022

The 2022-23 California Spending Plan

Other Provisions

- California Arts Council

- California Department of Veterans Affairs

- Cannabis Regulation

- California Department of Food and Agriculture (CDFA)

- Department of Consumer Affairs

- Department of General Services

- Governor’s Office of Emergency Services

- Target Legislative Augmentations

- Statewide Infrastructure

- California Department of Human Resources (CalHR)

- Governor’s Office of Business and Economic Development

- Labor and Employment

- Office of Planning and Research

- Tax Changes

- Broadband Infrastructure

- California Department of Technology

- Financial Information System for California

- Office of Data and Innovation

- Proposed California State Payroll System Information Technology Project

California Arts Council

The budget provides $108 million to the California Arts Council (CAC), mostly from the General Fund. This is a net decrease of $45 million (29 percent) from the revised 2021-22 level. This net change primarily reflects the expiration of funds provided in prior years as well as funding for a new grant program and various reappropriations described below.

Cultural Districts. The budget provides a one-time $30 million General Fund augmentation for the council’s cultural district program. These funds will support the existing 14 cultural districts and expand the program to support traditionally underserved communities.

Grant Funding Reappropriation. The budget reappropriates $40 million in 2022-23 ($34.8 million from the General Fund and $4.8 million from various special funds) to provide CAC with additional time necessary to award grants funded in prior years. For example, the budget reappropriates $500,000 from the Keep Arts in Schools Fund originally appropriated in the 2020-21 and 2021-22 budgets.

Control Section 19.56 Grants. The budget package also requires CAC to oversee $74 million in grant funds allocated through Control Section 19.56. The funds are generally allocated directly to individual local governments and community-based organizations for specific purposes, such as facility upgrades and arts programming. (For more information on Control Section 19.56, please see the “Targeted Legislative Augmentations” section of this post.)

California Department of Veterans Affairs

The spending plan for the California Department of Veterans Affairs (CalVet) includes $639 million General Fund in 2022-23, an increase of about $76.7 million (13.6 percent) relative to revised estimates for 2021-22. General Fund costs in 2022-23 are expected to be offset by $94 million from federal reimbursements for Veterans Homes. The year-to-year increase in General Fund is primarily due to a number of one-time funding augmentations, which we describe in detail below.

Funding for California Veteran Health Initiative (CVHI). The 2022-23 spending plan includes $50 million one-time General Fund, to be spent over three years, for grant programs that will provide outreach and support activities aiming to end veteran suicide through the CVHI. The funding will be split across three subprograms: (1) Outreach and Education Campaign to raise awareness of risk factors associate with veteran suicide ($5 million), (2) Veteran Mental Health Support Network to provide competitive grants to veteran-specific mental health service providers ($40 million), and (3) Veteran Suicide Surveillance and Review Program to collect veteran-specific suicide data and analyze the efficacy of veteran mental health support network system response ($5 million).

Capital Outlay Project. The 2022-23 budget for CalVet includes funding for two capital outlay projects:

Veterans Home of California, Yountville: Steam Distribution System Renovation. The spending plan provides $39.2 million General Fund to renovate the existing Yountville steam distribution system. Additionally, the spending plan extends the liquidation period for Working Drawings funds appropriated in the 2017-18 Budget Act until June 30, 2023 and authorizes reversion of $17.4 million Public Building Construction Fund to further support the Yountville steam distribution system.

Northern California Veterans Cemetery, Igo: Columbaria Expansion. The spending plan provides $2.3 million General Fund for the construction phase of the columbarium expansion project at the Northern California Veterans Cemetery in Igo, California.

Other Facility Changes and Improvements. The 2022-23 budget includes funding for other CalVet facility changes and improvements, which we describe below.

Veterans Home of California, Yountville Emergency Power Connections. The spending plan provides $5.3 million General Fund to install transfer switches and upgrade electrical panels at the Veterans Home of California, Yountville.

Facilities Planning and Construction Management Staff. The spending plan provides $515,000 General Fund in 2022-23, and $498,000 General Fund annually thereafter, to address the increased workload in facilities planning and construction management.

Veterans Cemetery Operations. The spending plan provides $492,000 General Fund in 2022-23, and $483,000 General Fund annually thereafter, to support the operational custodian and security requirement at the Northern California Veterans Cemetery and California Central Coast Veterans Cemetery.

Administrative and Information Technology (IT)-Related Changes. The 2022-23 budget includes funding for administrative and IT-related changes, which we describe below.

CalVet Administrative Support. The spending plan provides $1.5 million General Fund for administrative support in the CalVet Homes, Legal Affairs, Administration, and Communications Division.

Refresh IT Devices. The spending plan provides $1.4 million ongoing General Fund to regularly replace IT devices, including desktop computing devices, medical IT equipment, and other IT-related devices.

CalVet Information Services Support. The spending plan provides $657,000 General Fund, increasing to $635,000 General Fund annually thereafter, to address the staffing needs of the CalVet Information Services Division.

Completion of Electronic Health Records System. The spending plan includes $433,000 one-time General Fund to continue the implementation of a standardized electronic health records system across all CalVet veterans’ homes.

Improve IT Security. The spending plan provides $354,000 General Fund, and $343,000 General Fund annually thereafter, to improve overall the information security program, including implementing new security solutions and mitigating security risks and incidents.

Hire Dental Personnel for Two CalVet Homes. The spending plan provides $216,000 net General Fund, and $206,000 net General Fund annually thereafter, to hire permanent, full-time dental personnel at the Veterans Home of California, Chula Vista and Veterans Home of California, Fresno. The costs associated with hiring the dental personnel (about $1 million General Fund) are partially offset by savings in the Barstow Veterans Home resulting from the scheduled ramp down of domiciliary services ($784,000 General Fund savings).

CalVet Electronic Timekeeping Tool. The spending plan provides $116,000 General Fund in 2022-23, increasing to $262,000 General Fund annually thereafter, to replace the manual paper timesheet process with an automated and electronic timekeeping process for employees.

Cannabis Regulation

Changes to Cannabis Taxes. The budget package shifts the point of collection for the cannabis retail excise tax from distributors to retailers effective January 1, 2023. It also eliminates the cannabis cultivation tax effective July 1, 2022. In the short term, the budget package addresses the lost cultivation tax revenue by appropriating $150 million General Fund in 2023-24, which will be available for disbursement in 2023-24 and 2024-25. Starting in 2025-26, the budget package directs the California Department of Tax and Fee Administration to adjust the retail excise tax once every two years to offset the lost cultivation tax revenue. Such adjustments cannot raise the rate above 19 percent.

Tax Credits for Cannabis Businesses. The budget package creates two new income tax credits for cannabis businesses. To qualify for the first credit, a cannabis business must be an equity licensee. To qualify for the second credit, a cannabis business must be a retailer or microbusiness that meets certain employee compensation requirements. The budget package authorizes these credits for tax years 2023 through 2027. It limits the aggregate amount of each type of credit to $20 million General Fund cumulatively over this five-year period.

Department of Cannabis Control (DCC). The budget provides DCC with $201.6 million, primarily from the Cannabis Control Fund, which is supported largely by licensing fees. This is a net decrease of $92.1 million (31 percent) from the revised 2021-22 level. This decrease is primarily due to the expiration of one-time General Fund support provided in 2021-22 related to assisting individuals in participating in the cannabis market. This decrease is partially offset by various augmentations, including the following:

$20.5 million one time from the General Fund in 2022-23 for the Cannabis Local Jurisdiction Retail Access Grant Program to provide funding to cities and counties that do not currently have a local cannabis retailer licensing program, in order to aid them in developing such programs.

$13.6 million one time from the Cannabis Tax Fund in 2022-23 for an IT assessment of a unified cannabis licensing system, consumer awareness campaign, and data collection and sharing efforts.

California Department of Food and Agriculture (CDFA)

The budget provides $894 million from various fund sources to support CDFA in 2022-23, a decrease of $294 million (25 percent) compared to revised estimates for 2021-22. The decrease is largely due to (1) one-time funding provided last year related to fairgrounds and community resilience centers, and (2) one-time funding from this year’s Drought Response and Resilience Package that is attributed to 2021-22, as described below. Consistent with multiyear agreements adopted as part of last year’s budget, CDFA’s budget also includes funding in 2022-23 from the Sustainable Agriculture Package ($250 million)—including for safe and sustainable pest management—and from the Drought and Water Resilience Package for the State Water Efficiency and Enhancement Program (SWEEP, $50 million). We note that much of the capital outlay and emergency spending in CDFA’s budget is excluded from the state appropriations limit. (For more on this, please see our State Appropriations Limit Spending Plan post.)

Funding From Climate-Related Budget Packages. CDFA’s budget includes funding from several climate-related packages that were agreed to as part of the 2022-23 budget. First, the Drought Response and Resilience Package provides $100 million in 2021-22 from the General Fund and the Community Economic Resilience Fund in response to the declared drought emergency. (While funding from this package is reflected as an appropriation in 2021-22, spending will primarily occur in the current and coming years.) The funding will be used to provide direct drought relief and technical assistance to farmers and to support on-farm water and energy use efficiencies through SWEEP. The package also includes ongoing funding for a special assistant on drought response who will coordinate policy and program implementation for the department. Second, the Extreme Heat Package provides General Fund resources of $1.9 million in 2022-23 and $2.4 million in 2023-24 to (1) enhance pest inspection agreements with other states, (2) promote the adoption of sustainable pest management practices, and (3) support technical assistance and pilot projects related to managing unexpected animal mortalities due to extreme heat. Third, the Nature-Based Solutions Package expresses intent to provide $10 million for the Healthy Soils Program in 2023-24. Funding for all of these packages is described in more detail in our Natural Resources and Environmental Protection spending plan post.

Farm to School Efforts. The budget includes $30 million from the General Fund in 2022-23 for the Farm to School Incubator Grant Program to allocate additional grants. Combined with an additional $30 million that was agreed upon as part of last year’s budget package, the budget provides a total of $60 million for the program in 2022-23. The budget also includes $2.9 million from the General Fund in 2022-23 and ongoing to support 16 regional Farm to School network coordinators and market specialists. The staff will help to advance farm to school practices statewide.

Livestock Methane Reduction. The budget provides $30 million from the Greenhouse Gas Reduction Fund for several activities related to reducing methane emissions from the livestock sector. This includes $20 million for the Alternative Manure Management Program, which provides funding to livestock operators to implement non-digester manure management practices that reduce methane emissions. The remaining $10 million will be used to (1) support research on dietary modifications that are intended to reduce methane emissions from livestock, and (2) fund demonstration projects that utilize feed additives that have shown scientific efficacy in reducing livestock methane emissions.

Other Augmentations. The budget includes funding for five initiatives initially proposed by the Legislature: (1) biorepository upgrades ($11.3 million); (2) DNA library ($11.1 million); (3) expanding a teaching and innovation farm in Allensworth, California ($10 million); (4) Invasive Plants Management Program ($10 million); and (5) organics transition ($5 million).

Department of Consumer Affairs

The budget provides the Department of Consumer Affairs (DCA) and its boards and bureaus with $707.6 million, almost entirely from various special funds supported primarily by license fees. This is a net decrease of $1.4 million (less than one-half of 1 percent), from the revised 2021-22 level.

Bureau for Private and Postsecondary Education. The budget provides $14 million from the General Fund in 2022-23 (decreasing to $6 million in 2023-24 and $4 million in 2024-25) to stabilize the Private Postsecondary Education Administration Fund and allow the bureau to establish a new fee structure that will support its existing and future expenditures. The budget includes provisional language making funding for 2024-25 contingent upon the bureau submitting a new fee structure proposal to the Legislature by January 30, 2024. In addition, the budget provides $1.5 million ongoing from the Private Postsecondary Education Administration Fund to continue operation of the Office of Student Assistance and Relief and the Student Tuition Recovery Fund unit, which provide services to students of private postsecondary institutions.

IT. The budget provides $12.7 million annually in 2022-23 and 2023-24 from various special funds to support the maintenance and operation of the BreEZe IT system, which supports 18 of DCA’s boards and bureaus. The budget also provides $6 million one time in 2022-23 from various special funds for Business Modernization IT projects. Of this amount, the budget provides $1.7 million for software licensing, project management, maintenance, credit card services, and technical knowledge transfer. The remaining $4.3 million allows various boards, bureaus, and committees to begin implementing their business modernization software.

Department of General Services

The budget provides $1.4 billion to the Department of General Services (DGS) from various funds, including reimbursements from other state departments. This is a net decrease of $907.5 million (40 percent) from the revised 2021-22 level. This decrease is primarily due to the expiration of one-time funding provided in 2021-22. In addition to the $1.4 billion, the budget also includes $136.9 million in new lease bond authority for capital outlay projects.

Deferred Maintenance. The budget provides $100.7 million one-time General Fund for deferred maintenance projects, including elevator projects in three state buildings. The funding will also support the repair and replacement of direct digital control system projects in eight state buildings.

Control Section 19.56 Grants. The budget package also requires DGS to oversee $23.9 million in grant funds allocated through Control Section 19.56. Most of the funds are allocated directly to individual school districts for facility upgrades. (For more information on Control Section 19.56, please see the “Targeted Legislative Augmentations” section of this post.)

Capital Outlay. The budget provides $137 million in additional lease revenue bond authority to address cost increases for two previously approved projects. Specifically, the budget provides the following:

-

$74 million for the design-build phase of the Resources Building Renovation project, bringing total project costs to $534.7 million.

-

$63 million for the design-build phase of the Jesse Unruh Building Renovation project, bringing total project costs to $193.8 million.

Capitol Annex Projects. The budget makes a one-time transfer of $917 million from the General Fund to the State Project Infrastructure Fund to fully fund the remaining design, pre-construction, and construction activities for the State Capitol Annex Projects, which were previously approved to be partially financed by lease revenue bonds. These projects are expected to be completed in 2026. Budget trailer legislation specifies that the State Capitol Annex Projects are managed by the Joint Rules Committee rather than DGS. However, the legislation requires DGS to provide counsel and advice to the committee on the projects.

Governor’s Office of Emergency Services

The budget provides $2.4 billion for the Governor’s Office of Emergency Services (OES), primarily from federal funds and the General Fund. This is a net decrease of $76.6 million (34 percent) from the revised 2021-22 level. This decrease primarily reflects the net effects of the expiration of one-time funding provided in previous years and the augmentations described below.

Grant Funding. The budget provides General Fund support for various grant programs, including:

-

$114 million augmentation in 2022-23 (decreasing to $37.4 million in 2023-24 and ongoing) for the California Disaster Assistance Act (CDAA) program to provide financial assistance to local governments for costs incurred as a result of disasters. This brings total funding for CDAA to $176.6 million in 2022-23 and $100 million in 2023-24 and ongoing.

-

$50 million one time in 2022-23 for the Nonprofit Security Grant Program that provides support for security enhancement projects (such as reinforced doors and gates) to nonprofit organizations at risk of hate-motivated violence, such as nonprofits from the Asian American Pacific Islander; Lesbian, Gay, Bisexual, Transgender, Queer and plus; Black; and Jewish communities.

-

$50 million one time in 2022-23 to pilot the Flexible Assistance for Survivors Grant Program, which provides grants to qualifying community-based organizations to support direct cash assistance to certain crime victims.

-

$18.6 million one time in 2022-23 to complete the Los Angeles Regional Interoperable Communications System Land Mobile Radio System.

-

$13 million in 2022-23 and $12 million in 2023-24 to continue to implement the wildfire mitigation assistance pilot program authorized by Chapter 391 of 2019 (AB 38, Wood).

In addition, the Legislature adopted budget trailer legislation to establish the Multifamily Seismic Retrofit Grant Program to provide financial assistance for seismic retrofitting to owners of multifamily housing at risk of collapse in earthquakes. The legislation specifies that the Legislature shall appropriate $250 million one time from the General Fund in 2023-24 for this program.

The budget package also requires OES to oversee $141.3 million in grant funds allocated through Control Section 19.56. The funds are generally allocated directly to individual local governments for specific purposes, such as upgrading emergency-related infrastructure. (For more information on Control Section 19.56, please see the “Targeted Legislative Augmentations” section of this post.)

Emergency Response Capacity. The budget package directs OES to provide a report related to the state’s emergency response goals. Among other things, the report is specifically required to provide a detailed description of the department’s existing emergency response capacity, state emergency response goals, and related objectives, as well as gaps or weaknesses in the state’s ability to meet its stated goals and objectives.

In addition, the budget includes various General Fund augmentations to maintain or increase emergency response capacity, including:

-

$114.3 million one time to provide warehouse space, purchase new and replace expiring emergency supplies (such as personal protective equipment), increase commodity supply for an all-hazard event, and procure logistic support equipment.

-

$25 million annually for three years to provide funding for local law enforcement agencies that are deployed by OES through the Law Enforcement Mutual Aid System where neighboring emergency management, law enforcement, and fire agencies agree to assist each other to respond to a disaster or emergency.

-

$24.4 million in 2022-23 (decreasing to $24.3 million in 2023-24 and ongoing) for OES to take over direct responsibility for the Fire Integrated Real-Time Intelligence System (FIRIS) software from Orange County and contract for two surveillance aircraft. (The budget also provides $5.6 million to the California Department of Forestry and Fire Protection in support of FIRIS.)

-

$17.1 million ongoing to support education and outreach, operations, and research and development for the California Earthquake Early Warning System.

-

$11.2 million in 2022-23 (decreasing to $10.9 million in 2023-24 and ongoing) to support additional costs associated with the maintenance and replacement of the fleet of mutual aid fire engines that are part of the Fire and Rescue Mutual Aid System.

COVID-19 Response. The budget provides $29.5 million one time from the California Emergency Relief Fund for COVID-19 direct response activities, including funds for testing and to provide resources to activate the state’s mutual aid system to assist with outbreaks. (We note the California Emergency Relief Fund is exclusively supported by transfers from the General Fund.) In addition, the budget provides a $34.5 million one time increase in federal fund authority in 2022-23 for OES to receive Family Violence Prevention and Services Act American Rescue Plan COVID-19 Testing, Vaccine Access, and Mobile Health Units supplemental funding. OES will release the funds through grants.

Information Technology (IT). The budget provides $19 million one-time General Fund in 2022-23 (decreasing to $10.5 million in 2023-24 and ongoing) to develop and modernize various IT systems within the department. For example, the funds will be used to support development of the Disaster Information Sharing and State Threat Repository Platform, which will serve as the single secure repository for intelligence collection and analysis for OES.

Capital Outlay. The budget includes $35.4 million one-time General Fund in 2022-23 to support various capital outlay projects. These include:

$17.8 million in funding for a project to relocate the Red Mountain Communications Center.

$9.9 million for a project to make various modifications to the State Operations Center.

$5.4 million for a project to construct the Southern Region Emergency Operations Center.

$1.7 million for two projects to increase the lobby and checkpoint security of the OES headquarters building.

We note that much capital-related spending—both in OES and other areas of the budget—is excluded from the state appropriations limit. (For more on this, please see our State Appropriations Limit Spending Plan post.)

Targeted Legislative Augmentations

Control Section 19.56 provides $2.5 billion in appropriations for legislative priorities across a broad range of program areas and departments. The expenditures associated with these augmentations are initially allocated as a set-aside in budget Item 9901; however, in the Governor’s Budget next year, the administration will distribute them by department for 2022-23.

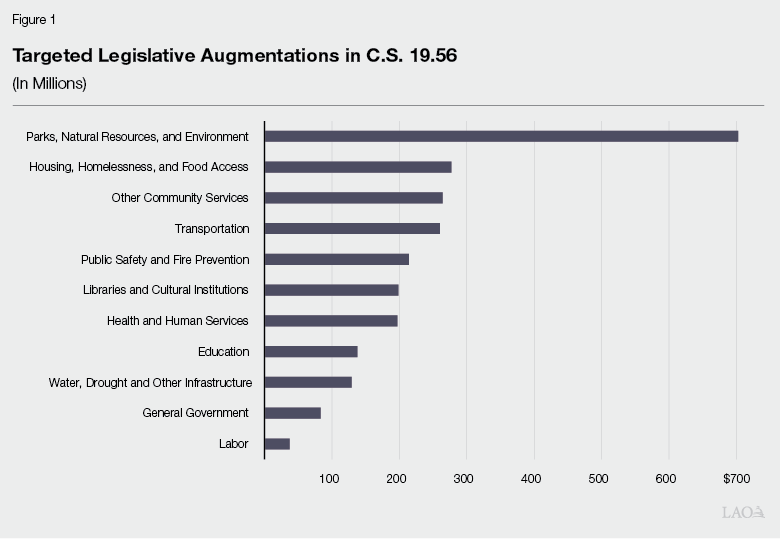

Amounts by Program Area. Figure 1 summarizes the amounts allocated by program area. Of the total, the largest augmentations are dedicated to:

$701 Million for Parks, Natural Resources, and Environment. Some of the largest augmentations in this category include: $100 million to the California Department of Forestry and Fire Protection for grants to local educational agencies and nonprofit childcare facilities receiving government funding for projects consistent with the Urban Forestry Act, $50 million to the San Gabriel and Lower Los Angeles Rivers and Mountains Conservancy for the Southeast Los Angeles Cultural Center Project, and $36 million to the State Coastal Conservancy for the East Bay Recreation and Park District for the Point Molate open space acquisition and clean up.

$277 Million for Housing, Homelessness, and Food Access. Some of the largest augmentations in this category include: $25 million to the County of Sacramento to address the concerns of the unpermitted homeless population on the American River Parkway, $23 million to the City of Glendale for the Burbank-Glendale-Pasadena Regional Housing Trust to be used to help finance affordable housing projects, and $20 million to the Satellite Affordable Housing Associates for Bridge Financing for two affordable housing projects.

$265 Million for Community Services. Some of the largest augmentations in this category include: $25 million to the City of Alhambra for the construction of the Alhambra community center, $25 million to the City of Riverside for the Cesar Chavez Community Center Renovations, and $19 million to the City of Colton for Community Development Projects.

Statewide Infrastructure

Debt Service

The budget provides $7.8 billion from various funds for debt service payments in 2022-23. This represents a decrease of 4 percent from 2021-22, mainly due to decreases in transportation debt service. This total includes $6.8 billion for general obligation bond debt ($5.1 billion from the General Fund) and $999 million for lease revenue bond debt ($600 million from the General Fund).

Capital Outlay

Overall, the budget includes $7.9 billion for 190 capital outlay projects in 2022-23. Capital-related spending is excluded from the state appropriations limit (SAL). (For more on this, please see our SAL spending plan post.) The total funding is an increase of $5.2 billion—or nearly three times as much—compared to the level of capital outlay spending in 2021-22. The bulk of this increase—80 percent—is the appropriation of $4.2 billion for the High-Speed Rail Project, with the remainder representing funding for additional projects (due in part to the increase in General Fund resources available in 2022-23). The funding provided in 2022-23 will support various phases of projects from preliminary plans to construction, and total estimated costs for all projects with known costs are $104.6 billion. (Three projects have unspecified total costs.) Figure 2 shows a summary of projects receiving funding by administering department. A complete list of all state capital outlay projects approved in the 2022-23 budget is available for download at this link. (The table generally does not include state funding for local infrastructure projects.)

Figure 2

Capital Outlay Appropriations

(In Millions)

|

Department |

2022‑23 Funding |

Number of Projects |

Total Project Costs |

|

High‑Speed Rail Authority |

$4,200 |

1 |

$93,489 |

|

Department of General Services |

1,531 |

5 |

2,288 |

|

California Department of Corrections and Rehabilitation |

405 |

22 |

964 |

|

California Community Colleges |

401 |

15 |

2,754 |

|

Judicial Branch |

317 |

30 |

1,159 |

|

California Department of Forestry and Fire Protection |

200 |

28 |

765 |

|

Military Department |

171 |

4 |

425 |

|

California Conservation Corps |

124 |

3 |

136 |

|

Department of Parks and Recreation |

113 |

28 |

298 |

|

California State University |

85 |

4 |

364 |

|

Board of State and Community Corrections |

81 |

1 |

81 |

|

California Highway Patrol |

80 |

14 |

845 |

|

Franchise Tax Board |

27 |

1 |

28 |

|

Department of State Hospitals |

26 |

6 |

128 |

|

Department of Veterans Affairs |

24 |

2 |

43 |

|

University of California |

23 |

2 |

174 |

|

Department of Water Resources |

23 |

1 |

23 |

|

California Tahoe Conservancy |

15 |

3 |

17 |

|

Department of Motor Vehicles |

14 |

7 |

166 |

|

California Department of Education |

10 |

3 |

160 |

|

State Lands Commission |

4 |

1 |

144 |

|

California Department of Food and Agriculture |

3 |

1 |

3 |

|

Department of Developmental Services |

1 |

1 |

5 |

|

Office of Emergency Services |

‑6a |

7 |

176 |

|

Totals |

$7,873 |

190 |

$104,637 |

|

aNegative numbers indicate that a department had more funding reverted than appropriated for its projects in 2022‑23. |

|||

In total, the budget provides 24 departments with funding for at least one capital outlay project approved in 2022-23. Projects in two departments account for nearly three-quarters of the total statewide capital outlay funds in the budget: High-Speed Rail Authority ($4.2 billion) and Department of General Services ($1.5 billion). Some individual capital outlay projects are discussed in more detail in other 2022-23 Spending Plan Series posts.

Capital outlay projects can be funded through a variety of different fund sources, including the General Fund, special funds, bonds, and federal funds. Some projects rely on multiple fund sources, depending on the project phase. The most common fund sources include the General Fund (124 projects); the 2016 California Community Colleges Capital Outlay Bond Fund (21 projects), which comes from general obligation bonds passed in Proposition 51; and the Public Buildings Construction Fund (13 projects).

Not all state capital outlay projects are approved by the Legislature in the annual budget act and, therefore, some are not reflected in the above figure. For example, while the Legislature approves the overall budget for the California Department of Transportation, individual projects generally are approved by the California Transportation Commission. In addition, funds for some capital expenditures are (1) continuously appropriated, such as some bond funds; (2) reappropriated, which provides additional time for the completion of the project; and (3) reverted, if the project has ended or requires modification.

Cost Increases. Several projects included in the budget represent cost increases. For example, the budget provides $1.6 billion for 80 projects to support increasing construction costs. Departments state these project cost increases are due to growing labor costs, heightened prices for construction materials (primarily due to supply chain issues), as well as other broad-based inflationary pressures. Statewide, 14 different departments reported cost increases for their projects. The following departments had the most projects with cost increases: California Department of Corrections and Rehabilitation (25 projects), Department of Parks and Recreation (13 projects), and California Department of Forestry and Fire Protection (12 projects).

California Department of Human Resources (CalHR)

2022-23 Budget Includes Significant Increase to Department Budget. The Legislature approved various budget proposals for CalHR. These proposals increased CalHR resources by a total of $17.5 million General Fund ($854,000 other funds) and 81.5 new authorized positions. The total CalHR budget in 2021-22 is estimated to be $119.4 million ($13.8 million from the General Fund) and 373 authorized positions, meaning that the 2022-23 budget proposals increased the department’s funding by more than 15 percent and its position authority by more than 20 percent.

CalHR Must Report Information to Legislature. The largest single CalHR budget augmentation was approval of the administration’s January budget proposal related to the California Leads as an Employer Initiative. As we discussed in our analysis of the budget proposal, the resources provided in the budget are for the initial stages of a multiyear and multiphase initiative aimed at making the state a more equitable, diverse, and inclusive place to work. In order to provide oversight of the initial stages of the initiative, the Legislature adopted budget bill language that requires CalHR to report a number of things to the Legislature by January 10, 2023. Among other things, CalHR is required to report on the department’s efforts to (1) fill the new positions that were authorized in the 2022-23 budget and (2) develop a diversity, equity, and inclusion strategy for the state’s civil service.

Employee Compensation

2022-23 Budget Package Ratified Labor Agreements With Four Bargaining Units. In 2022, the Legislature ratified memoranda of understanding between the state and four bargaining units. These bargaining units included Unit 2 (Attorneys), Unit 8 (Firefighters), Unit 9 (Professional Engineers), and Unit 18 (Psychiatric Technicians). In total, after assuming provisions of the agreements are extended to related excluded employees, the agreements increase state costs in 2022-23 by $221.7 million ($76.2 million General Fund). For context, these four bargaining units account for 18.5 percent of the state’s payroll costs.

Governor’s Office of Business

and Economic Development

Local Government Sustainability Fund

$300 Million to Establish New Local Government Grant Program. The spending plan provides a total of $300 million General Fund over three years—$100 million in 2023-24, $100 million in 2024-25, and $100 million in 2025-26—to establish the Local Government Budget Sustainability Fund. The Governor’s Office of Business and Economic Development (GO-Biz) will make grants to counties that are facing significant near-term unemployment, poverty, and local revenue challenges related to climate change and the state’s transition away from the use of fossil fuels.

Grant Award Criteria Under Development. GO-Biz will award grants to counties on a competitive basis, however, the administration has not finalized the specific criteria for evaluating grant applications. Eligible counties must have either high unemployment or high poverty. Counties also must participate in their region’s Community Economic Resilience Fund planning process. Eligible counties must be able to explain challenges to their local revenue sustainability over the next six years and how these challenges may put the funding of existing government services at risk.

Grants Must Be Used for Identified Types of Projects. GO-Biz will award grants for specific projects in any of five categories:

Process improvement projects, such as streamlining permit or site review processes.

Economic diversification projects.

Workforce development projects for new or existing programs.

Matching funds for existing process improvement, economic diversification, or workforce development projects that have already received awards from federal agencies.

Funding, up to $3 million across all counties, for staff to identify and develop process improvement, economic diversification, or workforce development projects.

Supplemental Paid Sick Leave

Temporary Paid Sick Leave for Employees Affected by COVID-19 Extended Through 2022. The 2022-23 budget package extends the state’s temporary supplemental paid sick leave policy for three months, through December 31, 2022. Chapter 4 of 2022 (SB 114, Committee on Budget and Fiscal Review) allowed employees who were affected by COVID-19 to take up to 80 more hours of supplemental paid sick leave between January 1, 2022 and September 30, 2022.

$250 Million for Grants to Small Businesses and Nonprofits. The budget package establishes the California Small Business and Nonprofit COVID-19 Supplemental Paid Sick Leave Relief Grant Program and provides $250 million one-time Emergency Relief Funds in 2022-23 to GO-Biz for grants to small businesses and nonprofits. Under this program, the California Office of the Small Business Advocate (CalOSBA) will make grants to qualified small businesses and nonprofits for their actual costs incurred, up to $50,000, for supplemental paid sick leave provided between January 1, 2022 and December 31, 2022. Eligible applicants, subject to other specified restrictions, must be active businesses and nonprofits that have 26 to 49 employees.

Third-Party Fiscal Agent. CalOSBA will contract with a private third party to accept and process applications and award the grants. This arrangement will likely be similar to that used to implement other CalOSBA administered grant programs, such as the California Small Business COVID-19 Relief Grant Program. CalOSBA will spend up to 5 percent of the appropriated funds, $12.5 million, on program administration costs.

California Competes

$120 Million for California Competes Grants. The budget provides $120 million General Fund in 2022-23 for California Competes grants. California Competes annually awards income tax credits to attract or retain businesses considering a significant new investment here. The 2021-22 Budget Act established the new California Competes grant program on a one-time basis. This grant program is similar to the tax credit program, except that qualified applicants indicate that they would prefer a grant to a tax credit.

Expanded Selection Criteria to Provide Special Consideration for Companies in States With Discriminatory Laws and Laws Limiting Reproductive Freedom. The budget package also includes provisions that modify the program to give special consideration to applicants considering relocation to California from states that have enacted laws which: (1) require discrimination on the basis of sexual orientation, gender identity, or gender expression; (2) permit discrimination on the basis of sexual orientation, gender identity, or gender expression; or (3) deny or interfere with a woman’s right to choose to bear a child or to choose and obtain an abortion.

Extends California Competes Tax Credit Program for Five Years. The California Competes tax credit was also extended for five years. See our spending plan post on tax changes for more information.

Other Items

$200 Million for Climate Catalyst Fund. The budget provides $200 million General Fund in 2022-23 to the state Infrastructure and Economic Development Bank (IBank) to provide financing for energy transmission projects through the Climate Catalyst Revolving Loan Fund. The Climate Catalyst Revolving Loan Fund was established at IBank in 2020 to provide financial assistance for public and private climate-related projects. According to the administration, IBank will use these funds to provide financial support for the development of new geothermal energy resources located in the Salton Sea region.

$150 Million for Waitlisted COVID-19 Relief Grants. The budget package provided $150 million in Emergency Relief Funds in 2021-22 for additional COVID-19 relief grants. The state established a new grant program in December 2020 to provide economic relief for small businesses affected by the COVID-19 pandemic. At the beginning of the year, CalOSBA reported that the total demand for the program would somewhat exceed the cumulative $4 billion that had been appropriated to the program for grants and program costs. This additional funding is sufficient to make approximately 13,000 grants and CalOSBA expects this will fund all of the waitlisted applicants. As of September 2022, $3.7 billion in grants have been awarded to more than 320,000 businesses. The private third-party fiscal agent continues to process applications and award grants.

$75 Million for Grants to Agricultural Businesses Affected by Severe Drought. The budget package provides $75 million Emergency Relief Funds in 2022-23 to establish and fund the California Small Agricultural Business Drought Relief Grant Program. CalOSBA will administer this program to make grants to small agricultural businesses that have been affected by severe drought. Similar to its other grant programs, CalOSBA likely will contract with a private third-party fiscal agent to evaluate applications and award the grants. Eligible agricultural businesses may be small farms, as defined by the U.S. Department of Agriculture; or businesses in specified industries, such as food manufacturing; and farm supply retailers with 100 or fewer employees. Eligible businesses also must have been affected by severe drought according to the U.S. Department of Agriculture. Grant amounts will be between $20,000 and $100,000 based on applicants’ decline in income.

$30 Million for Port Interoperability Grants. The budget package provides $30 million General Fund in 2022-23 to establish the California Containerized Ports Interoperability Grant Program. Of this amount, $2.1 million may be used to fund data aggregation and analysis efforts to improve port operations. The remainder of the funds will be allocated to the containerized ports based on their data system needs and performance metrics, such as container volumes. Grant funds must be used to support data systems that are necessary to achieve port interoperability and may not be used to track or monitor labor productivity. The funding is contingent on all of the containerized ports in California reaching an agreement regarding how they will work to help achieve real-time interoperability by May 1, 2023.

$26 Million in Ongoing Funding for Small Business Technical Assistance. The budget package increases limited-term funding for the California Small Business Development Technical Assistance Expansion Program (TAEP) by $6 million General Fund—from $17 million to $23 million—in 2022-23. The spending plan makes this TAEP funding permanent, along with $3 million for Small Business Development Centers, for a total of $26 million ongoing General Fund beginning in 2023-24. These programs financially support programs that provide training and consulting to small businesses and entrepreneurs.

$25 Million to Establish California Regional Initiative for Social Enterprises. The budget package provides $25 million General Fund in 2022-23 to establish the California Regional Initiative for Social Enterprises program. CalOSBA will contract with a private third-party fiscal agent to competitively award grants up to $500,000 to qualified employment social enterprises. Employment social enterprises are mission-based nonprofit or for-profit corporations that provide employment opportunities to individuals with a barrier to employment, such as homeless individuals and formerly incarcerated individuals, along with comprehensive supportive services and training.

$20 Million for Innovation Hubs. The budget provides $20 million General Fund in 2022-23 to CalOSBA to expand its existing innovation hubs program. Innovation hubs are formal partnerships between industry, startups and entrepreneurs, universities and research institutions, and government in a specific geographic area, focused on a specific sector. The 2021-22 Budget Act provided one-time funding to establish a new network of ten innovation hub partnerships, with a greater emphasis on outreach to businesses and entrepreneurs from underserved regions and communities. The additional funding will increase the number of partnerships from 10 to 13, one per Community Economic Resilience Fund region, and to fund a new Accelerate California Entrepreneurship Fund grant program. CalOSBA will award grants to small businesses and entrepreneurs that have received services from an Accelerate California Inclusive Innovation Hub. The administration has not specified how the grantees would be selected.

$15 Million for Tourism Marketing. The budget provides $15 million General Fund in 2022-23 to the California Travel and Tourism Commission, which operates as Visit California, for an expansion of its tourism marketing efforts. Visit California is responsible for marketing the state as a tourism destination. While Visit California is primarily funded through a voluntary assessment on the tourism industry, the COVID-19 pandemic significantly impacted the tourism industry and the 2021-22 Budget Act appropriated $95 million to supplement its declining revenues.

$15 Million to Expand California Venues Grant Program. The budget provides $15 million Emergency Relief Fund in 2022-23 to award grants to small movie theaters and drive-ins through the existing California Venues Grant Program. This program awards relief grants to eligible independent live events venues affected by the COVID-19 pandemic. Like other CalOSBA grant programs, the California Venues Grant Program is administered by a private third-party fiscal agent.

$11.6 Million for Immigrant Integration Activities. The budget package provides $11.6 million General Fund in 2022-23 and $500,000 per year through the 2025-26 fiscal year to establish the Local Government Immigrant Integration Initiative in GO-Biz. GO-Biz will competitively award up to $8.7 million in grants to local governments to develop or expand local immigrant integration initiatives. Examples of such initiatives include creating multilingual government resources or funding immigrant-focused positions to improve the access to government services for immigrants. GO-Biz also will competitively award $2 million to economic development agencies, educational institutions, or other service providers to develop export training programs and curriculum aimed at underserved business owners, including immigrant entrepreneurs and small business operators. The administration did not specify how many grants would be awarded or how the applications would be evaluated for either of these new grant programs. The remaining funding will be used to translate business quick start pamphlets into languages other than English, fund trade missions, and support new staff.

$8 Million for Women’s Business Center Enhancement Program. The budget provides $8 million one-time General Fund for grants to Women’s Business Development Centers. CalOSBA will competitively award grants up to $500,000 to Women’s Business Development Centers to provide focused technical assistance to underserved small business owners who have limited access to small business resources and capital.

Labor and Employment

Background

California’s major labor and employment programs provide work-related services and benefits to its residents, enforce its employment laws, oversee its workers’ compensation system, and regulate its workplace safety and health. Many of the work-related services and benefits are funded or required by the federal government, including unemployment insurance (UI) benefits and federal workforce training programs. The labor and employment programs are administered at the state level by the Employment Development Department (EDD), the Department of Industrial Relations (DIR), the California Workforce Development Board (CWDB), and the Agricultural Labor Relations Board. The state’s Labor and Workforce Development Agency oversees these entities and works to set policy and coordinate programs.

Key Budget and Related Actions

Partial Extra Payment on UI Loan From Federal Government. The budget includes $250 million in 2022-23 and $750 million in 2023-24 to make partial, early payments on the state’s outstanding federal UI loans. Following an unprecedented increase in UI claims during the pandemic, the state UI Trust Fund became insolvent. Under federal law, when a state’s UI trust fund becomes insolvent, the state must borrow money from the federal UI trust fund to continue paying state UI benefits. Under this federal program, business’ UI payroll taxes increase incrementally over time to repay the federal loans. During the pandemic, California borrowed roughly $20 billion to continue paying UI benefits. The state’s current outstanding balance is $18 billion. The budget plan would therefore repay about 6 percent of the state’s outstanding balance.

Funding to Begin New Technology System at EDD. The budget includes $68 million General Fund ($136 million all funds) to begin a new technology system to manage EDD benefits. The system, to be called EDDNext, would replace aging technology the state currently uses to manage the UI program and Disability Insurance/Paid Family Leave (DI/PFL).

Funding at EDD to Prevent Benefit Fraud and Maintain Recent Improvements. The budget includes $120 million General Fund in 2022-23 including $86 million General Fund to renew contracts with third-party anti-fraud service providers, $24 million General Fund to maintain technology staffing levels, and $10 million to improve cybersecurity of the state’s UI and DI/PFL programs.

Funding for COVID-19 Workplace Safety Outreach. The budget includes $50 million General Fund one time at DIR to educate workers and employers about how to minimize the workplace spread of COVID-19.

Budget Includes Various Workforce Development Initiatives. The budget includes various new workforce development initiatives under EDD, DIR, and CWDB. Figure 3 summarizes these programs and their General Fund funding amount.

Figure 3

Key Labor and Employment Budget Items

|

2022‑23 Funding Amount |

|

|

Employment Development Department |

|

|

Additional training for Emergency Medical Technicians |

$20 million annually for three years |

|

Assist displaced oil and gas workers |

$40 million one time |

|

California Workforce Development Board |

|

|

Training programs for Health and Human Services apprenticeships |

$115 million one time |

|

Port worker training facility |

$110 million one time |

|

California Youth Leadership Program Language Justice Pathway |

$60 million one time |

|

Well capping workforce training pilot |

$20 million one time |

|

Re‑entry employment grants |

$53 million one time |

|

Continued funding for low carbon economy grant program |

$45 million one time |

|

Department of Industrial Relations |

|

|

Expand nontraditional apprenticeship programs |

$55 million in 2022‑23, $60 million for next two years |

|

Expand Apprenticeship Programs for youth |

$20 million in 2022‑23, $25 million for next two years |

|

New Women in Construction Unit |

$15 million ongoing |

Extended Existing COVID-19 Sick Leave Until End of 2022. The budget extends the state’s COVID-19 sick leave policy by three months, from September 30, 2022 to December 31, 2022. The state’s COVID-19 sick leave policy requires employers to provide workers up to 40 hours of sick leave to use if (1) under COVID-19 isolation, (2) attending a vaccine appointment, or (3) experiencing COVID-19 symptoms. If the worker (or a family member) tests positive for COVID-19, the law requires employers to provide up to an additional 40 hours (for a total of 80 hours) of sick leave if needed.

Increased Weekly PFL and DI Benefits. Chapter 878 of 2022 (SB 951, Durazo) increases the weekly benefit amount for the state’s PFL and DI programs to 70 percent of recent wages for most workers and to 90 percent of recent wages for lower-income workers. These higher wage replacement rates go into effect in 2025. The state’s current wage replacement rate is 60 percent for most workers and 70 percent for a small number of very low-income workers. Benefits are funded with a 1 percent tax on wages. Workers pay the tax on their wages up to $145,600—the taxable wage ceiling—but do not pay additional taxes on wages above this amount. The administration forecasts that the new higher benefit amounts will result in $3 billion to $4 billion in additional payments each year. To fund these higher payment levels, beginning in 2024, SB 951 eliminates the taxable wage ceiling of $145,600, meaning all wages will be taxed.

Office of Planning and Research

Office of Community Partnerships and Strategic Communications

Establishes New Office to Manage Statewide Public Outreach Activities. The budget package establishes a new Office of Community Partnerships and Strategic Communications (OCPSC) in the Office of Planning and Research (OPR) to manage the state’s highest-priority community engagement and public awareness efforts, such as disseminating information about COVID-19. The budget provides $65 million General Fund per year through the 2025-26 fiscal year for OCPSC. Of this amount, $50 million is for grants to community-based organizations, philanthropic organizations, and other partners for culturally relevant public outreach activities towards hard-to-reach groups. In some instances, other state agencies manage pre-existing statewide public outreach activities and the budget package requires those agencies to share information regarding outreach efforts with OCPSC. The Legislature also directs OCPSC to increase the awareness of and participation in services that immigrant communities may qualify for with an Individual Taxpayer Identification Number.

Additional $250 Million One-Time Funding for Specified Outreach Activities. The budget package includes the following additional one-time spending for public outreach to be conducted by or in partnership with the new OCPSC:

COVID-19 Vaccine. The budget provides $230 million in 2022-23 from the California Emergency Relief Fund for communications and outreach grants related to COVID-19. The budget package transfers to OCPSC the various duties and responsibilities of the California Department of Public Health relating to the administration or implementation of the COVID-19 vaccine-related public education and outreach campaigns.

Extreme Heat. The budget provides $20 million General Fund—$6 million in 2022-23 and $14 million in 2023-24—to increase public awareness of extreme heat among hard-to-reach groups. OCPSC will spend funding on marketing research, public education and grants to community-based organizations, philanthropic organizations, and other partners for culturally relevant public outreach activities to raise public awareness about extreme heat.

Drought. The budget package directs the Department of Water Resources to implement the Save our Water public outreach campaign in partnership with OPR.

Extreme Heat

$170 Million for Community Resilience Centers. The budget package provides $85 million General Fund in 2022-23 and 2023-24 to the Strategic Growth Council for community resilience centers. The Strategic Growth Council would make grants to local governments to fund community resilience center projects. Community resilience centers provide physical facilities, as well as community services, that will be resilient to climate hazards. Grant funding will be allocated though a competitive process that has not yet been adopted.

$75 Million for Community Resilience and Heat Program. The budget package provides $75 million General Fund—$25 million in 2022-23 and $50 million in 2023-24—to the Integrated Climate Adaptation and Resiliency Program to establish a Community Resilience and Heat program. The program will coordinate state extreme heat activities and make grants to support local and regional heat adaptation efforts.

California Volunteers

California Volunteers, which is housed within OPR, coordinates volunteer activities related to disaster response and recovery and administers the federal AmeriCorps program. The budget package provides limited-term and one-time funding for several California Volunteers programs.

$146.2 Million for College Service Initiative. The budget provides $73.1 million General Fund in 2024-25 and 2025-26 to continue the College Corps service initiative after federal COVID-19 relief funding is exhausted. Administered as part of AmeriCorps, the initiative provides students at public and private higher education institutions with service opportunities in areas such as education and youth development, health, and disaster response. The funding supports programmatic and administrative costs and stipends (up to $7,000) or scholarships (up to $3,000) for participating student volunteers.

$25 Million for Summer Youth Jobs Program. The budget provides $25 million General Fund in 2022-23 for the Youth Jobs Corps program. The Youth Jobs Corps program provides part-time minimum wage jobs to youth, along with additional training and services, in partnership with local governments and community-based organizations.

$10 Million for Neighbor-to-Neighbor Program. The budget provides $10 million General Fund in limited-term funding through 2025-26 to develop the Neighbor-to-Neighbor program. California Volunteers coordinates volunteers before, during, and after disasters. The Neighbor-to-Neighbor program supports disaster response and recovery and will develop new volunteer projects to support critical community needs and statewide priorities, such as those related to drought and extreme heat.

$10 Million for Service Opportunities for Older Adults. The budget provides $10 million General Fund in 2022-23 to increase the number of volunteer service opportunities for older adults. California Volunteers will competitively award one or more grants to eligible public or nonprofit agencies to increase the number of Foster Grandparents and Senior Companions projects in the state. The current federally funded Foster Grandparents and Senior Companions programs support about 30 projects involving roughly 2,200 volunteers. The number of new volunteer service opportunities that would be supported by these state funds will depend on the grant process.

Higher Education

$20 Million for Carnegie Science Facility. The budget provides $20 million General Fund in 2022-23 for a grant to support the construction of a Carnegie Science climate research facility in Pasadena.

$3 Million to Increase Funding for the California Education Learning Laboratory (CELL). The budget provides $3 million General Fund in limited-term funding through 2025-26 to CELL. The purpose of CELL is to expand lower-division online and hybrid courses in science, technology, engineering, and mathematics at the state’s three public higher education segments. Of this amount, $2 million will restore CELL’s ongoing base to its pre-pandemic level of $10 million. The remaining $1 million will be used to expand a free adaptive learning homework system.

$10 Million for Golden State Awards. The budget provides $10 million General Fund in 2022-23 to establish the Golden State Awards program. CELL will administer the grant program, which will make awards to individuals or teams at, or associated with, the public higher education segments who have developed or are developing innovative practices.

Precision Medicine

$10 Million for Depression Research Funding. The budget provides $10 million General Fund in 2022-23 to the California Initiative to Advance Precision Medicine (CIAPM) to fund grants to precision medicine research projects focusing on depression. Eligible research projects will be located in California and will provide in-kind contributions to cover indirect costs. The administration did not specify how many research projects will be funded.

$9.3 Million to Address Inclusion in Biomedical Research Studies. The budget includes $9.3 million General Fund in 2022-23 to increase the number of participants from underrepresented backgrounds who are recruited, enrolled, and retained in biomedical research studies. CIAPM will create a network of ten state agencies and eight nongovernmental agencies to raise awareness of and participation in research among groups that are typically underrepresented.

Tax Changes

Better for Families Tax Refund. The 2022-23 Budget Act includes $9.5 billion General Fund to provide tax refunds for an estimated 17 million taxpayers. Joint filers with income below $150,000 ($75,000 for single filers) will receive $350 per taxpayer and an additional $350 if they claim a dependent, for a maximum of $1,050. Taxpayers with incomes above $150,000 ($75,000 for single filers) will receive smaller refunds. Taxpayers with incomes above $500,000 ($250,000 for single filers) are not eligible.

Repeals Limits on NOLs and Credits Early. The 2022-23 budget package repeals limits on net operating loss (NOL) deductions and business tax credits for 2022. This is one year earlier than the limits had previously been set to expire. In anticipation of a severe economic recession, the 2020-21 Budget Act adopted limits on NOLs and credits for tax years 2020, 2021, and 2022. While the 2020 recession was severe, the fiscal effects were smaller than anticipated and the recession was followed by strong economic growth across many sectors of the economy. Relative to the baseline revenue estimates, repealing the limits on NOLs and credits one year early reduces revenues in 2021-22 and 2022-23 and increases revenues somewhat in later years. The budget package assumes the following changes in revenue: -$1.9 billion in 2021-22, -$3.5 billion in 2022-23, and +$170 million in 2023-24. Most of the changes affect the corporation tax, although there are some small changes to the personal income tax (PIT).

Tax Conformity to Federal COVID-19 Economic Relief Benefits. The budget package conforms state tax laws to the federal tax treatment of federal assistance programs for businesses affected by COVID-19, excluding this assistance from taxable income. Chapter 39 of 2020 (AB 1577, Burke) and Chapter 17 of 2021 (AB 80, Burke) partially conformed state tax laws to the federal treatment of forgiven Paycheck Protection Program (PPP) loans and Economic Injury Disaster Loan advance grants. However, a later federal law extended the PPP and adopted two new relief programs—the Restaurant Revitalization Fund and the Shuttered Venue Operators Grant program. The budget package assumes that conforming to the federal tax treatment of these later programs will reduce revenues by $290 million in 2021-22, $304 million in 2022-23, and $179 million 2023-24. These costs are split evenly between the PIT and the corporation tax.

Extends California Competes Tax Credit Program for Five Years. The budget package extends the California Competes tax credit program—which had been set to expire at the end of the 2022-23 fiscal year—for five more years. The California Competes program is administered by the Governor’s Office of Business and Economic Development (GO-Biz). California Competes annually awards $180 million in income tax credits to attract or retain businesses considering a significant new investment here. California Competes is designed so that companies earn credits incrementally over a five-year period. Unused credit amounts may be carried forward for up to five additional years. Consequently, extending California Competes will have only a small short-term fiscal impact but will reduce state tax revenues by unknown, but significant amounts, in years outside the budget window. See our spending plan post on GO-Biz for more information about several additional changes the budget package made to the California Competes program.

Expands YCTC to Families With No Income. The budget expands the state’s existing Young Child Tax Credit (YCTC) to families with no earnings. Previously, the YCTC provided an additional $1,000 refundable tax credit to most families who qualify for the state’s Earned Income Tax Credit (or CalEITC) who also have children under the age of 6. Families with young children but with no earners were not eligible for the YCTC. The budget agreement makes these families now eligible for the $1,000 YCTC. The estimated cost of this tax change is $55 million annually.

New Tax Credit for Current and Former Foster Youth. The budget includes $20 million ongoing to establish the California Foster Youth Tax Credit, a refundable tax credit for current and former foster youth who qualify for the CalEITC. The refundable tax credit—worth up to $1,000—is available to current and former foster youth aged 18 to 25 who have earnings below $30,000 per year. The Franchise Tax Board will administer the new credit and the Department of Social Services, who oversees foster care programs, will confirm eligibility. Future costs for the credit will vary depending on how many foster youths are eligible and how many claim the credit. Without this full information, the administration has estimated that as many as 20,000 foster youth will claim the credit and has accordingly budgeted $20 million for the credit.

Tax Payment Flexibility for Pandemic Period for Certain Taxpayers. The budget plan includes tax payment flexibility for low- and middle-income taxpayers who did not file, filed late, or underpaid state income taxes during the pandemic. For these taxpayers who have started installment plans to pay their taxes, the budget action will waive penalties and interest for late payment, late filing, or underpayment. Taxpayers must repay their full tax obligations by 2023 to be eligible for these penalty abatements. The administration estimates that these waivers will reduce state penalty and interest collections by $60 million in 2022-23.

Conditional Commitment to Provide Tax Credit Related to Union Dues. The budget agreement includes language to potentially provide a tax credit to offset paid union dues. Currently union dues are deductible from state income taxes, meaning they reduce the amount of income on which individuals owe tax. Under a credit, the amount of paid dues would reduce the tax filer’s taxes paid. In general, tax credits provide a greater tax benefit than tax deductions. The policy change would go into effect after 2024 if certain state budget conditions are met. At this early stage, the administration estimates that this change could reduce state tax revenue by $400 million annually.

Suspends Sales Tax on Diesel Fuel. The budget package suspends the General Fund portion of the sales tax on diesel fuel from October 2022 through September 2023. The administration estimates that this tax suspension will reduce revenue by $439 million total over that period ($327 million in 2022-23 and $112 million in 2023-24). These revenues provide transportation funding via transfers to the Public Transportation Account. The budget package directs the State Controller to continue making transfers to the Public Transportation Account as if the tax suspension had not occurred. As a result, the General Fund ultimately will bear the full amount of the revenue loss.

New State Lithium Tax and Ban on Local Lithium Taxes. The spending plan includes various policy changes related to lithium extraction and processing. Most notably, it levies a new state excise tax on lithium extraction. The tax rate will range from $400 to $800 per metric ton of lithium carbonate equivalent that a producer extracts, adjusted annually for inflation. A total of 80 percent of the revenue from this tax will go to the counties where lithium extraction occurs, while the other 20 percent will go to the Salton Sea Restoration Fund. The budget package also prohibits local governments from levying excise taxes on lithium extraction or storage.

Broadband Infrastructure

As part of the 2021-22 spending plan, the administration and the Legislature agreed to spend $6 billion ($1.7 billion General Fund) over three fiscal years (starting in 2021-22) on broadband infrastructure. Accompanying changes in state law—enacted in Chapter 112 of 2021 (SB 156, Committee on Budget and Fiscal Review)—facilitate the planning and implementation of broadband infrastructure projects and programs.

Funding Pursuant to 2021-22 Three-Year Agreement. Consistent with the three-year broadband infrastructure spending agreement, the spending plan provides $250 million General Fund for broadband infrastructure in 2022-23—$125 million for a deposit into the Broadband Loan Loss Reserve Fund and $125 million for last-mile project grants. (Budget-related legislation—Chapter 249 of 2022 (AB 179, Ting)—also allows the administration to shift the funding source for up to $1 billion of the $3.25 billion appropriated in 2021-22 for the state’s middle-mile broadband network from federal American Rescue Plan fiscal relief funds to the General Fund.) For more information about the three-year agreement and each of the funded broadband infrastructure programs or projects, see our October 27, 2021 budget and policy post—The 2021-22 California Spending Plan: Broadband Infrastructure.

Language Stating Intent to Provide Additional Funding for Middle-Mile Network Costs in 2023-24 and 2024-25. Budget-related legislation—Chapter 48 of 2022 (SB 189, Committee on Budget and Fiscal Review)—also affirms the Legislature’s intent to provide $300 million General Fund in 2023-24 and $250 million General Fund in 2024-25 for additional costs to develop, construct, and acquire the state’s middle-mile broadband network. (No additional funds are appropriated for the middle-mile network in 2022-23.) Statute also requires the California Department of Technology (CDT) (in consultation with other state entities) to submit a report to the Joint Legislative Budget Committee with specific information about the middle-mile broadband network before CDT can encumber or expend any additional funds.

California Department of Technology

The California Department of Technology (CDT) is the administration’s central information technology (IT) entity with broad authority over most aspects of technology in state government. The spending plan provides $156.8 million General Fund for CDT in 2022-23, an increase of $88 million from revised 2021-22 General Fund expenditures of $68.8 million. This year-over-year net increase in General Fund expenditures is primarily attributable to two program changes discussed further below: (1) a one-time appropriation of $54.6 million to accommodate a reduction in State Data Center IT service rates and cover short-term net revenue losses, and (2) a one-time appropriation of $55.7 million General Fund (and four positions) in 2022-23 ($711,000 and four positions in 2023-24 and ongoing) to fund system stabilization efforts and technology modernization solutions for state entities. (This $110.3 million total increase is more than the $88 million year-over-year net increase because of reductions elsewhere in CDT’s 2022-23 budget.) Budget-related legislation—Chapter 48 of 2022 (SB 189, Committee on Budget and Fiscal Review)—also includes the Legislature’s intent to provide CDT with an additional $300 million General Fund in 2023-24 and $250 million General Fund in 2024-25 to fund the state’s middle-mile broadband network, which we discuss in more detail in the Broadband Infrastructure section of this post.

State Data Center IT Service Rates. The spending plan includes a one-time appropriation of $54.6 million General Fund in 2022-23 for the department to (1) reduce State Data Center IT service rates by shifting funding for some of its internal administrative expenditures and positions from cost recovery to General Fund and (2) cover short-term net revenue losses in the department’s cost recovery fund resulting from some state entities moving the provision of their IT services from the State Data Center to private vendors because of, for example, lower service rates offered by private vendors. SB 189 also adds to and revises state law to outline the State Data Center rate re-assessment process over the next three fiscal years, starting in 2022-23, and require annual legislative reporting until the process is completed. For more information about the State Data Center, its rate development process, and the expenditures funded by the appropriation, refer to our February 22, 2022 budget and policy post—The 2022-23 Budget: California Department of Technology.

System Stabilization and Technology Modernization Funding. The spending plan includes a one-time appropriation of $55.7 million General Fund (and four positions) in 2022-23 ($711,000 and four positions in 2023-24 and ongoing) for the department to start funding state entity system stabilization efforts ($30 million) identified by the department and continue funding technology modernization solutions ($25 million) proposed by state entities. (System stabilization funding is available for encumbrance or expenditure until June 30, 2026, and technology modernization funding is available for encumbrance or expenditure until June 30, 2028.) Provisional language in Chapter 43 of 2022 (SB 154, Skinner) provides a list of the eligible uses for these funds, limits the total cost of any effort and/or solution to no more than $5 million, requires that CDT submit a prioritized list of efforts and/or solutions to the Department of Finance for review and approval prior to expenditure of any funds, and requires semiannual reporting on the uses of this funding to the Legislature.

Other Program Changes. In addition to the major program changes summarized above, the spending plan also provides $2.8 million General Fund and 11 positions in 2022-23 and 2023-24 ($2.1 million General Fund and 11 positions in 2024-25 and ongoing) for corrective actions in response to audit findings in a January 18, 2022 California State Auditor (CSA) report on CDT’s information security (IS) oversight capacity. (Supplemental report language adopted by the Legislature also directs our office to submit a report on the IS compliance of nonreporting entities—that is, entities that fall outside of the Governor’s direct authority and are not required by state law to comply with and report on IS policies and procedures set by CDT—in response to one of the findings raised in CSA’s report.) The spending plan also includes $1.7 million General Fund in 2022-23 and ongoing to cover the cost of the department’s Security Operations Center’s cloud infrastructure.

Financial Information System for California

The purpose of the state’s Financial Information System for California (FI$Cal) information technology (IT) project was to replace its aging and decentralized financial IT systems with one system that integrates state government processes for accounting, budgeting, cash management, and procurement. As reflected in the spending plan and budget-related legislation, the project is transitioning from active development and implementation to maintenance and operations by the Department of FI$Cal.

Funding for Project and System Workload. The spending plan provides $24.3 million ($14.6 million General Fund) and five positions in 2022-23 to (1) add additional departments to FI$Cal and (2) plan, develop, and implement the interfaces between FI$Cal and the proposed California State Payroll System (CSPS) IT project. (Outyear funding includes $5 million [$3 million General Fund] and five positions in 2023-24, $3.2 million [$1.9 million General Fund] and five positions in 2024-25, and $846,000 [$508,000 General Fund] and five positions in 2025-26 and ongoing.) The spending plan also provides $16.6 million ($9.9 million General Fund) and 46 positions in 2022-23 ($11 million [$6.6 million General Fund] and 46 positions ongoing) to transition some of the remaining workload from the project’s system integrator to FI$Cal staff to complete. The Department of FI$Cal also receives $5.3 million ($3.2 million General Fund) and 13 positions in the spending plan for information security and internal control activities. (Outyear funding includes $4.3 million [$2.6 million General Fund] and 13 positions in both 2023-24 and 2024-25, and $3.4 million [$2.1 million General Fund] and 13 positions in 2025-26 and ongoing.)