LAO Contacts

- Ann Hollingshead

- Major New Control Sections

- Proposition 2

- Angela Short

- CalSTRS State Contributions

- Brian Metzker

- California Department of Technology

- Brian Weatherford

- Economic Development and Tax Incentives

- Chas Alamo

- Economic Relief

- Labor and Employment Issues

- Eunice Roh

- Statewide Infrastructure

- Frank Jimenez

- Department of Food and Agriculture

- Jackie Barocio

- California Department of Veteran Affairs

- Jessica Peters

- Cannabis Regulation

- Department of General Services

- Department of Financial Protection and Innovation

- California Arts Council

- Governor's Office of Emergency Services

- Nick Schroeder

- Employee Compensation

- Elections

- Ross Brown

- California Public Utilities Commission

September 23, 2021

The 2021-22 California Spending Plan

Other Provisions

- Cannabis Regulation

- Department of General Services

- Department of Financial Protection and Innovation

- California Arts Council

- Governor’s Office of Emergency Services

- California Department of Technology

- Economic Development and Tax Incentives

- Economic Relief

- Labor and Employment Issues

- Major New Control Sections in the Spending Plan

- Proposition 2

- Statewide Infrastructure

- California Public Utilities Commission (CPUC)

- California Department of Food and Agriculture (CDFA)

- California Department of Veterans Affairs

- CalSTRS State Contributions

- Elections

- Employee Compensation

Cannabis Regulation

The budget package reflects various actions related to the state’s continued implementation of laws to regulate medical and adult-use cannabis, including Proposition 64 (2016).

Reorganization of Cannabis-Related Responsibilities. The budget includes statutory changes and shifts resources to transfer most cannabis regulatory responsibilities to a new department within the Business, Consumer Services and Housing Agency—the Department of Cannabis Control (DCC). Specifically, the budget shifts $151 million in Cannabis Control Fund (CCF) resources and 598 positions to DCC from the Bureau of Cannabis Control (BCC), the California Department of Food and Agriculture (CDFA), and the California Department of Public Health (CDPH). In addition, the budget provides DCC a $3.2 million (CCF) augmentation to support 23 new positions. Under the reorganization, various entities will maintain some limited cannabis-related responsibilities. For example, CDFA will retain responsibility for the Cannabis Appellations Program and CDPH will retain responsibility for the Medical Marijuana Identification Card Program.

Because BCC’s only responsibilities were related to cannabis licensing, the budget reflects the dissolution of the bureau. We note that the budget package shifts from BCC to the Governor’s Office of Business and Economic Development (GO-Biz) $15.5 million in Cannabis Tax Fund resources and primary responsibility for the California Equity Act of 2018 program, which provides grants to local jurisdictions to support the participation of individuals impacted by cannabis criminalization in the legal market.

Funding for Programs to Support Cannabis Market Participation. The budget package includes several one-time General Fund augmentations for programs designed to assist individuals in participating in the cannabis market. These include the following:

$100 million for DCC to establish the Cannabis Local Jurisdiction Program, which provides grants to local governments to aid licensees in transitioning from provisional to annual cannabis licenses. (Provisional licenses allow licensees to operate before all state licensure requirements are fully verified to encourage transition to the legal market.)

$30 million for DCC to implement a fee waiver or deferral program to reduce barriers to entry into the legal cannabis market.

$20 million for GO-Biz to increase support for the California Equity Act of 2018 program.

Statutory Changes Related to Provisional Cannabis Licenses. Budget trailer legislation makes various changes to the provisional cannabis licensing program. For example, the legislation generally extends the ability of DCC to grant new provisional licenses from January 1, 2022 to June 30, 2022. In addition, the legislation specifies that DCC cannot renew certain cultivation provisional licenses after January 1, 2023 and all other provisional licenses after January 1, 2025. Finally, the legislation terminates all provisional licenses after January 1, 2026.

Department of General Services

The budget provides $1.6 billion for the Department of General Services (DGS) from various funds, including reimbursements from other state departments. This is a net decrease of $522 million (24 percent) from the revised 2020-21 level. This decrease is primarily due to the expiration of one-time funding provided in 2020-21 related to the coronavirus disease 2019 (COVID-19) pandemic. In addition to the $1.6 billion, the budget also includes $768 million in new lease revenue bond authority.

Regional K-16 Education Collaboratives. The budget provides $250 million one-time General Fund to DGS for supporting new regional collaboratives. Each collaborative is to include at least one school district, community college district, California State University campus, and University of California campus. To receive grants, collaboratives must create new intersegmental academic pathways in at least two of the following occupational areas: health care, education, business management, and engineering/computing. (For more information about the regional K-16 education collaboratives, please see our Higher Education spending plan post.)

COVID-19 Direct Response Costs. The budget provides $32 million one-time General Fund for COVID-19 direct response costs. Of the total, $31.8 million supports the Hotels for Healthcare Workers program, which provides free or reduced-price hotel rooms to healthcare workers who are treating COVID-19 patients to reduce the risk of these workers spreading the virus to their families. The remaining funds primarily support statewide testing costs.

Infrastructure. The budget includes (1) $50 million (General Fund) and $1.3 million (Service Revolving Fund) one time to design and install zero-emission electric vehicle charging stations at state-owned facilities, (2) $50 million (General Fund) one time for deferred maintenance at DGS operated facilities, and (3) $15.3 million (Service Revolving Fund) to operate the new Clifford L. Allenby and Natural Resources Headquarters Buildings in Sacramento. The budget also includes $11.6 million one-time General Fund for the design phase of the Bonderson Building Swing Space project.

In addition, the budget provides $768 million in new lease bond revenue authority for the renovation of three buildings: (1) $452 million for the design-build phase of the Resources Building project, (2) $192 million for design-build phase of the Gregory Bateson Building project, and (3) $124 million for the design-build phase of the Jesse M. Unruh Building project.

Department of Financial Protection and Innovation

The budget provides $146 million for the Department of Financial Protection and Innovation (DFPI), primarily from the Financial Protection Fund (FPF), which is supported largely by regulatory fees. This is a net increase of $31 million (27 percent) from the revised 2020-21 level.

Debt Collector Licensing. The budget provides $5.8 million (FPF) in 2021-22—as well as $5 million in 2022-23 and $4.9 million in 2023-24—for the implementation of Chapter 163 of 2020 (SB 908, Wieckowski), which requires DFPI to establish a regulatory and licensing system to oversee debt collectors. The limited-term funding will provide DFPI sufficient time to evaluate the ongoing funding and staffing needs of the program.

Financial Empowerment Fund. The budget includes a $10 million one-time transfer from the General Fund to the Financial Empowerment Fund to increase grant funding available for nonprofits to serve unbanked and underbanked people. This brings the total amount available in the Financial Empowerment Fund to $11.3 million in 2021-22.

California Arts Council

The budget provides $154 million for the California Arts Council (CAC), mostly from the General Fund. This is a net increase of $112 million (267 percent) from the revised 2020-21 level.

California Creative Corps Pilot Program. The budget provides a $60 million one-time General Fund augmentation to provide grants to local artists and art organizations with a focus on art campaigns that bring awareness to various issues such as coronavirus disease 2019 (COVID-19), water and energy conservation, emergency preparedness, civic engagement, and social justice.

Creative Youth Development Grant Programs. The budget includes a $40 million one-time General Fund augmentation to expand CAC’s existing creative youth development programs, such as Artists in Schools and Youth Arts Action. These funds will support the expansion of these programs statewide through partnerships with community-based organization, educators, and local artists.

Governor’s Office of Emergency Services

The budget provides $2.3 billion for the Governor’s Office of Emergency Services (OES), primarily from federal funds and the General Fund. This is a net increase of $130 million (6 percent) from the revised 2020-21 level. This reflects the net effects of the expiration of one-time funding provided in previous years and the augmentations described below.

Community Disaster Resilience and Recovery Funding. The budget provides various augmentations to enhance the state’s disaster resilience and recovery programs. These augmentations include:

$100 million one-time General Fund for the California Disaster Assistance Act (CDAA) to repair or replace publicly owned property damaged by a disaster and reimburse local governments for various disaster-related activities. This augmentation brings the total amount provided for CDAA in 2021-22 to $163 million.

$100 million one-time General Fund for community hardening and supporting disaster resiliency in under-resourced communities by covering local governments’ share of costs for the federal hazard mitigation grant program and providing technical assistance in the grant application process.

$15.7 million General Fund and $22.1 million in federal funds for long-term disaster recovery support to maximize the amount of federal reimbursements and hazard mitigation grant funding received by the state and local governments.

Increased State Emergency Response Capacity. The budget includes $60.6 million General Fund (decreasing to $59.2 million in 2022-23 and ongoing) to increase OES response and recovery capabilities. This includes:

$29.9 million to establish an Office of Equity ($4.9 million) and make permanent the Listos California grant program ($25 million), which allocates emergency-related funds to support marginalized and underserved communities across the state.

$16.5 million to establish incident response teams to operate the State Operations Center, where OES coordinates emergency response, or regional emergency operations centers.

$10.2 million to modernize technology and update outdated data systems.

$4 million to establish a disaster cost tracking unit.

COVID-19 Direct Response Costs. The budget provides $18.9 million one-time General Fund for coronavirus disease 2019 (COVID-19) direct response costs. This funding will support the State Operation Center and subject matter expert costs.

Earthquake Early Warning System. The budget includes $17.3 million one-time General Fund to support and expand the earthquake early warning system. The funding will support system operations, program management, an outreach campaign, and research and development.

Local Assistance for Public Safety and Other Grant Programs. The budget includes $253.7 million General Fund for various local assistance augmentations to public safety and other grant programs. The augmentations are shown in Figure 1.

Figure 1

Public Safety and Other Grant Program Augmentationsa

2021‑22, General Fund (In Millions)

|

Description |

Amount |

|

Supplemental support for existing federally funded victim programs |

$100.0 |

|

Security enhancements at nonprofits at risk of violence and hate crimes |

50.0 |

|

Homeless youth emergency housing |

50.0 |

|

Domestic and sexual violence prevention programs |

15.0 |

|

Family justice centers |

11.0 |

|

Public awareness campaign and training on gun violence restraining orders |

11.0 |

|

Support for human trafficking survivorsb |

10.0 |

|

Sexual assault kit testingc |

6.7 |

|

Total |

$253.7 |

|

aFunding is one time unless otherwise noted. b$10 million annually for three years for a total of $30 million. cFunding is ongoing. |

|

Capital Outlay. The budget includes $44 million General Fund for several OES capital outlay projects. This includes $26.5 million for the acquisition phase of a project to build a Southern Region Emergency Operations Center and $16.7 million in reappropriated funds for the construction and equipment phases to relocate the Red Mountain Communications Site in Del Norte County.

California Department of Technology

The California Department of Technology (CDT) is the administration’s central information technology (IT) entity with broad authority over most aspects of technology in state government. The spending plan provides $67.9 million General Fund for CDT in 2021‑22, an increase of $57 million from revised 2020‑21 General Fund expenditures of $10.9 million. This year-over-year increase in General Fund expenditures is primarily attributable to three major program changes: (1) a one-time appropriation of $25 million to fund technology modernization solutions for state entities, (2) an ongoing appropriation of $21 million (and an equal reduction in the expenditure authority of the department’s cost recovery fund—the Technology Services Revolving Fund [TSRF]) to fund CDT’s Security Operations Center (SOC) and information security (IS) program audits of state entities. and (3) the creation of three new programs at a cost of $11.4 million in 2021‑22 to assess how some critical services are delivered by state entities and to make initial technical changes to improve service delivery. (The spending plan also includes $3.25 billion from the federal American Rescue Plan Act’s Coronavirus Fiscal Recovery Fund of 2021 to fund construction of a statewide open-access middle-mile broadband network. We discuss this appropriation, and the remainder of broadband infrastructure funding in the spending plan, in a separate publication, The 2021‑22 Spending Plan: Broadband Infrastructure.)

Technology Modernization Funding. The spending plan includes a one-time appropriation of $25 million General Fund in 2021‑22 (available for encumbrance or expenditure until June 30, 2024) for the department to fund technology modernization solutions proposed by state entities. Budget act language identifies the purposes for which this funding shall be used, including to improve, retire, or replace existing IT systems in state entities; improve IS in state entities; improve the efficiency and effectiveness of state entities; or transition state entities’ legacy IT systems to cloud computing. The budget language also limits the total cost of any solution to no more than $5 million, requires that CDT submit a prioritized list of solutions to the Department of Finance for review and approval prior to expenditure of the funding, and report to the Legislature on a semiannual basis (among other information) the expenditures from the fund and the solutions funded. The CDT anticipates that some of the solutions will be identified by one or more of the new departmental programs that assess and improve state entities’ delivery of critical services.

SOC and IS Audit Program Funding Conversion. The spending plan provides $21 million General Fund in 2021‑22 and ongoing to pay the costs of the department’s SOC and IS program audit services, instead of funding these activities through CDT’s TSRF as has been the case up to now. The department’s Office of Information Security (OIS) operates the state’s SOC, which continuously monitors and reacts to any threats on the California Government Enterprise Network, the state government’s primary enterprise network. The OIS also provides IS program audit services to determine whether any state entities are noncompliant with state IS policy and standards. The intent of the administration is to allow state entities with funding currently budgeted for IS program audits and SOC services to instead use those funds to remediate IS deficiencies.

Stabilize Critical Services and IT Infrastructure. The spending plan includes $11.4 million General Fund in 2021‑22 (as well as $9.4 million General Fund in 2022‑23 and $6.4 million General Fund in 2023‑24 and ongoing) to fund contracts and positions within existing CDT programs and services, and also to create three new departmental programs: The Service Assessment Program, the Service Transformation Program, and the Infrastructure/Platform Transformation Program. (For more information about each of the new programs, as well as existing programs and services that received additional funding, refer to our February 8, 2021 budget and policy post—The 2021‑22 Budget: California Department of Technology.) Broadly, the administration’s Service Assessment Program will evaluate first some critical services delivered using state IT systems and identify opportunities for system improvements. Then, CDT’s Service Transformation Program will perform additional assessments, identify short-term stability issues, and address those and other urgent needs. Finally, CDT’s Infrastructure/Platform Transformation Program will identify and remediate infrastructure and platform stability issues not addressed by the department’s Service Transformation Program. Some number of solutions identified by these programs might be funded with the aforementioned technology modernization funding included in the spending plan.

Other Program Changes. In addition to the major program changes summarized above, the spending plan also provides $2.3 million General Fund in 2021‑22 (as well as in 2022‑23) to continue the development of the CA.gov website and make improvements to CDT’s CAWeb State Enterprise Web Hosting offering. The spending plan also includes a one-time appropriation of $1.1 million General Fund to create a Digital Identification pilot program to demonstrate the technical viability of a single digital identification platform across two state entities and at least some of their services. Budget act language requires CDT to include specific security provisions in the contracts executed for the pilot program, to ensure the protection of any personal information collected by state entities participating in the program, and to report to the Legislature on a semiannual basis the current and expected participation of state entities in the program. Finally, budget-related legislation requires an annual report to the Legislature on CDT’s identification, assessment, and prioritization of high-risk, critical IT services and systems across state government. This legislation also requires CDT perform an analysis of existing state entity IT service contracts to identify contracts for potential centralization, and to submit a plan to the Joint Legislative Budget Committee by February 2023 on the transition from existing contracts to any new centralized service contracts.

Economic Development and Tax Incentives

Elective Tax on Pass-Through Businesses

Some Business Income Taxed at Individual Level. Many businesses including partnerships, limited liability companies, and “S” corporations with 100 or fewer shareholders (owners) do not pay the federal corporate income tax. Instead, they first distribute (or pass through) their income to their shareholders, who then report it on their individual income tax returns. California taxes S corporation income similarly, except that the state also imposes a 1.5 percent tax on the income of S corporations at the entity level. This 1.5 percent rate is lower than the 8.84 percent rate paid by “C” corporations, whose income (other than dividends paid to shareholders) is not taxed at the individual level.

Federal Deduction for State and Local Taxes (SALT) Limited to $10,000. Federal individual income tax filers may deduct up to $10,000 of SALT from their taxable income. Prior federal tax changes in 2017, there was no upper limit on the amount of SALT a filer could deduct.

New Proposed Federal Rule Excludes Entity-Level Taxes From $10,000 Limit. Last November, the federal Internal Revenue Service introduced regulations specifying that state and local taxes on partnership and S corporation income imposed at the entity level (that is, before the business distributes income to individual owners) do not count against each individual owner’s $10,000 SALT deduction. The owner’s federal taxable income declines by the full amount of their share of the business’s state or local entity-level tax, because the distributions reported on income tax returns only include post-tax business income.

Spending Plan Action: New Optional Entity-Level Tax Would Be Refunded on Personal Income Tax (PIT). The recently passed state budget includes a provision allowing California S corporations, partnerships, or LLCs to pay an optional 9.3 percent tax at the entity level from tax years 2021 to 2025. If a business elects to pay this tax, its owners who pay the California PIT would receive a nonrefundable credit for their full share of the new entity-level tax. Example: an S corporation equally split among ten shareholders has California income of $1 million. It would pay an entity-level tax of $93,000, and each shareholder would receive a PIT credit of $9,300.

Reduction in Total Federal and State Taxes for Most S Corporation Shareholders… Most individuals with income from pass-through entities would see their total federal and state taxes fall if the business elects to pay the new tax. The new tax would reduce the taxable business income reported on the filer’s federal return, resulting in lower federal taxes. At the same time, they would receive a state PIT credit equal to their share of the entity tax. For most filers, the state PIT credit would more than offset the cost of the new S corporation tax, although filers with total income below the threshold for the 9.3 percent state PIT bracket ($58,634 for a childless single filer in 2020) could see higher state taxes. Most filers with pass-through income should see a decline in combined state and federal taxes.

…Nonetheless, Entity Tax Projected to Raise $1.3 Billion in 2021‑22. The Department of Finance projects a General Fund revenue gain of $1.3 billion in fiscal year 2021‑22, with lower gains in subsequent years, as some of the owners of firms that elect to pay the new tax may not be able to take full advantage of the credit. The credit is not refundable, meaning that it cannot be used to reduce a filer’s liability below zero. Filers whose pre-credit PIT liability is less than their credit amount are allowed to carry their unused credits forward and apply them against their liability in subsequent years. Still, in any given year, the amount of revenue the entity tax generates should exceed the amount of entity tax credits used by PIT filers.

Entity Tax Will Sunset in 2026 if Not Sooner. As stated above, the entity tax will be in effect from calendar years 2021 to 2025. The law also contains a provision that will repeal the tax if the $10,000 limit on the federal SALT deduction is repealed before the sunset date.

Main Street Credit

Legislature Created $100 Million Credit for Businesses Hurt by Pandemic in 2020. In September 2020, the Legislature instituted the Main Street Small Business Tax Credit, which provides income or sales tax credits to firms with 100 or fewer employees that added jobs in the second half of 2020. Each eligible firm’s credit allotment was $1,000 multiplied by the increase in the firm’s average full-time employee count between the April to June period and the July to November period. The aggregate amount of credits to all firms was capped at $100 million. Credits were allotted to eligible firms on a first-come, first-served basis.

Credit Extended Into 2021. For 2021, firms again are allowed to claim $1,000 multiplied by the increase in the firm’s average full-time employee count between the period from April to June of 2020 (as before) and the lesser of either (1) the period from July 2020 to June of 2021 or (2) the period from April to June of 2021.

Eligible Firms’ Gross Receipts Must Have Declined in 2020. To be eligible, a firm’s gross receipts must have dropped by at least 20 percent from 2019 to 2020. Firms that file taxes on a fiscal year basis must have incurred a decline of 20 percent or more in 2018‑19 as compared to either (1) 2019‑20 or (2) the average of 2019‑20 and 2020‑21. Firms that started up in 2019 must have incurred a decline of 20 percent or more (averaged on a monthly basis) in April, May, and June of 2020 compared to January and February 2020.

Bigger Firms Allowed to Claim Credit. The 2020 credit was limited to firms with 100 or fewer employees. The new law allows firms with as many as 500 employees (as of the end of 2020) to claim the credit.

Budget Impact Limited to $70 million. The aggregate amount of credits to all firms is capped at $70 million. Credits will again be made available on a first-come, first-served basis. No single firm is allowed to claim more than $150,000. Data from the California Department of Tax and Fee Administration, which oversees the credit, show that nearly 10,000 firms applied for a total of $56 million in credits in 2020. However, demand for the credit may increase for two reasons: the upper limit on firm size has been raised from 100 employees to 500, and aggregate statewide employment was higher in both the second quarter of 2021 and the average over all of 2020‑21 than in the second half of 2020, which was the reference period for the 2020 credit.

Film Tax Credit

Increases Film Tax Credits By $180 Million. The budget package increases the amount of film tax credits the state can annually allocate by $90 million—from $330 million to $420 million—for fiscal years 2021‑22 and 2022‑23. The California Film Commission competitively awards tax credits of up to 25 percent of certain production expenses, such as crew wages and post-production costs, to motion picture production companies. From the increased amount of credits, $75 million is for recurring television series and $15 million is for television series that relocate to California from other states. The budget package also places new limits on the total amount of credits any one recurring television series may receive.

Additional $150 Million in Film Tax Credits for Motion Pictures Filmed at Newly Constructed or Renovated Soundstages. The budget package includes an additional $150 million in film tax credits for productions that are filmed at new or renovated soundstages. The California Film Commission must identify and certify qualified soundstage construction projects in order for those productions to be eligible for these new tax credits. Tax credits available under this new program otherwise will be similar to the broader film credit program.

Budget Package Adopts New Film Diversity Requirements. The budget package requires film tax credit recipients to provide additional information to the state, including data regarding the diversity of the applicant’s workforce. In addition, the new studio construction program described above requires productions to set ethnic, racial, and gender diversity goals and to develop a plan to achieve those diversity goals. Those productions are eligible to receive an additional 4 percent tax credit if they achieve their diversity goals.

California Competes

Increases California Competes Tax Credits by $110 Million. The budget package increases the amount of California Competes tax credits that the Governor’s Office of Business and Economic Development may award from $180 million to $290 million for the 2021‑22 fiscal year. This program allows the administration to negotiate agreements under which selected businesses may qualify for tax credits by meeting hiring and investment targets. The amount of tax credits reverts to $180 million for the 2022‑23 fiscal year.

Creates New $120 Million California Competes Grant Program. The budget provides $120 million General Fund for a new California Competes Grant Program. This grant program will be similar to the tax credit program described above, except that qualified applicants will be able to indicate that they would prefer a grant to a tax credit. To be eligible for a grant, a business must either (1) commit to creating at least 500 new jobs, (2) invest at least $10 million in a major construction or renovation project, or (3) be located in a high-poverty or high-unemployment area of the state. No grant may exceed 30 percent of the annual allocation, or $36 million, in 2021‑22.

Homeless Hiring Credit

Employers Can Claim Credits for Hiring Workers Who Are Homeless. The budget bill includes a new personal or corporate (depending on the employer’s organizational form) income tax credit for employing workers who are homeless or formerly homeless. For an employee to be eligible for the credit, a designated service provider must certify that the employee either (1) has been homeless at some point up to 180 days before their hire date or (2) is receiving services from the provider. The employer must also pay eligible employees at least 20 percent more than the state minimum wage.

Annual Credit Amount Depends on Hours Worked. The annual credit amount for each eligible employee depends on the number of hours the employee works for the firm over the course of the year: $2,500 if the employee works at least 500 hours, $5,000 for at least 1,000 hours, $7,500 for at least 1,500 hours, and $10,000 for at least 2,000 hours. In any case, an employer is limited to a maximum of $30,000 in credits each year.

Credit Will Be Effective for Five Years. The credit will be in effect for tax years 2022 through 2026. The credit sunsets at the beginning of 2027.

Credit Capped at $30 Million Per Year. The aggregate amount of the credit is limited to $30 million each year.

Visit California

$95 Million for Expanded Tourism Marketing. The budget provides $95 million in federal American Rescue Plan Act funds to the California Travel and Tourism Commission, which operates as Visit California, for an expansion of its tourism marketing efforts. Visit California is responsible for marketing the state as a tourism destination and is funded through a voluntary assessment on the tourism industry.

Increases Visit California Transparency. The budget package requires Visit California to prepare reports for the Legislature that identify how the public funds provided for tourism marketing were used and that measure the effectiveness of those marketing activities. In addition, Visit California is required to post on its internet website financial reports that it currently shares only with assessed tourism industry businesses.

Office of the Small Business Advocate

Financial Relief for Small Businesses and Nonprofits. The 2021‑22 Budget Act includes a total of $1.7 billion in financial relief for businesses and nonprofit organizations that were affected by the coronavirus disease 2019 pandemic. We describe the funding for these programs in a separate Spending Plan post.

$49.5 Million for Financial Assistance to Nonprofit Performing Arts Organizations. The budget includes $49.5 million General Fund one time to establish the California Nonprofit Performing Arts Grant Program. This program will make grants of $25,000, $50,000, or $75,000—based on 2019 revenues—to eligible nonprofit performing arts organizations on a first-come, first-served basis. Eligible organizations include theaters, dance companies, and symphonies, for example, and must have less than $2 million in annual revenue. The stated purpose of the new program is to encourage workforce development.

Modifies Small Business Technical Assistance Centers and Provides $35 Million to Establish California Dream Fund. The budget includes $35 million to establish the California Dream Fund. The budget package also makes changes to the California Small Business Technical Assistance Expansion Program, which contracts with small business technical assistance centers to help small businesses and entrepreneurs through free or low-cost one-on-one consulting and low-cost training. The new Dream Fund will allow participating small business technical assistance centers to provide grants up to $10,000 to new businesses that participate in entrepreneurship training programs.

California Infrastructure and Economic Development Bank (IBank)

Climate Catalyst Fund. The budget package includes $31 million General Fund in 2021‑22 and $25 million General Fund in 2022‑23 for the Climate Catalyst Revolving Loan Fund. The Climate Catalyst Fund was established in the 2020‑21 budget package to allow IBank to help finance a broader range of climate-related projects. While Climate Catalyst initially was not funded, Chapter 14 of 2021 (SB 85, Committee on Budget and Fiscal Review) provided $16 million General Fund in 2020‑21 for forestry projects related to reducing wildfire risk. The $31 million in 2021‑22 also will be used to finance forestry projects. The $25 million in 2022‑23 will be used for climate-related projects in the agriculture industry. The budget package also made significant changes to Climate Catalyst, including making the fund continuously appropriated and requiring the IBank to adopt a financing plan.

$70 Million for Small Business Lending Programs. The Small Business Finance Center at the IBank administers small business loan guarantee programs and a disaster loan program. The budget includes $70 million for the Small Business Finance Center. Of this amount, $50 million is to provide financing to the most underserved small businesses, including female owned, minority owned, and small businesses operated in low- to moderate-income tracts. These funds may be used to help capitalize the California Rebuilding Fund or another program. During the pandemic, IBank helped to establish the California Rebuilding Fund, in partnership with private microlenders and Community Development Financial Institutions, to make low interest loans to businesses with 50 or fewer employees and revenue under $2.5 million. The remaining $20 million is to support the loan guarantee programs.

Marketing Zero-Emissions Vehicles

$5 Million for Zero-Emissions Vehicle Marketing. The budget includes $5 million General Fund to raise consumer awareness of zero-emission vehicle technology and its benefits in partnership with other organizations, including vehicle manufacturers.

Economic Relief

Golden State Stimulus

The 2021‑22 Budget Act includes $8.1 billion General Fund in Golden State Stimulus payments, the second round of state direct payments to lower-income taxpayers to mitigate the economic impact of the pandemic. Under the second round, the state Franchise Tax Board will send payments to an estimated 14.2 million taxpayers. Most of the funding will go out in the form of $600 one-time payments to taxpayers with adjusted gross income below $75,000 (taxpayers with dependents will receive an additional $500 payment). The remainder will go out in the form of a $500 one-time payment to undocumented taxpayers with incomes less than $75,000 who file using an Individual Taxpayer Identification Number.

Small Business Grants

Grants up to $25,000 for Small Businesses Affected by Pandemic. The California Small Business Coronavirus Disease 2019 (COVID-19) Relief Grant Program provides grants for up to $25,000 for small businesses that were impacted by economic disruption related to the pandemic. Eligible businesses and nonprofit organizations had annual revenues of less than $2.5 million and meet certain other conditions. The program is administered by Lendistry—a private financial institution—under contract to the California Office of the Small Business Advocate (CalOSBA) in the Governor’s Office of Business and Economic Development.

Demand for Grants in the 2020‑21 Fiscal Year Exceeded Funding. The grant program was established in December 2020 with $500 million in funding from the Disaster Response-Emergency Operations Account. Chapter 7 of 2021 (SB 87, Caballero) established the program in statute and appropriated an additional $2.075 billion General Fund for grants and program administration in fiscal year 2020‑21. Of that amount, $50 million was set aside for nonprofit arts and cultural institutions. As of September 3, 2021, 212,780 grants totaling $2.4 billion had been awarded. (Awards are still being processed and these amounts will increase over time.) The demand for the program exceeded funding and the administration estimated that about 180,000 applications would be placed on a waitlist.

$1.5 Billion for Additional Small Business Relief Grants. The budget includes $1.5 billion in federal American Recovery Plan Act funds for additional grants. Those applicants that were placed on the waitlist in the 2020‑21 fiscal year will receive priority for these funds.

Additional Round of Grants for Nonprofits. Only $22 million of the $50 million that the Legislature set aside for nonprofit arts and cultural institutions was allocated in 2020‑21 because the program received too few qualified applications. The budget package requires at least one additional round of grants for nonprofit arts and cultural institutions.

Other Relief Grants

$150 Million for Grants to Performing Arts and Other Live Events Operators. The budget includes $150 million General Fund one time to establish the California Venues Grant Program. Under this program, CalOSBA will make grants of up to $250,000 to independent venues and related businesses whose operations were disrupted by the pandemic. Eligible businesses include those that organize, promote, produce, or host live concerts, comedy shows, sporting events, and theater productions. In addition, these businesses must show that their revenues declined by at least 70 percent following the onset of the pandemic. The grant will be for 20 percent of gross 2019 revenues, up to a maximum of $250,000. In the event that demand for grants exceeds $150 million, priority will be given to those venues with the greatest decline in revenue.

$50 Million for Financial Assistance to Underserved Microbusinesses. The budget includes $50 million General Fund one time to establish the California Microbusiness COVID-19 Relief Grant Program. This program will provide financial relief to small businesses that have been impacted by the pandemic but have not been able to receive assistance from other federal and state programs, such as the COVID-19 Relief Grant program. Such business owners may, for example, be unable to complete the application forms because of a language barrier or are unable to fully participate in the formal economy because of their immigration status. CalOSBA will award grants to county government agencies and nonprofit organizations that provide services to microbusinesses, who then will identify and make $2,500 grants directly to eligible microbusinesses. Eligible microbusinesses must, among other requirements, be able to demonstrate that their business is their primary source of income, their revenues were impacted by the pandemic, and they have not received a grant under the California Small Business COVID-19 Relief Grant Program.

Labor and Employment Issues

The 2021‑22 Budget Act includes several labor and employment initiatives. This post provides a high-level overview of the state’s major labor and employment programs and highlights the key labor issues in the budget package, including provisions related to the coronavirus disease 2019 (COVID-19) pandemic.

Background

California’s major labor and employment programs provide work-related services and benefits to its residents, enforce its employment laws, oversee its workers’ compensation system, and regulate its workplace safety and health. Many of the work-related services and benefits are funded or required by the federal government, including unemployment insurance (UI) benefits and federal workforce training programs. The labor and employment programs are administered at the state level by the Employment Development Department (EDD), the Department of Industrial Relations, the California Workforce Development Board, and the Agricultural Labor Relations Board. The state’s Labor and Workforce Development Agency (LWDA) oversees these entities and works to set policy and coordinate programs.

Key Proposals

Provides State Funding to Address Unfinished Eligibility Workload at EDD. The spending plan includes $276 million General Fund for EDD to retroactively perform routine UI application screenings that were temporarily suspended during the pandemic. In an effort to issue UI benefits quickly during the unprecedented pandemic workload, the LWDA Secretary directed EDD to issue initial UI benefit payments prior to determining each worker’s final eligibility for benefits. As pointed out in a recent California State Auditor report, although the state’s steps were allowable under federal guidance, federal law nevertheless requires the state to re-evaluate eligibility for all workers that received benefits during this crisis period. Under the budget plan to address this workload, EDD will hire an outside contractor to determine whether several million workers who received UI benefits during the pandemic were eligible to receive those benefits. The administration expects that these outstanding determinations will be completed by mid-2022. The state may take steps to recover benefits from unemployed workers who are found to be ineligible upon completing this determination workload. State and federal law govern the process to recover benefits and dictate under what circumstances improper benefits must be repaid.

Extends Existing Wage Replacement Rate for Paid Family Leave and Disability Programs. The state’s paid family leave program provides up to eight weeks of partial wage replacement to workers who take time off to bond with a new child or care for an ill family member. The state’s disability benefit program provides up to 16 weeks of partial wage replacement for workers who become injured outside of work. Benefits for these two programs are funded by a 1 percent payroll tax paid by employees. Chapter 5 of 2006(AB 908, Gomez) increased the wage replacement rate—that is, the share of a worker’s typical wages that they receive in benefits—from 50 percent to 60 percent for most workers. However, the wage replacement rate increase under AB 908 was scheduled to expire December 31, 2021 and revert back to the pre-existing, lower wage replacement rates. The budget package extends the higher rates under AB 908 for two years, through January 1, 2023.

Major Expansion of State’s Workforce Development Programs. The spending plan includes roughly $1 billion for new and expanded workforce development programs. The majority of funding for this package comes from federal American Rescue Plan (ARP) Act fiscal relief funds ($600 million), while the remainder is from the General Fund. Belo,w we highlight the major provisions of the workforce package:

New Regional Grants for Economic Development. The budget agreement includes $600 million one-time ARP fiscal relief funds to start a new grant program for regions to develop and implement regional plans to create jobs in sustainable industries. According to the administration, sustainable industries include zero-emission vehicle infrastructure, climate resilience, transit systems, biomass projects, offshore wind, and oil well capping and remediation. For the new program, known as the Community Economic Resilience Fund, program requirements and grant evaluations will be decided jointly by the Governor’s Office of Planning and Research, LWDA, and the Governor’s Office of Business Development. Under the spending plan outline, the EDD is tasked with disbursing and managing grants made by these entities.

Expands State’s Main Apprenticeship Programs. For the past several years, the state has provided grant funding to local, regional partnerships to develop and pay for apprenticeship programs. Grant funds under this program, known as the High Roads Training Partnerships, have been used to fund apprenticeship collaborations across various industries, including construction, healthcare, information technology, trade, agriculture, manufacturing, hospitality, janitorial, and utilities. The budget plan adds $100 million one-time General Fund to expand apprenticeship slots offered in existing partnership programs and to expand the number of regional partnerships operating these apprenticeship programs. Of this amount, $25 million is to be directed to apprenticeship partnerships that align with California Community College workforce training programs.

Additional Funds for Employment Training Panel (ETP) Grants. The spending plan provides $65 million General Fund to ETP to provide businesses additional state-funded incumbent workers training grants. Typically, ETP funds about $100 million in incumbent worker training programs each year, funded by a 0.1 percent payroll tax paid by all workers. To receive funding, employers apply to ETP with proposed training programs and must meet some basic worker wage and retention targets. Of the $65 million in additional ETP grant funding, $15 million is to be directed at training programs that align with California Community College workforce training programs.

Various Smaller Proposals. In addition to these major components, the spending plan’s workforce package includes various smaller General Fund expenditures. These include, among others: $30 million to expand the state’s Breaking Barriers to Employment program, $20 million to extend the state’s Prison to Employment program, $20 million to support the Social Entrepreneurs for Economic Development (or SEED) nonprofit, $20 million to the Mutual Aid Training Center in Los Angeles, $10 million to the Los Angeles Cleantech Incubator, and $10 million to fund a new apprenticeship program in residential construction.

Major New Control Sections in the Spending Plan

This section describes the major new control sections in the 2021‑22 Budget Act. The first three—Control Sections 11.91, 11.95, and 11.96—provide the administration with additional flexibility to expend state and federal funds. The second two—Control Sections 19.56 and 19.57—provide appropriations for a variety of legislative priorities.

COVID-19 Spending and Control Section 11.91

The 2021‑22 Budget Act provides $1.7 billion one time from the General Fund for coronavirus disease 2019 (COVID-19)-related activities. As shown in Figure 2, these funds are allocated to nine state departments.

Figure 2

COVID‑19‑Related Appropriations in the 2021‑22 Budget

|

Department |

Description |

Amount |

|

CDPH |

Statewide testing, vaccination, hospital surge, and contact tracing. |

$1,079.9 |

|

CDCR |

Testing, treatment, surge capacity, custody overtime, and cleaning, as well as reimbursements for county jails housing people sentenced to state prison. |

408.0 |

|

GovOps |

Contracts associated with statewide vaccine distribution efforts, coordination with stakeholders, and direct support to vaccine providers and local health jurisdictions. |

90.8 |

|

DSH |

Increased operating costs primarily related to increased sanitation, purchase of personal protective equipment, and testing staff and patients. |

69.2 |

|

DGS |

Primarily hotels for health care workers and housing for vulnerable agricultural workers. |

32.0 |

|

OES |

State Operation Center and subject matter expert costs. |

18.9 |

|

EMSA |

Ambulance transportation, medical personnel support, and infrastructure support. |

17.0 |

|

DDS |

Surge sites for individuals served by DDS who have been exposed to or are at high risk of COVID‑19. |

15.0 |

|

BSCC |

Probation department supervision of people released from prison to county supervision due to COVID‑19. |

12.1 |

|

Total |

$1,742.9 |

|

|

COVID‑19 = coronavirus disease 2019; CDPH = California Department of Public Health; CDCR = California Department of Corrections and Rehabilitation; GovOps = Government Operations Agency; DSH = Department of State Hospitals; DGS = Department of General Services; OES = Office of Emergency Services; EMSA = Emergency Medical Services Authority; DDS = Department of Developmental Services; and BSCC = Board of State and Community Corrections. |

||

Control Section 11.91 allows the Department of Finance (DOF) to shift the $1.7 billion between these departments and/or reduce the amount of funding provided to each department. In addition, the language allows DOF to shift these funds to any other item in the budget to support COVID-19-related activities. Control Section 11.91 requires DOF to notify the Joint Legislative Budget Committee (JLBC) ten days prior to making such adjustments. This gives the administration flexibility to respond if COVID-19 response and recovery needs change over the course of the fiscal year.

HCBS and Control Section 11.95

The state expects to receive $3 billion in one-time additional federal Medicaid funds authorized under the American Rescue Plan (ARP) for existing spending on home- and community-based services (HCBS). As a condition of receiving these funds, the state will be required to spend an equal amount of funding on new HCBS enhancements and expansions. Control Section 11.95 creates a new fund—the HCBS ARP Fund—dedicated to this purpose. The control section allows the administration to oversee and expend the HCBS ARP funds through the annual budget process or through written midyear notifications to the Legislature. We plan to describe the budget’s allocation of HCBS funding—and this control section—in a forthcoming post: The 2021‑22 California Spending Plan: Home- and Community-Based Services.

ARP Fiscal Relief Funding and Control Section 11.96

ARP Provided State With $27 Billion in Fiscal Relief Funds. The ARP included $350 billion in flexible funding to state and local governments for fiscal recovery in Coronavirus State and Local Fiscal Recovery Funds. Of this total, California’s state government received about $27 billion. The state has until December 31, 2024 to use the funds for any of the following purposes: (1) to respond to the public health emergency or negative economic impacts associated with the emergency; (2) to support essential work; (3) to backfill a reduction in total revenues that have occurred relative to the pre-pandemic trajectory; or (4) for water, sewer, or broadband infrastructure.

How the Budget Allocates the ARP Funds. Figure 3 shows how the budget package allocates these funds. In particular, the budget allocates $9.2 billion to backfill lost state revenue that has occurred since the beginning of the pandemic. (However, since the budget was enacted, this amount has been updated to $8.9 billion to reflect updated budgetary estimates made by DOF. As a result, General Fund offsets will decline by about $300 million and there will be an additional, corresponding amount of ARP funding for the Legislature to allocate.) Although state revenues have grown since the pandemic started, the formula included in U.S. Department of the Treasury guidance directs the state to compare pre-pandemic growth in total revenues to revenue growth that has occurred after. Under this formula, the state has estimated it is permitted to claim $8.9 billion under the revenue loss provision. (As such, these federal funds will offset existing General Fund expenditures.) Figure 3 also shows how the budget allocates the remaining ARP fiscal relief funds, for example, to housing and homelessness and broadband. We discuss other uses of ARP funding in other spending plan posts, as relevant.

Figure 3

How the Budget Package Allocates $27 Billion in

ARP Fiscal Relief Funds

(In Millions)

|

Amount |

|

|

Replace Lost State Revenuea |

$9,196 |

|

Address Increased Homelessness and Housing Shortages |

4,876 |

|

Broadband Infrastructure, Access, and Affordability |

3,772 |

|

Relief for Unpaid Energy Utility Bills and Arrearages |

2,000 |

|

Child Savings Accounts |

1,778 |

|

Small Business Grants |

1,500 |

|

COVID‑19 Response Costs |

725 |

|

Community Economic Resilience |

600 |

|

Behavioral Health Continuum Infrastructure Program |

530 |

|

Training and Education Support for Displaced Workers |

473 |

|

Community Care Expansion |

450 |

|

Economic Support for Ports |

250 |

|

Emergency Financial Aid for Community College Students |

250 |

|

Youth Workforce Development |

185 |

|

CaliforniansForAll College Service Program |

128 |

|

Mental Health Student Services Partnership Grant Program |

100 |

|

Revitalization of California Tourism |

95 |

|

Legal Aid for Renters |

80 |

|

Reserve for Accountability and Oversight |

19 |

|

Federal Tracking, Accountability, and Cost Recoveryb |

11 |

|

Total |

$27,017 |

|

aSince the budget was enacted, this amount has been updated to $8.9 billion to reflect updated budgetary estimates made by the Department of Finance. bExpenditures planned over four‑year period. |

|

|

ARP = American Rescue Plan and COVID‑19 = coronavirus disease 2019. |

|

Control Section 11.96 Provides Administrative Flexibility to Fully Expend Funds. In addition to providing appropriation authority for these funds throughout the spending plan, the budget includes Control Section 11.96 to give the administration some flexibility to fully expend the $27 billion in fiscal relief funds. For example, the language allows DOF to: (1) transfer amounts within a program, project, or function, or between departments’ state operations and local assistance items, in order to support the implementation of the appropriations of these funds; (2) reallocate funding if they are not encumbered by August 1, 2024; (3) use up to $10 million in interest earnings on the funds to address unanticipated workload; and (4) authorize the augmentation of funds to conduct an audit to ensure they are used for federally allowable purposes. The Control Section also clarifies that Control Section 28.00 does not apply to these funds and that the funds are available for expenditure through June 30, 2024. Any changes DOF makes pursuant to this section require a 30-day notification to JLBC. DOF also is required to report annually to the JLBC on unexpended or unencumbered funds by program.

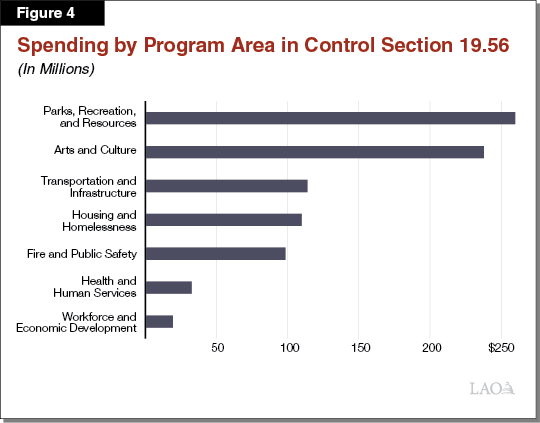

Control Section 19.56

Control Section 19.56 provides appropriations for legislative priorities. Control Section 19.56 includes $871 million in spending across a range of program areas, as shown in Figure 4. Spending for parks, recreation, and resources, for example, includes funding for local parks and trails restoration, improvements, and construction; water infrastructure, green infrastructure, and water supply and treatment projects; and other recreation facilities such as aquatic centers, playgrounds, and piers. Funding for transportation and infrastructure projects includes, for example, funds for pedestrian crosswalks and bridges, local roadway safety projects, and other improvements to roads and bridges.

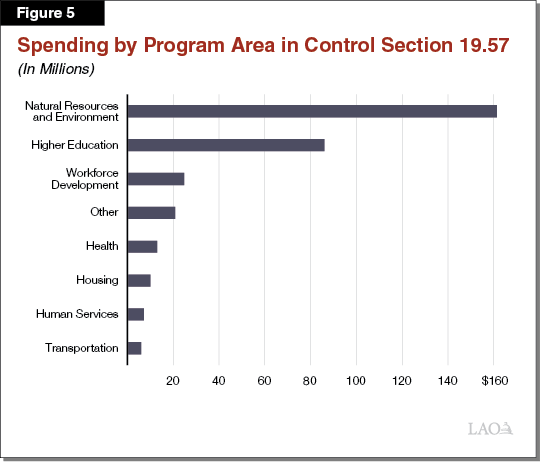

Control Section 19.57

Control Section 19.57 also provides appropriations for legislative priorities. Control Section 19.57 includes $329 million in spending across a range of program areas, as shown in Figure 5. The largest of these augmentations include $45 million for the Southeast Los Angeles Cultural Center Project; $35 million to the University of San Diego, Scripps Reserve Vessel; $28.5 million for West Coyote Hills; $15 million for the Homeboy Industries workforce job training program; and $15 million to the University of California, San Diego, Scripps Institution of Oceanography for the ALERT Wildfire Camera Mapping System.

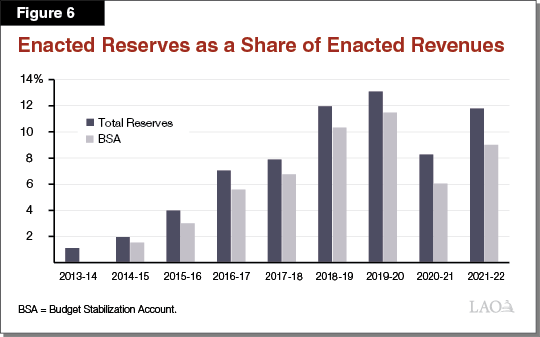

Proposition 2

Passed by voters in 2014, Proposition 2 changed budgeting practices concerning: (1) reserves and (2) debt payments. First, it created new rules for minimum annual deposits into the Budget Stabilization Account (BSA), the state’s rainy-day fund. Second, Proposition 2 created new requirements that the state spend a minimum amount each year, until 2030, to pay down specified debts. This post provides a summary of the budget package Proposition 2-related estimates and choices. (For more information about how Proposition 2 works, see: The 2021‑22 Budget: The Governor’s Proposition 2 Proposals)

Reserves

Under budget package revenue estimates and constitutional rules, the state is required to deposit $3.4 billion into the BSA in 2021‑22. In addition, the spending plan makes a $3 billion true up to the 2020‑21 suspended deposit and a $1.2 billion true up to the 2019‑20 deposit. These reserve deposits and true ups bring the enacted balance of the BSA to $15.8 billion by the end of 2021‑22, representing about 9 percent of revenues and transfers.

Figure 6 shows the enacted BSA balance and total reserves—which includes other reserves like the Special Fund for Economic Uncertainties and the Safety Net Reserve—by year. As the figure shows, the 2021‑22 enacted BSA level is higher than the 2020‑21 enacted level of $8.3 billion (6 percent of revenues and transfers), but down somewhat from the 2019‑20 enacted level of $16.5 billion (11 percent of revenues and transfers).

Debt Payments

Under the constitutional rules, the state is required to make $3.4 billion in additional debt payments in 2021‑22, which can only be used for certain eligible debts. The spending plan allocates most of these funds to address the creation of new unfunded liabilities generated in 2020‑21 and to accelerate the pay off of all three of the state’s main retirement liabilities. Specifically, the budget makes one-time payments of: (1) $1.9 billion as a supplemental pension payment to the California Public Employees’ Retirement System (CalPERS) state pension plans (apportioned across the plans based on the annual General Fund contributions to each plan), (2) $926 million toward the state’s retiree health unfunded liabilities ($616 million of this would be make up for employee contributions that were suspended in 2020‑21), and (3) $410 million as a supplemental pension payment to the California State Teachers’ Retirement System to help pay down the state’s share of unfunded liabilities. In addition, the spending plan uses $225 million to pay down the General Fund share of the state’s CalPERS borrowing plan, a 2017‑18 plan to borrow $6 billion from the state’s cash resources to make a one-time supplemental payment to CalPERS.

Statewide Infrastructure

Debt Service

The budget provides $8.1 billion from various funds for debt service payments in 2021‑22. This represents a decrease of 2 percent from 2020‑21, mainly due to decreases in transportation debt service. This total includes $7.1 billion for general obligation bonds ($5.2 billion from the General Fund) and $1 billion for lease revenue bonds ($662 million from the General Fund).

Capital Outlay

Overall, the budget includes $2.7 billion for 146 capital outlay projects in 2021‑22. (This total does not include capital outlay projects for the University of California [UC] or California State University [CSU] because the administration had not yet provided final approval of the projects proposed by the segments at the time this post was prepared.) The total funding is an increase of $ 1.7 billion, or 166 percent compared to the level of capital outlay spending (excluding UC and CSU projects) in 2020‑21. This increase reflects the funding of additional projects due to the increase in General Fund resources available in 2021‑22, as well as relatively few projects being funded in 2020‑21 because of the state’s fiscal situation at the time the 2020‑21 budget was enacted. The funding provided in 2021‑22 will support various phases of projects from preliminary plans to construction, and total estimated costs for all projects with known costs are $9.1 billion. (Ten projects have unspecified total costs.) Figure 7 shows a summary of projects receiving funding by administering department. A complete list of all state capital outlay projects approved in the 2021‑22 budget is available for download. (The table generally does not include state funding for local infrastructure projects.)

Figure 7

Capital Outlay Appropriations

(In Millions)

|

Departments |

2021‑22 Funding |

Number of Projects |

Total Project Costs |

|

Department of General Services |

$872.7 |

5 |

$1,553.7 |

|

California Community Colleges |

631.7 |

48 |

1,266.9 |

|

Department of Water Resources |

208.5 |

5 |

1,632.8 |

|

Judicial Branch |

167.7 |

8 |

702.3 |

|

California Highway Patrol |

155.6 |

6 |

249.5 |

|

Department of Corrections and Rehabilitation |

149.6 |

8 |

1,595.4 |

|

Department of Parks and Recreation |

147.8 |

12 |

344.5 |

|

California Department of Food and Agriculture |

101.1 |

3 |

239.5 |

|

Department of Motor Vehicles |

88.4 |

6 |

136.2 |

|

Department of Forestry and Fire Prevention |

59.8 |

21 |

749.4 |

|

Department of State Hospitals |

52.0 |

3 |

75.3 |

|

Military Department |

27.5 |

2 |

199.1 |

|

Office of Emergency Services |

27.5 |

4 |

103.5 |

|

California Department of Education |

20.3 |

4 |

127.0 |

|

California Conservation Corps |

6.8 |

2 |

96.0 |

|

Department of Developmental Services |

4.1 |

1 |

4.3 |

|

Franchise Tax Board |

1.6 |

1 |

20.3 |

|

Tahoe Conservancy |

1.5 |

3 |

3.2 |

|

San Joaquin River Conservancy |

1.3 |

1 |

— |

|

Department of Veterans Affairs |

1.3 |

2 |

3.7 |

|

Wildlife Conservation Board |

1.0 |

1 |

— |

|

Totals |

$2,727.8 |

146 |

$9,102.6 |

In total, 21 departments had at least one capital outlay project approved in 2021‑22. Projects in three departments received nearly two-thirds of the capital outlay funds approved: Department of General Services ($872 million), California Community Colleges (CCC) ($632 million), and Department of Water Resources ($209 million). The project receiving the most funding in 2021‑22 is the Department of General Services’ Resources Building Renovation ($452 million). Some other individual capital outlay projects are discussed in more detail in the other 2021‑22 Spending Plan posts.

Capital outlay projects can be funded through a variety of different fund sources, including the General Fund, special funds, bonds, and federal funds. Some projects rely on multiple fund sources, depending on the project phase. For example, Judicial Branch’s Lakeport Courthouse will be funded by the General Fund for the performance criteria and lease revenue bonds for the design-build phase. The most common fund sources include the 2016 CCC Capital Outlay Bond Fund, which comes from general obligation bonds passed in Proposition 51 (2016) (41 projects); General Fund (76 projects); and Public Buildings Construction Fund (9 projects).

We note that not all state capital outlay projects are approved by the Legislature in the annual budget act and, therefore, are not reflected in the above figure. For example, while the Legislature approves the overall budget for the California Department of Transportation, individual projects generally are approved by the California Transportation Commission. In addition, some capital expenditures are (1) continuously appropriated, such as some bond funds; (2) reappropriated, which provides additional time for the completion of the project; and (3) reverted, if the project is ended or requires modification.

Deferred Maintenance

The budget includes one-time funding totaling $2.2 billion from the General Fund to address backlogs of deferred maintenance at facilities operated by various departments, as shown in Figure 8. Of the total, $1.7 billion is from non-Proposition 98 General Fund. This supports 22 state entities, with about half allocated to UC, CSU, and the Department of Water Resources. The budget also includes $511 million from Proposition 98 funds for CCC. We discuss the allocations for various specific departments in the other 2021‑22 spending plan posts.

Figure 8

Deferred Maintenance Allocations

(In Millions)

|

Department |

Amount |

|

General Fund (Non‑Proposition 98) |

|

|

University of California |

$325 |

|

California State University |

325 |

|

Department of Water Resources |

237 |

|

Judicial Branch |

188 |

|

Department of Parks and Recreation |

185 |

|

Department of State Hospitals |

100 |

|

Department of Corrections and Rehabilitation |

100 |

|

Department of Forestry and Fire Protection |

50 |

|

Department of General Services |

50 |

|

Housing and Community Development, Office of Migrant Services, Farmworker Housing |

30 |

|

State Special Schools |

25 |

|

Department of Fish and Wildlife |

15 |

|

California Military Department |

15 |

|

Department of Veterans Affairs |

15 |

|

California Highway Patrol |

10 |

|

Department of Motor Vehicles |

10 |

|

Department of Development Services |

5 |

|

Exposition Park |

5 |

|

Office of Emergency Services |

5 |

|

Department of Food and Agriculture |

2 |

|

Employment Development Department |

2 |

|

California Conservation Corps |

1 |

|

Subtotal, Non‑Proposition 98 General Fund |

($1,700) |

|

Proposition 98 |

|

|

California Community Colleges |

$511 |

|

Subtotal, Proposition 98 |

($511) |

|

Total |

$2,211 |

California Public Utilities Commission (CPUC)

The budget provides $2.8 billion, primarily from special funds and federal funds, to support CPUC. This is an increase of $1.2 billion from the estimated 2020‑21 level. The year-over-year increase largely reflects federal funds for broadband, which we discuss in more detail in our Broadband spending plan post. We also describe another notable budget change—the shift of the Wildfire Safety Division to the Office of Energy Infrastructure Safety—in our Natural Resources and Environmental Protection spending plan post.

California Department of Food and Agriculture (CDFA)

The budget includes $1 billion from various funds (including $685 million from the General Fund) to support CDFA. The total is an increase of $460 million (79 percent) from the revised 2020‑21 spending level. The increase is mainly due to augmentations related to (1) the Sustainable Agriculture Package, (2) infrastructure and maintenance projects at fairgrounds and local community facilities, (3) operational support to the state’s network of fairs, and (4) the Water and Drought Resilience Package (described in more detail in our Natural Resources and Environmental Protection spending plan post). In addition to the totals cited, the budget includes control section provisions providing several one-time General Fund appropriations totaling $19.5 million for specified projects, such as providing support to local farming initiatives.

Sustainable Agriculture Package. The budget provides $683.3 million in 2021‑22 and $424.8 million in 2022‑23 from various fund sources to implement a package of proposals related to agriculture. Of the amount provided in 2021‑22, $445.7 million is from the General Fund, with the remaining amounts coming from the Greenhouse Gas Reduction Fund (GGRF) ($195 million) and the Air Pollution Control Fund ($42.6 million). (For more details on the GGRF expenditure plan, please view our Natural Resources and Environmental Protection spending plan post.) The General Fund would fully support the planned 2022‑23 spending.

As shown in Figure 9, the package provides funding for more than 20 programs that are administered by three departments. In 2021‑22, over half of the funds are provided to two programs administered by the California Air Resources Board: (1) the Funding Agricultural Replacement Measures for Emission Reductions Program ($212.6 million), which provides funding for agricultural equipment upgrades and replacements that reduce greenhouse gas and air pollutant emissions, and (2) financial incentives for farmers to implement alternative practices to agricultural burning in the San Joaquin Valley ($180 million). The remaining funds in 2021‑22—$290.7 million—support several new and existing CDFA programs. The four largest new CDFA programs funded in the Sustainable Agriculture Package include the Fresno-Merced Future of Food Innovation Initiative, a technical assistance grant program to support conservation plans, the Pollinator Habitat Program, and the Farm to Community Food Hubs Program. In addition, the package provides $25 million in 2022‑23 to support the Climate Catalyst Fund administered by the Governor’s Office of Economic Development. The fund would provide low interest loans to projects that advance the state’s climate mitigation and adaptation goals in the agricultural sector.

Figure 9

Sustainable Agriculture Package

(In Millions)

|

Program |

2021‑22 |

2022‑23 |

|

California Air Resources Board |

$392.6 |

$150.0 |

|

Funding Agricultural Replacement Measures for Emission Reductions (FARMER) Program |

$212.6a |

$150.0 |

|

Incentives for alternatives to agricultural burning in the San Joaquin Valley |

180.0 |

— |

|

California Department of Food and Agriculture |

$290.7 |

$249.8 |

|

Healthy Soils Program |

$75.0b |

$85.0 |

|

Livestock methane reduction |

32.0 |

48.0 |

|

Farm to School Incubator Grant Program |

30.0 |

30.0 |

|

Fresno‑Merced Future of Food Innovation Initiative |

30.0 |

— |

|

Technical assistance and conservation management plans |

17.0 |

22.0 |

|

Pollinator Habitat Program |

15.0 |

15.0 |

|

Farm to Community Food Hubs Program |

15.0 |

— |

|

Urban Agriculture Program |

12.0 |

— |

|

California Nutrition Incentive Program |

10.0 |

10.0 |

|

Healthy Refrigeration Grant Program |

10.0 |

10.0 |

|

Integrated pest management grants and university research |

9.8 |

7.8 |

|

Sustainable California Grown Cannabis Pilot Program |

9.0 |

‑ |

|

Technical assistance program for underserved farmersc |

5.4 |

5.0 |

|

New and Beginning Farmer Training and Farm Manager Apprenticeships Program |

5.0 |

5.0 |

|

Research on greenhouse gas reductions in agriculture |

5.0 |

5.0 |

|

Invasive Species Council |

5.0 |

5.0 |

|

Impact assessment and alignment of regulatory reporting requirements for agriculture |

4.0 |

2.0 |

|

Canine blood bank |

1.0 |

— |

|

Senior Farmers Market Nutrition Program |

0.5 |

— |

|

Governor’s Office of Economic Development |

— |

$25.0 |

|

Climate Catalyst Fund |

— |

$25.0 |

|

Totals |

$683.3 |

$424.8 |

|

a$170 million from Greenhouse Gas Reduction Fund (GGRF) and $42.6 million from Air Pollution Control Fund. b$50 million from the General Fund and $25 million from GGRF. cChapter 85 of 2021 (SB 85, Committee on Budget and Fiscal Review) augmented the 2020‑21 Budget Act to provide an additional $3.4 million in “early action” funding for this program. |

||

Fairground and Community Resilience Centers. The budget includes $150 million on a one-time basis from the General Fund to support infrastructure and maintenance projects at fairgrounds and local community facilities to enhance the state’s emergency preparedness capabilities. Of the amount provided, $10 million is set aside for the California Exposition and State Fair.

Fairground Operational Support. The budget includes $47 million on a one-time basis from the General Fund to provide operational support to the state’s network of 77 fairs, which have been prevented from conducting normal revenue-generating activities during the coronavirus disease 2019 pandemic. Funding will be allocated to fairs based on need, such as revenue losses during the pandemic. An additional $3 million from the General Fund will be used to conduct an assessment of whether fairgrounds located on state-owned land have the potential for additional development, such as affordable housing.

Transfer of Cannabis Resources to the Department of Cannabis Control. The budget includes a transfer of $64.1 million from the Cannabis Control Fund and 155 positions from CDFA to the new Department of Cannabis Control. The shift reflects budget trailer legislation that transfers cannabis regulatory responsibilities from several agencies to the new department. Responsibilities shifted to the new department from CDFA include licensing commercial cannabis cultivators and maintaining a statewide cannabis tracking system.

California Department of Veterans Affairs

The spending plan for the California Department of Veterans Affairs (CalVet) includes $543 million General Fund in 2021‑22, an increase of about $100 million (22 percent) relative to revised estimates for 2020‑21. General Fund costs in 2021‑22 are expected to be offset by $84 million from federal reimbursements for Veterans Homes. The year-to-year increase in General Fund is primarily due to a number of one-time funding augmentations, which we describe in detail below.

Provide Supportive Services for Formerly Homeless Veterans. The spending plan includes $25 million one-time General Fund to administer grants to support aging veterans and veterans with disabilities who have experienced chronic homelessness. CalVet will administer the grants on a competitive basis to organizations that have experience working with veterans and are able to provide veterans with supportive services, such as emergency or long-term housing support, behavioral health evaluation and assistance, and other services identified in Chapter 416 of 2017 (AB 1618, Cervantes). Additionally, CalVet shall submit a report to the Legislature with a project description for each awarded grant, the findings of any research conducted during the grant program, and recommendations to improve the quality of life for veterans.

Construct West Los Angeles Medical Center Housing for Homeless Veterans. The spending plan provides $20 million General Fund on a one-time basis to help with the construction of 1,200 permanent supportive housing units for homeless and at-risk veterans at the West Los Angeles Veterans Affairs Medical Center Campus.

Strategic Realignment for the Barstow Veterans Home. The spending plan provides $330,000 General Fund (increasing to $588,000 General Fund in 2022‑23 and ongoing) to (1) phase out through natural attrition domiciliary and intermediate care facility (ICF) beds, (2) convert ICF beds to residential care facility for the elderly (RCFE) beds, and (3) reactivate unused skilled nursing facility (SNF) beds. The realignment of the levels of care provided in the Barstow Veterans Home was informed by the recent Barstow Veterans Home plan, which identified demand for domiciliary and ICF beds in the Barstow Veterans Home significantly declined over time, while there is significant demand for RCFE and SNF beds.

Continue CalVet Electronic Health Record Project. The spending plan includes $10 million one-time General Fund to continue the creation and implementation of a standardized electronic health records system across all CalVet veterans homes.

Funding for County Veteran Service Offices (CVSOs). CVSOs are local and regional agencies that assist veterans applying for federal and state veteran benefits. The spending plan provides $5.4 million ongoing General Fund to increase CVSO outreach and staffing.

Capital Outlay Projects. The 2021‑22 budget for CalVet includes funding for three capital outlay projects:

Veterans Home of California, Yountville: Steam Distribution System Renovation—Reappropriation. The spending plan reappropriates $7.9 million Public Building Construction Fund for the construction phase of the steam distribution system renovation project at the Veterans Homes of California in Yountville.