LAO Contact

June 25, 2021

The 2021-22 Budget

Labor Agreements Ending Personal Leave Program 2020

In this analysis

- Introduction

- Common Provisions Across Agreements

- Service Employees International Union, Local 1000 (Units 1, 3, 4, 11, 14, 15, 17, 20, 21)

- Unit 2 (Attorneys and Hearing Officers)

- Unit 5 (Highway Patrol)

- Unit 6 (Corrections)

- Unit 7 (Protective Services and Public Safety)

- Unit 9 (Professional Engineers)

- Unit 10 (Professional Scientists)

- Unit 12 (Craft and Maintenance)

- Unit 13 (Stationary Engineers)

- Unit 16 (Physicians, Dentists, and Podiatrists)

- Unit 18 (Psychiatric Technicians)

- Unit 19 (Professional Health and Social Services)

- Overall LAO Comments

- Overall LAO Recommendations

Key Takeaways

Section 19829.5 of the Government Code requires that our office review successor memoranda of understanding (MOUs). This analysis is our review of 20 labor agreements submitted to the Legislature between June 9 and June 15, 2021. For the agreements among these 20 agreements that constitute successor MOUs, this analysis fulfills our statutory review.

Common Provision Across Agreements

While many of the agreements have provisions unique to a particular bargaining unit that we discuss in the analysis, there are common provision across the 20 agreements. These common provisions include:

-

Ending Personal Leave Program (PLP) 2020. Pursuant to the agreements, PLP 2020 ends the pay period following ratification. As such, employees no longer would (1) have their pay reduced or (2) receive PLP 2020 leave each month.

-

Restoring Employee Contributions to Prefund Retiree Health Benefits. With PLP 2020 ending, all of the employees represented by the bargaining units would resume contributing a specified percentage of pay to prefund their retiree health benefits.

-

Restoring Suspended or Deferred Compensation Increases. During PLP 2020, many previously scheduled compensation increases were suspended or deferred. The agreements implement these compensation increases.

Overarching LAO Comments

In the analysis, we provide overarching comments across the 20 labor agreements. These comments include:

-

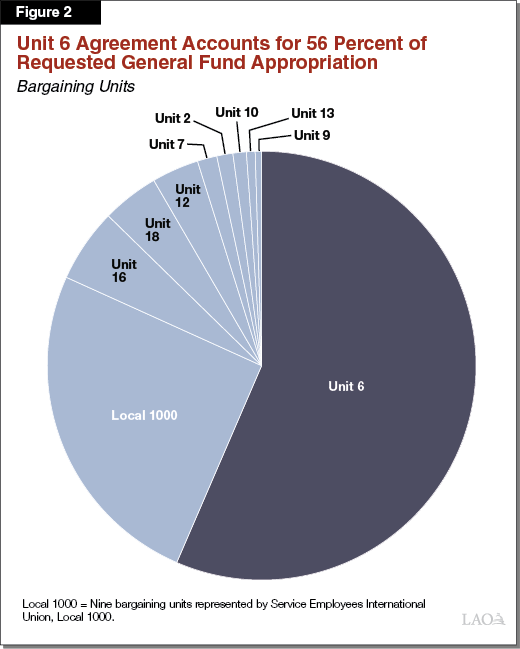

Agreements Significantly Increase State Costs. The agreements have direct and indirect fiscal effects on the state. The administration estimates that the direct fiscal effect of the agreements would increase state costs by $1.3 billion ($717 million General Fund) in 2021‑22. After accounting for indirect costs—such as extending provisions of the agreements to excluded employees and pay increases increasing overtime costs—we estimate that the total General Fund effect of the agreements could be around $1 billion in 2021‑22.

-

Administration’s Bargaining Time Line Significantly Impedes Legislature’s Role in Collective Bargaining Process. The administration has (1) provided very little time for the Legislature to review new agreements with nearly the entire state workforce.

-

No Recent Unit 6 Compensation Study. The administration did not submit compensation studies to the Legislature for the bargaining unit with the largest General Fund effect. These actions by the administration significantly limit the Legislature’s ability to review these new bargaining agreements.

-

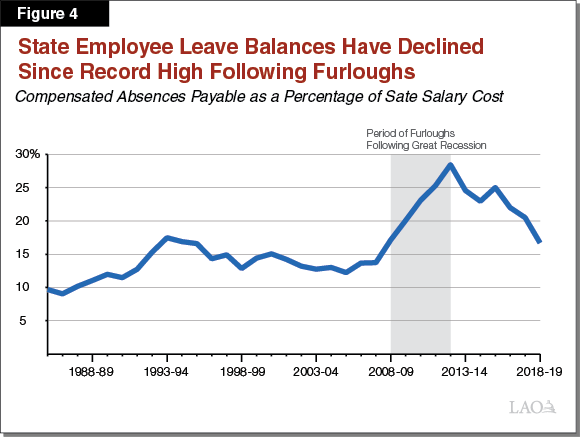

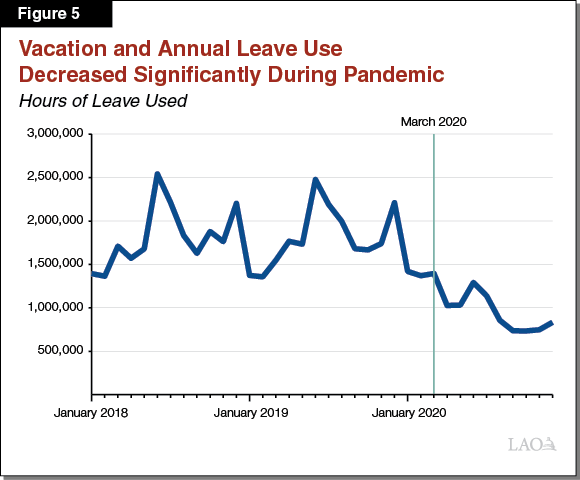

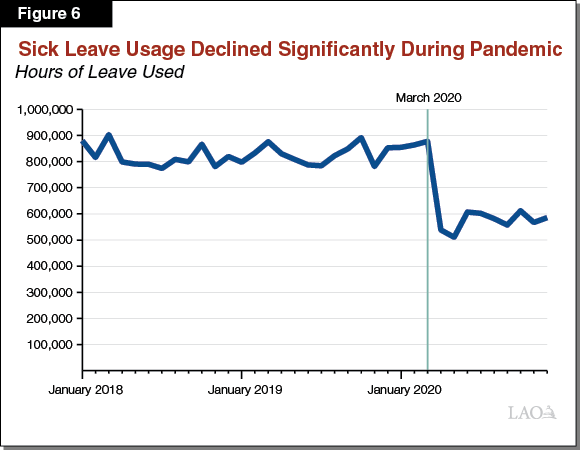

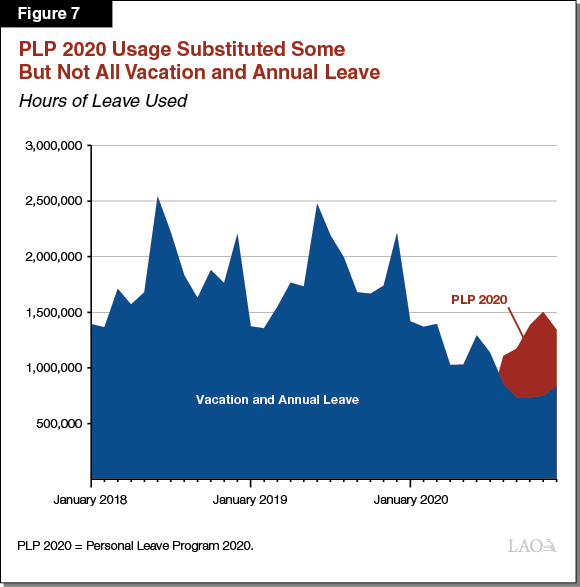

PLP 2020 and Pandemic Have Significantly Increased State Employee Leave Balances. Through decreased use of leave and increased leave accrual during PLP 2020 and the pandemic, we estimate that the state’s liabilities for leave balances likely have increased by hundreds of millions of dollars—potentially exceeding $500 million.

LAO Recommendations

We make a few recommendations in the analysis:

-

Direct the Administration to Provide Agreements in Manner Consistent With the Legislative Calendar. Specifically, going forward, we recommend the Legislature reject any agreements submitted after June 2 or fewer than two weeks before the end of session.

-

Require the Administration to Submit a Compensation Study for Each Bargaining Unit in Reoccurring Cycle, Without Respect to Bargaining Cycle. Compensation studies need not be tied to the bargaining cycle. Rather, the Legislature could require the administration to conduct compensation studies for each unit every three years. This change would ensure compensation studies are provided on a regular basis regardless of when bargaining occurs.

-

In the Event of Higher Than Assumed Revenues, Consider Enhancing Leave Buyback Programs. If revenues in 2021‑22 end up being higher than assumed, we recommend the Legislature consider two changes to the leave buyback program. First, increase the cap on the number of vacation and annual leave hours employees may cash out. Second, set state funds aside to pay for the leave cash outs so that departments do not need to use their resources for these purposes.

Introduction

This analysis reflects information that had been submitted to the Legislature by June 23, 2021. Between June 9 and June 15, 2021, the administration submitted to the Legislature 20 labor agreements between the Governor (represented by the California Department of Human Resources [CalHR]) and state employees (organized into bargaining units, each represented by a union). Of the state’s 21 bargaining units, only Bargaining Unit 8 (Firefighters) is not included among these agreements. These labor agreements reverse compensation reductions agreed to last year—including PLP 2020—when the state faced significant budgetary uncertainty due to the coronavirus disease 2019 (COVID-19) pandemic. Our analysis of the agreements last year can be found here.

As we discuss in greater detail later in this analysis, there are two types of labor agreements: MOUs and addenda to MOUs (including side letters). Pursuant to Section 19829.5 of the Government Code, our office produces analyses of proposed MOUs submitted to the Legislature for determination. Pursuant to provisional language under Item 9800 of the budget, addenda to ratified MOUs are reviewed by the Joint Legislative Budget Committee (JLBC) to determine whether or not the addenda require legislative approval before implementation. As advisors to the Legislature, we review MOU addenda and advise the JLBC throughout its review process. Some MOU addenda make relatively minor changes to the existing MOUs, while others make more significant changes. We typically release formal analyses of MOU addenda when the addenda significantly affect the existing MOUs. Our past analyses of labor agreements can be found on our State Workforce webpages. While some of the agreements discussed in this analysis are successor MOUs, most are side letters.

In this analysis, we first provide a high-level summary of the common provisions incorporated in the agreements. We then discuss each agreement separately and provide any comments that we have related to that agreement. Next, we provide comments on issues that affect multiple bargaining units. Finally, we provide recommendations for the Legislature to consider.

Common Provisions Across Agreements

Current Labor Agreements Established Compensation Reductions as Part of 2020‑21 Budget. All of the bargaining units currently have agreements in place that established PLP 2020. During PLP 2020, employee pay is reduced by an amount specified in the labor agreements and employees receive a specified number of PLP leave hours each month. For specific details on the structure of PLP 2020 for each bargaining unit, refer to our analysis from last year. In addition to establishing PLP 2020, the current labor agreements suspended or deferred several elements of compensation specified in the agreements. Finally, during PLP 2020, the agreements suspended employee contributions to prefund retiree health benefits.

Proposed Agreements Reverse Compensation Reductions, Reinstate Employee Contributions to Retiree Health Benefits. The proposed agreements end PLP 2020 so that employees no longer would have their pay reduced or receive PLP 2020 leave. In addition, the proposed agreements would reverse the other reductions in compensation provided under the current agreements. In most cases, the agreements account for compounding of previously suspended or deferred pay increases that would go into effect under the proposed agreements. In some cases, the agreements establish new compensation increases—either salary increases or other elements of compensation. Figure 1 shows the percent of pay restored to employees with the end of PLP 2020, the percentage of pay employees would contribute to retiree health benefits under the agreement, and any general salary increases (GSIs) that would be provided by the agreements in 2021‑22.

Figure 1

Summary of Common Provisions Across Agreements

|

Unit |

Percent of Pay Restored |

Employee Contributions to |

2021‑22 GSIa |

|

Local 1000b |

9.23% |

3.50% |

4.55% |

|

2 |

9.23 |

2.00 |

4.04 |

|

5 |

4.62 |

3.40c |

4.90d |

|

6 |

4.62 |

4.00 |

5.58 |

|

7 |

9.23 |

4.00 |

5.06 |

|

9 |

9.23 |

2.00 |

5.58 |

|

10 |

9.23 |

2.80 |

7.63 |

|

12 |

9.23 |

2.60 |

5.06 |

|

13 |

9.23 |

3.90 |

—e |

|

16 |

9.23 |

1.40 |

5.06 |

|

18 |

9.23 |

4.00 |

5.58 |

|

19 |

9.23 |

3.00 |

— |

|

aIn most cases, the General Salary Increase (GSI) implements previously deferred salary increases bService Employees International Union, Local 1000 (Local 1000) represents nine bargaining units: Bargaining Units 1, 3, 4, 11, 14, 15, 17, 20, and 21. cUnit 5 employee contribution phased in over four years. dUnit 5 GSI provided in main memorandum of understanding but accounted for in administration’s fiscal estimates of proposed agreement. eProposed Unit 13 agreement would provide employees at the top step of their salary range a 5.83 percent pay increase. |

|||

|

PLP 2020 = Personal Leave Program 2020. |

|||

Service Employees International Union, Local 1000 (Units 1, 3, 4, 11, 14, 15, 17, 20, 21)

Current MOU in Place through June 30, 2023. The state has an active MOU with the nine bargaining units represented by Service Employees International Union, Local 1000 (Local 1000). This MOU was ratified in 2019 and is scheduled to expire June 30, 2023.

PLP 2020 Agreement. On June 19, 2020, the administration and Local 1000 agreed to a side letter agreement to reduce state employee compensation costs through the establishment of PLP 2020 and the suspension of specified compensation increases. A summary of the side letter can be found here. The administration estimated that the PLP 2020 agreement reduced state costs in 2020‑21 by $1 billion ($462.1 million General Fund).

Proposed Agreement. On June 4, 2021, the administration and Local 1000 agreed to a side letter to replace the PLP 2020 side letter. The proposed agreement ends PLP 2020 and establishes other provisions, discussed in greater detail below. A summary of the agreement can be found here. Relative to 2020‑21, the administration estimates that the agreement would increase state costs in 2021‑22 by $1.3 billion ($571.1 million General Fund). However, because the elimination of PLP 2020 already is assumed in the budget, the administration indicates that the Legislature would need to appropriate $420.3 million ($181.3 million General Fund) in 2021‑22 to implement the other terms of the agreement.

Major Provisions of Proposed Agreement

End of PLP 2020: 9.23 Percent of Pay Restored. Effective June 30, 2021, employees’ pay no longer would be reduced by 9.23 percent and employees would not receive PLP 2020 leave each month. The agreement specifies that accrued PLP 2020 does not expire and can be used in the same manner as vacation or annual leave. Between July 1, 2021 and August 1, 2021, Local 1000 employees would be allowed to voluntarily enroll in Voluntary Personal Leave Program (VPLP). The VPLP allows employees to receive additional time off in exchange for a corresponding reduction in pay.

Restoration of Employee Contributions to Retiree Health Benefits. Effective the first day of the pay period following ratification, employees’ 3.5 percent monthly contributions to prefund retiree health benefits would resume being withheld from employees’ pay.

4.55 Percent GSI. Effective the first day of the pay period following ratification of the agreement, the agreement would increase the pay for all employees represented by Local 1000 by 4.55 percent. This GSI includes (1) the suspended 2.5 percent GSI employees would have received on July 1, 2020, (2) the 2 percent GSI employees are scheduled to receive on July 1, 2021, and (3) 0.05 percent to account for the compounding of the two GSIs.

CalHR Review of Leave Cash Out Policies. The agreement specifies that, by March 1, 2022, CalHR will review policies allowing employees to cash out unused leave and will determine “how these policies may be implemented more equitably across all departments.” The administration indicates that this review will look at leave cash out policies generally across state government, but with a particular focus on employee classifications represented by Local 1000.

Elimination of Minimum Wage Pay Differential (PD 443). The current agreement established PD 443 to ensure that PLP 2020 did not reduce any affected employee’s hourly wage below $15 per hour. With PLP 2020 ending, the proposed agreement specifies that Local 1000 members no longer would be eligible for the pay differential.

Essential Worker Premium Pay Contract Reopener. Under the agreement, the state and union would meet and confer when federal and state guidelines are released regarding essential worker premium pay.

LAO Comments

Review of Leave Cash Out Policies Seems Reasonable. We discuss leave balances in greater detail later in this analysis. Through the collective bargaining process, the state has offered some form of a leave buyback program for several years. However, these leave buyback programs typically have been structured so that a department director has the discretion to determine whether a department has sufficient resources on hand to offer a leave buyback program. The director determines whether a buyback program will be offered and, if so, the maximum number of hours (up to the limit established in the labor agreement) that employees may cash out. Departments’ budgetary flexibility to offer a leave buyback program varies. In particular, smaller departments likely are more constrained in their ability to offer leave buyback programs. As we discuss later in this analysis, leave buyback programs have been an important tool for the state to reduce a long-term liability, specifically, employees’ accrued leave balances. Depending on CalHR’s findings during its review, the Legislature may wish to consider permanently restructuring the current leave buyback program so that the state—rather than departments—pays for the leave cash out and establishes the eligibility requirements each year.

Compensation Study. The most recent compensation study produced by CalHR that evaluated Local 1000 members’ compensation was released in December 2019 and relied on compensation data from 2018. This study was released during a time when Local 1000 members were working under an MOU that would not expire until June 30, 2023. The study concluded that some of the occupations represented by Local 1000 received compensation above market while other occupations received compensation below market. On the extremes, the study found that dental assistants were compensated 39 percent above market and management analysts were compensated 31 percent below market. Given the two GSIs provided by this agreement are based on the existing MOU provisions, not providing an updated compensation study at this time is reasonable.

Unit 2 (Attorneys and Hearing Officers)

Current MOU Expired. Unit 2 is represented by the California Attorneys, Administrative Law Judges, and Hearing Officers in State Employment (referred to as “CASE”). Unit 2 members work under an expired MOU that was in effect until July 1, 2020. Pursuant to state law, the provisions of an expired MOU generally remain in effect until a successor agreement is ratified.

PLP 2020 Agreement. On June 30, 2020, the administration and CASE reached an agreement to reduce state employee compensation costs. The agreement is scheduled to expire June 30, 2022. The administration estimated that the agreement reduced state costs in 2020‑21 by $67.5 million ($18.9 million General Fund).

Proposed Successor MOU. On June 11, 2021, the administration and CASE agreed to a successor MOU that would be in effect through June 30, 2022. The proposed agreement ends PLP 2020 and establishes other provisions, discussed in greater detail below. A summary of the proposed MOU can be found here. Relative to 2020‑21, the administration estimates that the agreement would increase state costs in 2021‑22 by $117.8 million ($31.3 million General Fund). However, because the elimination of PLP 2020 already is assumed in the budget, the administration indicates that the Legislature would need to appropriate $37.2 million ($8.7 million General Fund) in 2021‑22 to implement the other terms of the agreement.

Major Provisions of Proposed Agreement

End of PLP 2020: 9.23 Percent of Pay Restored. Effective on the first day of the pay period following ratification, employees’ pay no longer would be reduced by 9.23 percent and employees no longer would receive PLP 2020 leave credits each month.

Restoration of Employee Contributions to Prefund Retiree Health Benefits. Effective the first day of the pay period following ratification, Unit 2 members would resume making monthly contributions of 2 percent of pay to prefund retiree health benefits.

4.04 Percent GSI for All Unit 2 Members. Effective the first day of the pay period following ratification, the agreement would provide Unit 2 members a 4.04 percent pay increase. This pay increase includes (1) accelerating the 2 percent GSI that—under the PLP 2020 agreement—Unit 2 members would receive July 1, 2022, (2) a new 1.5 percent GSI, and (3) 0.04 percent to account for compounding of the two other GSIs.

Special Salary Adjustments (SSA) for All Unit 2 Members. In addition to the 4.04 percent GSI, the agreement would provide all Unit 2 members a 1.33 percent SSA effective the first day of the pay period following ratification. In addition, the minimum and maximum of pay ranges A and B of ten different classifications represented by Unit 2 would receive an SSA of 15 percent effective the first pay period following ratification but no earlier than August 1, 2021. By affecting ranges A and B of these classifications, the intent of the provision is to increase entry level salaries of these classifications.

Doubles Bilingual Differential Pay to $200 Per Month. Effective the pay period following ratification, the bilingual pay differential would increase from $100 per month to $200 per month. The administration’s fiscal estimates indicate that this will affect 80 employees.

Eliminates $260 Monthly Payment to Improve Health Care Affordability. Effective the pay period following ratification by both parties, Unit 2 members no longer would receive the monthly $260 payment established under the current agreement.

Shortens Period During Which 640 Hour Leave Cap Is Increased to 832 Hours. Prior to PLP 2020, the Unit 2 agreement limited the number of banked vacation and annual leave hours to 640 hours. The PLP 2020 agreement increased the cap by the number of hours of PLP 2020 that Unit 2 members received until June 30, 2025. The proposed agreement specifies that the cap would be increased by 192 hours until June 30, 2024.

Increases Commute Program Reimbursements. Effective the pay period following ratification, the agreement would increase the Commute Program Reimbursement by $35 per month.

Meeting to Discuss Compensation Study. The agreement would change the date when the parties meet to “explore the components and methodology for conducting a salary survey” from January 2020 to September 2021. The agreement specifies that nothing in the provision requires the state to modify its existing methodology.

Classification Consolidations. The agreement specifies that the state will present to the State Personnel Board (SPB) two proposals related to specific Unit 2 classifications. First, no later than six months after ratification, the state would present to SPB a proposal to consolidate a majority of the Administrative Law Judge (ALJ) I and II classifications into one statewide classification. This would result in one larger continuous salary range for any affected ALJ classifications. Second, no later than July 1, 2022, the state would present a proposal to SPB to make specific changes to attorney classifications, including (1) eliminating Ranges A and B for entry level attorneys, making the starting salary at the Range C level; (2) consolidating a majority of the level III attorney classifications into a single statewide level III classification; and (3) consolidating a majority of the attorney level IV classifications into a single statewide level IV classification.

Workers’ Compensation Judge (WCJ) II Classification. Under the agreement, no later than June 18, 2021, CalHR would present to SPB a classification proposal to (1) create a WCJ II class and (2) revise the WCJ I class. No later than July 2, 2021, the agreement would require CalHR to prepare and disseminate a pay letter. The agreement would require the Department of Industrial Relations (DIR) to perform a job analysis, create and administer an exam, and develop a WCJ II certification list no later than the end of calendar year 2021.

LAO Comments

Compensation Study. The most recent compensation study for Unit 2 produced by CalHR was released January 2019 and used 2017 compensation data. The compensation study was released six months before the prior MOU expired on July 2, 2019. The current MOU under which Unit 2 members work expired July 2020 and specified that the state would not conduct a new compensation study “due to the recent release of the total compensation survey and the one year duration of [the] agreement.” In our 2019 analysis, we discuss two compensation studies that were conducted by groups other than CalHR—one by the California Department of Justice and the other by the University of California (UC) at Los Angeles. In our 2019 analysis, we concluded that these two studies and the 2019 CalHR study clearly demonstrate that Unit 2 attorneys are compensated at levels lower than their local government counterparts. Given the findings of these compensation studies, providing additional GSIs without a new compensation study likely is reasonable.

Changes to Attorney Classifications. The most recent CalHR compensation study found that state attorneys overall are compensated 17 percent below market levels; however, this lag varied significantly across regions in the state. For example, whereas in San Francisco, the study found that state attorneys are compensated 30 percent below market, the study found that state attorneys were compensated 16 percent above market in most counties in the state. While the changes that the agreement proposes could improve recruitment and retention of state attorneys broadly, we do not think it would address the challenges the state has in recruiting and retaining attorneys in regions where the state’s compensation significantly lags. In addition, how the classification consolidations would affect attorneys with specializations is unclear.

WCJ II. We understand that DIR has had trouble recruiting and retaining employees in the WCJ classification. Creating a WCJ II classification at DIR possibly could improve retention of employees as there would be more opportunities for salary increases over time.

Unit 5 (Highway Patrol)

Current MOU Originally in Place Through June 30, 2023. Unit 5 members are represented by the California Association of Highway Patrolmen (CAHP). In 2019, the Legislature ratified an MOU between the state and CAHP that was scheduled to be in place until June 30, 2023.

PLP 2020 Agreement Extended Term of MOU to Either July 3, 2024 or 2025. On June 26, 2020, the state and CAHP reached an agreement to reduce state employee compensation costs. In addition, the agreement extended the term of the current MOU from June 30, 2023 to July 3, 2024 and possibly July 3, 2025, if certain conditions were met, described in our analysis. The administration estimated that the agreement would reduce state costs in 2020‑21 by $191.3 million—none of which is from the General Fund.

Proposed Agreement Sets Expiration of Current MOU to July 3, 2024. On June 4, 2021, the state and CAHP reached an agreement that specifies that the MOU will expire July 3, 2024. The proposed agreement ends PLP 2020 and establishes other provisions, discussed in greater detail below. A summary of the agreement can be found here. Relative to 2020‑21, the administration estimates that the proposed agreement will increase state costs in 2021‑22 by $164.4 million. However, because the elimination of PLP 2020 already is assumed in the budget, the administration indicates that the Legislature would need to appropriate $89.7 million in 2021‑22 to implement the other terms of the agreement.

Major Provisions of Proposed Agreement

End of PLP 2020: Restoration of 4.62 Percent of Pay. Effective the first day of the pay period following ratification, employees’ pay no longer would be reduced by 4.62 percent and employees no longer would receive PLP 2020 leave credits.

Restoration of Suspended Uniform-Related Payments. The agreement would restore the suspended payments to employees related to the purchase and maintenance of uniforms. Specifically, the agreement would restore the $920 annual uniform allowance and the $25 monthly uniform maintenance and cleaning payment.

Employee Contributions to Prefund Retiree Health Benefits. Under the agreement, employee contributions to prefund retiree health benefits would be withheld from employees’ pay. Pursuant to the agreement, between 2021‑22 and 2024‑25, the amount contributed by employees would increase and the amount contributed by the state would decrease such that employees and the state each contribute 3.4 percent of pay beginning in 2024‑25. For purposes of the annual salary survey comparing highway patrol compensation with that of five local jurisdictions used to determine highway patrol officers’ annual pay increases, the agreement specifies that the employees’ share would be counted as 3.5 percent of pay beginning in 2021‑22. The scheduled changes in employee and employer contributions are listed below.

2021‑22: 0.9 Percent of Pay Withheld From Employees. The state would contribute 5.9 percent of pay.

2022‑23: 1.7 Percent of Pay Withheld From Employees. The state would contribute 5.1 percent of pay.

2023‑24: 2.6 Percent of Pay Withheld From Employees. The state would contribute 4.2 percent of pay.

2024‑25: 3.4 Percent of Pay Withheld From Employees. The state would contribute 3.4 percent of pay.

Ending Employee Supplemental Contribution to Pensions. Unit 5 members receive annual pay increases based on a salary survey of five local jurisdictions. Under the current MOU, any amount of the 2019‑20 Unit 5 salary increase above 3 percent was redirected as an employee contribution towards pension benefits. This contribution was in addition to what the state and employees otherwise would contribute to the pension system, meaning that the contribution was a supplemental pension contribution that paid down unfunded liabilities. The proposed agreement would end the 1 percent salary redirection and return it to employees’ compensation on July 1, 2023.

LAO Comments

Unit 5 GSI. The administration’s fiscal estimates for the Unit 5 agreement include the costs ($84 million, none from the General Fund) associated with the 4.9 percent 2021‑22 Unit 5 GSI. This cost is not the result of the proposed agreement as the GSI is provided by a provision in the Unit 5 MOU and Section 19827 of the Government Code. Pursuant to state law, Unit 5 members typically receive GSIs each year based on an annual survey of five local governments: the Los Angeles Police Department, Los Angeles County Sheriff’s Department, Oakland Police Department, San Diego Police Department, and the San Francisco Police Department. We discuss this survey in greater detail in our 2019 analysis of the Unit 5 MOU. California highway patrol officers currently are the only state employees in California who automatically receive adjustments to their salary ranges each year. Section 19827 specifies that any increase in total compensation resulting from the annual survey shall be implemented through an MOU.

Total Compensation Study. Although CalHR conducts an annual survey comparing highway patrol officers’ compensation with compensation provided to comparable classifications at five local jurisdictions, CalHR has not conducted a total compensation study comparing highway patrol officer compensation with other employers since 2008. Unlike newer compensation studies that CalHR produces in house, that study was conducted by CPS Human Resource Services. That study indicated that, statewide, patrol officers were compensated 7 percent above the median employer in the survey. A compensation study from 2008 cannot inform decisions to establish compensation in 2021. As such, while the Legislature has a sense of how state highway patrol officers’ compensation compares with compensation provided to peace officers in five coastal communities, it does not have sufficient information to assess how the state’s compensation package compares with other parts of the state.

Unit 6 (Corrections)

PLP 2020 Side Letter. On June 18, 2020, the administration submitted to JLBC a side letter to implement cost reductions, including establishing PLP 2020. The side letter had a term of July 1, 2020 through June 30, 2022.

PLP 2020 Agreement Incorporated Into Current MOU. The prior MOU between the state and the California Correctional Peace Officers Association (CCPOA) was in place for one year and expired July 2, 2020. On June 19, 2020, the administration submitted to the Legislature a successor MOU which is now the current MOU. Among other provisions, the MOU incorporated the PLP 2020 side letter. The current MOU is scheduled to expire on July 2, 2022.

Proposed Agreement Replaces PLP 2020 Side Letter and Extends Expiration Date of MOU. On June 6, 2021, the administration and CCPOA reached an agreement that ends PLP 2020 and establishes other provisions, discussed in greater detail below. The proposed agreement extends the term of the current MOU by one year so that it would expire on July 2, 2023. A summary of the agreement can be found here. Relative to 2020‑21, the administration estimates that the proposed agreement will increase state costs in 2021‑22 by $795.5 million (all from the General Fund). However, because the elimination of PLP 2020 already is assumed in both the Governor’s and Legislature’s budget and other provisions with costs are assumed to be paid from existing departmental resources, the administration indicates that the Legislature would need to appropriate $400.7 million in 2021‑22 to implement the other terms of the agreement.

Major Provisions of Proposed Agreement

End of PLP 2020: 4.62 Percent of Pay Restored. The agreement specifies that it is the intent of the parties that PLP 2020 end July 1, 2021. Effective the first day of the pay period following ratification, Unit 6 members’ pay no longer would be reduced (most Unit 6 members’ pay currently is reduced 4.62 percent during PLP 2020) and Unit 6 members no longer would receive PLP 2020 leave.

2021‑22 GSIs. The PLP 2020 side letter deferred a 3 percent GSI that previously was scheduled to go into effect July 1, 2020. The proposed agreement would restore this pay increase and provide employees a 2.5 percent GSI effective the first day of the pay period following ratification of the agreement. In total, after accounting for compounding of the deferred GSI, the agreement would give employees a 5.58 percent GSI in 2021‑22.

2022‑23 GSI. Effective July 1, 2022, the agreement would provide Unit 6 members a 2.5 percent GSI. However, the agreement specifies that CCPOA could choose to reopen the agreement should another bargaining unit receive a GSI in 2022 (that is negotiated after June 1, 2021) that is greater than 2.5 percent.

Restoration of Benefit Decreases. The proposed agreement would restore benefits that were either suspended or decreased during PLP 2020: specifically, holiday pay, night and weekend shift differentials, uniform allowances, and Personal Development Days. For specific information about these elements of compensation, refer to our analysis last year.

Restoration of Employee Contributions to Prefund Retiree Health Benefits. Beginning on the first day of the pay period following ratification, Unit 6 members would resume making monthly contributions of 4 percent of pay to prefund retiree health benefits.

COVID-19 Fatigue Leave Time Off (CFLTO). The agreement would establish CFLTO as a one-time, year-long program “intended to provide restorative time off” to Unit 6 members. Under the program, Unit 6 members would earn eight hours of non-compensable leave per month from August 2021 through July 2022. Employees would be expected to use the leave “routinely.” The agreement specifies that the California Department of Corrections and Rehabilitation (CDCR) would be able to mandate usage in reverse seniority order if employees do not voluntarily sign up for the time off. Under the agreement, unused CFLTO would expire on July 30, 2022. The agreement specifies that “classifications that do not require relief, such as Parole Agents, Correctional Counselors, or those who are not scheduled in Work Force TeleStaff will schedule an additional eight-hour day off per month.” This language is ambiguous; however, the administration indicates that these employees would not earn more CFLTO than others in the bargaining unit.

Nearly $5,000 Payment Over Two Years. The agreement specifies that, in recognition of increased health and wellness needs tied to the COVID-19 pandemic, Unit 6 members would receive $208 per month paid in a single lump sum in calendar year 2021 and calendar year 2022. This provision would result in Unit 6 members receiving two lump sum payments of $2,496 over the two years.

One-Time Leave Cash Out of up to 80 Hours. The agreement would provide all Unit 6 members a one-time opportunity to cash out up to 80 hours of leave credit (not including sick leave) in 2021. The agreement specifies that employees who wish to participate in the leave buyback program must submit a request to do so by October 15, 2021 and that the payments would be expected to be issued before November 19, 2021. Unlike other leave buyback programs that require departments to pay the cost of the program using departmental resources, the buyback program established by the agreement would be funded by the state.

Increased State Contributions to Health Benefits in 2023. The state contributes a flat dollar amount towards Unit 6 members’ health benefits. As such, when health premiums increase, the flat dollar contribution established in the labor agreement must be adjusted in order to maintain the same proportional cost sharing of premium costs between the state and employees. The agreement would increase the state’s contribution to employee health benefits to maintain the 80/80 benefit level when premiums increase in 2023.

Meet and Confer Regarding Essential Worker Premium Pay. The agreement specifies that the federal American Rescue Plan Act includes money to be provided to states for the purpose of distributing essential worker premium pay to some or all essential workers in both the private and public sectors. In the agreement, the parties agree to meet and confer whenever federal and state guidelines are released regarding essential worker premium pay.

Revives Language From Previous Agreements Pertaining to Compensation Study. As discussed in greater detail later in this analysis, the current Unit 6 agreement makes inoperable a provision related to CalHR’s Unit 6 compensation study. The proposed agreement would make the provision operable again.

Main Table Work Group Prepares for Bargaining in 2023. Although the parties agreed to extend the Unit 6 MOU by one year, under the agreement, the parties would convene a Main Table Work Group to meet regularly in 2022 to discuss issues, concerns, and new ideas in anticipation of and in preparation for bargaining in 2023.

New Correctional Officers Not Subject to Involuntary Overtime for First Four Weeks at Institution. Under the current agreement, Unit 6 members are exempt from working involuntary overtime during their first week at an institution after graduating from the academy. The agreement would increase the amount of time during which a new hire is exempt from involuntary overtime to four weeks.

LAO Comments

Interactions With State Budget

Encourage Legislature to View Unit 6 Agreement as a CDCR Budget Request. The trailer bill language submitted by the administration frames the Unit 6 agreement as 1 of 20 labor agreements seeking ratification from the Legislature. This framing helps compare growth in compensation across bargaining units. However, this framing is not helpful in understanding how the Unit 6 agreement interacts with the state budget. While all of the labor agreements significantly increase overall state costs, the Unit 6 agreement is unique in that it only affects the General Fund and only affects one department, CDCR. Many legislators express regular concern about the fact that the state’s costs to operate prisons continue to rise despite the fact that the inmate population has declined significantly in recent years. In our February 2020 report, State Correctional Spending Increased Despite Significant Population Reductions, we discuss the primary cost drivers that have contributed to the CDCR budget growing each year. A major driver of CDCR costs is personnel and the largest personnel cost at CDCR is employee compensation for Unit 6 and associated excluded employees. Considering the Unit 6 agreement as one of many budget change proposals (BCPs) requesting legislative approval to increase the CDCR budget provides helpful context as to why costs for prison operations continue to rise.

Unit 6 Labor Agreement Constitutes Largest Budget Proposal for CDCR in 2021‑22. Up to the May Revision, the administration submitted a number of BCPs—excluding the costs of this agreement—that, in total, would increase CDCR’s General Fund operating costs by $669 million (mostly from the General Fund) in 2021‑22. (The Legislature’s budget package, approved on June 14, 2021, increases the CDCR budget by a lesser amount—$575 million, mostly from the General Fund.) The $510 million appropriation that would be required to fund this agreement would constitute the single largest BCP for CDCR in 2021‑22 and would increase the total amount of General Fund resources requested for the department by 76 percent. For context, the second largest budget request for CDCR totals $408 million and is related to CDCR’s COVID-19 response. (The COVID-19 response request consists of one BCP submitted in January [requesting $281 million General Fund] and a request as part of the May Revision [requesting an additional $126.7 million General Fund].)

Compensation Study

State Law Requires Administration to Justify GSIs with a Compensation Study. A GSI—like the 5.58 percent pay increase in 2021‑22 proposed by this agreement—adjusts the entire salary range for a classification such that all employees within that classification receive the pay increase. Section 19826 of the Government Code specifies that CalHR shall establish salary ranges for state classifications “based on the principle that like salaries shall be paid for comparable duties and responsibilities.” Further, the law requires that—when establishing or changing pay ranges—“consideration shall be given to the prevailing rates for comparable service in other public employment and in private business.” The law requires that at least six months before an MOU expires, CalHR submit to the union that represents the affected employees and the Legislature “a report containing the department’s findings relating to the salaries of employees in comparable occupations in private industry and other governmental entities.” If this requirement under law conflicts with provisions of a ratified MOU, the law specifies that the ratified MOU shall be controlling.

Last Unit 6 Compensation Study—From 2013—Showed CCPOA Compensated Above Market. As we indicated in our 2018 and 2019 analyses of the then proposed Unit 6 agreements, the last compensation study for Unit 6 was conducted using data from 2013. That survey determined that correctional officers represented by Unit 6 received total compensation that was 40 percent higher than their local government counterparts.

Administration Completed a 2018 Compensation Study… Prior to 2016, the Unit 6 MOU did not include a provision related to the compensations study required by Section 19826. The MOU ratified by the Legislature in 2016 (henceforth referred to as the 2016 MOU) included language related to the compensation study required by state law. Specifically, the provision (Section 15.19 of the MOU) was added to require that:

Within ninety (90) days of ratification of this MOU, the parties agree to form a Joint Labor Management group who will meet to discuss the criteria, comparators and methodology to be utilized for [Bargaining Unit 6] in the next Total Compensation Report created pursuant to Government Code Section 19826. The Joint Labor Management group will be comprised of no more than two (2) representatives from each of the following: CCPOA, CalHR, CDCR and Department of Finance. The first meeting of the Joint Labor Management group will occur no later than eighteen (18) months prior to the expiration of the MOU.

In 2018, CalHR informed us that (1) the administration and CCPOA met beginning August 2017 and reached a consensus on the study’s methodology by mid-October 2017, (2) the survey was mailed to six county employers in mid-October 2017, (3) CalHR completed a draft compensation report by mid-February 2018, (4) CalHR shared a draft report with CCPOA, (5) CCPOA had questions about how the agreed upon methodology was applied in the study, and (6) CalHR agreed not to submit to the Legislature the 2018 compensation study until CCPOA had completed its review.

…But Did Not and Will Not Submit 2018 Compensation Study to the Legislature… When we reviewed the MOU ratified by the Legislature in 2018 (henceforth referred to as the 2018 MOU), the administration indicated it had not resolved their differences on the compensation study with CCPOA and that the administration would not submit it to the Legislature. Three years later, CalHR maintains that it will not submit the 2018 compensation study to the Legislature.

…And Did Not Conduct a 2019, 2020, or 2021 Compensation Study Before Submitting Agreements to Legislature. At the end of the language quoted above, the 2018 MOU added a sentence: “This section will be inoperable during the term of this MOU.” If the section related to CCPOA’s involvement in the compensation study was inoperable, CalHR should have submitted a compensation study pursuant to state law six months before the 2018 MOU expired on July 2, 2019. However, the administration did not submit a compensation study in 2019. At the time, the administration indicated that CCPOA and CalHR still had not resolved their methodological differences. In 2019, the Legislature ratified another one-year MOU for Unit 6 (henceforth referred to as the 2019 MOU). The 2019 MOU retained the sentence at the bottom of the provision stating that Section 15.19 is inoperable; however, it also added at sentence at the top of the provision: “The parties agree that this section shall remain dormant for the term of this MOU and that no Total Compensation Report will be created for the successor MOU.” CalHR did not submit a compensation study six months before the 2019 MOU expired on July 2, 2020. The two-year agreement ratified by the Legislature in 2020 retained the language from the 2019 MOU. Although all three of these agreements contained provisions that affected the salaries received by Unit 6 members, the administration agreed to these compensation changes without having conducted a compensation study.

Without Compensation Study, Legislature Cannot Assess Need for Pay Increase. Unit 6 compensation has changed significantly since the last compensation study in 2013. These changes include lower retirement benefits for future employees, new requirements to prefund retiree health benefits, pay increases, and a temporary pay reduction through PLP 2020. We suspect that correctional officers and probation officers employed by other governmental entities also have experienced significant changes to their compensation since 2013. Based on what the administration has provided, the Legislature has no way to assess whether the GSIs established under the proposed agreement are appropriate and how the pay increases might affect the state’s position in the labor market and its ability to recruit and retain employees. In 2019, we could not find evidence justifying pay increases for correctional officers. While we did not have time to extensively study this issue while preparing this analysis like we did in 2019, we are not aware of any new evidence that would provide such justification.

Proposed Agreement Sets Stage for CCPOA to Again Block Compensation Study. The proposed agreement reinstates the provision from the 2016 MOU. Specifically, the agreement includes the below language:

The parties agree that this section shall remain dormant for the term of this MOU and that no Total Compensation Report will be created for the successor MOU. Within ninety (90) days of ratification of this MOU, tThe parties agree to form a Joint Labor Management group who will meet to discuss the criteria, comparators and methodology to be utilized for [Bargaining Unit 6] in the next Total Compensation Report created pursuant to Government Code Section 19826. The Joint Labor Management group will be comprised of no more than two (2) representatives from each of the following: CCPOA, CalHR, CDCR and Department of Finance. The first meeting of the Joint Labor Management group will occur no later than eighteen (18) months prior to the expiration of the MOU. This section will be inoperable during the term of this MOU.

Based on what happened in 2018, CalHR interprets this language to allow CCPOA to review a completed compensation study before the study is submitted to the Legislature and to block the compensation study from being submitted to the Legislature or otherwise being made public. We disagree with this interpretation. Rather, this language allows the Joint Labor Management group to meet to discuss the compensation study. The language does not empower the Joint Labor Management group to determine the final methodology or results of the study, nor does the language allow for the compensation study to be withheld from the Legislature. Lastly, the language does not supersede existing law requiring a compensation study be provided to the Legislature.

CalHR’s interpretation of this provision undermines transparency, legislative oversight, and existing state statute. If CalHR does not provide a Unit 6 compensation study in 2023 when the proposed agreement expires, the most recent compensation study for Unit 6 will be ten years old. This would be highly problematic.

Missed Opportunities

Agreement Provides Substantial Compensation Increases to Employees Without Clear Justification. The proposed agreement would significantly increase employee compensation. In some cases, the increased costs also have a direct benefit to the state. For example, the 80-hour leave cash out would reduce the state’s long-term liabilities associated with leave balances (discussed in greater detail later in this analysis). However, other provisions, like the nearly $5,000 payment over two years, have no clear state benefit. While the administration states these payments would be intended to recognize Unit 6 members’ “increased Health and Wellness needs tied to the COVID-19 pandemic” the administration does not cite increased turnover or other data to justify this payment. Addressing differential impacts of the pandemic on essential workers like those represented by CCPOA likely would be better addressed through the parties’ agreement to meet and confer on essential worker pay described above.

Significant Operational Issues at CDCR Not addressed by Agreement. The proposed agreement does not seem to address several major issues that have been highlighted in recent legislative hearings and reports that likely will affect CDCR operations and labor relations during the two years of life of the proposed agreement. For instance, the agreement makes no mention of the processes by which prisons will be closed and personnel reassigned. (We discuss this and other issues more below.) These issues could be discussed at the bargaining table over the coming two years. Any effort to address the issues we discuss below in a future agreement likely would result in additional employee compensation cost increases for the state.

Employee COVID-19 Vaccinations. COVID-19 outbreaks at CDCR prisons have been a major issue during the pandemic. As of June 23, 2021, CDCR reports 49,394 total confirmed COVID-19 cases (about one-half of the total estimated average daily inmate population in 2020‑21) and 227 deaths among inmates. At its peak in January 2021, CDCR reported over 10,000 active cases among inmates. In its final report of COVID-19 among staff on June 15, 2021, CDCR reported 17,002 confirmed COVID-19 cases (representing about 30 percent of CDCR positions in 2020‑21) and 28 deaths among CDCR staff. As of June 23, 2021, the number of cases among inmates is relatively low with 32 confirmed COVID-19 cases among inmates and 28 new cases in the last 14 days. According to the May 27, 2021 Joint Case Management Conference Statement from the federal court case, Marciano Plata, et al. v. Gavin Newsom, et al (known as Plata v. Newsom), while 71 percent of the incarcerated population in California state prisons has received at least on dose of a COVID-19 vaccine, only 49 percent of correctional staff have had at least one dose of a vaccine. While case numbers currently are relatively low, low vaccination rates increase the likelihood of future outbreaks of COVID-19 which could negatively affect the health of prison staff and inmates and drive increased state costs to respond to the outbreak. The agreement could have made at least a portion of the nearly $5,000 payment contingent on employees receiving at least one dose of a COVID-19 vaccine or being fully vaccinated. Further, tying the payment to vaccination would be a simple way for the payment to meet its stated objective by providing greater protection to the broader prison employee and inmate population.

Personal Protective Equipment (PPE) Compliance. An October 2020 report from the California Office of the Inspector General (OIG) indicated that although CDCR distributed cloth masks to inmates and correctional staff and mandated via policy memorandum that masks be worn, there was at the time significant levels of noncompliance among staff and inmates. At the time, the OIG recommended that department management clearly communicate consistent face covering guidelines that are enforced consistently through disciplinary action when management observes noncompliance. Whether compliance has improved since October 2020 is unclear; however, including COVID-19-related health and safety provisions in the agreement would be an effective way to communicate clearly to staff the state’s expectations and plans of enforcement related to PPE usage.

Officer Mental Health. Being a correctional officer is a stressful job in normal times. A 2018 UC Berkeley survey identified that correctional officers have a high incidence of serious stress-related illnesses like high blood pressure, depression, and post-traumatic stress disorder. The survey identified that correctional officers are at higher risk than the general population to have suicidal thoughts or die by suicide. During the pandemic, being a correctional officer has become more stressful. A 2020 UC Berkeley survey of correctional officers identified a number of causes of increased stress during the pandemic for correctional officers. The biggest stresses identified by the survey included protecting their health at work, protecting the health and safety of their loved ones, financial instability, and managing their own stress at home. In addition, the survey identified that the day-to-day work for correctional officers has been more difficult and stressful during the pandemic. The survey asked correctional officers which types of services would be very or extremely useful to reduce stress and the top four services selected included a place to shower after work, access to a laundry service, a place to change clothes after work, and more or better food options. One-third of respondents indicated that they wanted access to mental health services. While the nearly $5,000 payment under the proposed agreement might alleviate financial stress on correctional officers, it does not seem to address employees’ health and wellness needs, especially those needs tied to the COVID-19 pandemic. On the other hand, the CFLTO could benefit Unit 6 members’ mental health assuming that (1) employees take more time off than they otherwise would have taken and (2) the increased time off does not result in other (less senior) employees working more overtime.

Officer Misconduct. As was discussed at the March 1, 2021 Assembly Budget Subcommittee No. 5 hearing, concerns about correctional staff misconduct against inmates and other staff and concerns about CDCR’s handling of staff misconduct claims have existed for quite some time. The OIG repeatedly has raised concerns about CDCR’s handling of staff misconduct allegations, most recently in its February 2021 report. CDCR reported to the committee that it is making significant changes to how it handles allegations of misconduct. To support those changes, the department requested a $19 million total augmentation (via three 2021‑22 budget proposals that can be found here, here, and here) to its $9.8 million base budget for handling inmate and parolee allegations against staff. (The Legislature approved the augmentation but eliminated the base funding.) The department also confirmed that the changes likely would be subject to the collective bargaining process in the hearing. Although CDCR claimed at the hearing that it has been working on developing a new process to handle officer misconduct since before the February 2021 OIG report, the agreement includes nothing related to officer misconduct or the CDCR process to review claims of officer misconduct.

Body-Worn Cameras and Video Surveillance in Facilities. As described in greater detail in two 2021‑22 CDCR BCPs (see here and here), federal courts have placed a number of requirements on CDCR related to requiring the use of body-worn cameras and fixed video surveillance systems in CDCR facilities. Courts have required the use of body-worn cameras and video surveillance at six state prisons. In a May Revision BCP, CDCR proposed installing video surveillance systems over three years beginning in 2021‑22 and the remaining 24 prisons (excluding those that are scheduled for closure). (The Legislature approved resources to install video surveillance at four prisons in 2021‑22 and rejected the portion of funding requested to install video surveillance at the remaining 20 prisons in 2022‑23 and 2023‑24.) While there are some provisions in the current MOU related to the use of camera footage during adverse actions against Unit 6 members, the administration did not make further headway on the expanded use of cameras in this agreement.

Prison Closures. The state is scheduled to close two prisons and two yards in 2021‑22. Further, based on projected declines in inmate populations, we have concluded that the state may be in a position to close around three additional prisons within the next several years. Depending on how the scheduled and any additional closures occur, employees could be affected directly, either through relocation to another facility or through job loss. Issues related to prison closures that could be topics at the bargaining table range from creating incentives for more senior (higher paid) employees to exit the workforce like a “golden handshake,” to modifications to the layoff process, to relocation expenses for employees who must move, to creating incentives for correctional staff to remain in their jobs until a facility is entirely shut down. The new agreement does not appear to contain any provisions related to these issues.

Division of Juvenile Justice (DJJ) Realignment and Closure. About 680 youth are housed in facilities operated by CDCR’s DJJ, which currently includes three facilities and one conservation camp. In approving the 2020‑21 budget package, the Legislature adopted a plan to gradually shift or “realign” the responsibility of DJJ for housing certain juvenile offenders from the state to the counties. Under the plan, DJJ will stop intake for most youth beginning on July 1, 2021. After that date, youth who would otherwise be sent to DJJ will generally be placed under county supervision. The administration plans to fully close DJJ by July 1, 2023. Depending on how and when the DJJ facilities close, employees could be affected directly, either through relocation to other assignments within CDCR (such as to an adult facility) or through job loss. There could be various issues related to the closure of DJJ—similar to those previously discussed in regard to prison closures—that could be topics at the bargaining table. The new agreement does not appear to contain any provisions related to these issues.

Unit 7 (Protective Services and Public Safety)

Current MOU in Place Through July 1, 2023. Unit 7 is represented by the California Statewide Law Enforcement Association (CSLEA).The current MOU was established in 2019 and is scheduled to expire July 1, 2023.

PLP 2020 Agreement. On June 24, 2020, the administration and CSLEA reached an agreement to reduce Unit 7 compensation and established PLP 2020. The PLP 2020 agreement is scheduled to expire June 30, 2022. The administration estimated that the agreement reduced state costs in 2020‑21 by $80 million ($25.2 million from the General Fund).

Proposed Agreement. On June 10, 2021, the administration and CSLEA reached an agreement that ends PLP 2020 and implements other provisions, discussed below. Relative to 2020‑21, the administration estimates that the proposed agreement would increase state costs in 2021‑22 by $105.8 million ($33.1 million from the General Fund). However, because the elimination of PLP 2020 already is assumed in the budget, the administration indicates that the Legislature would need to appropriate $36.9 million ($10.6 million General Fund) in 2021‑22 to implement the other terms of the agreement.

Major Provisions of Proposed Agreement

End of PLP 2020: 9.23 Percent of Pay Restored. Effective the first day of the pay period following ratification of the agreement, the PLP 2020 pay reduction would end under the agreement. This means that employees’ monthly pay no longer would be reduced by 9.23 percent and employees no longer would be credited with 16 hours of PLP 2020 leave each month. The agreement clarifies that employees could use any Personal Development Days before they use PLP 2020 leave.

Restoration of Employee Contributions to Prefund Retiree Health Benefits. Beginning the first day of the pay period following ratification, employees would resume contributing 4 percent of pay to prefund retiree health benefits.

5.06 Percent GSI. Effective the first day of the pay period following ratification, Unit 7 members would receive a 5.06 percent salary increase. This salary increase includes (1) a 2.5 percent GSI originally scheduled to go into effect July 1, 2020, (2) a 2.5 percent GSI originally scheduled to go into effect July 1, 2021, and (3) 0.06 percent to account for the compounding of the two GSIs.

Revocation of Eligibility of PD 443. The PLP 2020 agreement made Unit 7 classifications eligible for PD 443. This pay differential ensured that PLP 2020 did not result in any Unit 7 members earning less than $15 per hour. Effective the first day of the pay period following ratification, Unit 7 classifications no longer would be eligible to receive this pay differential.

Essential Worker Premium Pay Reopener Language. The parties agree to reopen the agreement as soon as practicable after the federal regulations on essential worker premium pay have been issued.

LAO Comments

Compensation Study. The most recent CalHR compensation study evaluating Unit 7 compensation was released in January 2019 and relied on data from 2017. This study was released six months before the prior MOU expired on July 1, 2019. The study evaluated four occupations represented by Unit 7—detective and criminal investigators, police, police dispatchers, and forensic science technicians. These occupations account for 54 percent of the classifications represented by Unit 7. The study concluded that (1) Unit 7 detectives and criminal investigators and police were compensated below market by 6 percent and 35 percent, respectively, and (2) Unit 7 dispatchers and forensic science technicians were compensated above market by 10 percent and 7 percent, respectively. Given the two GSIs provided by this agreement are based on the existing MOU provisions, not providing an updated compensation study at this time is reasonable.

Unit 9 (Professional Engineers)

PLP 2020 Established Through New MOU. Bargaining Unit 9 is represented by Professional Engineers in California Government (PECG). In 2020, the Legislature ratified a successor MOU that, among other provisions, established PLP 2020. The ratified MOU is scheduled to expire June 30, 2022. A summary of the MOU can be found here. The administration estimated that the agreement would reduce state costs in 2020‑21 by $197 million ($11.5 million General Fund).

Proposed Agreement. On June 9, 2021, the administration and PECG reached an agreement that ends PLP 2020 and establishes other provisions, discussed below. A summary of the agreement can be found here. Relative to 2020‑21, the administration estimates that the proposed agreement would increase state costs by $312.7 million ($14.9 million General Fund). However, because the elimination of PLP 2020 already is assumed in the budget, the administration indicates that the Legislature would need to appropriate $115.7 million ($3.4 million General Fund) in 2021‑22 to implement the other terms of the agreement.

Major Provisions of Proposed Agreement

End of PLP 2020: Restoration of 9.23 Percent of Pay. Effective the first day of the pay period following ratification, employees’ pay no longer would be reduced by 9.23 percent and they no longer would receive PLP 2020 leave.

Restoration of Employee Contributions to Prefund Retiree Health Benefits. The agreement would reinstate Unit 9 members’ 2 percent of pay contribution to prefund retiree health benefits.

5.58 Percent GSI. Effective the first day of the pay period following ratification, Unit 9 members would receive a 5.58 percent GSI. This pay increase includes (1) the acceleration of a 3 percent GSI that originally was scheduled to go into effect July 1, 2022, (2) a new 2.5 percent GSI, and (3) 0.08 percent to account for the compounding of the two GSIs.

Agreement to Meet and Confer to Discuss Federal Funding for Essential Worker Premium Pay. Under the agreement, the parties agree to meet and confer when federal and state guidelines are released regarding essential worker premium pay.

LAO Comments

Compensation Study. Since the MOU that was in effect July 2, 2003 to July 2, 2008, the Unit 9 MOU has required that CalHR and PECG jointly complete an annual compensation study. The methodology of the survey is laid out in detail in the MOU. The most recent Unit 9 compensation study was released October 2019. That compensation study found that Unit 9 entry level, journey, and first level supervisor classifications were roughly paid at market levels (the identified lag ranged from 0.2 percent to 1.8 percent). Without a new compensation study, the basis for the additional 2.5 percent GSI is unclear.

Unit 10 (Professional Scientists)

MOU Expired July 2020. Unit 10 members are represented by the California Association of Professional Scientists (CAPS). Unit 10 members work under an agreement that expired July 1, 2020. Pursuant to state law, the provisions of an expired agreement generally remain in effect until a successor agreement is ratified.

PLP 2020 Agreement. On June 25, 2020, the administration and CAPS signed a side letter agreement to establish PLP 2020.The side letter agreement is scheduled to expire June 30, 2022. A summary of the agreement can be found here. The administration estimated that the agreement would reduce state costs in 2020‑21 by $62.1 million ($15.3 million General Fund).

Proposed Agreement. On June 9, 2021, the administration and CAPS reached an agreement to end PLP 2020 and establish other provisions, discussed below. A summary of the agreement can be found here. Relative to 2020‑21, the administration estimates that the proposed agreement would increase state costs in 2021‑22 by $74.2 million ($17.3 million General Fund). However, because the elimination of PLP 2020 already is assumed in the budget, the administration indicates that the Legislature would need to appropriate $33.1 million ($7.2 million General Fund) in 2021‑22 to implement the other terms of the agreement.

Major Provisions of Proposed Agreement

End of PLP 2020: Restoration of 9.23 Percent of Pay. Effective the first day of the pay period following ratification, employees’ pay no longer would be reduced by 9.23 percent and they no longer would receive PLP 2020 leave. The agreement specifies that accrued PLP 2020 would not expire. In addition, the agreement would allow employees to modify their participation in VPLP during the first three months after ratification of the agreement.

Restoration of Employee Contributions to Prefund Retiree Health Benefits. Effective the first day of the pay period following ratification, the agreement would restore employee contributions to prefund retiree health benefits. Pursuant to this provision, 2.1 percent of pay would be withheld from employees pay as a contribution to prefund retiree health benefits.

7.63 Percent GSI in 2021‑22. Effective the first day of the pay period following ratification, the agreement would provide employees a 7.63 percent GSI constituting (1) the 5 percent GSI that was suspended under the current agreement, (2) a new 2.5 percent GSI, and (3) 0.13 percent to account for compounding of the two GSIs.

LAO Comments

Compensation Study. The most recent compensation study evaluating Unit 10 compensation was published January 2020 and used data from 2018. This compensation study was released six months before the Unit 10 MOU expired on July 1, 2020. The compensation study looked at three occupations represented by Unit 10—environmental scientists, epidemiologists, and chemists. These occupations account for 76 percent of the classifications represented by Unit 10. The study concluded that (1) epidemiologists and chemists were compensated above market by 7 percent and 5 percent, respectively, and (2) environmental scientists were compensated 3 percent below market. Without a new compensation study, the basis for the additional 2.5 percent GSI—rather than adjustments to specific classifications—is unclear.

Unit 12 (Craft and Maintenance)

Current MOU Established PLP and Expires June 30, 2021. Unit 12 is represented by the International Union of Operating Engineers (IUOE). The current MOU established PLP 2020, among other provisions, and is scheduled to expire June 30, 2021. A summary of the current MOU can be found here. The administration estimated that the agreement would reduce state costs in 2020‑21 by $91.6 million ($33.1 million from the General Fund).

Proposed Successor MOU. On June 4, 2021, the administration and IUOE agreed to a successor MOU that would end PLP 2020 and establish other provisions, discussed below. A summary of the agreement can be found here. The administration estimates that the Legislature would need to appropriate $91.4 million ($25.5 million General Fund) in 2021‑22 to implement the agreement. The successor MOU would be in effect from July 1, 2021 through June 30, 2023.

Major Provisions of Proposed Agreement

End of PLP 2020: 9.23 Percent of Pay Restored. Under the agreement, employee pay no longer would be reduced by 9.23 percent and employees no longer would receive PLP 2020 leave each month. The agreement specifies that the provisions related to the use and compensability of PLP 2020 leave are not changed by the proposed agreement.

Restoration of Employee Contributions to Prefund Retiree Health Benefits. Effective the first day of the pay period following ratification, employees would resume contributing a portion of pay to prefund retiree health benefits. The agreement specifies that the employees’ contribution would be one-half of the actuarially determined normal cost of the benefit. To maintain this level of cost-sharing, the agreement specifies that the employer and employee contributions to prefund retiree health benefits could not increase or decrease by more than 0.5 percent of pay per year.

2020‑21 GSI: 5.06 Percent. Effective the first day of the pay period following ratification, all Unit 12 members would receive a 5.06 percent GSI.

2021‑22 GSI: 2.25 Percent. The agreement would provide all Unit 12 members a 2.25 percent GSI effective July 1, 2022.

Health Benefits. Under the agreement, the state would increase its flat dollar contribution towards employee health benefits to account for premium growth in 2022 and 2023.

Various SSAs. The agreement would provide various SSAs in 2021‑22 and 2022‑23 ranging from 4 percent to 7 percent. The agreement specifies which classifications would be eligible for which SSAs. For a list of which classifications are eligible for which pay increases, refer to the administration’s summary of the agreement.

Various Pay Differentials and Allowances. The agreement would increase various pay differentials and allowances. Whether employees are eligible for the pay depends on their classification, work location, shift, and job. For a description of the pay differentials affected by the agreement, refer to the administration’s summary of the agreement.

Vacation and Annual Leave Hours Cap. The agreement would allow the Unit 12 vacation and annual leave cap to increase by the equivalent number of PLP 2020 hours employees were subject to through June 30, 2021. The agreement specifies that this higher cap would be in place through June 30, 2023.

Increases in Transportation Incentives. Effective the first day of the pay period following ratification, the agreement would increase the amount of reimbursement Unit 12 members can receive for mass transit tickets and vanpool expenses by $35 per month.

Moving Expenses. Effective July 1, 2021, the agreement specifies that employees who are required to move by the state would be reimbursed by the state for approved items under the same requirements that apply to excluded employees.

Federal Funding for Essential Worker Premium Pay. Under the agreement, the parties agree to meet and confer after federal regulations regarding essential worker premium pay are finalized.

LAO Comments

Compensation Study. The most recent compensation study evaluating Unit 12 compensation was released January 2020 and used 2018 data. This compensation study was released six months before the prior Unit 12 MOU expired on July 1, 2020. The current MOU is a one-year agreement that will expire June 30, 2021. Despite state law requiring CalHR to submit a compensation study to the Legislature six months before an MOU expires, CalHR has not submitted a compensation study for Unit 12. The most recent compensations study evaluated three occupations represented by Unit 12—maintenance and repair workers (general), stock clerks, and groundskeeping workers. These occupations account for about 55 percent of the classifications represented by Unit 12. The study found that all three of these occupations represented by Unit 12 were compensated above market: maintenance and repair workers by 16 percent, stock clerks by 43 percent, and groundskeeping workers by 13 percent. Given the recency of the compensation study, the additional GSIs provided by this agreement likely would maintain the difference in compensation between Unit 12 members and market rates.

Unit 13 (Stationary Engineers)

Current MOU in Place Through June 30, 2022. Unit 13 is represented by IUOE. The current MOU between the state and IUOE for Unit 13 is scheduled to expire June 30, 2022.

PLP 2020 Agreement. On July 21, 2020, the administration and IUOE reached an agreement to establish PLP 2020. The side letter is scheduled to be in effect through June 30, 2022. The administration’s summary of the agreement can be found here. The administration estimated that the agreement would reduce state costs in 2020‑21 by $13.5 million ($9.3 million General Fund).

Proposed Agreement. On May 26, 2021, the administration and IUOE reached an agreement that ends PLP 2020 and establishes other provisions, discussed below. A summary of the agreement can be found here. Relative to 2020‑21, the administration estimates that the proposed agreement would increase state costs by $17.9 million ($12.2 million General Fund). However, because the elimination of PLP 2020 already is assumed in the budget, the administration indicates that the Legislature would need to appropriate $7 million ($4.7 million General Fund) in 2021‑22 to implement the other terms of the agreement.

Major Provisions of Proposed Agreement

End of PLP 2020: Restoration of 9.23 Percent of Pay. Effective the first day of the pay period following ratification of the agreement, the PLP 2020 pay reduction will end under the agreement. This means that employees’ monthly pay no longer will be reduced by 9.23 percent and employees no longer will be credited with 16 hours of PLP 2020 leave each month.

Restoration of Employee Contributions to Prefund Retiree Health Benefits. Under the proposed side letter, employees would resume contributing 3.9 percent of their pay to prefund their retiree health benefits. This contribution would be withheld from employees’ salaries beginning the first day of the pay period following ratification of the agreement.

5.83 Percent Top Step Salary Increase. Effective the first day of the pay period following ratification of the agreement, employees who are at the top step of their salary range would receive a pay increase of 5.83 percent. This pay increase includes (1) a 3 percent adjustment to the top step of the salary range originally scheduled to go into effect July 1, 2020, (2) a 2.75 percent adjustment to the top step scheduled to go into effect July 1, 2021, and (3) 0.08 percent to account for the compounding of the other two pay increases.

LAO Comments

Compensation Study. The most recent compensation study evaluating Unit 13 compensation was released January 2019 and used 2017 data. The compensation study was released six months before the prior MOU expired on June 30, 2019. The compensation study evaluated two Unit 13 occupations—stationary engineers/boiler operators and water/wastewater treatment plant operators. These two occupations account for 91 percent of Unit 13 classifications. The study found that (1) water/wastewater treatment operators were compensated 11 percent above market and (2) stationary engineers/boiler operators were compensated 16 percent below market.

Unit 16 (Physicians, Dentists, and Podiatrists)

Current MOU Established PLP 2020 and Is in Effect Through July 1, 2022. Unit 16 is represented by the Union of American Physicians and Dentists (UAPD).The current MOU is scheduled to be in effect through July 1, 2022. The agreement established PLP 2020 as well as other provisions. A summary of the agreement can be found here. The administration estimated that the agreement would reduce state costs in 2020‑21 by $57 million ($53.5 million General Fund).

Proposed Agreement. On June 11, 2021, the administration and UAPD reached an agreement to end PLP 2020 and establish other provisions, discussed below. A summary of the agreement can be found here. Relative to 2020‑21, the administration estimates that the proposed agreement will increase state costs by $102.9 million ($55.9 million General Fund). However, because the elimination of PLP 2020 already is assumed in the budget, the administration indicates that the Legislature would need to appropriate $43.3 million ($39.8 million General Fund) in 2021‑22 to implement the other terms of the agreement.

Major Provisions of Proposed Agreement

Extension of MOU. The agreement would extend the expiration date of the current MOU by one year from July 1, 2022 to July 1, 2023.

End of PLP 2020: Restoration of 9.23 Percent of Pay. Effective the first day of the pay period following ratification, the agreement would end PLP 2020. Employees’ pay no longer would be reduced 9.23 percent each month and employees no longer would receive PLP 2020 leave credits.

Resumption of Employee Contributions to Prefund Retiree Health Benefits. Effective the first day of the pay period following ratification, Unit 16 members would resume their monthly contributions of 1.4 percent of pay to prefund retiree health benefits.