LAO Contact

December 11, 2018

Evaluation of a Sales Tax Exemption for Certain Manufacturers

- Introduction

- The CAEATFA Sales Tax Exemption

- CAEATFA’s Implementation of the Exemption

- Related Policies

- Assessment

- Recommendations and Options

- Appendix

- CAEATFA’s Net Benefit Calculation

- Effects of the CAEATFA Exemption

- Types of Advanced Manufacturing Used

- Selected References

Executive Summary

Authority Under Treasurer Administers Tax Exemption. The California Alternative Energy and Advanced Transportation Financing Authority (CAEATFA) administers a sales tax exemption for equipment used for certain manufacturing activities. This program aims to expand California’s economy and reduce pollution. Under current law, the program will end on January 1, 2021.

CAEATFA Allocates the Exemption Through Formal Application Process. CAEATFA evaluates each application based on the exemption’s estimated effects on state and local government budgets, the exemption’s estimated effects on pollution, and some other criteria.

Program Likely Increases Participants’ Equipment Purchases. We estimate that the current program increases participants’ equipment purchases in California by roughly 5 percent to 9 percent. The exemption also likely increases participants’ output and employment in the state, though by a smaller amount than the increase in equipment purchases.

Overall Economic Effects Highly Uncertain. The economic effects of the CAEATFA exemption extend well beyond the direct effects described above. Available data and methods cannot support credible, precise estimates of the net effects of the program on jobs or economic output. Depending on the alternative uses of the forgone sales tax revenue, the net economic effects of the program could be positive or negative.

Some Environmental Benefits Likely, but Overall Effects Limited. The CAEATFA exemption likely produces some environmental benefits. However, several factors limit the overall net environmental effects of the program. For example, much of the increase in California‑based output likely is offset by reductions in other states or countries. As a result, the net increase in global production of “green” goods—a key factor determining environmental benefits—likely is much smaller than the increase in production within California.

Allocation Process Unnecessarily Complex. To use the CAEATFA exemption, equipment purchasers must fill out extensive applications, wait for board approval, and submit periodic reports to CAEATFA. These requirements make participation more costly, likely reducing the effectiveness of the exemption. In addition, most of the information provided by applicants is not useful for allocating the exemption. These requirements have, however, led to greater transparency than the state typically provides regarding the use of tax expenditures.

State Has Overlapping Tax Exemptions. Most purchases that qualify for the CAEATFA exemption would be eligible for a different program—the partial sales tax exemption for manufacturing, research and development, and electricity‑related equipment. The partial exemption is broader than the CAEATFA exemption and easier for businesses to use.

Recommend Allowing CAEATFA Exemption to Expire. We do not see a need for the state to administer both the CAEATFA exemption and the partial exemption. Of the two programs, the CAEATFA exemption is narrower and harder for businesses to use. Consequently, we recommend that the Legislature allow the CAEATFA exemption to expire as scheduled under current law. To the extent that some CAEATFA participants would not be eligible for the partial exemption, the Legislature could expand the partial exemption to include them.

Alternatively, Streamline Process for Claiming Exemption. If the Legislature renews the CAEATFA exemption, we recommend streamlining the process for claiming it and transferring the program to the California Department of Tax and Fee Administration, which administers most sales tax exemptions.

Introduction

Statute Requires Report on Sales Tax Exemption. The California Alternative Energy and Advanced Transportation Financing Authority (CAEATFA) administers a sales tax exemption for equipment used for certain manufacturing activities. (Many people refer to this program as an exclusion rather than an exemption.) Under current law, this program will end on January 1, 2021. Public Resources Code 26011.8(g) requires our office to report on the effectiveness of the program—including its economic, fiscal, and environmental effects—by January 1, 2019. (The full text of the statute appears in the box below.) This report fulfills that statutory requirement.

Statute Requiring Report

Public Resources Code 26011.8(g)

The Legislative Analyst’s Office shall report to the Joint Legislative Budget Committee on the effectiveness of this program, on or before January 1, 2019, by evaluating factors, including, but not limited to, the following:

(1) The number of jobs created by the program in California.

(2) The number of businesses that have remained in California or relocated to California as a result of this program.

(3) The amount of state and local revenue and economic activity generated by the program.

(4) The types of advanced manufacturing, as defined in paragraph (1) of subdivision (a) of Section 26003, utilized.

(5) The amount of reduction in greenhouse gases, air pollution, water pollution, or energy consumption.

The first three sections of the report describe the statutory development of the tax exemption, CAEATFA’s implementation of it, and some key state policies that interact with it. The fourth section contains our assessment of the exemption, including its economic, fiscal, and environmental effects. (Further discussion of these effects appears in the Appendix.) The fifth section provides recommendations and options for Legislative action.

The CAEATFA Sales Tax Exemption

Basic Background

California’s Sales Tax. California’s state and local governments charge a sales and use tax (hereafter, sales tax) on retail sales of tangible goods, including many goods purchased by businesses. The average rate is 8.5 percent. Of that, 3.94 percent raises money for the state’s General Fund, and 2.06 percent raises money the state provides counties for various local programs. Local governments’ portion of the sales tax ranges from 1.25 percent to 4.25 percent. As a result, the overall rate ranges from 7.25 percent to 10.25 percent. The California Department of Tax and Fee Administration (CDTFA) administers the sales tax and also administers most sales tax exemptions.

CAEATFA. CAEATFA is housed within the State Treasurer’s Office and operates a variety of programs that provide financial assistance—such as tax exemptions, loans, and bonds—largely to entities developing technologies intended to reduce air pollution and conserve energy. CAEATFA consists of five members: the State Treasurer (who serves as the chairperson), the State Controller, the Director of the Department of Finance, the Chairperson of the California Energy Commission, and the President of the California Public Utilities Commission.

Statutory Development

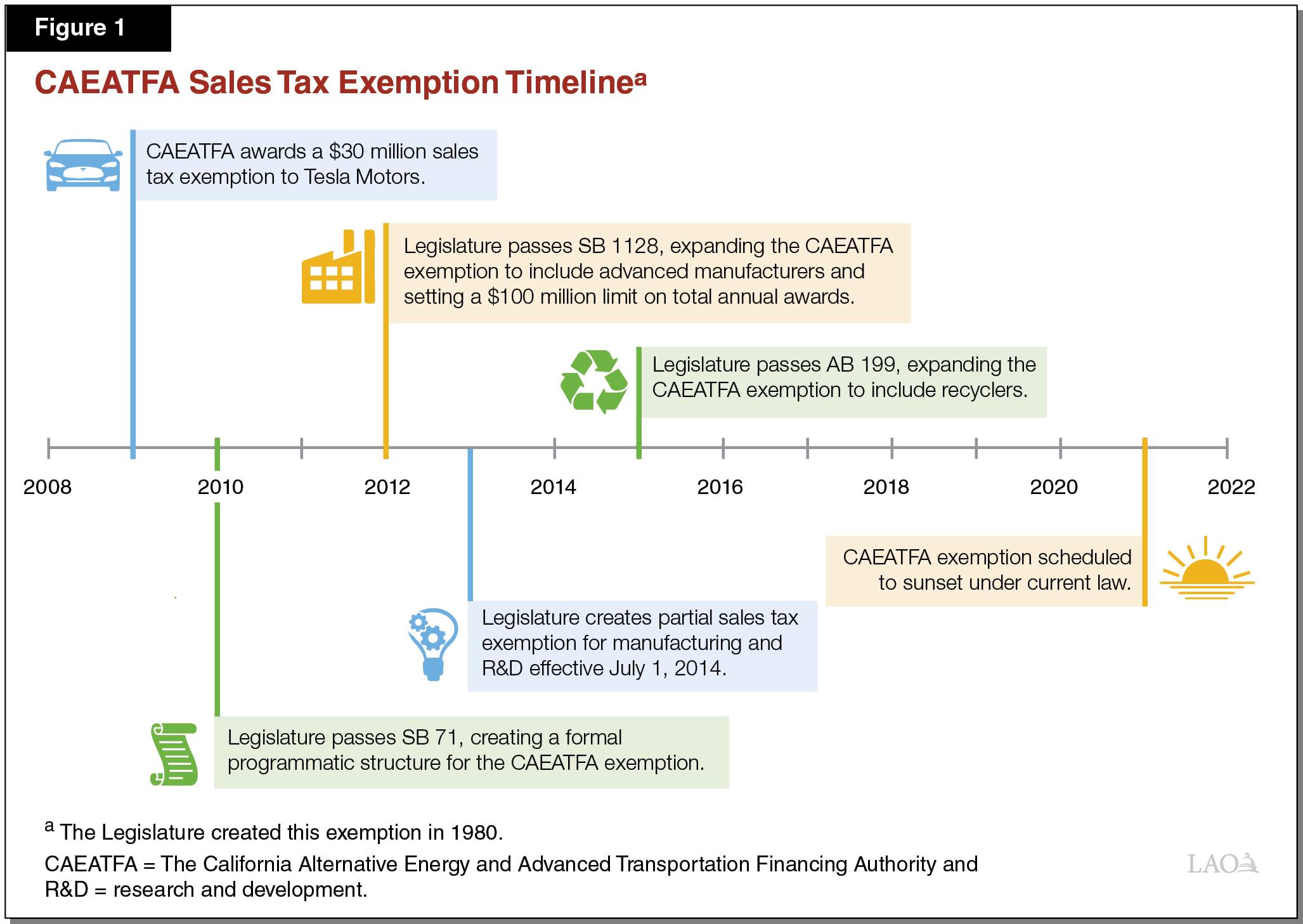

This section describes major events in the statutory development of the CAEATFA exemption. Many of these events appear chronologically in Figure 1.

Sales Tax Exemption for CAEATFA. The law that created CAEATFA (Chapter 908 of 1980) allowed the authority to purchase and transfer certain goods without paying any sales tax. Although the Legislature created this exemption in 1980, its first notable use occurred in 2009. At its October 2009 board meeting, CAEATFA agreed to purchase equipment on behalf of Tesla Motors, giving Tesla a $30 million tax exemption for this equipment. This agreement was part of the Schwarzenegger administration’s efforts to convince Tesla to establish a factory in California.

2010 Statute Created Current Program . . . When CAEATFA approved Tesla’s first use of the tax exemption, the statutory language governing the exemption was sparse. Chapter 10 of 2010 (SB 71, Padilla) created a more detailed statutory structure for the exemption, including policy goals, eligibility criteria, and an application process (described in detail below). Initially, the exemption was available for two types of manufacturing activities: production of alternative energy products (such as solar panels) and production of advanced transportation products (such as electric vehicles). SB 71 also established the reporting requirement for our office and the 2021 sunset date for the exemption.

. . . Laid Out Policy Goals . . . SB 71 established economic and environmental goals for the CAEATFA exemption. In particular, the statute highlighted the creation of manufacturing and jobs and reductions in pollution and energy consumption as the main purposes of the program.

. . . And Required CAEATFA to Evaluate Individual Applicants. Many sales tax exemptions are entitlements—the law guarantees that any taxpayer who meets specified eligibility criteria can use them. SB 71 did not structure the CAEATFA exemption as an entitlement. Instead, it directed the authority to evaluate each potential participant individually and to award exemptions based on those evaluations. The law listed a variety of criteria to be included in these evaluations but also authorized the authority to consider other criteria not specified. The listed criteria included a comparison between the “benefit to the state” and the “benefit to the participating party,” though the statute did not define these terms.

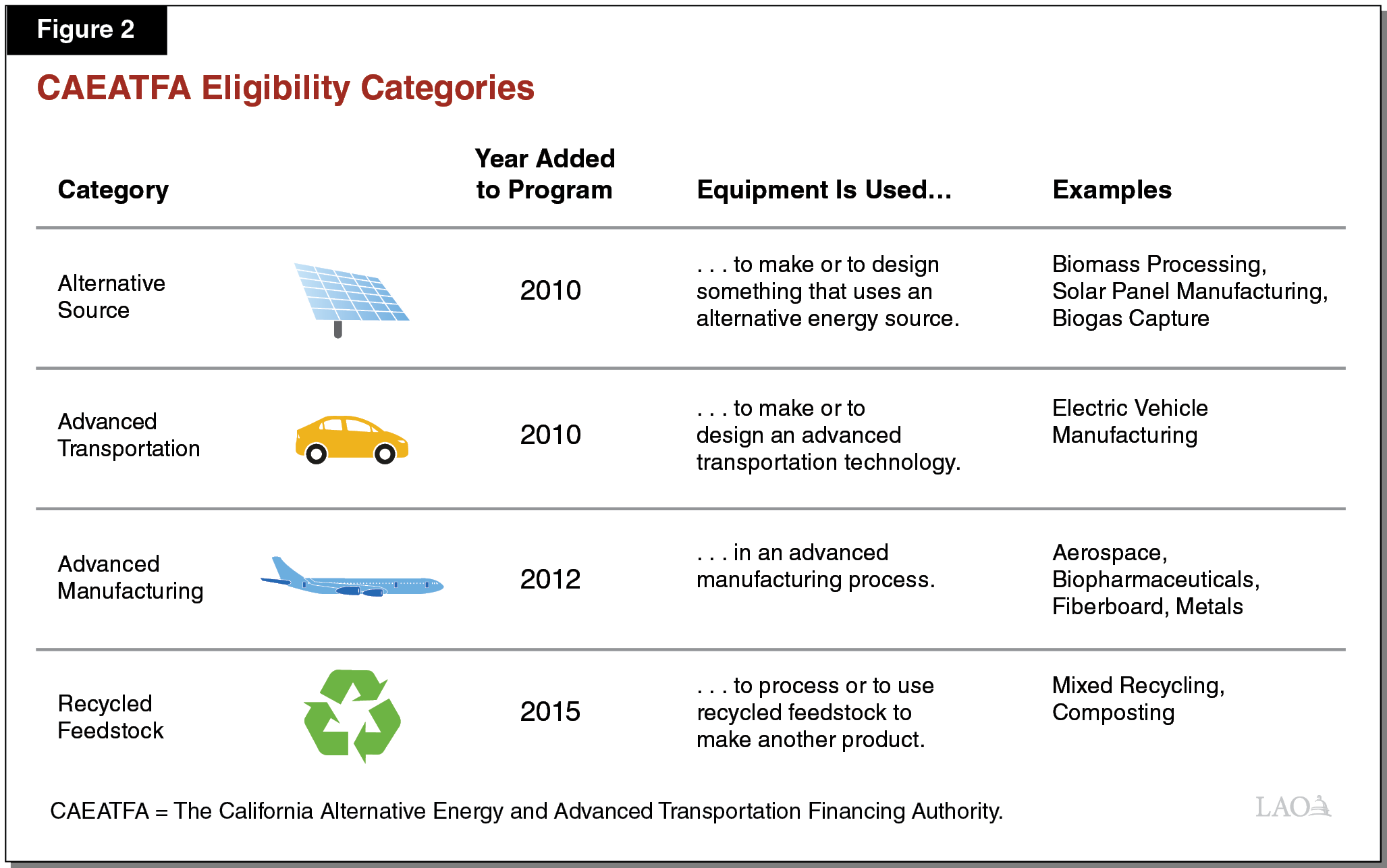

Subsequent Statutes Changed Exemption. The Legislature has made further changes to the exemption since 2010. In particular, two laws created new eligibility categories, bringing the total to four, as shown in Figure 2. Chapter 677 of 2012 (SB 1128, Padilla) made advanced manufacturers eligible for the program and set a $100 million cap on the total exemptions that CAEATFA can approve in each calendar year. (Advanced manufacturers use production processes that exceed industry standards.) Chapter 768 of 2015 (AB 199, Eggman) expanded the program to include certain types of recycling facilities.

CAEATFA’s Implementation of the Exemption

Process for Allocating Exemption

Statute directs CAEATFA to allocate the exemption based on individual evaluations of equipment purchasers. This section describes the allocation process that the authority has implemented.

Purchaser Talks to CAEATFA Staff. When prospective equipment purchasers want to claim the CAEATFA exemption, they often start by contacting CAEATFA informally. (Most applicants are businesses, but some are local governments or other entities that plan to purchase equipment.) At this stage, CAEATFA staff help prospective applicants determine whether the program is appropriate for them and whether their applications are likely to be approved.

Purchaser Submits Application to CAEATFA. To be considered for the exemption, each potential participant must submit a written application to the authority, along with an application fee. The information required for the application varies among eligibility categories. As an example, Figure 3 lists the information required for applications in the advanced transportation category.

Figure 3

Information Required for Advanced Transportation Applications

|

Qualitative Information |

Quantitative Estimates |

|

|

CAEATFA Staff Evaluate Application. After a potential participant submits an application, CAEATFA staff review the application. First, they determine whether the applicant meets the basic requirements described in Figure 2. If the applicant meets these requirements, staff perform a calculation known as the “net benefit test.” To conduct this test, staff use the information in the application to compute two numbers: an overall score, and an “environmental score,” which reflects the estimated reductions in pollution resulting from the applicant’s use of the exemption. If these scores exceed specified thresholds, then the applicant passes the net benefit test, and staff recommend that the board approve the application. (Regulations allow staff to recommend approval of applications that do not meet the net benefit test if they articulate specific reasons for doing so.)

Evaluation Focuses on Estimated Fiscal Benefits. As noted above, statute requires CAEATFA to evaluate applications based, in part, on a comparison between the “benefit to the state” and the “benefit to the participating party.” CAEATFA has interpreted “benefit to the state” primarily to mean state and local fiscal benefits—that is, positive effects on state and local government budgets. The authority has interpreted “benefit to the participating party” to mean the amount of the exemption. Accordingly, the overall score assigned to each application depends primarily upon the authority’s estimate of the fiscal benefits to California state and local governments from the applicant’s use of the exemption. It also depends on some other criteria listed in Figure 4.

Figure 4

Applicant Evaluation Criteria

|

Criterion |

Factors Contributing to Higher Scores |

Points Awardeda |

|

Estimated net fiscal benefits to state and local government |

Greater benefits per dollar awarded |

Typically 900 to 5,000 |

|

Estimated environmental benefits |

Greater benefits per dollar awarded |

Typically 30 to 200 |

|

Estimated jobs created |

More jobs created per dollar awarded |

0 to 150 |

|

Unemployment |

Higher local unemployment |

0 to 50 |

|

Emerging strategic industry |

Emerging strategic industry |

0 to 40 |

|

Related R&D facility in California |

R&D facility |

0 to 25 |

|

Training partnerships with educational institutions |

Training partnerships |

0 to 25 |

|

Part of industry cluster |

Part of industry cluster |

0 to 25 |

|

aApproval thresholds are overall score of 1,000 and environmental score of 20. R&D = research and development. |

||

CAEATFA Board Votes on Application. After CAEATFA staff make their recommendation, the application may proceed to the authority’s next monthly board meeting. At the meeting, CAEATFA’s five‑member board may vote on a resolution to approve the application.

Applicants Purchase Equipment and Submit Reports. After the board votes to approve an application, the applicant—now a participant in the program—may then purchase tax‑exempt equipment up to the amount approved by the board. (Under current law, CAEATFA does not need to purchase equipment on behalf of applicants.) Active participants must submit two types of reports to CAEATFA: semiannual reports tracking their use of the exemption, and annual reports tracking a broader set of business activities.

Applications

CAEATFA Has Approved Nearly 200 Applications . . . Through October 2018, CAEATFA has approved 191 of the 192 applications presented at its monthly board meetings. In the remaining instance, the board followed the staff recommendation to deny an application that did not pass the net benefit test.

. . . Including Three That Did Not Pass the Net Benefit Test. As noted above, CAEATFA staff may recommend approval of applications that do not meet the specified scoring thresholds. Over the course of the program, CAEATFA staff have made three such recommendations, and the board has approved all three applications.

Outcomes Reflect Pre‑Application Screening. As described above, prospective equipment purchasers talk to CAEATFA staff before they submit their applications. Many of them subsequently decline to apply. In some cases, they decline to apply because they do not meet the basic requirements described in Figure 2. In other cases, CAEATFA staff advise the prospective applicants that they likely would not pass the net benefit test. (The net benefit test focuses on equipment purchases that accompany net increases in production. As a result, other types of equipment purchases—such as routine replacement or research and development (R&D)—tend not to pass the net benefit test.) Based on this feedback from staff, such purchasers do not apply for the exemption.

Use of Exemption

CAEATFA Has Awarded $700 Million in Exemptions. As shown in Figure 5, the authority has awarded $700 million in exemptions. Participants have used $340 million of exemptions to purchase $4 billion of equipment.

Figure 5

Use of Exemption

|

Date Applications Approved |

Recyclers |

(In Millions) |

||

|

Exemption |

Exemption |

Equipment |

||

|

November 2010 Through September 2016 |

No |

$456 |

$216 |

$2,552 |

|

October 2016 Through October 2018 |

Yes |

243 |

121 |

1,445 |

|

All |

— |

$699 |

$337 |

$3,997 |

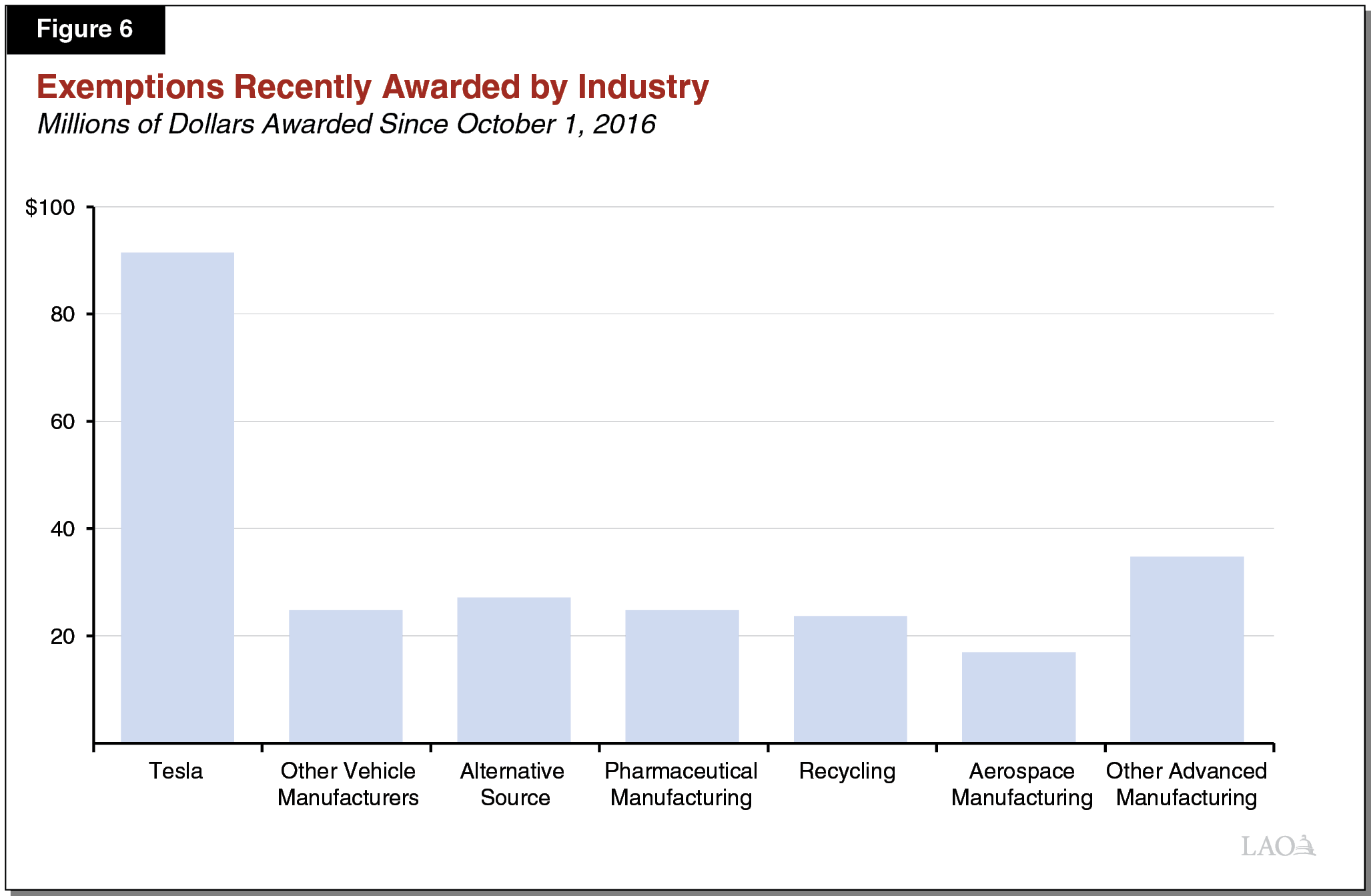

Half of Recent Awards Have Gone to Vehicle Manufacturers. As shown in Figure 6, roughly half of the exemption amount awarded since October 2016—when recyclers became eligible—has gone to vehicle manufacturers. Tesla has received 38 percent of the total amount awarded. Other industries receiving large amounts of CAEATFA exemptions include pharmaceutical manufacturing, recycling, and aerospace manufacturing.

Awards Have Hit $100 Million Cap in Recent Years. As noted above, a 2012 law set a $100 million cap on the total exemptions that CAEATFA can award in each calendar year. Awards made by the authority first hit the $100 million annual cap in 2015, and they have continued to hit the cap every year since. If the program uses up the entire $100 million well before the end of the calendar year, then additional applicants must wait until the following calendar year. To address this issue, the authority issued a regulation in 2016 that caps each individual applicant’s initial award at $20 million. The purpose of this regulation is to prevent the largest participants from using up the program’s $100 million “budget” before the end of the year. Applicants seeking exemptions exceeding $20 million can obtain the additional exemption amounts at the authority’s December board meetings if funds are still available.

Related Policies

In this section, we discuss some state policies that interact with the CAEATFA exemption.

Partial Exemption for Equipment

Sales Tax Applies to Many Goods Used in Production. The sales tax applies to many sales of tangible goods that businesses use to produce other goods or services. As described in the box below, including these transactions in the sales tax base raises some economic concerns. These concerns could justify broad sales tax exemptions for business‑to‑business sales.

Taxing Business‑to‑Business Sales Raises Economic Concerns

Sales Tax Applies to Many Business‑to‑Business Sales. California’s sales tax applies to retail sales of tangible goods. Many of these sales are made to businesses who, in turn, use those goods to produce other goods and services. For example, businesses often purchase furniture, tools, computers, or basic office equipment. Although the total amount of business‑to‑business taxable sales is uncertain, it likely constitutes a large share of total taxable sales.

Taxing Business‑to‑Business Sales Can Lead to “Tax Pyramiding.” As described above, many businesses purchase goods that are subject to sales tax. Many of these businesses, in turn, sell taxable goods to other businesses or to consumers. As a result, taxing business‑to‑business sales can lead to tax pyramiding—the application of the same tax at multiple stages of production. To the extent that tax pyramiding varies across businesses and industries, it raises a couple of economic concerns:

- Arbitrarily Disadvantages Certain Businesses. Within each industry, some businesses rely more heavily on taxable goods than others. (For example, some carpenters spend relatively large amounts of money on tools, while others spend much less.) Taxing business‑to‑business sales leads to disproportionate cost increases for businesses that rely heavily on taxable goods. As a result, such taxes can shift production from more productive businesses to less productive ones, leading to higher aggregate production costs and higher prices for consumers.

- Arbitrarily Disadvantages Certain Industries. Some industries rely more heavily on taxable goods than others. Taxing business‑to‑business sales leads to disproportionate cost increases for industries that rely heavily on taxable goods. As a result, those industries’ output can become relatively expensive.

Tradable Production Geographically Mobile. Many businesses produce goods or services that are tradable—they can easily be shipped from another state or country. Tradable businesses in California compete directly with tradable businesses in other jurisdictions. As a result, their location choices can be more sensitive to production costs—such as taxes—than location choices made by households or non‑tradable businesses. Due to this cost sensitivity, taxes on tradable businesses’ inputs can reduce in‑state economic activity to a greater extent than taxes on goods purchased by consumers.

2013 Laws Created Partial Exemption for Equipment. Chapters 69 and 70 of 2013 (AB 93, Committee on Budget; SB 90, Galgiani) established a package of new tax expenditures—including two credits and an exemption—to replace the state’s Enterprise Zone program. One of the new policies was a partial exemption for certain purchases of equipment used for manufacturing or R&D. The 2013 laws authorized the partial exemption through 2021.

2017 Law Expanded and Extended Partial Exemption. Chapter 135 of 2017 (AB 398, E. Garcia) pushed back the partial exemption’s sunset date to July 1, 2030. This law also expanded the partial exemption to include certain purchases of equipment used to generate, store, or distribute electric power.

Comparing the Two Exemptions. Figure 7 compares the CAEATFA exemption to the partial exemption along several dimensions, including:

- Rate Reduction. Both policies exempt purchases from the state General Fund portion of the sales tax rate (currently 3.94 percent). The CAEATFA exemption further exempts purchases from the rest of the sales tax (averaging 4.6 percent).

- Aggregate Cap. As described above, CAEATFA cannot award more than $100 million of tax exemptions in each calendar year. In contrast, there is no aggregate cap on the partial exemption.

- Individual Cap. Each purchaser can apply the partial exemption to no more than $200 million of equipment in each calendar year—equivalent to a $8 million annual cap on the exemption. As described above, each CAEATFA applicant initially can qualify for no more than $20 million of tax exemptions, but they often can receive more at the end of the calendar year.

- How to Claim. The partial exemption is an entitlement. To claim it, purchasers must fill out a one‑page certificate and present it to the seller of the equipment. There is no public record of such purchases. As described above, the CAEATFA application process is much more extensive, and this process produces a public record of each exemption awarded.

Figure 7

Comparing Two Tax Exemptions

|

Feature |

CAEATFA Exemption |

Partial Exemption |

|

Exemption from state General Fund sales tax? |

Yes |

Yes |

|

Exemption from other parts of sales tax? |

Yes |

No |

|

Taxpayers publicly identifiable? |

Yes |

No |

|

Aggregate cap? |

Statutory hard cap: CAEATFA cannot award more than $100 million of exemptions per year (roughly $1.2 billion of equipment). |

None. In 2017‑18, purchasers applied $210 million of exemptions to $5.3 billion of equipment purchases. |

|

Individual applicant cap? |

Regulatory soft cap: $20 million of exemption per year (roughly $235 million of equipment). |

Statutory hard cap: $200 million of equipment per year (roughly $8 million of exemption). |

|

Basic eligibility |

Equipment used to design or make certain products or used in certain types of industrial processes. |

Equipment and businesses engaged in manufacturing, R&D, or certain electricity‑related activities. |

|

Primarily administered by |

CAEATFA |

CDTFA |

|

How to claim |

Submit extensive application, wait for staff review and board meeting vote, then purchase equipment. |

Fill out one‑page certificate, then purchase equipment. |

|

R&D = research and development; CAEATFA = California Alternative Energy and Advanced Transportation Financing Authority; and CDTFA = California Department of Tax and Fee Administration. |

||

Major Overlap Between the Two Exemptions. Most participants in the CAEATFA program are manufacturers who use the exemption to purchase equipment used in the manufacturing process. As such, most purchases made under this program likely would be eligible for the partial exemption. (A business can participate in both programs, but it cannot apply more than one exemption to any given purchase.) There are some important exceptions, however. For example, some recyclers likely do not fall within the industry classifications that are eligible for the partial exemption. Furthermore, the largest CAEATFA participants receive exemptions on equipment purchases that exceed the cap on the partial exemption.

In Most Cases, CAEATFA Not a Full Exemption. As noted above, most purchases made with the CAEATFA exemption would be eligible for the partial exemption. If the CAEATFA exemption were not available, these purchasers still could use the partial exemption. In these instances, CAEATFA effectively acts as an add‑on exemption consisting of:

- An exemption from the portion of the sales tax rate that funds local programs (averaging 4.6 percent).

- An exemption from the entire sales tax rate on purchases that exceed the partial exemption’s $200 million cap.

California’s Environmental Policies

California has a wide variety of policies intended to reduce pollution and improve environmental quality. For example, some of the major state policies aimed at reducing greenhouse gas emissions include:

- Cap‑and‑Trade. This program establishes a declining annual “cap” on emissions from large emitters by issuing a limited number of permits to emit, also known as allowances. Allowing businesses to buy and sell (“trade”) allowances results in a market price, which creates a financial incentive for businesses and households to undertake emission reduction activities that are less costly than the allowance price.

- Low Carbon Fuel Standard. This program establishes declining annual statewide standards for the greenhouse gas emissions per unit of energy in California’s transportation fuel—also known as carbon intensity. To comply with the program, traditional transportation fuel suppliers—largely gasoline refiners and importers—must reduce the carbon intensity of their fuels or purchase credits from low carbon fuel suppliers.

The state also has goals for reducing the amount of waste going into landfills (known as waste diversion) and operates several programs meant to encourage recycling, composting, and reducing waste. In addition, state and local governments have many different policies—including regulations and incentive programs—intended to reduce local air pollution. For example, state and local governments provide funding to replace older, high‑polluting diesel vehicles with cleaner ones.

Assessment

Effects of CAEATFA Exemption

In this section, we discuss some of the effects of the CAEATFA exemption. Further discussion of the program’s effects appears in the Appendix.

Economic Effects

Program Likely Increases Participants’ Equipment Purchases . . . We estimate that the current program increases participants’ equipment purchases—a type of capital investment—by roughly 5 percent to 9 percent. (A detailed discussion of this estimate appears in the Appendix.) As shown earlier in Figure 5, for example, recent applicants approved have used the CAEATFA exemption to make $1.45 billion of equipment purchases. Applying our 5 percent to 9 percent estimate, the program increased these purchases by roughly $70 million to $130 million. In other words, if the CAEATFA program did not exist, we estimate that these businesses would have purchased equipment worth $1.32 billion to $1.38 billion.

. . . For Two Reasons. The response described above consists of two economic effects: a “scale effect” and a “substitution effect.”

- Scale Effect. The exemption reduces participants’ costs. As a result, participants have an incentive to expand their operations within California—leading to higher equipment purchases, employment, and output.

- Substitution Effect. The exemption reduces the cost of equipment relative to the costs of other production inputs. As a result, participants have an incentive to use proportionally greater amounts of equipment and proportionally lesser amounts of other inputs, such as labor.

Program Likely Increases Participants’ Output and Employment. The two economic impacts just described generate different outcomes. The scale effect, for instance, increases both output and employment. The substitution effect, by comparison, reduces employment and is neutral with regard to output. On net, the exemption likely increases participants’ output and employment. Due to the substitution effect, however, the increases in participants’ output likely are smaller than the increases in equipment purchases, and the increases in participants’ employment likely are smaller still.

Global Effects Smaller Than In‑State Effects. The description above focuses on effects within California. As described in the Appendix, some evidence suggests that large portions of the increased equipment purchases within California likely are offset by corresponding reductions in other states and countries. As a result, the program’s effects on the targeted industries’ global output could be quite small.

Net Effects on California’s Economy Could Be Positive or Negative. As described above, the CAEATFA exemption likely has some positive economic effects on the targeted industries in California. It is unclear, however, whether the program has positive or negative net effects on the state’s economy as a whole. For example, absent the CAEATFA exemption, state and local governments would have additional sales tax revenue. They could use this revenue for other purposes—namely, additional spending or other types of tax reductions. Those alternative uses also would have some positive economic effects. The true net effects of the CAEATFA exemption depend crucially on the effects of those alternative uses of the funds. If the best alternative use would have larger economic benefits than the CAEATFA exemption, then the net effects of CAEATFA are negative. If CAEATFA has larger economic benefits than the best alternative use, then its net effects are positive.

Fiscal Effects

Program Has Some Fiscal Benefits . . . The increases in equipment purchases and output described above have a variety of fiscal effects, including many positive effects. For example, participants pay property taxes on the equipment they purchase. Furthermore, the increase in output within California leads to higher income tax revenue.

. . . But Claims That It “Pays for Itself” Problematic. We cannot provide precise estimates of the program’s net effects on state and local revenue and spending. That said, we have serious concerns with claims that the program generates net fiscal benefits large enough to pay for itself. As a starting point, we note that typical state and local programs do not generate economic activity anywhere near the level required to pay for themselves. As described in the Appendix, a program can pay for itself through economic growth only if its economic effects are at least six times as large as a typical program. The CAEATFA exemption could have larger economic effects than a typical program, but we doubt that the effects are six times as large. Furthermore, CAEATFA’s net benefit calculation—which suggests that the exemption largely pays for itself—incorporates several assumptions that tend to overstate fiscal benefits. (We discuss these assumptions in detail in the Appendix.) Finally, as described above, alternative uses of funds also would generate economic—and therefore fiscal—benefits. It is unclear whether CAEATFA’s fiscal benefits exceed the benefits that would result from those alternative uses.

Program Likely Yields Net Benefit for State General Fund. Absent the CAEATFA exemption, the bulk of CAEATFA participants would be eligible for the partial exemption, so they would not pay the state General Fund sales tax. As such, the General Fund revenue loss due to the CAEATFA exemption is minor. Furthermore, to the extent that the exemption leads to increases in economic activity, much of the tax revenue generated by that activity goes to the General Fund. As a result, the CAEATFA exemption likely produces a net benefit for the state’s General Fund. The vast majority of the fiscal costs are borne by local governments.

Environmental Effects

Some Environmental Benefits Likely, but Overall Effects Limited. The CAEATFA exemption likely produces some environmental benefits. For example, additional recycling capacity could reduce the amount of waste going into landfills and help the state meet its waste diversion goals. Also, increasing the number of electric vehicles, electric buses, and alternative forms of energy could lower greenhouse gas emissions if they replace higher‑polluting vehicles and energy sources. Despite these potential benefits, a few key factors—described below—limit the overall net environmental benefits of the program.

Environmental Benefits Depend on Global Production, Not In‑State Production. The environmental benefits of the CAEATFA exemption depend in part on the degree to which the program increases global output of qualifying products, rather than simply the amount produced in California. As discussed above, the exemption likely shifts some production from other parts of the country (or world) to California. For example, many of the additional electric vehicles produced in California as a result of the program likely would have been produced elsewhere. If so, the net environmental benefits associated with these vehicles likely are limited. As discussed above, however, such a shift in production can have economic benefits for the state by attracting more manufacturing investment. Also, to the extent that electricity used in California generates less pollution then electricity used elsewhere, there could be some environmental benefits from relocating production to California.

Environmental Benefits Depend on Interactions With Other Policies. In some cases, the CAEATFA exemption might simply reduce the costs of meeting existing environmental requirements without providing any additional environmental benefit. For example:

- Cap‑and‑Trade. Within sectors covered by the state’s cap‑and‑trade program, the exemption could fail to achieve a net reduction in emissions. Instead, it might simply shift emissions from some covered entities to others. For example, if the exclusion leads Californians to drive more electric vehicles instead of conventional gasoline vehicles, then it reduces the amount of gasoline sold by transportation fuel suppliers. As a result, those suppliers need to purchase fewer cap‑and‑trade allowances than they otherwise would. This reduction in allowance purchases could, in turn, free up allowances to be used by other emitters, negating the original drop in emissions. (See our 2016 report, Cap‑and‑Trade Revenues: Strategies to Promote Legislative Priorities, for more details.)

- Low Carbon Fuel Standard. If the program encourages additional low carbon transportation fuels—such as biofuels—these fuels will likely generate credits that can be used to comply with the Low Carbon Fuel Standard program. This increases the supply of credits and reduces credit prices. As a result, there is less of an incentive for other businesses to produce other types of low carbon fuels.

Economic Activity Generates Pollution. There are likely some adverse local effects from the additional in‑state production generated by the program. For example, an expansion of an in‑state manufacturing facility could increase local or regional air pollution, which can have adverse health effects.

Allocation Process Unnecessarily Complex

Extensive Application Process Weakens Program Incentives . . . As described above, prospective participants in the CAEATFA program must fill out extensive applications and wait for board approval in order to use the exemption. As participants in the program, they must submit periodic reports to CAEATFA. These aspects of the program make participation more costly, likely reducing the effectiveness of the exemption.

. . . And Not Needed for Applicant Screening . . . Most of the information included in applications is related to the net benefit calculation. As described above, however, the calculation itself screens out very few applicants. Instead, staff use basic criteria to predict the outcome of the net benefit test before the purchaser submits a formal application. The program could achieve similar outcomes by dispensing with the formal calculation altogether and relying on those basic criteria instead.

. . . But Provides Transparency. CAEATFA lists information about all of its program participants on its website. This degree of transparency is unusual for tax expenditure programs. In most cases, the public does not have access to information about businesses’ use of tax expenditures. This information can help the Legislature and the public make better policy decisions. It also can help potential applicants track the availability of funds under the $100 million aggregate cap.

State Has Overlapping Tax Exemptions

As described above, the CAEATFA exemption overlaps heavily with the partial exemption for equipment.

CAEATFA Exemption Narrower Than Partial Exemption. The CAEATFA exemption and the partial exemption both apply to similar types of purchases. The CAEATFA exemption, however, is available to a much narrower set of businesses than the partial exemption. We do not see a compelling reason to allow CAEATFA‑eligible businesses to claim larger tax exemptions than other manufacturers.

Other Differences With Partial Exemption Present Trade‑Offs. As noted above, the CAEATFA program provides a full exemption with an aggregate cap. The partial exemption, on the other hand, applies only to the General Fund portion of the sales tax rate. It has an individual cap but no aggregate cap. As shown in Figure 8, these design choices all share a common feature: a trade‑off between the strength of the investment incentives provided and the revenue losses incurred by state and local governments. In light of this trade‑off, a reasonable case could be made for each of these design features. However, we see no reason why the choices should differ between the two exemptions.

Figure 8

Trade‑Offs Between Economic Incentives and Forgone Revenue

|

Design Choice |

Stronger Incentives and Larger Revenue Loss |

Weaker Incentives and Smaller Revenue Loss |

|

Full exemption or partial exemption? |

Full exemption |

Partial exemption |

|

Aggregate cap? |

No aggregate cap |

Aggregate cap |

|

Individual cap? |

No individual cap |

Individual cap |

Recommendations and Options

Main Recommendation

Allow CAEATFA Exemption to Expire. As discussed above, the CAEATFA exemption overlaps heavily with another program—the partial exemption for manufacturing, R&D, and electricity‑related equipment. We do not see a need for the state to administer two separate programs that provide similar benefits. Compared to the partial exemption, the CAEATFA exemption is narrower and harder for businesses to use. Consequently, we recommend that the Legislature allow the CAEATFA exemption to sunset as scheduled under current law. To the extent that some CAEATFA participants would not be eligible for the partial exemption, the Legislature could expand the partial exemption to include them.

Alternative Legislative Actions

If the Legislature renews the CAEATFA exemption, we recommend modifying the program as follows.

Streamline Process for Claiming Exemption . . . As described above, the program’s extensive application process is not worthwhile. We recommend that the Legislature make the process for claiming the CAEATFA exemption similar to the process for claiming the partial exemption: filling out a simple form at the time of purchase. The state could use the information from these forms to provide the public with information about businesses’ use of the program, preserving the transparency provided by the current application process.

. . . And Transfer Program to CDTFA. With a more streamlined process for claiming the exemption, there would be no reason for CAEATFA to administer the program. Instead, the program could be administered by CDTFA—the department that administers the sales tax.

Options for Further Legislative Action

Consider Changes to Partial Exemption. In addition to the actions described above, the Legislature could consider making some changes to the partial exemption. In particular, if the Legislature views some aspects of the CAEATFA exemption favorably, it could add those features to the partial exemption. Such changes could include:

- Make Program More Transparent. As noted above, the public has very little information about use of the partial exemption. The Legislature could make the program much more transparent by directing CDTFA to publish basic information about the purchasers of exempt equipment. This information could help the Legislature and the public make future policy decisions.

- Increase to Full Exemption. As noted above, larger exemptions provide stronger investment incentives but also result in larger revenue losses. If the Legislature wants to strengthen investment incentives, it could turn the partial exemption into a full exemption. (In this case, the additional revenue losses would be borne entirely by local governments.)

- Eliminate Individual Cap. As described above, each purchaser can apply the partial exemption to no more than $200 million worth of purchases per year—equivalent to $8 million of tax exemptions. Like the prior option, this one would strengthen investment incentives but result in larger revenue losses.

Take Broader Look at Sales Tax Base. In this report, we have called the CAEATFA exemption “narrow.” Indeed, CAEATFA‑eligible purchases represent a small share of the business‑to‑business sales that the Legislature reasonably could exempt from the sales tax. The partial exemption is much broader than the CAEATFA exemption, but it also represents a small share of business‑to‑business sales. Instead of continuing this piecemeal approach, the Legislature could use the sunset of the CAEATFA exemption as an opportunity to think more broadly about what should be included in the sales tax base.

Appendix

This Appendix contains three sections. In the first section, we assess the net benefit calculation that the California Alternative Energy and Advanced Transportation Financing Authority (CAEATFA) uses to evaluate individual applicants and to estimate the effects of the program. In the second section, we comment on the effects of the exemption, including the factors identified in statute. In the third section, we list the types of advanced manufacturing used by participants in the CAEATFA program, as required by statute.

CAEATFA’s Net Benefit Calculation

Overall Assessment

Development of Net Benefit Calculation. After the Legislature passed Chapter 10 of 2010 (SB 71, Padilla), CAEATFA hired Blue Sky Consulting to help CAEATFA implement the new law. In particular, Blue Sky—in consultation with CAEATFA and others—developed the scoring system that the authority has used to evaluate applicants for the exemption. This scoring system is based on the criteria laid out by SB 71—in particular, a comparison between the “benefit to the state” and the “benefit to the participating party.” In developing the net benefit calculation, Blue Sky and CAEATFA interpreted “benefit to the state” primarily to mean state and local fiscal benefits and “benefit to the participating party” to mean the amount of the exemption.

CAEATFA’s Approach Thoughtful . . . Proponents of tax expenditures often produce estimates based on the assumption that these policies are responsible for all of the recipients’ employment, output, and other economic activity. This assumption is unreasonable. These types of estimates systematically overstate the effects of such policies—potentially by an enormous amount. In contrast, Blue Sky and CAEATFA have made a serious attempt to estimate the economic effects—and, relatedly, the fiscal and environmental effects—of the tax exemption.

. . . And Provides a Good Starting Point . . . The net benefit calculation begins with an estimate of the effect of the exemption on a participant’s equipment purchases. To obtain this estimate, Blue Sky and CAEATFA use an economic framework developed by Chirinko and Wilson (2010) to estimate the effects of state tax policies on manufacturers’ capital investment. Although this framework is based on some simplifying assumptions, it is a reasonable starting point for analyzing the effects of the exemption. Within this economic framework, the net benefit calculation makes some assumptions about economic parameters—the basic quantities that characterize economic relationships. These assumptions match up well with the best evidence available in 2010, when Blue Sky and CAEATFA developed the net benefit calculation. As described later in this Appendix, we use a modified version of the calculation—incorporating more recent research—to estimate the effects of the exemption on participants’ equipment purchases.

. . . But Illustrates Inherent Problems With Exercise. Statute directs CAEATFA to make an up‑or‑down decision on each application based on various criteria, including the “benefit to the state,” which the authority has interpreted primarily in fiscal terms. To meet these requirements, CAEATFA has developed an approach that distills benefits into a single point estimate. Unfortunately, available data and methods cannot support credible estimates of such benefits to that degree of precision. Put another way, different calculations could produce vastly different point estimates, even if all such calculations are based on reasonable assumptions and the best available evidence.

Concerns About Certain Assumptions. In addition to our general concerns about the application of a net benefit calculation in this context, we have some concerns about specific assumptions embedded into the net benefit calculation used by CAEATFA. We describe some of these concerns below. Some of these assumptions overstate net benefits, while others understate them. Overall, they tend to err on the side of overstatement.

Assumptions That Overstate Net Benefit

Omits Some Fiscal Effects. The net benefit calculation includes revenue gains from four major taxes—the personal income tax, the sales tax, the corporation tax, and the property tax—resulting from economic activity generated by the exemption. This list omits some potentially large fiscal effects of the exemption. For example, the state provides rebates to consumers who purchase electric vehicles. To the extent that the CAEATFA exemption increases the number of electric vehicles purchased, it also increases state spending on these rebates. (The calculation also omits some positive fiscal effects.)

Omits Opportunity Cost . . . As discussed in the “Assessment” section of the report, the net effects of a policy depend crucially on the next best alternative use of resources—also known as the “opportunity cost.” In the context of the CAEATFA exemption, the opportunity cost would be an alternative use of the forgone revenue—such as spending on transportation infrastructure. Alternative uses would generate benefits that could be compared to the benefits generated by the CAEATFA exemption.

. . . As Directed by Statute. The statute governing the application process, however, does not direct CAEATFA to consider opportunity costs. Instead, it directs the authority to compare the “benefit to the state” to “the benefit to the participating party.” CAEATFA’s net benefit calculation follows this statutory direction. As discussed above, however, this comparison does not measure the true net benefit of the exemption.

Assumes Proportional Increases in Capital, Labor, and Output. As discussed in the “Assessment” section of the report, the CAEATFA exemption leads to higher capital investment through two channels: a scale effect and a substitution effect. CAEATFA’s estimate of the increase in equipment purchases includes both effects. However, the calculation further assumes that output and employment increase in direct proportion to the entire increase in equipment purchases. This assumption does not properly account for the substitution effect, leading to overstated increases in participants’ output and employment.

Sales Tax Assumptions. The net benefit calculation estimates the exemption’s effect on sales tax revenue as follows. It starts with the projected increase in output due to the exemption. It then multiplies this increase in output by: (1) the share of the applicant’s products projected to be sold in California, and (2) the sales tax rate. This calculation overstates sales tax revenue for two reasons:

- Assumes Products Would Not Be Made Elsewhere. The calculation assumes that the net worldwide increase in output is equal to the increase in output within California. As discussed elsewhere in this report, reductions in out‑of‑state production likely offset a large share of the increase in in‑state production, so this assumption likely overstates the net global increase.

- Assumes Purchases Do Not Displace Any Spending on Other Taxable Goods. The calculation assumes that all purchases of the applicant’s increased output are net increases in spending on taxable goods. In other words, it assumes that if businesses or consumers did not purchase these items, they would not have bought other taxable items instead. This assumption both overstates the net increase in taxable spending and contradicts an assumption used to estimate environmental benefits, as described below.

Assumes That Additional “Green” Goods Displace Equal Number of Conventional Goods. As described above, the net benefit calculation includes an estimate of the additional number of units sold by the participant due to the exemption. The environmental benefits calculation assumes that, on average, each additional “green” good sold by the participant displaces the purchase of a conventional “dirty” good. For example, if a participant sells 300 additional electric vehicles, the calculation assumes that consumers buy 300 fewer conventional gasoline vehicles. For some consumers, the closest substitute for an electric vehicle made by the participant might indeed be a conventional gasoline vehicle. For other consumers, however, the closest substitute might be an electric or hybrid vehicle made by a different manufacturer. As a result, this assumption likely overstates the environmental benefits of the exemption. (Either way, the increase in taxable sales is much smaller than assumed in the fiscal part of the calculation.)

Environmental Calculation Assumes Products Would Not Be Made Elsewhere. The environmental benefits calculation assumes that each additional good produced in California represents a net increase of one additional good produced globally. This assumption overstates the net increase in global production. To the extent that the exemption’s environmental benefits are due to higher consumption of these goods, this assumption overstates environmental benefits.

Assumes No Offsetting Emissions Increases Due to Policy Interactions. As described in the “Assessment” section, interactions with other environmental policies—such as cap‑and‑trade and the Low Carbon Fuel Standard—could negate some of the emissions reductions that otherwise would result from the exemption. The net benefit calculation does not account for these interactions, resulting in potential overstatement of environmental benefits.

Ignores Environmental Effects Of Production. To the extent that the exemption increases manufacturing activity in California, it increases local pollution. The net benefit calculation does not account for this effect, resulting in overstatement of environmental benefits.

Assumptions That Understate Net Benefit

Omits Indirect Job Creation. CAEATFA application scoring includes two types of jobs. The first type consists of employees who work for the business that purchases the tax‑exempt equipment. The second type consists of workers involved in the construction of the facility and the installation of the equipment. The full extent of the jobs created by the exemption, however, likely extends beyond these two types. The exemption increases capital investment and output in manufacturing—a tradable industry. Increased economic activity in tradable industries often leads to increased economic activity—including employment—in other industries, such as local service industries.

Low Social Cost of Greenhouse Gas Emissions. The net benefit calculation assumes that the social cost of greenhouse gas emissions is $10 per ton—lower than typical estimates. This assumption likely understates the global benefits resulting from each ton of emissions avoided due to the program.

Effects of the CAEATFA Exemption

In the “Assessment” section of the report, we summarize the effects of the CAEATFA exemption. In this section, we provide additional details.

Increase in Equipment Purchases

We estimate that the CAEATFA exemption increases participants’ equipment purchases by roughly 5 percent to 9 percent. We arrive at this estimate as follows.

CAEATFA Exemption Reduces Tax Rate on Equipment. Based on recent applications, we assume that the CAEATFA exemption acts as a partial exemption (an average rate cut of 4.6 percentage points) for 80 percent to 90 percent of purchases. For the remaining 10 percent to 20 percent—consisting of recyclers and purchases in excess of $200 million—we assume that the program acts as a full exemption (an average rate cut of 8.5 percentage points).

Lower Tax Rate Leads to Higher Equipment Purchases . . . We assume that a one percentage point reduction in the tax rate on equipment increases equipment purchases in the state by 1.0 percent to 1.6 percent. This range of estimates is based on the same economic framework used for CAEATFA’s net benefit calculation. This framework incorporates three economic parameters: the importance of equipment in production, the price elasticity of demand for output, and the elasticity of substitution between labor and capital. As described below, our assumptions regarding the latter two parameters differ from CAEATFA’s.

. . . Resulting in an Increase of 5 Percent to 9 Percent. As described above, we assume that the CAEATFA exemption reduces the net tax rate on 80 percent to 90 percent of participants’ purchases by 4.6 percentage points. Combining this assumption with the 1.0 to 1.6 percent range of investment responses, we estimate that the exemption increases these purchases by 5 percent to 7 percent. The 8.5 percentage point reduction on the remaining 10 percent to 20 percent of purchases increases those by 9 percent to 14 percent. The resulting average is an increase of 5 percent to 9 percent.

Price Elasticity of Demand for Output. The magnitudes of the scale effect and substitution effect described in the report depend, in part, on the price elasticity of demand for the industry’s output. Based on Li’s (2018) estimates of electric vehicle demand, we assume elasticities ranging from ‑2.1 to ‑3.4.

Elasticity of Substitution Between Labor and Capital. The magnitude of the substitution effect described in the report depends, in part, on the extent to which labor and capital are substitutes in production—summarized by an elasticity of substitution. Based on evidence from Chirinko and Wilson (2008), Oberfield and Raval (2014), and Chirinko and Mallick (2017), we assume aggregate elasticities ranging from ‑0.54 to ‑0.85. As noted by Oberfield and Raval (2014), we should expect a typical manufacturer’s individual response to be less elastic than the aggregate industry‑level response. The industry‑level response includes two distinct types of substitution:

- Substitution by Individual Factories. When the relative price of capital falls, individual factories have an incentive to change their production processes to use more capital and less of other productive inputs, such as labor.

- Substitution Across Factories. When the relative price of capital falls, more capital‑intensive factories develop a cost advantage over less capital‑intensive ones. As a result, capital‑intensive factories expand, while factories that rely more heavily on other productive inputs—such as labor—shrink.

Global Effects Smaller Than In‑State Effects. Chirinko and Wilson (2008) present evidence suggesting that a large portion of the increase in in‑state capital investment resulting from state tax exemptions is offset by reductions in investment in other states. Consequently, we interpret our estimates as California‑specific effects. The net global effects likely are much smaller.

Other Effects

Most Effects Highly Uncertain. The ultimate economic goal of programs like the CAEATFA exemption is to increase employment and output not just in a specific industry, but in California’s economy as a whole. The CAEATFA program has the additional goal of achieving net reductions in pollution. Unfortunately, available data and methods cannot support credible, precise estimates of the program’s net effects on jobs, economic activity, revenue, or pollution.

Number of Businesses in California. As noted above, statute requires our office to evaluate the number of businesses that have remained in California or relocated to California as a result of the program. We have not found any credible evidence that speaks to this effect specifically, so—like the effects listed above—it is highly uncertain. Evidence presented by Chirinko and Wilson (2008), however, addresses a closely related effect: the net change in the number of manufacturers in the state. Based on that evidence, our best estimate is that the CAEATFA exemption has had little to no net impact on the number of manufacturers in California. (The small net impact could consist of offsetting increases and decreases. For example, more equipment intensive‑manufacturers could replace less equipment‑intensive manufacturers.)

Fiscal Effects. In the “Assessment” section of the report, we claim that a state or local program can pay for itself through economic growth only if its economic effects are at least six times as large as a typical program. We obtain this number as follows. In 2016‑17, state and local revenue accounted for 9 percent of California personal income. Assuming that economic growth generates revenue at that rate—nine cents on the dollar—a program can “pay for itself” through macroeconomic effects only if the program generates $11 of personal income for every dollar of spending (or forgone revenue). In other words, the “multiplier” on the program must be equal to or greater than 11. In contrast, credible estimates of state and local fiscal multipliers tend to be in the range of 1.5 to 2. Consequently, for a program to pay for itself through economic growth, it must have a multiplier that is at least six times as large as a typical program.

Types of Advanced Manufacturing Used

In Appendix Figure 1, we list the types of advanced manufacturing used by participants in the CAEATFA program, as required by statute. In total, CAEATFA has awarded the exemption to 40 different types of advanced manufacturers.

Appendix Figure 1

Types of Advanced Manufacturing Used Since 2010

|

Type |

Total Exemption Amount (Millions of Dollars) |

|

|

Awarded |

Used |

|

|

Aerospace Manufacturing |

$83.3 |

$12.9 |

|

Metal Forging |

14.1 |

8.6 |

|

Biopharmaceutical Manufacturing |

24.9 |

7.8 |

|

Medium Density Fiberboard Manufacturing |

7.8 |

4.6 |

|

Plastic Recycling |

10.1 |

4.5 |

|

Plug‑In Hybrid Vehicle Manufacturing |

3.2 |

3.2 |

|

Specialty Aerospace Fastener Manufacturing |

3.9 |

2.9 |

|

Water Bottling Facility |

2.5 |

2.5 |

|

Corrugated Packaging Manufacturing |

2.5 |

2.4 |

|

Thin Steel Plate Manufacturing |

3.4 |

2.1 |

|

Advanced Food Production |

3.3 |

0.8 |

|

Tooling and Metal Stamping |

0.8 |

0.8 |

|

Defense and Aerospace Manufacturing |

1.4 |

0.7 |

|

Composites Manufacturing |

0.7 |

0.7 |

|

Silicon Anode Powder Manufacturing |

0.9 |

0.6 |

|

Medical Waste Recycling |

3.1 |

0.5 |

|

Carbon Black Production |

0.5 |

0.4 |

|

Optical Ferrule Manufacturing |

0.7 |

0.4 |

|

Electric Vehicle Battery Manufacturing |

1.5 |

0.4 |

|

Food Grade Recycled Packaging Manufacturing |

0.9 |

0.3 |

|

Lithium Ion Battery Manufacturing |

1.4 |

0.3 |

|

Peptide Pharmaceutical Manufacturing |

1.1 |

0.3 |

|

Corn Oil Production |

0.4 |

0.3 |

|

Advanced Carpet Recycling |

1.4 |

0.2 |

|

Soil Amendments Production |

0.3 |

0.2 |

|

Recycled Paper Bottles Manufacturing |

0.6 |

— |

|

Electric Vehicle Charging Station Production |

0.1 |

— |

|

Specialized Concrete Ring Manufacturing |

0.3 |

— |

|

Beverage Production |

0.2 |

— |

|

Biomass Processing and Fuel Production |

37.2 |

— |

|

Fertilizer Production |

9.1 |

— |

|

CNC Machine Manufacturing |

6.9 |

— |

|

Aero Engine Ring Forging |

4.5 |

— |

|

Multifamily Unit Building Component Manufacturing |

4.5 |

— |

|

Additive Manufacturing |

0.7 |

— |

|

Turned Part Manufacturing |

0.6 |

— |

|

Recycled PET Food Packaging |

0.4 |

— |

|

Water Feature Manufacturing |

0.4 |

— |

|

Omega Oil Production |

0.4 |

— |

|

Advanced Packaging Label Production |

0.2 |

— |

Selected References

Chirinko, Robert and Debdudal Mallick (2017). “The Substitution Elasticity, Factor Shares, and the Low‑Frequency Panel Model.” American Economic Journal: Macroeconomics 9(4):225‑253.

Chirinko, Robert and Daniel Wilson (2008). “State Investment Tax Incentives: A Zero‑Sum Game?” Journal of Public Economics 92:2362‑2384.

Chirinko, Robert and Daniel Wilson (2010). “State Business Taxes and Investment: State‑by‑State Simulations.” Federal Reserve Board of San Francisco Economic Review.

Chodorow‑Reich, Gabriel (2018). “Geographic Cross‑Sectional Fiscal Spending Multipliers: What Have We Learned?” Mimeo, Harvard University.

Li, Jing (2018). “Compatibility and Investment in the U.S. Electric Vehicle Market.” Mimeo, Massachusetts Institute of Technology.

Nakamura, Emi and Jon Steinsson (2014). “Fiscal Stimulus in a Monetary Union: Evidence from U.S. Regions.” American Economic Review 104(3):753‑792.

Oberfield, Ezra and Devesh Raval (2014). “Micro Data and Macro Technology.” Mimeo, Princeton University.

Suarez Serrato, Juan Carlos and Philippe Wingender (2016). “Estimating Local Fiscal Multipliers.” Mimeo, Duke University.