Overview. The Governor’s budget provides a total of $17.6 billion from various fund sources for all departments and programs under the California State Transportation Agency (CalSTA) in 2015–16. This is an increase of $1.9 billion, or 11.8 percent, over estimated current–year expenditures. The budget includes $10.5 billion for the California Department of Transportation (Caltrans), $2.8 billion for the California High–Speed Rail Authority (HSRA), $2.4 billion for the California Highway Patrol (CHP), $1.1 billion for the Department of Motor Vehicles (DMV), and $588 million for transit assistance. In this report, we assess the Governor’s budget proposals in the transportation area. Below, we summarize our major findings and recommendations.

Road Usage Charge Pilot Program. The Governor’s budget proposes $9.6 million to implement recently enacted legislation that requires the development and implementation of a road usage charge pilot program. The pilot program would test the concept of charging individuals for each mile they drive as an alternative to the gas tax system. The legislation requires the creation of an advisory committee to guide the design and development of the pilot program. We find that the Governor’s proposal, combined with Caltrans’ recent action to enter into a contract to implement the program, are premature given that the advisory committee has not completed its work. In order to ensure that the budget appropriately funds the development and implementation of the program as envisioned by the Legislature, we recommend that the Legislature require the administration to provide additional information to justify its proposal.

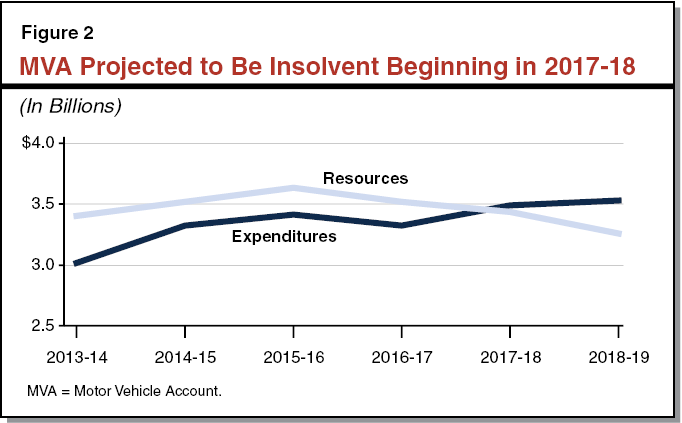

Motor Vehicle Account (MVA) Fund Condition. The MVA, which receives most of its revenues from vehicle registration and driver license fees, mainly supports the activities of CHP and DMV. Due to recent increases in MVA expenditures, the fund faces an operational shortfall beginning in 2014–15. While the MVA’s fund balance has been able to help offset this shortfall, we estimate—based on the Governor’s proposals—that the MVA will likely become insolvent in 2017–18. This is primarily due to planned expenditures regarding new CHP and DMV facilities and salary increases for CHP officers. Given the projected insolvency of the MVA, the Legislature will want to establish its priorities for the MVA to determine how to best address the projected insolvency based on these priorities.

Project Initiation Document (PID) Program. The budget proposes a net increase of $3.4 million and 25 positions for the PID program at Caltrans, primarily to develop additional PIDs (1) due to a projected increase in funding for highway rehabilitation projects and (2) to create a shelf of projects to the extent additional unexpected funds become available. We find that there is (1) a lack of robust PID cost and workload data, (2) existing resources potentially available to meet the increased workload, and (3) no need to create a shelf of PIDs. Thus, we recommend the Legislature withhold action on the proposed resources to develop PIDs due to increased funding for projects, pending additional workload and budget data from Caltrans. Additionally, we recommend rejecting the proposed resources to develop a shelf of PIDs.

High–Speed Rail Project Oversight. The first phase of the high–speed rail project began in the Central Valley in 2012 on a segment known as the Initial Construction Segment (ICS). The HSRA estimates completing construction of the ICS in 2018. In order to do so, certain key nonconstruction activities must be completed (such as environmental reviews, obtaining necessary permits, and acquiring necessary land). Given the state’s significant investment in the project, we recommend the Legislature take steps to allow for adequate oversight of HSRA’s progress towards completing required activities. Specifically, we recommend requiring HSRA to establish specific benchmarks and to periodically report on its progress in meeting these benchmarks.

The CalSTA has jurisdiction over the state’s transportation departments and programs. These departments and programs include Caltrans, HSRA, CHP, DMV, State Transit Assistance (STA) program, California Transportation Commission (CTC), and the Board of Pilot Commissioners.

The Governor’s budget proposes a total of $17.6 billion in expenditures from various fund sources—the General Fund, state special funds, bond funds, federal funds, and reimbursements—for all departments and programs under CalSTA in 2015–16. This is an increase of about $1.9 billion, or 11.8 percent, over estimated expenditures for the current year, with the increase explained primarily by greatly expanded spending on the state’s high–speed rail project.

Figure 1 shows spending for the state’s major transportation programs and departments from selected sources.

Figure 1

Transportation Budget Summary—Selected Funding Sources

(Dollars in Millions)

|

|

Actual

2013–14

|

Estimated

2014–15

|

Proposed

2015–16

|

Change From 2014–15

|

|

Amount

|

Percent

|

|

Department of Transportation

|

|

|

|

|

|

|

General Fund

|

$83.4

|

$83.4

|

$84.0

|

$0.6

|

0.7%

|

|

Special funds

|

4,854.5

|

3,735.4

|

3,633.6

|

–101.8

|

–2.7

|

|

Bond funds

|

1,334.7

|

559.2

|

562.4

|

3.1

|

0.6

|

|

Federal funds

|

3,771.4

|

4,759.8

|

4,627.1

|

–132.7

|

–2.8

|

|

Local funds

|

819.3

|

1,139.4

|

1,595.3

|

455.9

|

40.0

|

|

Totals

|

$10,863.4

|

$10,277.2

|

$10,502.3

|

$225.1

|

2.2%

|

|

High–Speed Rail Authority

|

|

|

|

|

|

|

Bond funds

|

$48.4

|

$50.2

|

$1,354.5

|

$1,304.3

|

2597.5%

|

|

Federal funds

|

1,291.1

|

616.1

|

1,224.0

|

608.3

|

98.7

|

|

Greenhouse Gas Reduction Fund

|

—

|

250.0

|

250.0

|

—

|

—

|

|

Reimbursements

|

—

|

1.0

|

—

|

—

|

—

|

|

Totals

|

$1,339.5

|

$917.3

|

$2,828.9

|

$1,911.6

|

208.4%

|

|

California Highway Patrol

|

|

|

|

|

|

|

Motor Vehicle Account

|

$1,836.9

|

$2,043.9

|

$2,174.3

|

$130.4

|

6.4%

|

|

Other special funds

|

164.7

|

180.1

|

182.9

|

2.8

|

1.5

|

|

Federal funds

|

15.5

|

19.9

|

19.8

|

—

|

–0.1

|

|

Totals

|

$2,017.1

|

$2,243.9

|

$2,377.0

|

$133.1

|

5.9%

|

|

Department of Motor Vehicles

|

|

|

|

|

|

|

Motor Vehicle Account

|

$975.1

|

$1,058.7

|

$1,049.8

|

–$8.9

|

–0.8%

|

|

Other special funds

|

46.7

|

48.1

|

47.2

|

–0.9

|

–1.9

|

|

Federal funds

|

4.1

|

4.1

|

2.9

|

–1.2

|

–29.7

|

|

Totals

|

$1,025.9

|

$1,110.8

|

$1,099.9

|

–$11.0

|

–1.0%

|

|

State Transit Assistance

|

|

|

|

|

|

|

Public Transportation Account

|

$408.1

|

$385.9

|

$387.8

|

$1.9

|

0.5%

|

|

Bond funds

|

278.4

|

649.2

|

150.0

|

–499.2

|

–76.9

|

|

Greenhouse Gas Reduction Fund

|

—

|

25.0

|

50.0

|

25.0

|

100.0

|

|

Totals

|

$686.5

|

$1,060.1

|

$587.8

|

–$472.3

|

–44.6%

|

Caltrans. The Governor’s budget proposes total expenditures of $10.5 billion in 2015–16 for Caltrans—$225 million, or 2 percent, more than estimated current–year expenditures. As shown in Figure 1, Caltrans expenditures from local reimbursements are assumed to increase by $456 million (or 40 percent). This higher level of expenditures primarily reflects the shifting of some workload initially assumed to occur in the current year to the budget year.

HSRA. The Governor’s budget proposes total expenditures of about $2.8 billion in 2015–16 for HSRA. This amount is $1.9 billion (or three times) more than the estimated level of expenditures in the current year. The increase in expenditures would primarily be supported from the proceeds of bonds authorized by Proposition 1A (2008).

CHP and DMV. The budget proposes $2.4 billion for CHP in 2015–16, which is 6 percent higher than the current–year estimated level. Over 90 percent of all CHP expenditures are supported from the MVA, which generates its revenues primarily from driver license and vehicle registration fees. For DMV, the Governor’s budget proposes total expenditures of about $1.1 billion—about $11 million, or 1 percent, less than estimated current–year expenditures. About 95 percent of all DMV expenditures would come from the MVA.

Transit Assistance. The Governor’s budget estimates total expenditures of $588 million in 2015–16 for the STA program, which is $472 million, or 45 percent, less than estimated current–year expenditures. The reduced spending reflects the completion in the current year of transit capital projects supported with Proposition 1B bond funds.

Funding Transportation Infrastructure. Funding for transportation infrastructure in California comes from local, state, and federal sources, and funds various modes of transportation, such as the state’s highways, local roads, and transit. Most state funding for transportation comes from excise taxes on gasoline that are dedicated to funding highways and roads. The state began charging excise taxes on gasoline in 1923. The state’s current gasoline excise tax is 36 cents per gallon. The state also collects taxes on diesel fuel.

Essentially, the gas excise tax serves as a proxy charge for road usage, as taxes paid roughly correspond with miles driven. For example, individuals who drive more miles and inflict more wear on the road also use more fuel and therefore pay more in fuel excise taxes than those who drive fewer miles. However, over time changes in the type and fuel efficiency of vehicles have eroded the relationship between fuel taxes and road usage. For example, as vehicles have become more fuel efficient, less gas is used for each mile driven—resulting in a lower amount of gas tax revenue collected even if the number of miles driven remains the same. We also note that the availability of vehicles that are not powered by gasoline or diesel fuel, and which therefore pay no fuel taxes at all, has increased in recent years. For example, between March 2010 and March 2014 more than 83,000 plug–in battery electric vehicles were sold in the state. While the number of such vehicles is currently a small percent of the statewide fleet, it will grow in the future. At the same time, construction costs have risen and the highway system has aged, increasing the overall cost of maintaining it.

Legislature Authorizes Road Usage Charge Pilot Program. In light of these issues, the Legislature enacted Chapter 835, Statutes of 2014 (SB 1077, DeSaulnier), to study the feasibility of a “road usage charge”—an amount charged to individuals for each mile they drive. Such a charge is also sometimes referred to as a “mileage based user fee.” Several states have begun exploring the idea of funding their transportation systems with a road usage charge as an alternative to the fuel excise taxes. Currently, Oregon is the only state that has implemented a road usage charge program. (Please see the nearby box for more information on Oregon’s experience with a road usage charge.)

Oregon has taken steps to implement road usage charges on public roads. The state first implemented two pilot programs. Afterwards, the state authorized a voluntary road usage program on a statewide basis (known as the OReGO Program).

First Pilot Program. In 2001, the Oregon Legislature established an independent task force to examine the potential challenges and benefits of a road usage charge as an alternative to the state’s gasoline excise tax. The task force was required to provide recommendations to the Legislature and the Oregon Department of Transportation on the design and implementation of a road usage charge. Based on the task force’s recommendations, the Oregon Department of Transportation implemented the state’s first road usage charge pilot program in 2006. Under this 12–month pilot, the vehicles of 300 participants were equipped with Global Positioning System (GPS)–based metering equipment that transmitted mileage data to a central processing system when drivers used one of two specially equipped gas stations. The equipment transmitted aggregated mileage and billing data on total amount owed, but did not collect or transmit detailed travel records (such as where the individual traveled). The pilot program was for demonstration purposes only—meaning sample bills were delivered and no actual money was collected. Thus, the pilot program did not explicitly assess the ability of the road user fee to raise comparable amounts of money as the state’s existing gas tax. While the pilot proved the viability of a road usage concept, a number of concerns were raised. Specifically, users expressed privacy concerns and concerns with the government mandating the use of a specific type of technology for the program.

Second Pilot Program. In view of these concerns, Oregon conducted a second pilot from 2012 to 2013. While this pilot program was of smaller scale with only 88 participants, it evaluated a broader range of methods of collecting road usage data than the first pilot program. This is because instead of mandating the use of a particular mileage reporting technology, Oregon allowed private vendors to make a range of products available to motorists for reporting mileage. Specifically, the state established reporting technology standards that vendors had to meet. For example, one vendor developed a mileage reporting application for smartphones. Thus, the pilot allowed participants to choose from several options, such as simple odometer–based reporting and smartphone–based GPS reporting. Unlike Oregon’s first pilot program, this pilot involved an actual exchange of money. Participating drivers were charged 1.56 cents per mile, and were given a refund on their gas taxes to offset the cost of participation. The collection of the fee was successful, as there was little noncompliance.

OReGO Program. Following the completion of the second pilot program, the Oregon Legislature authorized a mileage–based revenue program for light vehicles (generally meaning noncommercial vehicles) known as OReGO. The program is expected to begin on July 1, 2015, and involve a maximum of 5,000 initial volunteers who will be charged 1.5 cents per mile. The OReGO program is based on many of the principles of the second pilot program, including user choice in terms of reporting technology, private sector involvement, and a fuel tax credit for participating drivers.

Chapter 835 requires that several steps be taken over the next few years to design and implement a pilot program to test the concept of a road usage charge in California as an alternative to the current gas tax system. First, the legislation requires the CTC, in consultation with CalSTA, to create a Technical Advisory Committee (TAC) to guide the design, development, and evaluation of the pilot program. The TAC shall consist of 15 members appointed by the chairperson of the CTC who are representative of specified groups, including highway user groups, the telecommunications industry, the data security and privacy industry, and privacy rights advocates. According to the legislation, the TAC may request Caltrans to perform such work as it deems necessary to carry out its duties and responsibilities. Specifically, the TAC is required to consider and gather public comment on various issues such as:

- Availability of methods to record and report on the number of miles that individuals drive in the state and the costs to obtain such data.

- Ease and cost associated with collecting and enforcing a road usage charge.

- Various privacy issues related to the collection and reporting of travel data, including privacy protection, data security, and law enforcement access to data.

The TAC is required to make recommendations to CalSTA on the structure and specific features of the design and implementation of a road usage charge pilot program, including potentially determining the state department best suited to administer the pilot and the ideal number of participants. Chapter 835 requires that these recommendations be included in CTC’s annual report to the Legislature.

Based on the recommendations of the TAC, CalSTA shall implement a road usage charge pilot program by January 1, 2017. The pilot program is required to (1) analyze various methods for collecting road usage data (including at least one method that does not rely on electronic vehicle location data), (2) collect a minimum of personal information from pilot participants, and (3) protect the privacy and integrity of driver data. Upon completion of the pilot program, CalSTA must submit its findings on the feasibility of implementing a road usage charge to the TAC, the CTC, and the Legislature by June 30, 2018. In January 2015, the CTC chairperson appointed the members of the TAC, which held its first meeting on January 23, 2015.

The Governor’s budget for 2015–16 includes two proposals—totaling $9.6 million from the State Highway Account (SHA)—related to the implementation of Chapter 835.

Resources for CTC to Support TAC ($162,000). First, the budget includes $162,000 annually for three years to support one limited–term position to provide day–to–day support and coordination for the TAC, such as helping organize and manage a number of meetings to gather public comment on issues and concerns related to the pilot program.

Resources for Caltrans to Assist TAC and Implement Pilot ($9.4 Million). Second, the budget provides $9.4 million and five limited–term positions for Caltrans to (1) provide technical assistance to the TAC prior to the start of the road usage charge pilot program and (2) implement the actual pilot program. Specifically, the budget includes:

- $8.8 million for Caltrans to contract with consultants to both provide technical assistance to the TAC and to conduct the road usage charge pilot program. The budget also includes provisional language to provide Caltrans the flexibility to encumber these funds through June 2018.

- $618,000 annually for three years to support five limited–term positions to (1) assist the TAC (including managing any contracts for technical support to the TAC as they are needed) and (2) manage the contract for the implementation of the pilot program.

Based on our analysis, we find that the Governor’s proposals, combined with recent actions by Caltrans, raise several concerns. Specifically, we find that (1) the budget assumes that Caltrans will administer the pilot program, (2) the budget assumes certain design features of the pilot, (3) Caltrans recently signed a contract to commit some of the funds proposed in the budget, and (4) the administration has not provided a complete plan for the requested contract funds.

Assumes Caltrans Will Administer Pilot Program. As indicated above, Chapter 835 requires the TAC to provide recommendations on the design and development of the road usage charge pilot program. However, the Governor’s budget is based on the premise that Caltrans will administer the pilot program, prior to the TAC even providing its recommendations. This is because the budget provides funding for Caltrans specifically for this purpose. Moreover, the administration has not provided sufficient justification as to why Caltrans is the appropriate state department to administer the program. For example, in certain instances, it could make sense for the DMV to be the lead department. While Caltrans is primarily responsible for the construction and maintenance of the state highway system, it does not necessarily have the expertise in managing programs that involve the tracking and protection of personal data and the calculation and assessment of fees.

Budget Assumes Certain Design Features of the Pilot Program. Additionally, the Governor’s budget assumes a given size and scope of the pilot program. Specifically, the $8.8 million in contract funds proposed for Caltrans is based on a 12–month statewide pilot involving 6,000 participants. As indicated above, the TAC is in the early stages of developing its recommendations regarding the design of the pilot program, which it intends to include in its annual report to the Legislature in December 2015. Thus, it is unclear why the proposed budget would assume a particular size and scope of the pilot project prior to the TAC completing its work.

Caltrans Recently Signed Contract for Pilot Implementation. On January 29, 2015, Caltrans signed a $7.7 million contract with a consultant to perform the work described in this budget request—before the Legislature begins its deliberations on the budget request and roughly five months before the adoption of the 2015–16 budget. The department indicates that it is redirecting funds from other programs in order to absorb a portion of the cost of the contract for work performed by the consultant in the current year, which is estimated to be $1 million. It is unclear why Caltrans signed a contract before receiving legislative approval for the additional funding to support the total cost of the contract. Moreover, we find no justification for why Caltrans needed to enter into a contract for the implementation of the pilot project before the TAC provides its recommendations around the design and scope of the pilot program. Given that Chapter 835 does not require CalSTA to implement a road usage charge pilot program until January 1, 2017, funding to implement the program does not necessarily have to be provided and expended in either the current year or budget year in order to adhere to the timeline approved by the Legislature.

No Complete Plan for Requested Contract Funds. As stated above, the budget proposes $8.8 million in one–time contract funding for Caltrans. Based on the contract recently entered into by Caltrans, the department plans to use $6.7 million of these requested funds to deliver additional technical assistance to the TAC and for the implementation and evaluation of the pilot program. (As indicated above, the department has redirected $1 million to support costs for the contract in the current year.) At this time, it is unclear what additional activities the remaining $2.1 million in contract funds would support. While it is possible that the TAC could require additional contract services in the future, the administration has not provided detailed justification for the amount requested. Absent a complete plan regarding the proposed contract funds, it is difficult for the Legislature to assess the proposal.

As discussed above, the Governor’s proposals, as well as Caltrans’ recent action to enter into a contract to implement the pilot program, are premature given that the TAC has not completed its work regarding the design of the pilot program. In order to ensure that the budget appropriately funds the implementation of Chapter 835 as envisioned by the Legislature based on its priorities, we recommend that the Legislature require the administration to provide additional information to justify its proposals at budget hearings. We also recommend requiring CTC to provide an update on the work of the TAC. Pending the additional information, we recommend that the Legislature withhold action on the Governor’s budget proposals. In order to guide the Legislature’s deliberations, we recommend that it ask the administration the following key questions.

- How did the administration determine that Caltrans should administer the road usage charge pilot program? What other state departments were considered? Why did the administration not wait for the recommendations from TAC prior to making the decision?

- How did the administration determine the size and scope of the pilot program? What criteria was used to make this determination?

- Why did Caltrans enter into a contract prior to the approval of the funding to support the contract?

- What programs did Caltrans redirect funding from to support the contract in the current year? What is the impact of the redirection on these programs?

The MVA was created to support the state’s activities related to the administration and enforcement of laws regulating the operation or registration of vehicles used on public streets and highways, as well as to mitigate the environmental effects of vehicle emissions. Below, we describe MVA revenues and expenditures, provide an update on the condition of the MVA, and identify issues for legislative consideration.

Revenues. The MVA receives most of its revenues from vehicle registration and driver license fees. In 2014–15, $3.1 billion is estimated to be deposited into the MVA with vehicle registration fees accounting for $2.7 billion (85 percent) and driver license fees accounting for $299 million (10 percent). The remaining revenue primarily comes from identification card fees, late fees associated with renewals, and miscellaneous fees for special permits and certificates. Between 2009–10 and 2014–15, revenues have increased at an average rate of 5 percent annually.

Vehicle registration fees consist of two components—a base fee of $46 and an additional fee of $24 that directly benefits CHP. The base vehicle registration fee was last increased in 2011, from $34 to $46. In 2014, the CHP fee increased from $23 to $24 and was indexed to the Consumer Price Index (CPI), allowing the fee to automatically increase with inflation. The current driver license fee is $33 and was last increased by $1 in 2014. The driver license fee is also indexed to the CPI.

Expenditures. The MVA primarily provides funding to three state departments—DMV, CHP, and the Air Resources Board (ARB)—to support the activities authorized in the California Constitution. In recent years, expenditures from the MVA have increased. The major cost drivers include:

- CHP Officers’ Salary Increases. The state and the union representing CHP officers negotiated a memorandum of understanding (MOU) in 2013 that provides salary increases for CHP officers annually from 2013–14 through 2018–19. The MOU specifies that the increases are determined by calculating the weighted average of the salaries of the state’s five largest local police agencies. In 2013–14 and 2014–15, CHP officers received average salary increases of 5 percent—adding $110 million in costs for the MVA.

- CHP Air Fleet Replacement. As part of an ongoing air fleet replacement plan for CHP’s air fleet of 26 aircraft, the Legislature approved $17 million in 2013–14 and $16 million in 2014–15 to replace four CHP aircraft in each year. As we discuss below, this replacement plan creates cost pressures on the MVA over the next several years.

- CHP Field Office Replacement. In 2013–14, the Legislature approved a total of $6.4 million to initiate a multiyear plan to replace existing CHP field offices. The funding supported the acquisition of land for one new office and the advanced planning to replace five additional offices. In 2014–15, the Legislature approved $32.4 million to fund the acquisition of land for the five new offices initiated in the prior year, as well as $1.7 million for advanced planning for five additional replacement projects.

- Implementation of AB 60. In 2014–15, the Legislature provided resources for DMV to implement Chapter 524, Statutes of 2013 (AB 60, Alejo), which specifies that beginning January 1, 2015, DMV accept driver license applications from persons who are unable to submit satisfactory proof of legal presence in the U.S. Specifically, $67.4 million was provided in 2014–15 and $57.1 million in 2015–16.

Loans to the General Fund. In order to help the state meet its spending priorities during the recent recession, $480 million was loaned from the MVA to the General Fund—$300 million in 2010–11 and $180 million in 2012–13

Operational Shortfall Beginning in 2014–15. As indicated above, in recent years, MVA expenditures have increased at a higher rate than revenues deposited into the fund. As a result, beginning in 2014–15, expenditures from the MVA are estimated to exceed the amount of revenues deposited in the fund—thereby resulting in an operational shortfall. Specifically, the MVA is estimated to have revenues of $3.1 billion and expenditures of $3.3 billion in the current year. This would leave an ongoing operational shortfall of about $200 million that will require the use of the MVA’s fund balance, which amounted to $415 million at the start of 2014–15. Such operational shortfalls are likely to continue in 2015–16 and future budget years.

The Governor’s budget includes various proposals that would further impact the MVA in 2015–16 and thereafter. First, the budget proposes to repay $480 million in loans that were previously made from the MVA to the General Fund. Specifically, the administration proposes to repay $300 million in 2015–16 and $180 million in 2016–17. These loan repayments would provide the MVA with additional revenues that can be used to address operational shortfalls identified above—delaying when the MVA becomes insolvent.

Second, the proposed budget includes various proposals that would increase expenditures from the MVA in 2015–16, as well as in subsequent years. These proposals include the following:

- Additional CHP Field Office Replacements ($136 Million). The Governor’s budget proposes $135 million for construction activities for five previously approved CHP area offices and $1 million for planning and site selection activities for up to five CHP area offices. These proposals are part of the administration’s plan to replace many CHP field offices over several years.

- Initiate Multiyear DMV Office Replacement Plan ($4.7 Million). The Governor’s budget proposes $4.7 million for pre–construction activities to replace three DMV offices. This proposal is the initial phase of the administration’s plan to replace eight DMV offices over the next several years.

- New ARB Research Facility ($3.8 Million). The Governor’s budget proposes $3.8 million from the MVA to partially support the costs of evaluating a site and developing performance criteria for a new ARB research facility in Southern California. (Total costs of these activities are $5.9 million, with the remaining $2.1 million supported with other fund sources.) The total cost of the project is estimated to be $366 million. The administration indicates that a portion of this cost would be supported by the MVA. (In our recent report, The 2015–16 Budget: Resources and Environmental Protection, we find that the proposal is premature, as the administration has not yet provided information that justifies the scope, costs, and need for the facility.)

- CHP Salary Increase. The Governor’s budget assumes a salary increase for CHP officers of 3.3 percent for 2015–16 and provides $41 million from the MVA to support these costs. Based on the MOU discussed above, CHP officers will likely receive additional salary increases in 2016–17, 2017–18, and 2018–19.

While the Governor’s proposed loan repayments from the General Fund to the MVA would offset operational shortfalls in the MVA in 2015–16 and 2016–17, our forecast of MVA revenues and expenditures indicates that the MVA’s fund balance will still be depleted by 2017–18—resulting in insolvency. Our forecast includes revenue estimates based on historical trends and expenditure estimates based on proposals already approved by the Legislature (such as the multiyear replacement of CHP’s aircraft) and those proposed in the Governor’s budget (such as the proposed replacement of DMV offices), as well as assumed in the administration’s 2015 Five–Year Infrastructure Plan. Our forecast also includes out–year expenditures related to the annual CHP officer salary increases discussed above.

Figure 2 compares total MVA resources (revenues, proposed loan repayments, and fund balances) with expenditures from 2013–14 through 2018–19. As shown in the figure, absent any corrective actions, our forecast indicates that the MVA would become insolvent in 2017–18 with a shortfall of about $50 million that grows to roughly $250 million by 2018–19. As previously indicated, existing reserves and the above loan repayments help prevent the fund from becoming insolvent prior to 2017–18. We would also note that various additional cost pressures could further impact the solvency of the MVA the next few years, such as possible information technology system replacements being considered by the DMV.

Given the projected insolvency of the MVA in the near future—assuming approval of the various proposals in the Governor’s budget from the MVA—the Legislature will want to establish its priorities for the MVA and determine how best to address the projected insolvency based on these priorities. While the MVA is not projected to become insolvent until 2017–18, we recommend that the Legislature begin to take steps now to help prevent this insolvency, especially given that the Governor’s budget proposals for 2015–16 have fiscal implications in subsequent years. Below, we discuss some of the options that the Legislature could consider.

- Reject Some of the Governor’s Capital Proposals. The Legislature could reject some of the Governor’s capital outlay proposals as a way to reduce MVA expenditures in 2015–16 and in future years. For example, the Legislature could not approve any new projects but allow previously approved projects to continue as planned (such as the CHP field offices approved for replacement in the 2014–15 budget). We note that such actions would leave various safety and operational challenges facing certain offices unaddressed.

- Reduce Other Expenditures. The Legislature could choose to reduce or delay other expenditures—meaning the base programs supported by the MVA. For example, by delaying expenditures to replace CHP aircraft in future years or reducing CHP salary increases in future years. In addition, the Legislature could reduce base operational costs for CHP and DMV, such as the replacement of equipment or ending certain programs. We note that during the recent recession, CHP delayed vehicle replacements in order to reduce MVA expenditures.

- Increase Fees. The Legislature could also choose to generate additional revenues by increasing vehicle registration or driver license fees to mitigate the shortfall in the MVA. For example, we estimate that roughly $30 million in additional revenue could be generated annually from a $1 increase in the base vehicle registration fee.

Caltrans is responsible for planning, coordinating, and implementing the development and operation of the state’s transportation system. These responsibilities are carried out in four programs. Three programs—Highway Transportation, Mass Transportation, and Aeronautics—concentrate on specific transportation modes. Transportation Planning seeks to improve the planning of all modes.

The Governor’s budget proposes total expenditures of about $10.5 billion for Caltrans in 2015–16. This is $255 million, or about 2 percent, higher than the estimated current–year expenditures. Most of the proposed spending supports the department’s highway program, which primarily includes $3.9 billion for capital outlay, $2 billion for local assistance, $1.8 billion for highway maintenance and operations, and $1.7 billion to provide the support necessary to deliver capital highway projects. The total level of spending proposed for Caltrans for 2015–16 supports about 20,000 positions at the department and several thousand transportation improvement projects statewide.

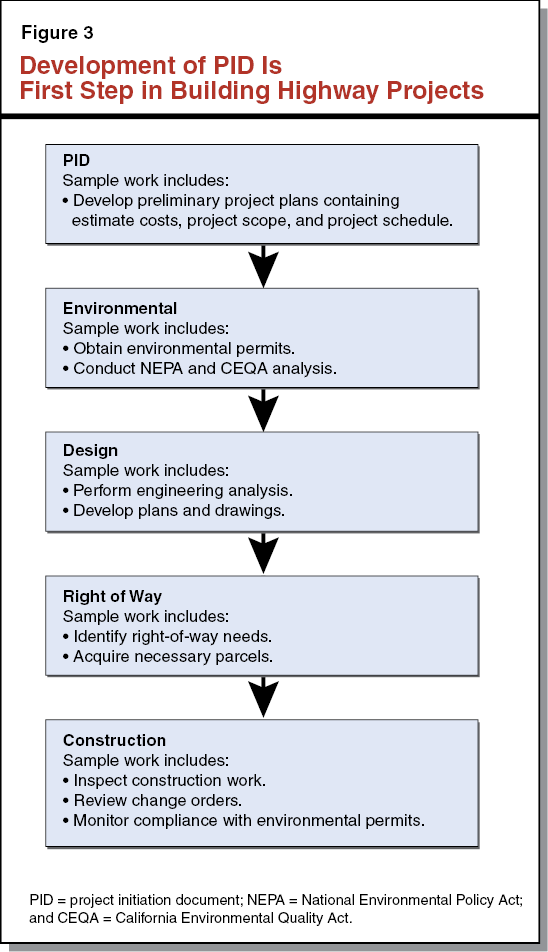

Initial Plan for Project. At various stages throughout the development of a highway capital project, Caltrans estimates the cost and scope of the work required to complete the project. One such estimate is completed during the preparation of the initial plan for a project, which is commonly referred to as a PID. Specifically, the PID contains various information about the proposed project, including the identification of the transportation problem that is to be addressed and an evaluation of alternatives to address the problem. In addition to the estimated cost and scope, the PID also includes the estimated schedule of the project. As shown in Figure 3, the completion of a PID is the first phase in developing a highway project.

PID Needed to Program Project Funding. According to Caltrans, the above PID information is needed to decide if, how, and when to fund a particular project. Specifically, state law requires a PID be completed before a project can be programmed in the State Transportation Improvement Program (STIP), which is a five–year program that funds new highway construction projects that add capacity to the highway system. Caltrans and the CTC administratively require a PID also be completed before a project can be programmed for funding in the State Highway Operations and Protection Program (SHOPP), which is a four–year program of projects to improve the state highway system (such as pavement rehabilitation and safety improvements). Caltrans develops PIDs to provide the necessary information to add new projects to the STIP and SHOPP when these programs are updated every other year to account for two additional years of funding. As a result, Caltrans budgets for PID workload on two–year cycles to align the development of PIDs with the need for such documents to program new projects in the STIP and the SHOPP. In addition, local transportation agencies develop PIDs for STIP projects and locally funded state highway projects. Caltrans oversees and must approve these locally developed PIDs before the related projects can be programmed. After a PID is completed and a project is programmed, a more refined cost estimate is made based on the specific project scope and design.

The number of PIDs Caltrans needs to prepare in a given year depends on the estimated level of funding that will be available to add new projects to the SHOPP and the STIP. Caltrans develops estimates of the amount of available funding on two–year cycles so that updated estimates are available each time the SHOPP and STIP programs are updated. In the most recent estimate in 2014, Caltrans projected a $300 million annual increase in funding available for the SHOPP, increasing funding for the program from $2 billion (based on the 2012 SHOPP) to $2.3 billion each year.

Legislature Required Improvements to PID Program. Over the last several years, the Legislature has directed Caltrans to make several improvements to the PID program. First, the Legislature directed the department to streamline its PID development process by eliminating requirements to perform certain studies and to provide information that is not necessary on certain projects. Such direction was intended to reduce both the cost and workload required to complete PIDs. In response, Caltrans has developed several streamlined PID documents that better tailor the amount of workload required to complete a PID with the size and risk of a project. For example, for a capital project under $3 million in value, the department completes a streamlined PID that reflects only the studies and preparatory work required based on the scope of the project (rather than the full list of studies required in a traditional PID). As a result, the streamlined PID typically requires less work than a traditional PID.

Second, due to concerns around the lack of sufficient and complete data regarding the types of PIDs completed and the level of workload involved, the Legislature adopted supplemental report language as part of the 2013–14 budget package requiring Caltrans to report specific workload data for the PID program by January 31 of each year for five years beginning in 2014. Such data includes the time and resources required to complete PIDs, as well as the impact of the PID process on overall project cost. In response to this requirement, the department began developing a database to track the actual workload required to complete each PID. We note, however, that Caltrans has not provided the required report to the Legislature in each of the past two years.

Finally, the Legislature has taken steps to make the PID program more cost–effective. In the past, Caltrans had developed and maintained a large shelf of completed PIDs (meaning PIDs that were developed in case a significant increase in funding became available to support additional projects). However, these PIDs were ultimately never funded due to changing priorities and because the anticipated funding never materialized. Most of these PIDs were discarded when the associated projects were not funded. Since the existence of a shelf of projects did not appear to be an effective use of limited resources, the Legislature required Caltrans to reduce its shelf of completed but unfunded PIDs. Specifically, the Legislature reduced Caltrans’ budget for PIDs to eliminate the funding previously used to create a shelf of PIDs.

The Governor’s budget proposes a total of 362 positions and $53.8 million (SHA) for Caltrans to develop roughly 600 PIDs in 2015–16. (Under the proposal, the same level of PID resources would be provided in 2016–17.) This reflects a net increase of 25 new positions and $3.4 million from the levels provided to the department in 2014–15. Specifically, the budget reflects the following changes.

- $2.6 million and 18 additional positions to develop roughly 40 additional PIDs resulting from an estimated annual increase in SHOPP funding of $300 million.

- $2 million and 14 additional positions to develop additional PIDs for projects with a total estimated cost to complete construction of $500 million. According to Caltrans, this would provide them with a shelf of projects to the extent that additional funding above what is currently estimated for SHOPP unexpectedly becomes available (such as unanticipated federal funds). If such funding does not become available, the developed PIDs would be programmed as part of the next SHOPP cycle. Under the administration’s plan, Caltrans would add new PIDs to the shelf when the existing shelf of projects are programmed, such that the department will continually maintain a $500 million shelf of PIDs.

- $1.2 million reduction and 7 fewer positions due to various other workload adjustments.

In reviewing the Governor’s proposal, we identified three key concerns. Specifically, we find that there (1) is a lack of robust PID cost and workload data, which makes it difficult to assess the appropriateness of the level of resources being requested, (2) are existing resources potentially available to meet increased workload, and (3) is no need to create a shelf of SHOPP PIDs.

Lack of Robust Data Makes it Difficult to Determine Level of Resources Needed. While it appears reasonable to provide Caltrans with resources to develop additional SHOPP PIDs due to a projected $300 million annual increase in SHOPP funding, it is difficult to determine the specific level of resources needed. This is because the department has not made adequate progress in collecting the specific workload data that the Legislature directed it to collect as part of the 2013–14 budget package. Without such data it is unclear whether the requested level of resources is adequate to deliver the required level of work.

Existing Resources Potentially Available to Meet Increased Workload. Additionally, it is possible that Caltrans could meet the projected increase in PID workload with resources in its Capital Outlay Support (COS) program, which provides the staff support to deliver transportation infrastructure projects (such as project design and environmental review) after a PID is developed. Given the type of work involved in both the PID program and the COS program, there is considerable overlap in terms of the type of resources needed for each program. In our report, The 2014–15 Budget: Capital Outlay Support Program Review, we found that the COS program was significantly overstaffed for its current workload. On April 15, Caltrans will submit its annual budget request for the COS program. Based on this request, it is possible that COS resources could be redirected to meet the projected increase in PID workload.

Shelf of PIDs Not Needed. As noted above, the department is proposing to create a shelf of PIDS for projects totaling $500 million. We find that such a shelf lacks justification for two main reasons. First, Caltrans indicates a shelf of projects would better position the state to quickly spend unexpected increases in SHOPP funding to avoid the risk of losing such funds. We note, however, that the department has not experienced any challenges in programing projects in a timely manner when the state has received such increases in the past. For example, near the end of each federal fiscal year, the Federal Highway Administration typically redistributes unused federal spending authority (meaning funds not used) to the states based on each states’ share of total federal highway funding. In 2014, California’s share of this federal redistribution was significantly larger than anticipated at $191 million. Despite receiving more funds than expected, Caltrans was successfully able to use the funds without having a shelf of PIDs. This was done by advancing existing projects that were closer to the start of construction and not by utilizing a shelf of PIDs. Because PIDs are developed at the initial stage of a project and years of additional work (such as environmental review, project design, and right–of–way acquisition) must be completed after the PID is developed and before the project can begin construction, a shelf of PIDs is unlikely to assist Caltrans in quickly advancing the construction of projects when unexpected funding becomes available.

Second, we find that the development of a shelf of PIDs would likely result in a higher cost per PID. This is because PIDs that are not programmed immediately must be regularly updated to reflect changing costs and circumstances over time. For example, changing environmental circumstances may render a given project unfeasible. As such, project cost estimates must be updated every six months to a year on average. This means that PIDs that are not actually programmed within a given time frame (for example, if an increase in funding never materialized) will need to be updated at least once before they can be taken off the shelf and programmed. Updating cost estimates and potentially other information would require additional workload for Caltrans and, thus, increase the total cost of each PID produced. We also note that it is possible that the projects for which the shelf of PIDs were created may no longer be a priority by the time additional funding actually becomes available. Under the Governor’s proposal, the shelf of PIDs would be programmed after both existing PIDs and those that Caltrans will develop over the next two years based on the estimated level of funding for SHOPP. This means that it would likely be five to seven years before the shelf PIDs could be programmed into the SHOPP if unexpected funding does not become available. This increases the likelihood that the PID would need to be updated or that the project would no longer be a priority.

Require Caltrans to Report Why It Has Not Provided Requested Data. As indicated above, Caltrans has not annually reported the PID workload data that the Legislature required as part of the 2013–14 budget. Accordingly, we recommend that the Legislature require Caltrans to report at budget hearings this spring on (1) the reasons why it has not provided the requested data, (2) when the department plans to provide the data, and (3) the steps it is taking to ensure the necessary data is collected and reported.

Withhold Action on Proposed Resources to Develop PIDs for Increased SHOPP Funding. Until the department can provide more robust data to accurately determine the level of resources needed to complete a specified level of PIDs, we recommend the Legislature withhold action on the proposed $2.6 million and 18 additional positions. This would allow the Legislature to consider the request in conjunction with the department’s COS budget request.

Reject Proposed Resources to Develop Shelf of PIDs. In view of the concerns that developing a shelf of PIDs is both unnecessary and would likely increase state costs, we recommend that the Legislature reject the proposed increase in funding and positions to create a shelf of SHOPP PIDs. Specifically, we recommend reducing Caltrans’ budget for PIDs by 14 positions and about $2 million.

Overview of System. In order to anticipate and clear traffic incidents, provide traveler information, and manage traffic in a given corridor, Caltrans maintains a transportation management system (TMS) for the state’s highways. Currently, the TMS consists of more than 24,000 individual components, including numerous traffic signals, ramp meters, changeable messaging signs, highway advisory radios, closed circuit TV cameras (CCTVs), vehicle detection systems, and weather stations. This is an increase 5,000 components since 2007. The department’s Traffic Operations and Maintenance programs are responsible for operating and maintaining the various components of the TMS.

Federal Traffic Monitoring Standards. Federal regulations require monitoring of existing traffic and travel conditions with 85 percent accuracy and 90 percent information availability. These standards needed to be met for interstate highways by November 2012 and must be met for non–interstate routes on the state highway system by November 2016. Caltrans indicates that it is currently meeting these standards as they pertain to the interstate highways, but is not certain at this time whether it is meeting the requirements for non–interstate routes. The department is in the process of collecting data to determine its current rate. If Caltrans fails to meet the above federal requirements, it could be sanctioned by the Federal Highway Administration, such as by withholding project approval or making the department ineligible for certain federal transportation funds.

The Governor’s budget proposes $6.6 million from the SHA and 64 permanent positions for Caltrans to support the TMS. The request includes:

- $3.9 million and 44 positions to the Maintenance program to help adequately maintain and preserve the TMS. According to the administration, the department’s maintenance budget has not kept pace with the increase in the number of components added to the TMS in recent years (such as ramp meters and traffic signals). Specifically, the additional resources are intended to meet maintenance needs related to the increase in TMS components since 2007.

- $2.7 million and 20 positions to the Traffic Operations program to implement two TMS pilot projects on two highway corridors—one in Northern California and one in Southern California—to measure changes in traffic mobility and safety outcomes resulting from maintaining a TMS in accordance to federal requirements.

Existing TMS in Need of Maintenance. A well maintained TMS could help the state make more efficient use of the state’s existing highway system, which could reduce the need for additional highway capacity. While the number of components added to the TMS (such as ramp meters and traffic signals) has increased in recent years, the level of resources available to maintain the accuracy and operability of the different TMS components has been relatively flat. As a result, several required operational checks and preventative measures have not been completed. Such deferred maintenance has caused the current TMS to operate at less than full functionality, and can expedite the need to replace certain TMS components. For example, certain TMS components such as CCTV cameras require regular inspection to ensure proper operation and identify any failures or physical damage that may have occurred—such as from extensive use, an accident, or vandalism.

Proposed Pilot Programs Could Result in Various Benefits. . . As mentioned above, an effective and well maintained TMS could help the state make more efficient use of the existing highway system, as well as improve travel reliability and safety, by minimizing the need to make large investments to expand highway capacity. If implemented effectively, the two pilot programs proposed by the department could provide information on the most cost–effective TMS components, best practices in operating the TMS, the measurable benefits that can be achieved within a given corridor from maintaining an accurate and functional TMS system, and any implementation challenges.

. . .But Difficult to Assess Appropriate Level of Resources Required. According to Caltrans, it plans to complete implementation plans for the two proposed pilot programs by June 2015. Such plans should include key information regarding the design and evaluation of the pilot programs, including the corridors selected, workload and cost associated with each corridor, and a timeline of the projects. Absent this detailed information, it is difficult at this time for the Legislature to assess the appropriate level of resources required to implement the pilots as planned. Moreover, the department’s current timeline of providing the information in June would be too late for the Legislature to consider as part of its budget deliberations this spring.

In view of the above, we recommend that the Legislature:

- Approve Proposed Resources for TMS Maintenance. We recommend the Legislature approve the proposed funding and positions for the Maintenance program. This would allow Caltrans to make needed repairs and replacements to ensure that the components of the TMS are working as intended and in accordance to federal standards, improving the overall functionality of the system.

- Withhold Action on Proposed Pilot Projects Pending Additional Information. While the proposed pilot projects would allow Caltrans to better understand the potential benefits and proper operations of the TMS, the level of resources needed to effectively implement and evaluate the projects is unclear. This is because Caltrans has not provided sufficient detail regarding the pilot projects, including the scope of the pilot projects, the number and specific TMS components that will be tested, and a timeline for completion. Without such information, it is difficult for the Legislature to evaluate the additional resources proposed for the Traffic Operations program. Thus, we recommend that the Legislature withhold action on the requested resources until the department provides certain key information regarding the pilot projects.

- Require Caltrans to Provide Pilot Implementation Plans. As indicated above, Caltrans does not plan to provide the implementation plans for the pilots until June, which would not provide sufficient time for the Legislature to consider the plans as part of its deliberations on the 2015–16 budget. In order to allow the Legislature to effectively review this request, we recommend that the Legislature require Caltrans to provide the implementation plans by May 1. We also recommend requiring that these implementation plans include: (1) the specific highway corridors selected and the criteria used to select them, (2) the number and type of TMS components on the selected corridors, (3) the workload and cost associated with each corridor for the duration of the pilot, (4) the specific metrics that will be used to evaluate the effectiveness of the pilot projects, and (5) a timeline for completion. To the extent that Caltrans is not able to provide this information in time for the Legislature to consider this spring, the proposal could be resubmitted as part of the 2016–17 budget.

Chapter 796, Statutes of 1996 (SB 1420, Kopp), established the HSRA to plan and construct an intercity high–speed train that would link the state’s major population centers. The HSRA is an independent authority consisting of a nine–member board appointed by the Legislature and Governor. The Governor’s budget proposes total expenditures of $2.8 billion in 2015–16 for HSRA, an increase of $1.9 billion (or about three times) above the estimated expenditures in 2014–15. The growth is primarily due to an increase in construction activities and in grants for local transit projects that will support the operation of the high–speed rail. Below, we (1) provide an update on the high–speed rail project, (2) identify issues that could potentially delay the project and increase costs, and (3) make recommendations to increase legislative oversight over the project in order to monitor potential risks.

Construction of the High–Speed Rail Project. The HSRA plans to construct the high–speed rail project in two phases. The first phase of the project is planned to provide service between San Francisco and Anaheim by 2028. According to the authority’s 2014 business plan, the estimated cost of the first phase is $68 billion. The second phase of the project would expand service to Sacramento and San Diego. The authority has not provided an estimate at this time for the timeline or cost of the second phase. Work on the first phase of the project began in the Central Valley in 2012 on a segment extending 130 miles from Madera to Bakersfield. This segment—known as the ICS—represents 25 percent of the total construction planned in the first phase. The HSRA estimates completing construction of the ICS in 2018 at a total cost of $5.9 billion.

Funding Appropriated for High–Speed Rail. Since 2006–07, the Legislature has appropriated a total of $8.8 billion to the high–speed rail project. This amount includes (1) $4.7 billion in Proposition 1A bond funds, (2) $3.5 billion in federal funds, and (3) $650 million in cap–and–trade auction revenue. (The bond funds authorized in Proposition 1A require a match of at least 50 percent from other funding sources such as the state, federal, and local governments, or the private sector.) Of the total amount appropriated, about $6 billion is for the ICS, $2 billion to improve the connectivity of existing passenger rail systems with the high–speed rail system, and $650 million for other segments of the first phase of the project. In addition, the Legislature approved budget trailer legislation as part of the 2014–15 budget to continuously appropriate, beginning in 2015–16, 25 percent of annual cap–and–trade auction revenue for the planning and capital costs for the first phase of the high–speed rail project. The legislation specifies that such revenues could be used to repay any loans made to HSRA to fund the project. The Governor’s budget assumes that the continuous appropriation will provide $250 million in cap–and–trade revenue for the project in 2015–16.

High–Speed Rail Expenditures. Of the $8.8 billion appropriated thus far for high–speed rail, HSRA reports that $950 million has been spent through 2013–14. For 2014–15, the Governor’s budget assumes that the authority will spend $917 million. For 2015–16, the Governor’s budget assumes that the authority will spend $2.8 billion. Specifically, HSRA plans to spend $1.4 billion in Proposition 1A bond funds, $1.2 billion in federal funds, and $250 million in cap–and–trade auction revenues on capital expenditures. In addition, HSRA plans to spend $25.9 million in Proposition 1A bond funds on state administration.

HSRA Reporting Requirements. Existing state law requires HSRA to periodically report to the Legislature on the progress of the high–speed rail project. Specifically, HSRA must provide the following two reports.

- Business Plan. Chapter 267, Statutes of 2008 (AB 3034, Galgiani), requires HSRA to submit a business plan to the Legislature every two years. This plan must include the estimated capital costs for each segment, the expected schedule for initiating and completing construction for each segment of the first phase, the risks the project may encounter, and HSRA’s strategies to mitigate the identified risks. The next business plan is due by May 1, 2016.

- Project Update Report. Chapter 152, Statutes of 2012 (SB 1029, Committee on Budget and Fiscal Review), requires HSRA to provide a project update report every six months until the ICS is completed. This report must describe the overall progress of the project and provide key pieces of data on the progress of the ICS, such as the number of land parcels acquired by the state and actual and projected expenditures for each phase of the project. The next project update report is due by March 1, 2015.

Construction of the ICS. The HSRA has divided the construction of the ICS into four separate packages that will be completed by private contractors—referred to as Construction Packages 1, 2/3, 4, and 5. (The authority initially developed five construction packages, but later combined two of them into one package.) The first three construction packages will be for work to clear a path for high–speed rail through three distinct geographic areas, such as demolishing existing structures and building grade separations, tunnels, and bridges. Once the path is cleared, Construction Package 5 will be for work to place high–speed rail tracks throughout the entire ICS. According to HSRA, construction work has only commenced on Construction Package 1, which will clear the path between the cities of Madera and Fresno. Figure 4 provides a summary of HSRA’s geographic scope, timeline for completion, and current status of each of the four construction packages. For example, as shown in the figure, Construction Package 2/3 is for 60 miles between Fresno to the Tulare–Kern County line and is estimated to be completed in December 2018.

Figure 4

Initial Construction Segment Construction Packages

|

Construction

Package

|

Scope

|

Estimated

Completion

|

Contract Status

|

|

1

|

Madera to Fresno (29 miles)

|

January 2018

|

Contract awarded

|

|

2/3

|

Fresno to Tulare–Kern County line (60 miles)

|

December 2018

|

Contract awarded

|

|

4

|

Tulare–Kern County line to north of Bakersfield (30 miles)

|

December 2018

|

Bidding on contract in progress

|

|

5

|

Madera to north of Bakersfield (130 miles)

|

December 2018

|

Preparing to request bids

|

Key Nonconstruction Activities. The HSRA has identified certain key nonconstruction activities that must be completed by the state and private contractors before the ICS can be completed. Specifically, the authority must:

- Complete Environmental Review. Prior to beginning construction or acquiring land, HSRA must complete a series of statutorily required environmental reviews. For example, HSRA must identify the environmental impacts of each stage of the project in an Environmental Impact Report to comply with the California Environmental Quality Act.

- Obtain Necessary Permits. The authority must also obtain permits from various regional, state, and federal agencies in order to perform certain construction activities. For example, HSRA must obtain a permit from the California Public Utilities Commission to construct railroad crossings. Some permits require HSRA to mitigate the negative impacts of construction.

- Obtain Third–Party Agreements. The HSRA must obtain agreements with certain third–party stakeholders to relocate utilities, facilities, and railroads that are currently in the proposed path of the high–speed rail. For example, the authority must obtain agreements with railroad companies to relocate their railroad tracks that are in the path of the high–speed rail.

- Acquire Necessary Land. The authority must obtain the various land parcels on which construction will occur. The HSRA has identified 1,332 parcels that must be acquired in order to complete the ICS. A majority of these parcels are private land that can only be acquired after completing a series of “right–of–way” activities in accordance with state law. For example, HSRA must first provide a written offer to the owner of a property after contracting for an initial appraisal of the parcel, after which HSRA and the owner can negotiate on a price. If the property owner refuses to sell the land, the authority can then apply to the State Public Works Board for a “resolution of necessity” (RON), which certifies that acquiring the parcel is necessary to complete the project. Approval of a RON allows the state to acquire the parcel through eminent domain.

As of February 2015, HSRA reported that the majority of the key nonconstruction activities for all of the construction packages remain incomplete. For each of the first three construction packages, Figure 5 summarizes the authority’s progress on each key nonconstruction activity—permits, third–party agreements, and land acquisition. (Construction Package 5 is not included as nonconstruction activities are not required in order to place high–speed rail track.) As shown in the figure, HRSA has obtained only 50 percent of the regulatory permits and acquired only 23 percent of the parcels required to complete the ICS segment between the cities of Madera and Fresno under Construction Package 1. For each construction package, these nonconstruction activities must be completed before the contractors can finish construction. Thus, it appears that HSRA has a significant amount of nonconstruction activities to complete in order ensure that the ICS is completed by December 2018.

Figure 5

Progress on Key Nonconstruction Activities

As of February 2015

|

Construction

Package

|

Estimated

Completion

|

Environmental Review

|

Percent of Regulatory Permits Acquired

|

Percent of Third–Party Agreements Acquired

|

Percent of Parcels Acquired

|

|

1

|

January 2018

|

Complete

|

50%

|

43%

|

23%

|

|

2/3

|

December 2018

|

Complete

|

8

|

91

|

—

|

|

4

|

December 2018

|

Complete

|

—

|

92

|

—

|

To the extent that HSRA is unable to complete the various nonconstruction activities (such as land acquisition) as planned, it is possible that the ICS may not be completed by December 2018. Such a delay would likely cause the cost of the project to increase. In order to help ensure that the project is completed as planned and within budget, it will be important for the Legislature to oversee and measure the authority’s progress in completing the necessary nonconstruction activities. Such oversight would allow the Legislature to hold the HSRA accountable and determine if any additional steps must be taken to ensure completion, as well as mitigate any potential risks. In order to facilitate such oversight, the Legislature needs for each nonconstruction activity (1) specific benchmarks based on the time frame for when a given activity must be completed and (2) periodic data to measure whether each benchmark is completed.

Benchmarks for Completing Nonconstruction Activities. In order to perform oversight of the ICS, the Legislature must first obtain from HSRA specific benchmarks for each key nonconstruction activity that will result in its completion. For example, in order to complete Construction Package 1, the authority will need to acquire the right of way to all of the relevant parcels of land for that segment of the ICS by a certain date. As such, the authority should establish intervening benchmarks between now and the date when the activity should be completed (such as acquiring 50 percent of the right of way for Construction Package 1 by July 1, 2015), in order to ensure that this outcome is achieved as planned.

Data to Track Progress. In order to effectively track the authority’s progress in meeting each identified benchmark, specific outcome data for each nonconstruction activity must be collected and reported on a regular basis. Specifically, HSRA should periodically report on data for each construction package on the number and type of permits, third–party agreements, and parcels needed and acquired. For example, the project update reports that the authority is required to provide to the Legislature every six months could be modified to include the data necessary to monitor progress.

Given the state’s significant investment in the high–speed rail project, we recommend that the Legislature take steps to allow for adequate oversight of HSRA’s progress towards completing the ICS—particularly the various nonconstruction activities that need to be completed prior to its construction. Such oversight would enable the Legislature to proactively take any required actions to minimize cost increases or delays. Such steps could include changing how HSRA staff manages the project, modifying staffing levels at HSRA, and holding oversight hearings.

Establish Specific Benchmarks. First, we recommend the Legislature require HSRA to provide at budget hearings this spring a plan with benchmarks for completing each nonconstruction activity required for each construction package. This should include benchmarks for acquiring parcels, permits, and third–party agreements.

Require Data to Measure Progress. Second, we recommend that the Legislature require HSRA to periodically report on its progress in meeting the identified benchmarks. Specifically, we recommend amending existing statute to require the authority to include specific data in its project update reports to the Legislature every six months. For each construction package, the authority should provide the number and type of permits, third–party agreements, and parcels of land needed and acquired. Such additional information would allow the Legislature to more closely monitor HSRA’s progress in completing the ICS.

The primary mission of the CHP is to ensure safety and enforce traffic laws on state highways and county roads in unincorporated areas. The department also promotes traffic safety by inspecting commercial vehicles, as well as inspecting and certifying school buses, ambulances, and other specialized vehicles. The CHP carries out a variety of other mandated tasks related to law enforcement, including investigating vehicular theft and providing backup to local law enforcement in criminal matters. The operations of the CHP are divided across eight geographic divisions throughout the state.

The CHP operates 103 area offices across the state, which usually include a main office building for CHP staff, CHP vehicle parking and service areas, and a dispatch center. Beginning in 2013–14, the administration initiated a plan to replace five CHP field offices each year for the next several years. For both the current year and prior year, the Legislature has approved funding in accordance to this plan. Specifically, the 2013–14 budget included $1.5 million for advanced planning and site selection to replace up to five unspecified CHP area offices. Based on the results of this advanced planning, the 2014–15 budget provided (1) $32.4 million to fund the acquisition and design for five new CHP area offices in Crescent City, Quincy, San Diego, Santa Barbara, and Truckee and (2) $1.7 million for advanced planning and site selection to replace up to five unspecified additional CHP area offices.

The Governor’s budget provides $135 million from the MVA to fund the design and construction of five CHP area offices in Crescent City, Quincy, San Diego, Santa Barbara, and Truckee. The Legislature previously allocated funding for the planning, site selection, and acquisition of parcels for these planned facilities. The Governor’s budget also provides $1 million from the MVA for advanced planning and site selection to replace five additional area offices. The budget does not identify the specific five area offices that would be replaced.

In addition, the proposed budget includes provisional language to allow the Department of Finance to provide an augmentation from the MVA of up $2 million to CHP to secure purchase options for parcels. The purchase option would provide the state the exclusive right to purchase a parcel if the project is authorized. The cost of the purchase option is estimated to be about 10 percent of the parcel’s value, which the state would lose if the project is not authorized.

Proposal Would Impact Solvency of MVA. We recognize that many of CHP’s existing area offices have deficiencies that merit their replacement in the near future. However, as we discussed earlier in this report, we project that the MVA will become insolvent beginning in 2017–18 based in part on the Governor’s proposed expenditures from the MVA in 2015–16 and their impact in subsequent years, which includes the proposed replacement of CHP field offices. Thus, the Legislature will want to consider the $136 million proposed in the budget for CHP office replacement in the context of meeting its other priorities for MVA funding.

Proposed Budget Bill Language Circumvents Legislative Oversight. We find that the proposed budget bill language would limit the type of legislative oversight that is typically provided in the traditional facility replacement process. This is because the proposed language would not allow the Legislature to adequately review and approve the specific offices to be replaced, as well as the proposed scope and estimated cost of each office, before the state commits funding to purchase the actual property. This is problematic in that making changes to the scope of the project after the property is chosen and money is spent to secure it becomes more challenging.

In view of the above, we recommend the Legislature withhold action on the Governor’s proposal pending consideration of its various priorities regarding expenditures from the MVA, given the fund’s projected insolvency beginning in 2017–18. To the extent that the Legislature decides to approve the proposed funding for CHP office replacements, we would recommend rejecting the proposed budget bill language authorizing CHP to secure purchase options for parcels, as it would circumvent legislative oversight.

The DMV is responsible for registering vehicles and for promoting safety on California’s streets and highways by issuing driver licenses. Currently, there are 24 million licensed drivers and 30 million registered vehicles in the state. Additionally, DMV licenses and regulates vehicle–related businesses such as automobile dealers and driver training schools, and collects certain fees and tax revenues for state and local agencies.

The DMV operates 313 facilities, which include customer service field offices, telephone service centers, commercial licensing facilities, headquarters, and driver safety and investigations offices. Over half of DMV facilities are customer service field offices. According to DMV, most of its field offices are programmatically deficient. For example, the department reports that many customer service field offices were built in the 1960s and 1970s and are not sufficiently sized to accommodate the number of customers who currently use the offices. This is primarily because of population increases in the areas served by the offices. In addition, DMV reports that certain customer service field offices are seismically deficient, which creates safety risks.

The Governor’s budget for 2015–16 requests a total of $4.7 million from the MVA for DMV to begin replacement of several of its facilities, specifically those most in need of replacement. This request reflects the initial phase of the administration’s multiyear plan to replace eight DMV facilities over the next several years. Specifically, the budget proposes:

- $1 million to fund the acquisition plan phase of the Delano field office replacement project. The proposed facility would be 10,718 square feet with a total cost of $11.5 million. The current Delano field office is in a leased facility of 3,386 square feet that was built in 1954.

- $1 million to fund the preliminary plan phase of the Inglewood field office replacement project. The proposed facility would be 15,042 square feet with a total cost of $14.9 million. The current Inglewood field office of 20,824 square feet was built in 1972, which includes DMV investigations offices that will not be included in the new facility—resulting in the smaller square footage.

- $2.6 million to fund the acquisition plan phase of the Santa Maria field office replacement project. The proposed facility would be 13,342 square feet with a total cost of $15.5 million. The current Santa Maria field office of 4,387 square feet was built in 1969.