All Articles

- Proposition 2 and Revenue Volatility. Over time, this blog will include more discussions about state budget revenue volatility. California's tax revenue volatility relates largely, but not entirely, to the volatility of the large portion of overall state taxes paid by the state's highest-income taxpayers. In November 2014, voters approved Proposition 2, a measure with provisions intended to help address revenue volatility effects on the state budget. In the November 2014 Voter Information Guide, our office prepared an analysis of Proposition 2, including its provisions to deposit certain state revenues (such as some capital gains taxes) in designated budget reserve accounts.

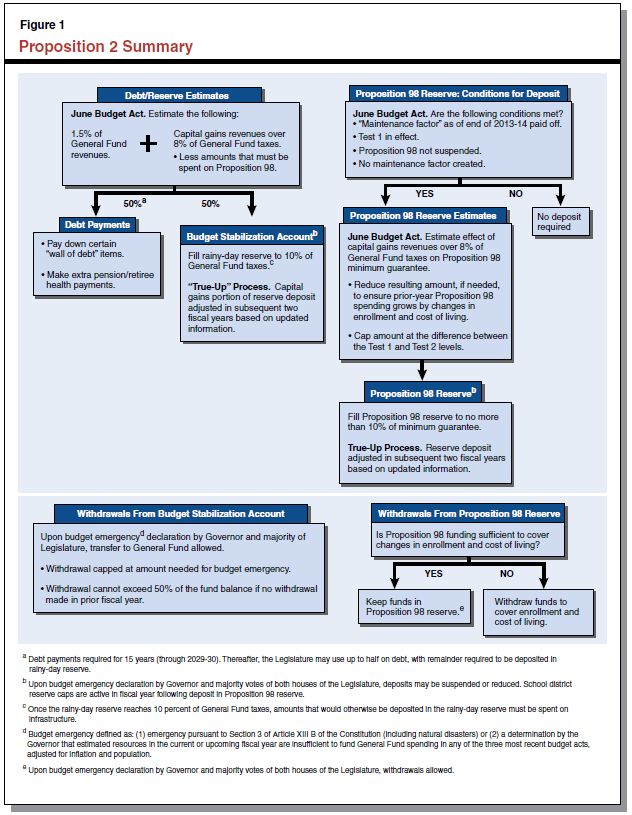

- Highly Complex Interactions With Other Budget Formulas. Proposition 2 is highly complex and will influence key decisions concerning the state’s reserve and debt policies. Due to interactions with the Proposition 98 funding formula for schools and community colleges, Proposition 2 will sometimes produce results that are difficult to predict and counterintuitive. The state will have various choices to make when implementing Proposition 2. We discussed some of those choices in Chapter 4 of our November 2014 Fiscal Outlook publication and in our March 2015 publication on the Governor's Proposition 2 budget proposal. Below is a flow chart summarizing how Proposition 2 works.

Updated April 23, 2015 to add link to March 2015 Proposition 2 analysis.