February 2, 2012

Pursuant to Elections Code Section 9005, we have reviewed the

proposed statutory initiative

(A.G. File No. 11‑0100) that would increase personal income tax rates

and dedicate revenues for K-12 education, early care and education

programs, and bond debt-service payments.

Background

State’s Fiscal Situation. California’s

General Fund, the state’s core account that supports a variety of

programs (such as public schools, higher education, health, social

services, and prisons) has experienced chronic shortfalls in recent

years. During this period, policymakers have taken actions to reduce

expenditures for a variety of public programs and temporarily raised

certain taxes between 2009 and 2011. State General Fund shortfalls of

several billion dollars per year are expected to continue over at least

the next few years under current tax and expenditure policies.

Personal Income Tax. The state’s personal

income tax (PIT) imposes rates ranging from 1 percent to 9.3 percent on

the portions of a taxpayer’s income in several income brackets, with the

9.3 percent rate applying to income in excess of $48,029 for single

filers and $96,058 for joint filers. The PIT revenue, which is deposited

into the General Fund, totaled $49.5 billion in 2010‑11. An additional

1 percent tax applies to income over $1 million, with associated

revenues dedicated to mental health services.

Proposition 98 Funding. In 1988, voters

approved Proposition 98. Including later amendments, Proposition 98

establishes a guaranteed minimum annual funding level—commonly called

the minimum guarantee—for K-14 education (consisting of schools and

community colleges). The minimum guarantee is funded through a

combination of state General Fund revenues and local property tax

revenues. In 2011‑12, schools and community colleges received

$48.7 billion in Proposition 98 funding. Of that amount, $43 billion was

allocated to

K-12 local education agencies (LEAs)—school districts, county offices of

education, and charter schools. The calculation of the minimum guarantee

depends on a number of factors, including the year-to-year changes in

General Fund revenues, student attendance, and California per capita

personal income. With a two-thirds vote in any given year, the

Legislature can suspend the Proposition 98 guarantee for one year and

provide any level of K-14 funding it chooses.

Early Care and Education (ECE). In 2011‑12,

state and federal funds provided roughly $2.5 billion to offer a variety

of child care and preschool programs for approximately 530,000, or about

15 percent, of California children ages five and younger. Standards and

characteristics—including staff qualifications, curriculum, and

adult-to-child ratios—vary across individual programs. In general,

participation in these publically subsidized programs is reserved for

families that display “need.” Eligibility criteria include low family

income, participation in the California Work Opportunities and

Responsibility to Kids program or other work or training activities,

and/or children with special needs. Because of funding limitations,

waiting lists for subsidized programs are common in most counties. As of

June 2010, about 125,000 eligible children under the age of five were

waiting for a slot in one of the state’s subsidized programs. Limited

data are available on children’s participation in non-subsidized

programs.

General Obligation Bond Debt Service. Bond

financing is a type of long-term borrowing that the state uses to raise

money, primarily for long-lived infrastructure assets (including school

and university facilities, highways, streets and roads, land and

wildlife conservation, and water-related infrastructure). The state

obtains this money by selling bonds to investors. In exchange, the state

promises to repay this money, with interest, according to a specified

schedule. The majority of the state’s bonds are general obligation

bonds, which must be approved by the voters and are guaranteed by the

state’s general taxing power. General obligation bonds are typically

paid off with annual debt-service payments from the General Fund.

Proposal

This measure increases rates on the vast majority of Californian

personal income taxpayers and uses the funds for schools, ECE programs,

and state debt-service payments. We discuss these proposals in further

detail below.

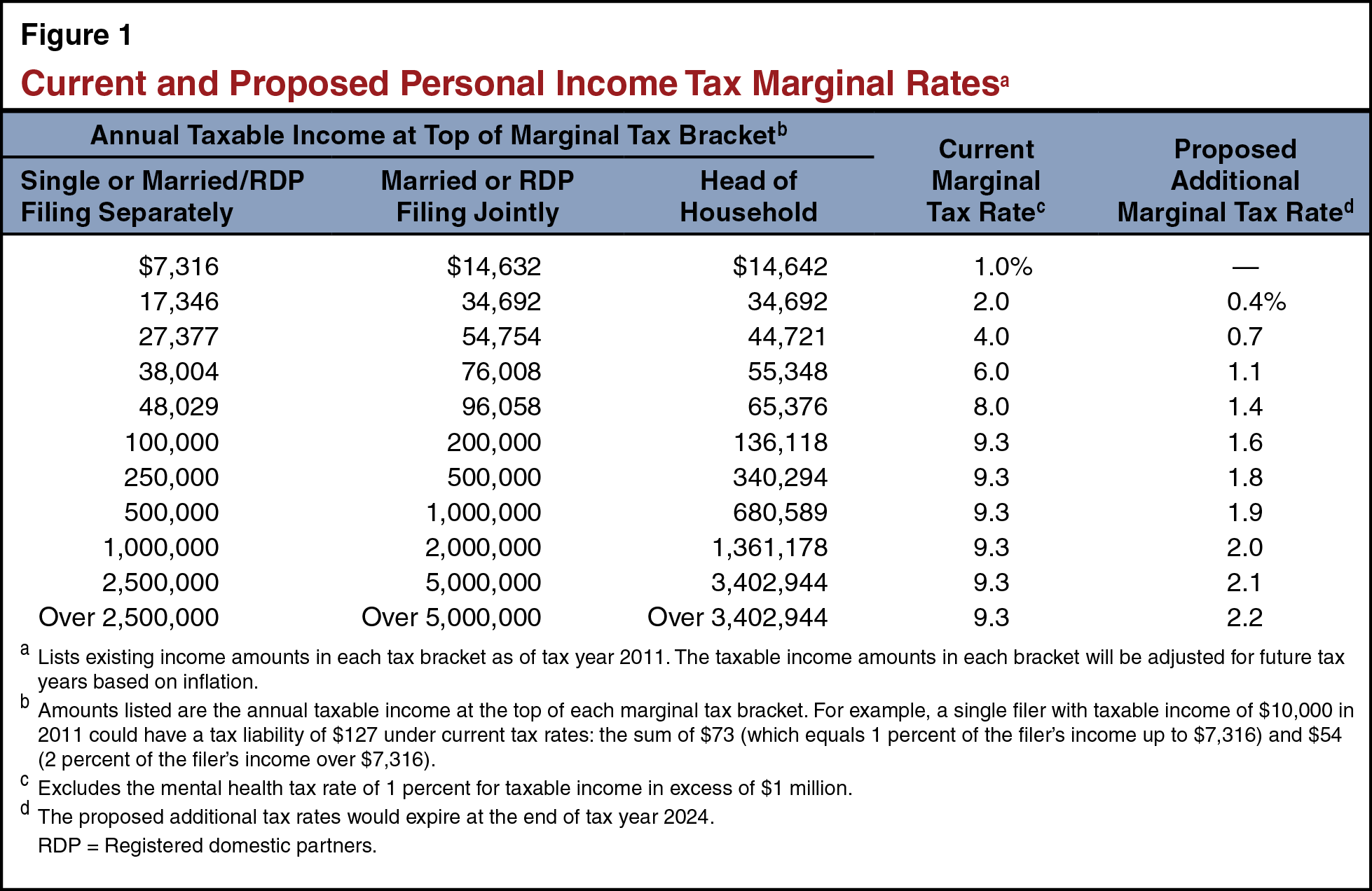

Increases PIT Rates Through 2024. As shown

in Figure 1 (see next page), this measure increases PIT rates on all but

the lowest income bracket, effective beginning in 2013 and ending in

2024. The additional marginal tax rates would be higher as taxable

income increases. For income of PIT filers currently in the highest

current tax bracket (9.3 percent marginal tax rate, excluding the mental

health tax), additional marginal tax rates would rise as income

increases. For example, as shown in Figure 1, an additional 1.8 percent

marginal tax rate would be imposed on income of joint filers between

$200,000 and $500,000 per year and an additional 2.2 percent marginal

tax rate would be imposed on income of joint filers over $5 million per

year. The income levels in the tax brackets shown in Figure 1 would be

indexed for inflation. The current mental health tax would continue to

be imposed.

Funds for Debt Service Through 2016‑17. The

revenues raised by the measure would be deposited into a newly created

California Education Trust Fund (CETF). Until the end of 2016‑17,

30 percent of revenues deposited into the CETF would be used by the

state to pay bond debt-service costs. The measure requires that these

funds first be used to pay education debt-service costs

(pre-kindergarten through university school facilities). If, however,

the state has no outstanding education debt-service costs, CETF funds

can be used to pay other general obligation bond debt-service costs.

These funds would offset the state’s General Fund costs and would

provide state General Fund savings.

Allocates Funds for Schools and ECE Programs.

For the first few years of the measure, all remaining CETF

funds would be allocated for schools and ECE programs. Beginning in

2015‑16, total CETF allocations to schools and ECE programs could not

increase at a rate greater than the average growth in California

personal income per capita in the previous five years (except for

2017‑18, when allocations can increase at a higher rate, since

30 percent of funds would no longer be required to be allocated for

debt-service relief). Of the funds available for allocation, 85 percent

would go to schools and 15 percent would go to ECE programs. The measure

also prohibits CETF monies from being used to replace state, local, or

federal funding that was in place prior to November 1, 2012. All revenue

collected by the measure and allocations made to schools are excluded

from the calculation of the Proposition 98 minimum guarantee.

Excess Funds Used for Debt-Service Payments.

Beginning in 2015‑16, the measure requires any CETF monies

collected in excess of the growth rate limit described above also be

used by the state to pay debt-service costs. As with the debt-service

payments mention above, first call on these payments would be to retire

education-related debt-service costs.

Provides Three Grants to Schools. The

measure requires CETF allocations to schools be provided through three

different grants: educational program grants (70 percent of K-12

allocations); low-income per-pupil grants (18 percent); and training,

technology, and teaching materials grants (12 percent). Educational

program grants are distributed on a per-pupil basis depending on the

grade of each student, with students in higher grades receiving more

funding than students in the lower grades. Low-income per-pupil grants

are allocated based on the number of low-income students (defined as the

number of students eligible for free meals) enrolled in each school.

These two grants can be spent on a broad range of activities, including

instruction, school support staff (such as counselors and librarians),

and parent engagement. Training, technology, and teaching materials

grants are provided on a per-pupil basis and can be used for

professional development activities, new technology, or teaching

materials. The governing board of the LEA has sole authority over how to

spend CETF funds.

Includes Several School-Site Spending Restrictions.

Up to 2 percent of a school district’s allocation can be used

to cover the district’s audit, budget, public meeting, and reporting

requirements. The remaining funds allocated must be spent at the

specific school where the associated student enrollment funding is

generated. In the case of low-income per-pupil grants, for example, if

100 percent of low-income students in a school district are located in

one particular school, all associated grant funds must be spent at that

specific school. The measure also prohibits CETF funds from being used

to provide salary or benefit increases for personnel, unless the

increases are provided to other like employees that are funded with

non-CETF monies.

Creates New School Reporting Requirements.

The measure includes several reporting requirements for LEAs. Most

notably, the measure requires all LEAs to create and publish an online

budget for every school within the LEA’s jurisdiction. The state

Superintendent of Public Instruction must provide a uniform format for

budgets to be reported and must make all budgets statewide available for

the public. The LEA governing boards also must seek input from the

public on how to spend CETF funds and explain how CETF expenditures will

improve educational outcomes and how those improved outcomes will be

measured. In addition, LEAs must provide a report on how CETF funds were

spent at each school within the LEA’s jurisdiction within 60 days after

the close of the school year.

Expands ECE Programs. CETF allocations to

the state’s ECE system is provided for programs benefiting children ages

five and younger. Of this amount, the first $300 million allocated each

year would need to be used to restore recent state budget reductions to

existing child care programs. The majority of remaining funds would be

used to expand the number of children from low-income families served in

publicly funded child care and preschool programs. The measure also uses

new revenues to establish a quality rating scale by which to assess the

effectiveness of ECE programs; allocates supplemental funding to those

programs achieving higher ratings on that scale; and establishes a new

state database to collect and maintain information on ECE programs and

participants.

Cannot Be Amended by the Legislature. If

adopted by voters, this measure could only be amended by a future ballot

measure approved by majority vote in a statewide election. The

Legislature would be prohibited from making any modifications to the

measure.

Fiscal Effect

Additional State Revenues. If approved, the

measure’s tax provisions would take effect January 1, 2013. In 2013‑14

(reflecting a full-year fiscal effect), estimates of the additional

state revenues that would be generated from the proposed PIT rate

increases currently range from about $10 billion (based on the current

Legislative Analyst’s Office revenue forecast) to about $11 billion

(based on the current Department of Finance revenue forecast). (In

2012‑13, the partial-year effect would be additional revenues of about

half this amount.) The total revenue generated would tend to grow over

time, but be somewhat volatile due primarily to the volatility of income

for upper-income filers. Most of the income reported by upper-income

filers is related in some way to their capital investments, rather than

wages and salary-type income, and can change significantly from one year

to the next.

Initial State Debt Service Relief. Until

the end of 2016‑17, the measure would use 30 percent of CETF monies to

pay for state debt-service costs, resulting in associated state General

Fund savings. In 2013‑14, the first full fiscal year of this measure, we

estimate the measure would provide $3 billion to $3.3 billion in state

savings, with savings tending to grow over the next few years.

Funds for Schools and ECE Programs.

Initially the measure would allocate roughly $6 billion to $6.5 billion

for schools and $1.1 billion to $1.2 billion for ECE programs with funds

tending to grow through 2016‑17. Beginning in 2017‑18, annual

allocations would increase substantially as funds would no longer be

dedicated to debt service relief. Given these revenues are excluded from

the Proposition 98 calculations, the minimum guarantee would be

unaffected by this measure. Accordingly, funding distributed to these

educational entities under this measure would be in addition to their

annual Proposition 98 funding.

Beginning in 2015‑16, Likely Some Additional Debt-service

Relief. The measure is also likely to provide General Fund

relief on bond debt-service costs in some subsequent years that the

measure is operative due to the requirement that growth in CETF funds

greater than the five-year average growth in per capita personal income

be used for debt-service relief. Because PIT revenues would increase as

population growth increases, they likely would grow at a faster rate

than per capita personal income. In addition, because PIT

revenues are more sensitive to swings in the capital gains of

upper-income earners, they tend to be considerably more volatile than

the five-year average growth in per capita personal income, often

exceeding that growth rate. When PIT revenues outpace the five-year

rolling average of per capita personal income, the measure would require

the excess to be used for debt-service costs. Using CETF funds to offset

these costs would result in General Fund savings. The exact amount of

associated General Fund savings would depend in the difference in the

PIT and per capita personal income growth rates, but state savings

easily could be several hundred million dollars per year.

Interaction With Rest of State Budget. The

measure would help the state balance its General Fund budget from

2012‑13 through 2016‑17 by providing roughly 30 percent of the revenues

for debt-service relief. These savings would be about $1.5 billion in

2012-13 and $3 billion in

2013-14, tending to grow thereafter until 2016-17. In subsequent years,

the vast majority of revenues raised by this measure would directly

benefit schools and ECE programs, with little corresponding state

General Fund savings.

Summary of Fiscal Effect

- Increased state personal income tax revenues beginning in 2013

and ending in 2024. Estimates of the revenue increases vary from

$10 billion to $11 billion per fiscal year beginning in 2013-14,

tending to increase over time. The 2012-13 revenue increase would be

about half this amount.

- Until the end of 2016‑17, 60 percent of revenues would be

dedicated to K-12 education and 10 percent would be provided to

early care and education programs. These allocations would

supplement existing funding for these programs. In 2017‑18 and

subsequent years, 85 percent would be provided to K-12 education and

15 percent to early care and education.

- General Fund savings on debt-service costs of about $1.5 billion

in 2012-13 and $3 billion in 2013-14, with savings tending to grow

thereafter until the end of 2016‑17. In 2015‑16 and subsequent years

with stronger growth in state personal income tax revenues, some of

the revenues raised by this measure—several hundred million dollars

per year—would be used for debt-service costs, resulting in state

savings.

Return to Propositions

Return to Legislative Analyst's Office Home Page