2013

Other Budget Issues

| Last Updated: | 3/15/2013 |

| Budget Issue: | Collective bargaining for CSU employee health care premiums. |

| Program: | CSU |

| Finding or Recommendation: | Either (1) adopt the Governor’s January proposal to apply the same minimum employer health care contribution rate to CSU as currently applied to most other the state agencies or (2) remove the standard for CSU from statute altogether, thereby treating CSU similar to UC and Hastings. |

Further Detail

Background

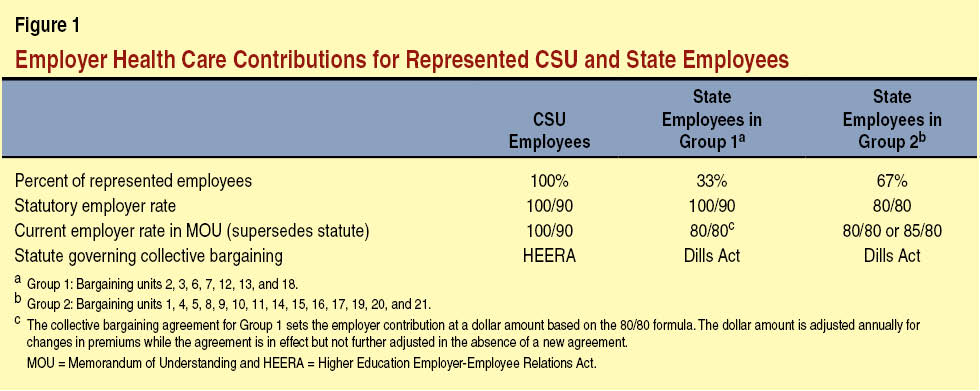

Employer Contributions to California State University (CSU) and State Employee Health Care Costs Governed by Statute . . . Current law requires CSU to pay 100 percent of the average health care premium for all employees and 90 percent of the average additional premium for employees’ family members. This is known as the 100/90 formula. In contrast, current law requires the state to pay 80 percent or 85 percent of the average health care premium for many (but not all) other state employees, and 80 percent of the average additional premium for these employees’ family members (known as the 80/80 or 85/80 formula).

. . . And Collective Bargaining. For both CSU and the state, the law further specifies that if agreement on a different employer contribution rate is reached through collective bargaining, then that rate takes precedence over the rate set in statute. For all state employee groups, collective bargaining agreements have resulted in employer contributions based on the 80/80 or 80/85 formula. (The state has the authority to set the rate for nonrepresented employees and typically sets it at a level similar to that for represented employees.)

Separate Rules for Collective Bargaining. The CSU and the state are subject to different statutes governing collective bargaining. The State Employer-Employee Relations Act of 1978, known as the Ralph C. Dills Act (Dills Act), established collective bargaining for state government employees. The Higher Education Employer-Employee Relations Act (HEERA) of 1979 established collective bargaining for CSU, the University of California (UC) and Hastings College of Law (Hastings). Although the rules for collective bargaining are similar under these laws, some differences exist. One of the major differences is that under the Dills Act, the Legislature must ratify all collective bargaining agreements whereas under HEERA, the universities’ governing bodies approve agreements.

Another Difference Affecting Health Care Bargaining. Another difference in the bargaining rules is that, in the event of a bargaining impasse, the state may, with legislative approval, impose employer health care contribution rates as part of a last, best, final offer (LBFO). (Any imposed rates must have been included in the bargaining negotiations.) In contrast, CSU lacks the authority to impose employer health care contribution rates as part of a LBFO. As a result, the CSU employer contribution would remain at the 100/90 formula in the event of an impasse.

Figure 1 summarizes the differences in rates for CSU and state employer health care contributions.

CSU Has Not Bargained Health Care Contribution. Although current law permits CSU to determine the employer health care contribution through collective bargaining—along with other compensation and conditions of employment—the university has not done so to date. University officials report that current restrictions preventing CSU from imposing health care contribution rates as part of a LBFO puts them in a weak negotiating position on this issue. As a result, CSU reports that it has not attempted to negotiate the employer contribution.

Governor’s Proposal

Requires Collective Bargaining on Employer Health Care Contribution, Within Specified Range. The Governor proposes statutory changes to require (rather than permit) that CSU’s employer contribution for represented employee groups be determined through the collective bargaining process. (The proposal also would authorize the CSU Board of Trustees to set the employer contribution for nonrepresented CSU employees, as the state currently does for other nonrepresented employees.) Under the proposal, the CSU employer contribution would be a flat dollar amount equal to no less than 80 percent of the average health care premium for state employees. The dollar amount would be adjusted annually as long as a memorandum of understanding is in effect but not annually adjusted without a negotiated agreement.

Authorizes CSU to Impose Employer Health Care Contribution as Part of a LBFO. Another change the Governor proposes is to allow CSU to impose an employer health care contribution as part of a LBFO. In this event, the rate imposed can be no less than the 80/80 formula.

Assessment

Current Law Treats CSU Inconsistently. For some aspects of collective bargaining, CSU is treated similarly to UC and Hastings and differently from other state agencies. For example, most university bargaining issues are covered by HEERA, and the universities’ governing boards rather than the Legislature ratify agreements. Similarly, the universities fund changes in salary and health care costs out of their base appropriations and do not receive automatic funding adjustments for these costs as other state agencies typically do after a bargaining agreement is approved by the Legislature. For other aspects of collective bargaining, CSU is sometimes treated more like other state agencies and differently from UC and Hastings. For example, CSU has a statutory formula for health care contributions, unlike UC and Hastings. In still other cases, CSU differs from both the state and the other universities. For example, CSU cannot impose lower health care contributions as part of a LBFO, whereas the other universities have this authority and the state can impose rates with legislative approval.

Governor’s Proposal Treats CSU More Like Other State Agencies. By authorizing CSU to impose employer contribution rates as part of a LBFO, the Governor’s proposal treats CSU similar to the state. (The lack of legislative involvement in a LBFO imposed by CSU, however, is a significant difference between the existing state process and the proposed CSU processes.) By reducing the statutory formula for CSU’s employer health care contribution rate to 80/80, the proposal also aligns CSU’s statutory formula with the formula used for most state employees.

Alternative Approach Would Treat CSU More Like UC and Hastings. In contrast, if the Legislature wishes to treat CSU more like UC and Hastings for determining health care contributions, it could remove the formula for CSU employer contributions from state statute altogether. Under this approach, CSU would determine its contribution rate solely through collective bargaining (for represented employees) and Trustee action (for nonrepresented employees), as is the case for UC and Hastings.

Proposal Changes Bargaining Relationship. By definition, any change in rules affecting collective bargaining changes the relationship between the parties at the bargaining table. Whether such a change “tips the scale” in one direction or “levels the playing field” depends on one’s assessment of the current bargaining rules, which are in turn the result of many statutory changes over time. Our assessment is that the proposed change may make it more likely that CSU and its represented employee groups agree to change the employer health care contribution, without necessarily affecting total compensation. That is because a change in one area of compensation is often offset by a corresponding change in another area. For example, a lower employer health care contribution could free up funds for a salary increase.

Conclusion

We do not see a strong rationale either for maintaining the current 100/90 statutory formula for CSU employer health care contributions or excluding the CSU employer health care contribution from the terms CSU may impose following a LBFO, as the state (with legislative approval) and other universities have this authority. To make CSU more consistent with the state, the Legislature could change the formula and provide greater bargaining authority to CSU, as the Governor proposes. Alternatively, the Legislature could make CSU more like UC and Hastings by eliminating the formula altogether so that CSU health care contributions would be determined solely through the collective bargaining process. In either case the Legislature will be changing the status quo and very likely affecting CSU negotiations.