Update (3/13/17): We have updated these posts to include health insurance premium subsidies and cost-sharing reductions to insurers. In this update, we also revised some estimates of refundable tax credits to include more recent and accurate data.

LAO Contact

Budget and Policy Post

January 18, 2017Federal Spending in California

Direct Federal Payments to Individuals, Private Entities, and Universities in California

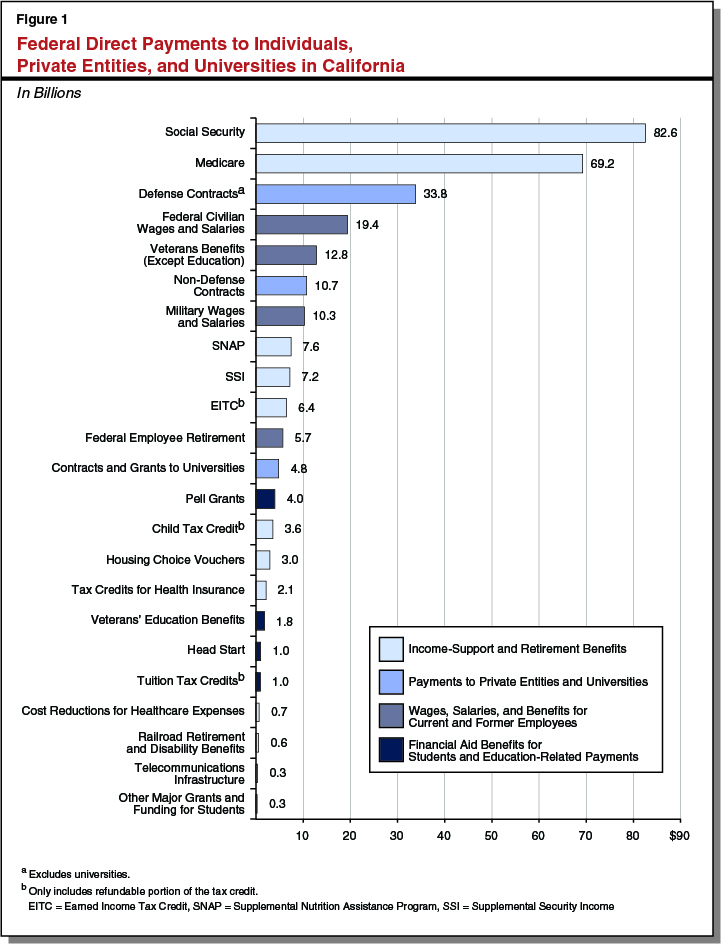

In this post we provide more details on those federal payments that are made directly to individuals, private entities (including businesses, healthcare intermediaries, non-profit organizations), and universities (including private universities, the University of California, and California State University). Together, these payments represent about 77 percent of the total $376 billion annual federal expenditures in California. Figure 1 shows the federal payments by program in four categories:

- Income-Support and Retirement Benefits are benefits the federal government pays directly to or on behalf of individuals to increase their incomes or support basic costs of living (such as food, housing, and healthcare).

- Payments to Private Entities and Universities are payments the federal government makes to businesses and universities in exchange for goods and services (through contracts) or to fund research and development (primarily, through grants).

- Wages, Salaries, and Benefits for Current and Former Federal Employees includes payments by the federal government to its current employees, including members of the armed services, and retirees, including veterans, and pensions for civilians.

- Financial Aid to Students largely includes financial assistance to students attending institutions of higher education in California, but also includes funding veterans enrolled in vocational training.

- Education-Related Payments includes other federal payments that are made directly to private entities (rather than the state government or individuals) to support education in the state.

Other Income-Support Benefits for In-Kind Assistance and Tax Credits. Our category of Income-Support and Retirement Benefits also includes federal in-kind assistance, which are benefits that pay for goods and services instead of cash payments. In addition to Medicare, these in-kind programs include: (1) the Supplemental Nutrition Assistance Program (SNAP), which provides food assistance to low-income individuals and (2) Housing Choice Vouchers, which provide assistance to very low-income families for housing. Counties administer SNAP, but the federal government paid the $7.6 billion in SNAP benefits directly to California grocers (we include costs to administer the SNAP program in payments to the state government, which are ultimately allocated to counties). In FFY 2014-15, the federal government also allocated $3 billion in Housing Choice Vouchers to local housing authorities, which then distribute them to individuals.

Finally, this category includes the refundable portion of two major tax credits: the Earned Income Tax Credit (EITC), which provides a refundable tax credit to low- to moderate-income working individuals and couples; and the Child Tax Credit, which provides refundable tax credits to eligible low-income families with children. This category also includes the entire amount of insurance premium subsidies provided to low income Californians to purchase health insurance coverage. All together, these credits provide about $12 billion in benefits to Californians.

Most Payments to Private Entities in California for Defense Contracts. In FFY 2013-14, the federal government paid about $45 billion in contracts to private entities in California for the provision of goods and services. Most of these contracts, nearly $34 billion, were procured for goods and services for the U.S. Department of Defense.

Federal Government Paid $5 Billion in Contracts and Grants to Universities. We estimate contract and grant payments to all California higher education institutions, mainly for research and development, were nearly $5 billion in FFY 2012-13. This includes $2.8 billion to University of California institutions, $1.8 billion to private universities, and nearly $200 million to California State University institutions.

Federal Wages, Salaries, and Benefits for Current and Former Employees. Around 2015, the federal government paid about $48 billion annually in wages and salaries for current employees and benefits for former employees who live in California. The government paid $19.4 billion in wages to the roughly 245,000 federal civilian employees (including U.S. Postal Service employees) who live in California. The federal government paid an additional $10.3 billion in wages and salaries to members of the armed forces (including Coast Guard employees) and the Reserves (including the National Guard). In FFY 2014-15, the federal government paid nearly $13 billion in benefits for veterans, including for disability compensation and pension, insurance and indemnities, and medical care (we include veterans’ benefits for education in aid to students).

Financial Aid to Students in California. In FFY 2014-15, the federal government provided $4 billion in Pell Grants to recipients attending all private and public higher education institutions in California. Pell Grants provide assistance to low-income undergraduate and certain postbaccalaureate students for tuition and other expenses. In that year, the federal government also provided $1.8 billion in funding for education and vocational training for veterans and, in 2014, $1 billion in the refundable portion of federal education tax credits.

Education-Related Payments. The federal government also provides some payments that support education in the state, but are paid directly to private entities, rather than the state government or individuals. In FFY 2014-15, this federal funding included nearly $1 billion in grants to providers for early childhood education and other parental services through the Head Start program. These funds also included about $300 million in payments to telecommunications companies to provide discounts to schools and libraries for internet access and other telecommunication services.