LAO Contact

June 24, 2016

MOU Fiscal Analysis: Bargaining Unit 7 (Protective Services and Public Safety)

This analysis of the proposed labor agreement between the state and Bargaining Unit 7 (Protective Services and Public Safety) fulfills our statutory requirement under Section 19829.5 of the Government Code. State Bargaining Unit 7’s current members are represented by the California Statewide Law Enforcement Association (CSLEA). The administration has posted the agreement and a summary of the agreement on its website. The union also has posted a summary of the agreement on its website. (Our State Workforce webpages include background information on the collective bargaining process, a description of this and other bargaining units, and our analyses of agreements proposed in the past.)

If this proposal is approved by the Legislature and Unit 7 members, the Governor would achieve his goal of implementing a funding plan for retiree health benefit liabilities and reducing retiree benefits for future Unit 7 members. These actions would lower state retiree health costs significantly over the long term. In order to reach this agreement, however, the Governor agreed to propose various pay and benefit increases for Unit 7 members in the near term. (He has chosen to do this for other state bargaining units too—see our analyses of agreements with Units 6 [Corrections], 9 [Professional Engineers], 10 [Scientists], and 12 [Craft and Maintenance].) These proposed pay and benefit increases—along with the state contributions to match employee payments to a retiree health funding account—would be a significant new budgetary commitment for the state with both near- and long-term effects on state obligations.

Major Provisions of Proposed Agreement

If ratified by the Legislature and the CSLEA membership, this agreement would be in effect through July 1, 2019 and would increase the state’s annual costs for these employees over the course of four fiscal years. In the sections below, we discuss the provisions of the proposed agreement that affect employee pay, employee health benefits, and retiree health benefits.

Salary and Pay

Provide Three General Salary Increases. The proposed agreement would increase pay by a specified percentage for all Unit 7 members on three separate occasions—3 percent on July 1, 2016, 3 percent on July 1, 2017, and 2 percent on July 1, 2018. This is a cumulative increase of 8.2 percent over the course of the agreement. These salary increases also increase state costs for salary-driven benefits, including state contributions to employees’ pension and Medicare benefits.

Provide Classification-Specific Salary Increases. In addition to the general salary increases discussed above, the agreement would provide employees of specified classifications (about 38 percent of Unit 7 members) additional pay increases on July 1, 2016. The administration indicates that these salary increases are necessary to address recruitment and retention issues with affected classifications. These salary increases also increase state costs for salary-driven benefits.

One 5 Percent Salary Increase. The agreement would provide an additional 5 percent salary increase to about 2,300 rank-and-file employees employed in specified classifications—including communication operators, park rangers, and investigators. Between this pay increase and the general salary increases discussed above, these employees would receive a cumulative salary increase of 14 percent over the course of the agreement.

Alcoholic Beverage Control (ABC) Agent Pay Range Adjustments. The agreement would adjust the pay ranges for the Agent Trainee and Agent classifications at ABC—affecting about 145 employees. The Agent classification has three alternate pay ranges—A, B, and C—depending on an employee’s level of experience. The administration indicates that most affected employees currently are paid at the top step of Range C. As Figure 1 shows, the proposed adjustments to steps in each pay range varies with the largest adjustment made to the top step of Range C. Pursuant to the agreement, these salary adjustments would be phased in over time. Affected employees would receive (1) a specified pay increase in 2016‑17, as shown in Figure 1 and (2) merit salary adjustments in subsequent years until paid at the top step of the pay range. For example, an employee currently at the top step of Range C would receive a 5.14 percent salary adjustment in 2016‑17, a 5 percent merit salary adjustment in 2017‑18, and a merit salary adjustment in 2018‑19 bringing the employee to the new top step of the salary range. Between these pay increases and the general salary increases discussed above, an agent paid at the top step of Range C would receive a 22 percent pay increase over the course of the agreement.

One 3 Percent Salary Increase. The agreement would provide an additional 3 percent salary increase to about 260 rank-and-file employees employed in the Motor Carrier Specialist I classification. Between this pay increase and the general salary increases discussed above, these employees would receive a cumulative salary increase of 12 percent over the course of the agreement.

Governor’s Office of Emergency Services (CalOES) Coordinator Pay Range Adjustments. As Figure 2 shows, the agreement would increase the bottom and top steps of the pay ranges for Fire and Rescue and Law Enforcement Coordinators at CalOES. Depending on employees’ current pay step within these classifications, affected employees would receive between a 23 percent and a 36 percent salary increase over the course of the agreement after these adjustments and the general salary increases discussed above.

Figure 1

Proposed Pay Increases to Agent Classifications at Alcoholic Beverage Control

|

Class Code |

Classification |

Pay Range |

Current Monthly Pay Range |

Proposed Monthly Pay Range |

2016-17 Salary Increasea |

|||||

|

Min |

Max |

Min |

Max |

|||||||

|

1012 |

Agent Trainee |

$3,077 |

$3,745 |

$3,139 |

(2%) |

$4,184 |

(12%) |

2% |

||

|

1013 |

Agent |

A |

4,019 |

4,942 |

4,019 |

(—) |

4,942 |

(—) |

— |

|

|

B |

4,588 |

5,916 |

4,588 |

(—) |

6,089 |

(3) |

3 |

|||

|

C |

5,035 |

6,508 |

5,294 |

(5) |

7,356 |

(13) |

5 |

|||

|

aThe agreement would provide all employees the specified pay increase in 2016-17. In subsequent years, employees would receive merit salary adjustments until reaching the new top step. Min = bottom step in salary range and Max = top step in salary range. |

||||||||||

Figure 2

Proposed Adjustments to Governor’s Office of Emergency Services Coordinator Classification Pay Ranges

|

Class Code |

Coordinator Type |

Current Monthly Pay Range |

Proposed Monthly Pay Range (% Increase) |

|||||

|

Min |

Max |

Min |

Max |

|||||

|

8188 |

Fire and Rescue |

$5,621 |

$7,272 |

$6,571 |

(17%) |

$8,286 |

(14%) |

|

|

8122 |

Law Enforcement |

5,239 |

6,772 |

6,571 |

(25) |

8,286 |

(22) |

|

|

Min = bottom step in salary range and Max = top step in salary range. |

||||||||

Increase Allowable Annual Cash Out of Vacation and Annual Leave. The current memorandum of understanding (MOU) permits Unit 7 members to cash out up to 20 hours of vacation or annual leave each year. Beginning in 2016‑17, the proposed agreement would permit—to the extent authorized by department directors—Unit 7 members to cash out up to 80 hours of vacation or annual leave each fiscal year. Leave would be cashed out based on employees’ current hourly pay. These leave cash outs are subject to Medicare payroll taxes but do not affect employees’ pension benefits. The administration assumes that departments would absorb these costs within existing departmental resources.

Expand Definition of Base Pay. The current MOU provides $65 each pay period to peace officers and firefighters represented by Unit 7 who annually pass a medical assessment and a physical fitness test. As currently structured, this payment does not affect an employee’s pension benefit but is subject to Medicare payroll taxes. Pursuant to the proposed Unit 7 agreement, this payment no longer would be contingent on an employee’s physical condition and would be received by all peace officer and firefighter classifications represented by Unit 7—about 2,700 employees. In addition, the agreement proposes that the payment be incorporated into employees’ base pay. (This proposal is similar to the treatment of the “Physical Fitness Incentive” under the recently ratified Unit 6 agreement.) Accordingly, the $780 employees receive each year would (1) be considered in calculations of salary-driven benefit payments and leave cash outs and (2) grow with any future percentage increases to base pay, for example the general salary increases and other pay increases provided by the proposed agreement.

Increase Payments for Educational Attainment. The current MOU provides Unit 7 members who have attained specified educational degrees or certifications either $50 or $100 each month. Specifically, employees who possess (1) an Intermediate POST Certificate or equivalent or an associate degree receive $50 and (2) an Advanced POST Certificate or equivalent or a bachelor degree receive $100. This payment is included when calculating employee Medicare and pension benefits and affects state contributions to fund these benefits accordingly. The agreement would increase by $25 the payments received by employees who have an associate degree or a bachelor degree. Specifically, employees with an associate degree would receive $75 and employees with a bachelor degree would receive $125. The agreement would not change the payment received by employees with Intermediate or Advanced POST Certificates. The administration indicates that it does not maintain data on the number of employees who have an associate degree or bachelor degree. Therefore, the administration’s cost estimate assumes that all 1,800 employees who currently receive this payment will receive an additional $300 each year as a result of this provision (the state’s costs for each employee will increase $430 after accounting for increased Medicare and pension costs).

Increase Uniform Allowances. More than a quarter of Unit 7 members receive an allowance to purchase a uniform. These uniform allowances range significantly by classification. For example, lifeguards receive $20 for every 160 hours of work while specified firefighters and peace officers receive $640 each year. The agreement would increase various uniform and footwear allowances provided to Unit 7 members. For example, the allowance to lifeguards would be increased by $35 to $55 and the allowance to firefighters and peace officers would be increased by $310 to $950. These payments are subject to Medicare payroll taxes but do not affect employees’ pension benefits.

Establish Allowance for Cleaning and Maintaining Uniforms. Under the proposed agreement, most of the Unit 7 members who receive a uniform allowance would receive $25 each month for the maintenance and cleaning of uniforms. (Some employees who receive a uniform allowance—for example, lifeguards—would not be eligible for this cleaning allowance.) This is a new payment that does not exist in the current MOU. The payment would be subject to Medicare payroll taxes but would not affect employees’ pension benefits.

Increase Pay Differential for Senior Employees. In 2016, about 450 employees each with more than 17 years of state service receive a pay differential based on their years of service. The proposed agreement would increase this pay differential by 1 percent of pay so that an employee with 17 years of service would receive a 2 percent pay differential and employees with 25 or more years of service would receive an 8 percent pay differential. This pay differential also increases the state’s costs for employees’ pension and Medicare costs.

Increase Lodging Reimbursement for Four Counties. State employees are reimbursed for specified costs incurred while traveling and doing business for the state. In the past, these reimbursement rates typically have been established in MOUs for rank-and-file employees. The administration indicates that it intends to remove reimbursement rates from future MOUs and establish a consistent, statewide reimbursement policy. The proposed agreement moves towards this goal by tying Unit 7 travel and lodging reimbursements to those established through policy memos issued by the administration. The specific reimbursement rates will be codified in a future policy memo—PML 2016‑10—but also are included in the agreement. The new lodging reimbursement rates increase the amount of money Unit 7 employees may be reimbursed for lodging in four counties in the Bay Area.

Provide Cell Phones to Specified Classifications. Depending on departmental policy, the current MOU provides approximately 270 Unit 7 members employed by the California Highway Patrol as Motor Carrier Specialist Is and School Pupil Transportation Safety Coordinators either (1) $100 each year “to offset the cost of obtaining and use of personal cellular phones for business purposes which may also be used for personal use” or (2) state-issued cell phones. Based on estimates published by the administration in 2011, a state-issued cell phone costs about $36 per month—$432 per year. The proposed agreement specifies that the state shall provide cell phones to these employees “at no cost to the employee.” The administration indicates that this conforms to existing practice as the department currently provides these employees state-issued cell phones.

Increase Overtime Meal Allowance. Under the current MOU, Unit 7 members who work at least two hours longer than their regular work hours are eligible to receive $7.50 as a meal allowance. The administration indicates that the state spends about $67,400 each year for these overtime meal allowances. These payments do not affect state costs towards salary-driven benefits. The agreement would increase the meal allowance by $0.50 to $8.00.

Employee Health Benefits

Increase State Costs for Health Benefits. The state contributes a flat dollar amount to Unit 7 members’ health benefits that was last adjusted in January 2016. The proposed agreement would adjust the amount of money the state pays towards these benefits in January of 2017, 2018, and 2019. For the term of the agreement, the state’s contribution would be adjusted so that the state pays 80 percent of an average of California Public Employees’ Retirement System (CalPERS) premium costs plus up to 80 percent of average CalPERS premium costs for enrolled family members—referred to as the “80/80 formula.” The state’s contributions would not be increased after January 2019 unless agreed to in a future agreement.

Eliminate Vesting Period for Dependent Health Benefits. The current MOU requires new Unit 7 members to work with the state for two years before receiving the state’s full contribution towards health coverage for the employees’ enrolled dependents. Specifically, the share of the state’s contribution to dependent health coverage increases over time so that the state pays (1) 50 percent of this benefit in the first year, (2) 75 percent of this benefit in the second year, and (3) the full benefit after the employee has worked two years with the state. The proposed agreement would eliminate this vesting period so that the state pays the full contribution towards health coverage of new hires’ enrolled dependents. The administration assumes departments would absorb these costs within existing departmental resources.

Retiree Health Benefits and Prefunding

Current Benefits and Funding. Until recently, like most governments in the U.S., California did not fund health and dental benefits for its retirees during their working careers in state government. This has resulted in large unfunded state liabilities for the benefits. The state now pays for retiree health and dental benefits on an expensive “pay-as-you-go” basis. This means that later generations pay for benefits of past public employees.

Currently, after Unit 7 members retire, the maximum state contribution to their health benefits covers 100 percent of an average of CalPERS premium costs plus 90 percent of average CalPERS premium costs for enrolled family members. (This maximum contribution is sometimes referred to as the “100/90 formula.”) Most Unit 7 members—hired after 1989—receive 50 percent of the maximum contribution from the state if they retire with ten years of service, with this amount growing each year until it reaches 100 percent of the maximum contribution if they retire after 20 or more years.

Proposed Retiree Benefit Changes. The proposed agreement changes future retiree health benefits for Unit 7 members first hired in 2017 and thereafter. The agreement requires future workers to pay more towards their health benefits in retirement. The maximum state contribution for these workers’ future retiree health benefits would be revised to reflect the contribution received by active workers based on the 80/80 formula. In addition, the agreement requires future employees to work longer to receive the maximum state contribution. Under the agreement, employees first hired by the state in or after 2017 will not receive any employer contribution for health and dental benefits in retirement unless they work for 15 or more years. After 15 years of service, these workers would receive 50 percent of the revised maximum state contribution in retirement, with this amount growing each year until it reaches 100 percent of the revised maximum contribution if they retire after 25 or more years.

Proposed Funding Changes. The agreement would institute a new arrangement to begin to address unfunded retiree health benefits for Unit 7 members. While the administration’s plan seems to be to keep making pay-as-you-go benefit payments for many years, the new arrangement would begin to fund “normal costs” each year for the future retiree health benefits earned by today’s Unit 7 workers. The agreement would deposit those payments in an invested account that would generate earnings and gradually reduce unfunded liabilities over the next three decades or so.

Under the agreement, all Unit 7 members would contribute 1.3 percent of pay to a retiree health funding account beginning effective July 1, 2017, rising to 2.7 percent of pay on July 1, 2018, and rising again to 4 percent of pay beginning on July 1, 2019. The state would match these contributions to the trust account. Beginning in 2019‑20, total annual employee and state payments to the account would be about $34 million, which is essentially equal to the actuarially estimated Unit 7 rank-and-file normal costs under the most recent state valuation (specifically, the valuation’s “full funding policy” scenario with an assumed 7.3 percent discount rate). Under no circumstances would an employee or beneficiary or survivor be able to receive employee contributions to the retiree health funding account, even if the employee leaves state service after a few years and is ineligible for retiree benefits.

Fiscal Effect

Significant New State Budget Commitments. Figure 3 shows the administration’s estimated fiscal effects of the proposed Unit 7 agreement. The estimates displayed in the figure are slightly different than what was submitted by the administration to the Legislature on June 15, 2016. The administration provided our office updated estimates to address questions we raised about the initial estimates. Specifically, relative to what was submitted to the Legislature as part of the administration’s original transmittal package, the figure includes additional costs estimated by the administration resulting from (1) establishing the state’s contribution to prefund retiree health benefits as a salary-driven benefit that grows with salary increases and (2) ending the two-year vesting period for dependent health benefits. In total, the administration estimates that the agreement will increase state annual costs by more than $110 million by 2019‑20. Based on the administration’s estimated costs of past Unit 7 agreements submitted to the Legislature for ratification, this agreement would increase annual state costs more than any of the Unit 7 agreements ratified since at least 2005 (when the Government Code was changed to require our review of labor agreements).

Figure 3

Administration’s Fiscal Estimates of Proposed Unit 7 Agreementa

(In Millions)

|

2016-17 |

2017-18 |

2018-19 |

2019-20 |

||||||||

|

General Fund |

All Funds |

General Fund |

All Funds |

General Fund |

All Funds |

General Fund |

All Funds |

||||

|

Salary and pay increases |

$8.0 |

$32.5 |

$13.5 |

$51.9 |

$17.2 |

$64.9 |

$17.2 |

$64.9 |

|||

|

Retiree health prefunding |

— |

— |

1.6 |

5.5 |

3.3 |

11.6 |

4.9 |

17.1 |

|||

|

Leave cash outb |

4.2 |

14.6 |

4.3 |

15.0 |

4.4 |

15.3 |

4.4 |

15.3 |

|||

|

Employee health benefits |

0.5 |

1.7 |

1.6 |

5.6 |

3.0 |

10.3 |

3.5 |

12.4 |

|||

|

End of dependent health vestingb |

0.1 |

0.5 |

0.2 |

0.6 |

0.2 |

0.6 |

0.2 |

0.6 |

|||

|

Overtime meal allowance and lodging reimbursementb |

— |

0.1 |

— |

0.1 |

— |

0.1 |

— |

0.1 |

|||

|

Totals |

$12.8 |

$49.2 |

$21.1 |

$78.6 |

$28.1 |

$102.9 |

$30.3 |

$110.5 |

|||

|

aFigure reflects fiscal effects identified by administration on June 15, 2016 and subsequent revisions to those estimates. bAdministration assumes these cost will be absorbed within existing departmental resources. |

|||||||||||

Additional Short-Term Costs to Consider When Reviewing Agreement. While we think the administration’s estimates in Figure 3 are reasonable, we have identified additional likely costs that we think the Legislature should be aware of while reviewing the agreement. We discuss these costs below.

Increased Overtime Payments. The administration’s estimates do not include the effect that increasing employees’ salaries has on the state’s overtime costs. Overtime is a significant component of Unit 7 members’ compensation. For example, Unit 7 members received more than $44 million in overtime pay (on average, nearly $8,000 per employee who worked overtime) in 2015. We estimate that the scheduled pay increases will increase the state’s annual cost for Unit 7 member overtime by more than $3.7 million by the end of the agreement. The administration assumes that these increased costs will be absorbed within existing departmental resources.

Extension of Provisions to Management. When rank-and-file pay increases faster than managerial pay, “salary compaction” can result. Salary compaction can be a problem when the differential between management and rank-and-file is too small to create an incentive for employees to accept the additional responsibilities of being a manager. Consequently, the administration often provides compensation increases to managerial employees that are similar to those received by rank-and-file employees. Although the administration has significant authority to establish compensation levels for employees excluded by the collective bargaining process, these compensation levels are subject to legislative appropriation. We estimate that extending a comparable increase in compensation to Unit 7 supervisors and managers will increase state annual costs by between $20 million and $30 million by 2019‑20. About $5 million of these costs would fund the state’s share of the Governor’s plan to prefund retiree health benefits for Unit 7 managers and supervisors.

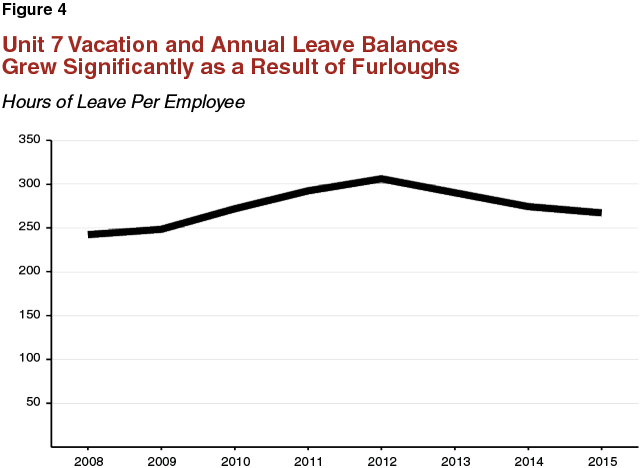

Leave Cash Outs Can Reduce Long-Term Costs. The average state employee earns significant numbers of days off each year. During the five years of furlough from 2008‑09 and 2012‑13, it was virtually impossible for Unit 7 members to use the 94 furlough days they received plus the vacation or annual leave they earned throughout the year. As Figure 4 shows, the result of these furloughs was that the average Unit 7 member’s vacation/annual leave balance increased by about a quarter between 2008 and 2012. As the figure shows, these balances have been coming down since 2012.

As we explain in our March 14, 2013 report After Furloughs: State Workers’ Leave Balances, unused leave balances create a liability for the state because the state must compensate employees for any unused leave—at their final pay rate—when the employee separates from state service. Employees typically earn their highest salary during their last year of service with the state. We estimate that the total value of Unit 7 members’ unused vacation and annual leave will be more than $55 million after employees receive the first general salary increase proposed under the agreement. Allowing employees to cash out a larger share of their unused vacation/annual leave at their current pay level will reduce the state’s long-term costs associated with these liabilities.

Long-Term Fiscal Effects of Retiree Health Proposals Uncertain. We have long recommended that the state move toward funding normal costs for these benefits. This agreement—according to the best information available now—would achieve that important goal. Over the long term, by generating investment gains in a dedicated retiree health funding account, this approach would significantly reduce state taxpayer costs. In addition, the proposed reduction of future Unit 7 retiree benefits also would significantly reduce state costs over the long term.

The administration has submitted no Unit 7-only actuarial valuation specifically tied to this agreement’s retire health and dental benefit provisions. Moreover, as with other recent labor agreements, there is no detailed analysis of the complex legal issues involved with the new retiree health provision. If the Legislature and Unit 7 members approve this agreement, it will be important to monitor future state actuarial valuations to see if the new funding plan is on track to achieve the goal of eliminating Unit 7 unfunded liabilities over the next 30 years or so.