- All Articles CalFacts

Housing Costs Have Grown Faster Than Incomes December 17, 2014

Since 2002, on an inflation-adjusted basis, housing costs in California have grown faster than the total change in median household income.

Californians Spend More of Their Income on Housing December 17, 2014

Across the state, Californians spend more of their income on housing compared to residents in other states' metropolitan areas.

California Home Prices Rising Again December 16, 2014

2013 was the first year since 2006 in which California home prices increased significantly.

California Housing Construction Recovering Slowly December 16, 2014

Building permits for residential construction dropped sharply after the collapse of the housing bubble. They are recovering slowly.

Counties, Cities, Special Districts Receive Variety of Revenues December 16, 2014

The property tax is the largest source of local tax revenue for all local governments combined.

Allocation of Property Tax Has Varied Over Time December 16, 2014

Since passage of Proposition 13 in 1978, the allocation of local property taxes has changed several times.

California Governments Rely on a Variety of Taxes December 16, 2014

The state government and local governments, respectively, rely on different tax revenue sources.

Breaking Down State and Local Sales Tax Rates December 15, 2014

California's sales and use tax is dedicated to various state and local purposes.

Share of Consumer Income Spent on Taxable Goods Has Declined December 15, 2014

In recent decades, Californians have spent more of their income on housing, health care, and other services not subject to the state and local sales tax.

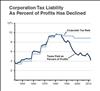

Corporation Tax Liability As Percent of Profits Has Declined December 10, 2014

Using various provisions of state tax law, such as tax credits, corporations may reduce their tax liability. These tax law provisions have led to corporations' effective state tax rate falling in recent years.

In Many Sectors, California's Job Mix Similar to the U.S. December 9, 2014

California has a greater share of jobs in professional/business services and information combined than those sectors have in the rest of the U.S. This can be attributed in part to the state's technology and entertainment industries.

Personal Income Tax Is State's Dominant General Fund Revenue December 9, 2014

Over the past several decades, the personal income tax has replaced the sales tax as the main source of the state's General Fund revenue.

Voting Requirements to Increase Taxes and Fees December 9, 2014

The California Constitution and laws require a variety of different voter or legislative approval thresholds to increase taxes, fees, assessment, or debt.

California Oil Production Has Stabilized in Recent Years December 8, 2014

California ranks behind Texas and North Dakota in oil output, excluding offshore production on federal lands. Over 70 percent of statewide oil production is in Kern County. Oil prices fluctuate widely, and changes in prices can be connected with changes in production activity.

Local Governments Getting Some Taxes Formerly Allocated to Redevelopment December 8, 2014

In February 2012, over 400 redevelopment agencies were dissolved, and the process of unwinding their financial affairs began.