Ballot Pages

Propositions on the November 8, 2016 Ballot

November 8, 2016Proposition 56

Cigarette Tax to Fund Healthcare, Tobacco Use Prevention, Research, and Law Enforcement. Initiative Constitutional Amendment and Statute.

Yes/No Statement

A YES vote on this measure means: State excise tax on cigarettes would increase by $2 per pack—from 87 cents to $2.87. State excise tax on other tobacco products would increase by a similar amount. State excise tax also would be applied to electronic cigarettes. Revenue from these higher taxes would be used for many purposes, but primarily to augment spending on health care for low-income Californians.

A NO vote on this measure means: No changes would be made to existing state taxes on cigarettes, other tobacco products, and electronic cigarettes.

Summary of Legislative Analyst’s Estimate of Net State and Local Government Fiscal Impact

-

Increased net state revenue of $1 billion to $1.4 billion in 2017-18, with potentially lower annual revenues over time. These funds would be allocated to a variety of specific purposes, with most of the monies used to augment spending on health care for low-income Californians.

Ballot Label

Fiscal Impact: Additional net state revenue of $1 billion to $1.4 billion in 2017-18, with potentially lower revenues in future years. Revenues would be used primarily to augment spending on health care for low-income Californians.

Background

Cigarette and Tobacco Products

People currently consume different types of cigarette and tobacco products:

-

Cigarettes. Smoking cigarettes is the most common way to use tobacco.

-

Other Tobacco Products. Other tobacco products can be consumed by smoking or other forms of ingestion. These include cigars, chewing tobacco, and other products made of or containing at least 50 percent tobacco.

-

Electronic Cigarettes (E-Cigarettes). These are battery-operated devices that turn specially designed liquid, which can contain nicotine, into a vapor. The vapor is inhaled by the user. Some e-cigarettes are sold with the liquid, while others are sold separately from the liquid.

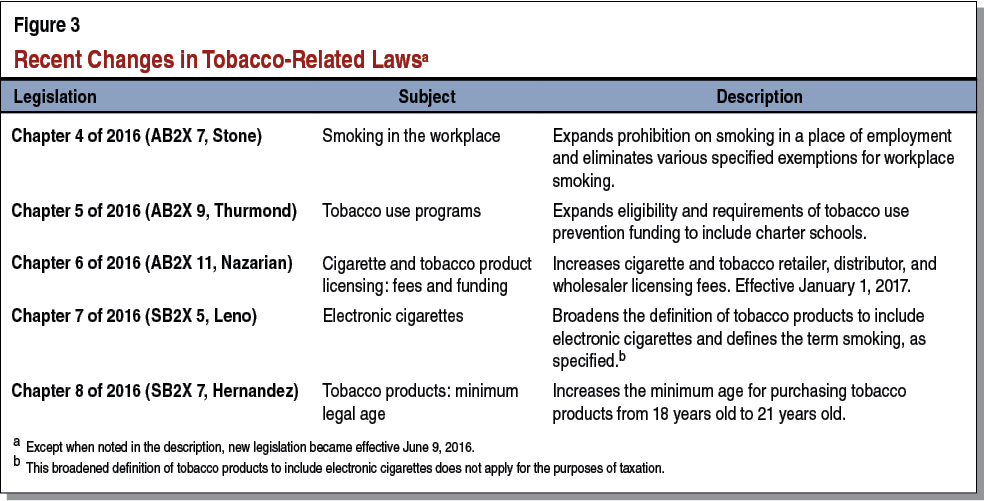

These products are subject to excise taxes (which are levied on a particular product) and sales taxes (which are levied on a wide array of products). The excise tax is levied on distributors (such as wholesalers) while the sales tax is imposed at the time of purchase. As shown in Figure 1, cigarettes and other tobacco products currently are subject to state and federal excise taxes as well as state and local sales and use taxes (sales taxes). E-cigarettes are only subject to sales taxes.

Existing State Excise Taxes on Cigarettes. The current state excise tax is 87 cents for a pack of cigarettes. Figure 2 shows how the tax has increased over time and how these revenues are allocated for different purposes. Existing excise taxes are estimated to raise over $800 million in 2015-16.

Existing State Excise Taxes on Other Tobacco Products. While excise taxes on other tobacco products are based on the excise tax on a pack of cigarettes, they are somewhat higher due to the provisions of Proposition 10. Currently, the excise taxes on other tobacco products are the equivalent of $1.37 per pack of cigarettes. Revenues from excise taxes on other tobacco products are allocated solely to Proposition 99 (1988) and Proposition 10 (1998) funds for various purposes, as described in Figure 2. Under current law, any increase in cigarette excise taxes automatically triggers an equivalent increase in excise taxes on other tobacco products.

Existing Federal Excise Taxes on Tobacco Products. The federal government also levies excise taxes on cigarettes and other tobacco products. Currently, the federal excise tax is $1.01 per pack of cigarettes and varying amounts on other tobacco products.

Existing Sales Taxes on Tobacco Products and E-Cigarettes. Sales taxes apply to the sale of cigarettes, other tobacco products, and e-cigarettes. Sales taxes are based on the retail price of goods, which includes the impact of excise taxes. The average retail price for a pack of cigarettes in California is close to $6. Currently, the sales tax ranges from 7.5 percent to 10 percent of the retail price (depending on the city or county), with a statewide average of around 8 percent. Thus, sales tax adds roughly 50 cents to 60 cents to the total cost for a pack of cigarettes. The sales taxes on cigarettes, other tobacco products, and e-cigarettes raises about $400 million annually, with the proceeds going both to the state and local governments.

Adult Smoking Trends and E-Cigarette Use in California

Most tobacco users in California smoke cigarettes. According to the California Department of Public Health (DPH), California has one of the lowest adult cigarette smoking rates in the country. The DPH reports that about 12 percent of adults smoked cigarettes in 2013, compared to about 24 percent of adults in 1988. While cigarette smoking rates in California have steadily declined over the past couple decades for a variety of reasons, this trend appears to have stalled in recent years according to DPH. As the number of individuals smoking cigarettes in California has decreased, so has the total amount of cigarette purchases by California consumers. As a result, revenues from taxes on these purchases also have declined.

The DPH reports that e-cigarette use among California adults was about 4 percent in 2013, nearly doubling compared to the prior year. Because e-cigarettes are relatively new products, however, there is little information to determine longer-term use of e-cigarettes.

State and Local Health Programs

Medi-Cal. The Department of Health Care Services administers California’s Medi-Cal program, which provides health care coverage to over 13 million low-income individuals, or nearly one-third of Californians. With a total estimated budget of nearly $95 billion (about $23 billion General Fund) for 2015-16, Medi-Cal pays for health care services such as hospital inpatient and outpatient care, skilled nursing care, prescription drugs, dental care, and doctor visits. Some of the services provided in the Medi-Cal program are for prevention and treatment of tobacco-related diseases.

Public Health Programs. The DPH administers and oversees a wide variety of programs with the goal of optimizing the health and well-being of Californians. The department’s programs address a broad range of health issues, including tobacco-related diseases, maternal and child health, cancer and other chronic diseases, infectious disease control, and inspection of health facilities. Many public health programs and services are delivered at the local level, while the state provides funding, oversight, and overall strategic leadership for improving population health. For example, the DPH administers the California Tobacco Control Program—a Proposition 99 program—that funds activities to reduce illness and death from tobacco-related diseases with a budget of about $45 million in 2015-16.

Recent Changes in Tobacco-Related Laws

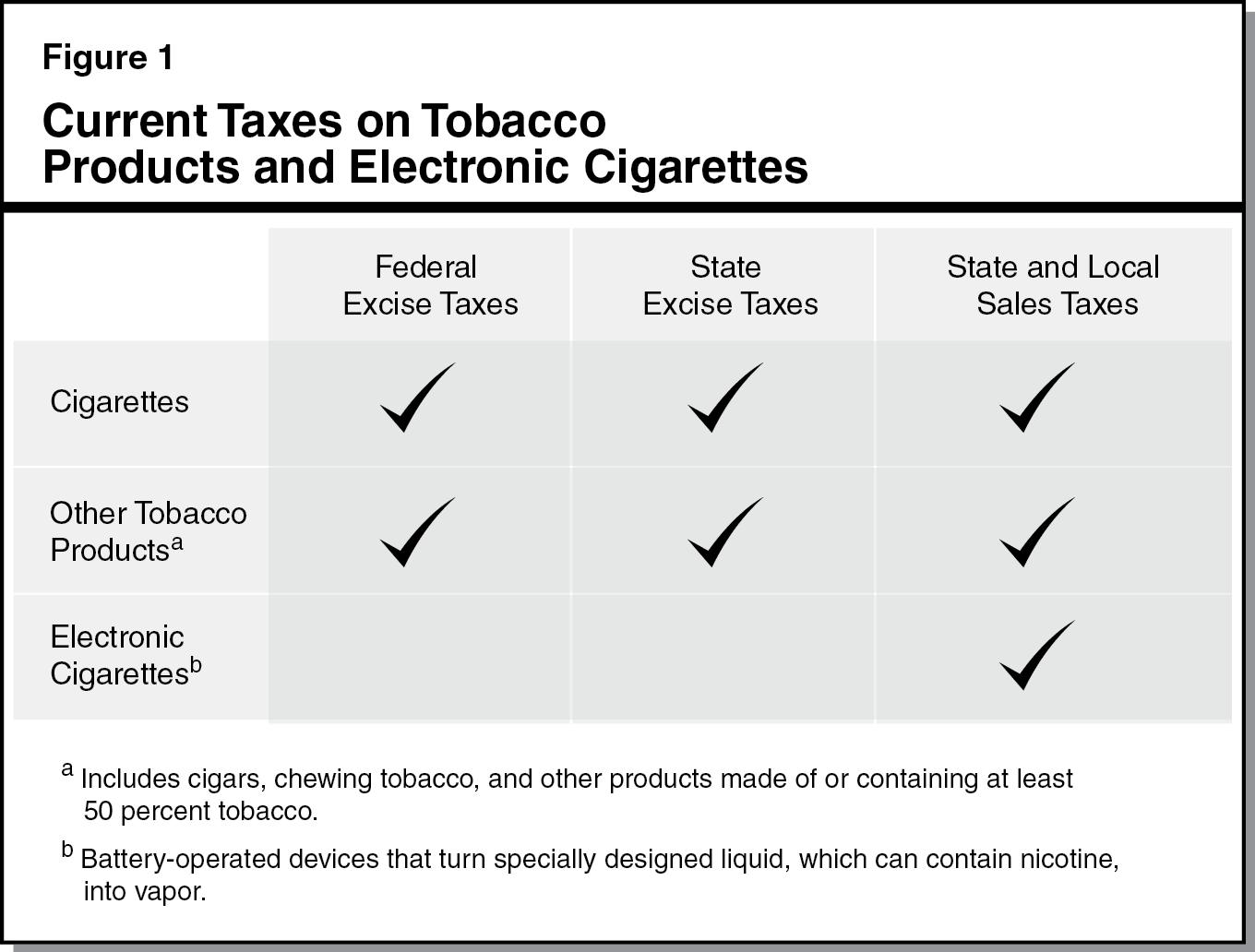

The Legislature recently passed, and the Governor signed in May 2016, new tobacco-related legislation that made significant changes to state law. Figure 3 describes these changes. Also in May 2016, the U.S. Food and Drug Administration (FDA) issued new rules that extend the FDA’s regulatory authority to include e-cigarettes, cigars, and other tobacco products. These recent changes do not directly affect the state taxes on these products or the programs that receive funding from these taxes.

State Spending Limit and Minimum Funding Level for Education

The State Constitution contains various rules affecting the state budget. Proposition 4, passed by voters in 1979, establishes a state spending limit. Proposition 98, passed in 1988, establishes a minimum level of annual funding for K-12 education and the California Community Colleges.

Proposal

This measure significantly increases the state’s excise tax on cigarettes and other tobacco products and applies this tax to e-cigarettes. The additional revenues would be used for various specified purposes. The major provisions of the measure are described below.

New Taxes Imposed by Measure

Increases Cigarette Tax by $2 Per Pack. Effective April 1, 2017, the state excise tax on a pack of cigarettes would increase by $2—from 87 cents to $2.87.

Raises Equivalent Tax on Other Tobacco Products. As described earlier, existing law requires taxes on other tobacco products to increase any time the tax on cigarettes goes up. Specifically, state law requires the increase in taxes on other tobacco products to be equivalent to the increase in taxes on cigarettes. Accordingly, the measure would raise the tax on other tobacco products also by $2—from $1.37 (the current level of tax on these products) to an equivalent tax of $3.37 per pack of cigarettes.

Imposes New Taxes on E-Cigarettes. As noted above, the state does not currently include e-cigarettes in the definition of other tobacco products for purposes of taxation. The measure changes the definition of “other tobacco products” for purposes of taxation to include e-cigarettes that contain nicotine or liquid with nicotine (known as e-liquid). Changing the definition in this way causes the $3.37 equivalent tax to apply to these products as well.

How Would Revenues From New Tobacco and E-Cigarette Taxes Be Spent?

Revenues from the cigarette, other tobacco product, and e-cigarette excise taxes that are increased by this measure would be deposited directly into a new special fund. Revenues deposited in this fund would only be used for purposes set forth in the measure, as described below. (Revenues from applying the $1.37 per pack rate on e-cigarettes, however, would support Proposition 99 and Proposition 10 purposes. This would be new revenue to these funds.)

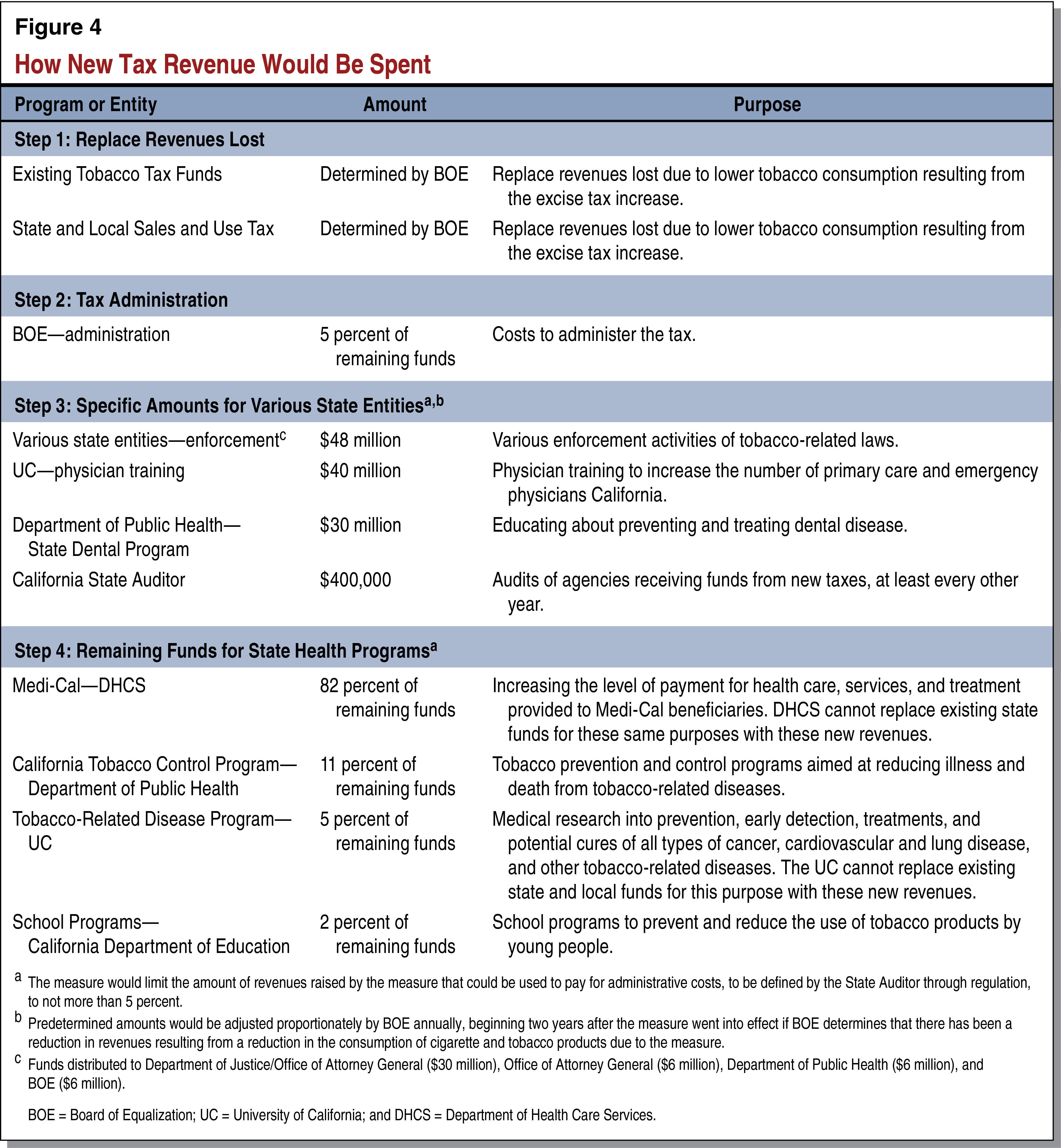

As shown in Figure 4, the revenues would be allocated as follows:

-

Step One. The measure requires that new revenues raised by the measure first be used to replace revenue losses to certain sources (existing state tobacco funds and sales taxes) that occur as a result of the measure. These revenue losses would occur due to lower consumption of tobacco products due to the higher excise taxes.

-

Step Two. The state Board of Equalization would then receive up to 5 percent of the remaining funds to pay for administrative costs to implement the measure.

-

Step Three. The measure provides specified state entities with fixed dollar amounts annually for specific purposes, as described in Figure 4.

-

Step Four. The remaining funds would be allocated—using specific percentages—for various programs, primarily to augment spending on health care services for low-income individuals and families covered by the Medi-Cal program.

Other Provisions

Required Audits. The California State Auditor would conduct audits of agencies receiving funds from the new taxes at least every other year. The Auditor, who provides independent assessments of the California government’s financial and operational activities, would receive up to $400,000 annually to cover costs incurred from conducting these audits.

Revenues Exempt From State Spending Limit and Minimum Education Funding Level. Proposition 56 amends the State Constitution to exempt the measure's revenues and spending from the state's constitutional spending limit. (This constitutional exemption is similar to ones already in place for prior, voter-approved increases in tobacco taxes.) This measure also exempts revenues from minimum funding requirements for education required under Proposition 98.

Fiscal Effects

This measure would have a number of fiscal effects on state and local governments. The major impacts of this measure are discussed below.

Impacts on State and Local Revenues

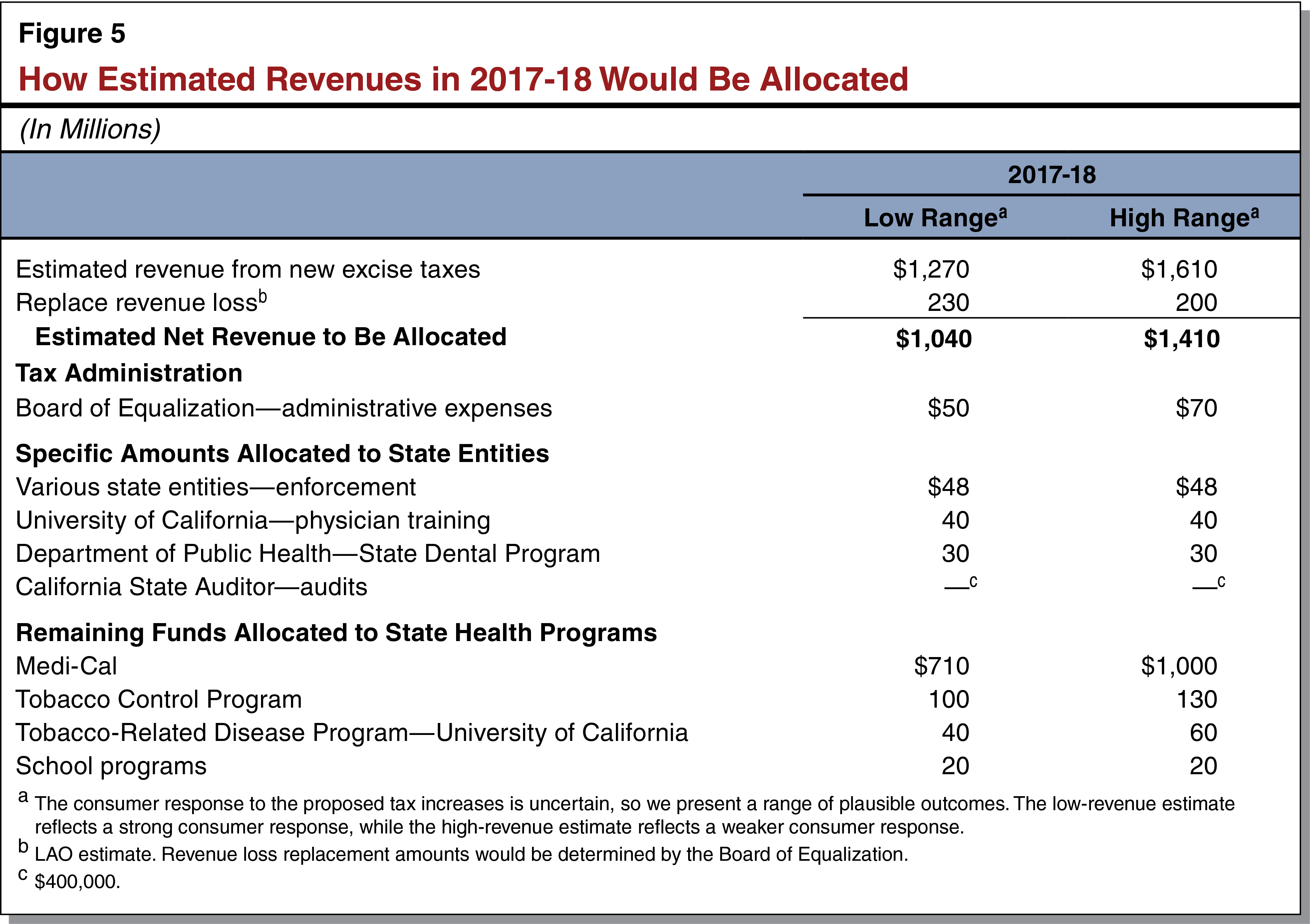

New Excise Taxes Would Increase State Revenue by Over $1 Billion in 2017-18. This measure would raise between $1.3 billion and $1.6 billion in additional state revenue in 2017-18—the first full year of the measure’s implementation. The excise tax increase would result in higher prices for consumers. As a result, consumers would reduce their consumption of cigarettes and other tobacco products, including e-cigarettes. (Many consumers might also change the way they buy these products to avoid the tax.) The range in potential new revenue reflects uncertainty about how much consumers will reduce their purchases in response to higher prices. The low-range estimate ($1.3 billion) assumes consumers have a stronger response to the tax than under the high-range estimate ($1.6 billion). In future years, revenues may decline relative to 2017-18 due to changes in consumer choices.

Applying Excise Taxes on E-Cigarettes Also Would Generate Additional Revenue for Existing Tobacco Funds. As noted earlier, the measure expands the definition of other tobacco products to include e-cigarettes. This change makes e-cigarettes subject to the taxes passed by voters in Proposition 99 and Proposition 10. As a result, the funds supported by those two propositions would receive additional revenue due to this measure. This additional revenue likely would be in the tens of millions of dollars annually.

Over $1 Billion in Increased Funding in 2017-18, Mostly for State Health Programs. Figure 5 estimates the amount of funding each program and government agency would receive from the new tax revenues in 2017-18. After covering revenue losses resulting from the measure, the revenue available for specific activities funded by the measure—mostly health programs—would be between $1 billion and $1.4 billion. If cigarette use continues to decline, these amounts would be somewhat less in future years. In addition, much of the added spending on health programs would generate additional federal funding to the state. As a result, state and local governments would collect some additional general tax revenue.

Potentially Little Effect on State and Local Sales Tax Revenue. Higher cigarette and other tobacco product prices would increase state and local sales tax revenue if consumers continued to buy similar amounts of these products. However, consumers would buy less of these products as prices increase due to the measure’s taxes. As a result, the effect of the measure on sales tax revenue could be positive, negative, or generally unchanged, depending on how consumers react. Under the measure, if the state or local governments received less sales tax revenue as a result of the measure’s taxes, those losses would be replaced by the revenue raised by the measure.

Effects on Excise Tax Collection. As described in Figure 4, the measure would provide additional funding to various state agencies to support state law enforcement. These funds would be used to support increased enforcement efforts to reduce tax evasion, counterfeiting, smuggling, and the unlicensed sales of cigarettes and other tobacco products. Such enforcement efforts would increase the amount of tax revenue. The funds also would be used to support efforts to reduce sales of tobacco products to minors, which would reduce revenue collection. As a result, the net effect on excise tax revenue from these enforcement activities is unclear. In addition, while cigarettes and other tobacco products—as currently defined—are covered by federal laws to prevent tax evasion, e-cigarettes are not covered. As a result, enforcement of state excise taxes on e-cigarettes may be more challenging if consumers purchase more of these products online to avoid the new taxes.

Impact on State and Local Government Health Care Costs

The state and local governments in California incur costs for providing (1) health care for low-income and uninsured persons and (2) health insurance coverage for state and local government employees and retirees. Consequently, changes in state law such as those made by this measure that affect the health of the general population would also affect publicly funded health care costs.

For example, as discussed above, this measure would result in a decrease in the consumption of tobacco products as a result of the price increase of tobacco products. Further, this measure provides funding for tobacco prevention and cessation programs, and to the extent these programs are effective, this would further decrease consumption of tobacco products. The use of tobacco products has been linked to various adverse health effects by the federal health authorities and numerous scientific studies. Thus, this measure would reduce state and local government health care spending on tobacco-related diseases over the long term.

This measure would have other fiscal effects that offset these cost savings. For example, state and local governments would experience future health care and social services costs that otherwise would not have occurred as a result of individuals who avoid tobacco-related diseases living longer. Further, the impact of a tax on e-cigarettes on health and the associated costs over the long term is unknown, because e-cigarettes are relatively new devices and the health impacts of e-cigarettes are still being studied. Thus, the net long-term fiscal impact of this measure on state and local government costs is unknown.